Saudi Arabia Electric Water Heater Market Report by Product (Storage, Instant), Capacity (Small Water Heater, Medium Water Heater, Large Water Heater), End-User (Residential, Commercial, Industrial), and Region 2026-2034

Saudi Arabia Electric Water Heater Market Overview:

Saudi Arabia electric water heater market size reached USD 192.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 232.1 Million by 2034, exhibiting a growth rate (CAGR) of 2.09% during 2026-2034. The growing demand for energy efficiency and sustainability, rising construction of new structures, including residential buildings, corporate offices, hotels, and medical facilities, and increasing need for high-quality hotel accommodations in the tourism sector are some of the factors impelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 192.7 Million |

| Market Forecast in 2034 | USD 232.1 Million |

| Market Growth Rate (2026-2034) | 2.09% |

Saudi Arabia Electric Water Heater Market Analysis:

- Major Market Drivers: The market is experiencing moderate growth owing to the rising need for energy-efficient water heating solutions. Additionally, the increasing demand for renewable energy-based water heaters because of initiatives implemented by the governing body to promote sustainability is propelling the market growth.

- Key Market Trends: There is a shift toward energy-efficient and smart electric water heaters integrated with the Internet of Things (IoT) capabilities. Individuals are opting for products with advanced features like remote monitoring and control, which enhances convenience and efficiency.

- Competitive Landscape: The industry is very competitive, with major companies prioritizing the launch of creative and environment-friendly products. Local producers are broadening their product range in response to the increasing need for durable and affordable goods.

- Challenges and Opportunities: High initial costs of energy-efficient models pose a challenge for wider adoption. However, opportunities exist in incentives by the governing body and the growing awareness about the long-term benefits of energy-efficient appliances.

Saudi Arabia Electric Water Heater Market Trends:

Growing Demand for Energy Efficiency and Sustainability

The rising emphasis on energy-saving options represents one of the major factors impelling the market growth in Saudi Arabia. Initiatives by the governing body such as Vision 2030 are providing substantial support for energy-saving technologies as part of efforts to diversify the economy and promote sustainable development. Electric water heaters are becoming more popular as they are more efficient than traditional water heating methods. In addition, the growing awareness about carbon footprint reduction and the shift toward environment-friendly appliances is encouraging individuals and industries to adopt electric water heaters.

Increasing Focus on Infrastructure Development

Major cities like Riyadh, Jeddah, and Dammam are experiencing a rise in the construction of new structures, including residential buildings, corporate offices, hotels, and medical facilities, all of which have dependable hot water systems. Large-scale infrastructure projects like NEOM and the Red Sea Development, which are powered by 100% renewable energy, are driving the need for electric water heaters as these advanced utilities require futuristic developments. Furthermore, efforts by the governing body to enhance infrastructure in sectors, such as healthcare, education, and tourism are leading to higher investments in real estate, thereby encouraging the use of electric water heaters in new buildings.

Rising Employment in the Tourism Sector

Providing guests with a reliable source of hot water is critical at high-end destinations that focus on luxury and comfort. Electric water heaters are gaining popularity in hotels, resorts, and vacation properties because of their dependable performance and effectiveness. Electric water heaters offer continuous hot water, unlike traditional options, which often come with delays and interruptions. Additionally, electric systems are easier to install and maintain, making them ideal for large-scale projects that require rapid deployment and long-term efficiency. For instance, large-scale tourism projects like Amaala are attracting millions of visitors annually, leading to a higher need for high-quality hotel accommodation. The initial stage of the Amaala project in Saudi Arabia is set to finish by 2027, providing 1,945 hotel rooms and 430 residential properties. Red Sea Global (RSG) is planning to complete the entire 2,500 square kilometer development by 2030.

Saudi Arabia Electric Water Heater Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product, capacity, and end-user.

Breakup by Product:

- Storage

- Instant

The report has provided a detailed breakup and analysis of the market based on the product. This includes storage and instant.

Storage is the most commonly used water heater in residential and commercial settings in the Saudi Arabian electric water heater market. It is renowned for its capacity to store large volumes of hot water, making it suitable for households with high water usage. Its popularity is driven by the rising need for dependable and durable options, coupled with energy efficiency requirements.

Instant is becoming more popular, particularly in cities, because of its small size and energy-efficient features. By supplying instant hot water without a storage tank, it is the top choice for small homes and apartments. The increasing demand for instant water heater, as people are becoming more conscious about energy use, is strengthening the market growth.

Breakup by Capacity:

- Small Water Heater

- Medium Water Heater

- Large Water Heater

A detailed breakup and analysis of the market based on the capacity have also been provided in the report. This includes small water heater, medium water heater, and large water heater.

Small water heater, usually holding less than 30 liters, are suitable in apartments, small homes, and offices with low water usage. Its small size and energy efficiency make it ideal for bathrooms or kitchens with moderate hot water requirements. The increasing popularity of compact homes in cities, along with an emphasis on saving energy, is contributing to the market growth.

Medium water heater, ranging in capacity from 30 to 100 liters, is commonly utilized in mid-sized residences and small businesses. It strikes a balance between capacity and energy efficiency, making it appropriate for homes with average water utilization. It is particularly popular in cities where families need consistent hot water for several bathrooms and kitchen use.

Large water heater, typically above 100 liters, are primarily used in large residential homes, commercial buildings, hotels, and industrial applications. It is capable of providing hot water to multiple outlets simultaneously, making it suitable for large-scale operations. The growing need for high-capacity solutions in both residential and commercial projects is making it a crucial segment in the Saudi Arabia electric water heater market share.

Breakup by End-User:

- Residential

- Commercial

- Industrial

The report has provided a detailed breakup and analysis of the market based on the end-user. This includes residential, commercial, and industrial.

Residential is a key contributor to the market, driven by the growing population. As of 2024, Saudi Arabia's population is approximately 32,175,224 million, according to the General Authority for Statistics. Households, particularly in urban areas, are choosing electric water heaters because of higher living standards and the need for modern, energy-efficient household gadgets.

Commercial, including hotels, hospitals, restaurants, and offices, is a vital segment in the market. Electric water heaters are critical for these businesses as they need a steady and high amount of hot water regularly for their activities. The commercial sector is also adopting energy-saving and intelligent water heater technologies in order to cut costs and achieve sustainability targets.

Industrial plays a considerable role in the market by catering to sectors like manufacturing, food processing, and chemical industries, where hot water is necessary for various processes. There is higher adoption of large-capacity electric water heaters in industries because of the emphasis on automation, energy conservation, and operational effectiveness.

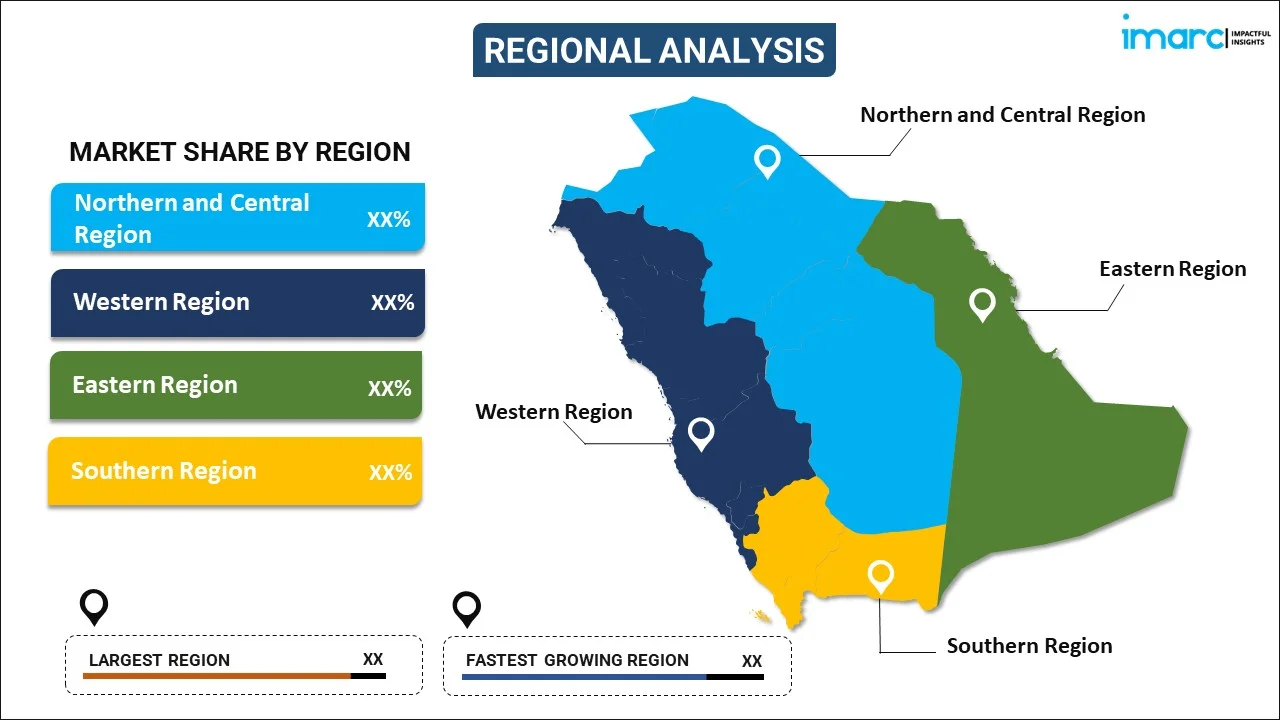

Breakup by Region:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major markets in the region, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Northern and Central region, including cities like Riyadh, represent a notable portion of the electric water heater market in Saudi Arabia. Besides this, the harsh weather in the area contributes to the high need for electric water heaters as people look for dependable heating options for their daily needs. Investments by the governing body in infrastructure, especially in industrial areas and public sector buildings, are driving the need for water heating solutions. For instance, the Saudi Infrastructure Summit and Expo is scheduled to take place in Riyadh from September 24 to 26, 2024, with the support of Mayor Dr. Faisal bin Abdulaziz bin Ayyaf. The purpose of the event is to bring together governing officials and international experts to talk about the most effective methods and new ideas for infrastructure development.

Western region, which consists of cities like Jeddah and Mecca, is known for its tourism and hospitality industry. The rising construction of hotels, resorts, and businesses in the area is driving the need for water heaters with high capacities to accommodate high usage.

Eastern region, being an industrial and commercial hub, represents a crucial market segment. The increasing construction of factories and new homes is catalyzing the demand for water heating systems that are dependable and long-lasting. The market in this region is further supported by the needs of large commercial buildings and industrial plants that rely on a constant supply of hot water.

Southern region, characterized by its residential and agricultural development, is gradually increasing its demand for electric water heaters. The growing number of housing projects and commercial establishments is driving the demand for water heating systems that provide efficiency and are cost-effective.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have been provided.

- Major key players in the market are concentrating on launching energy-efficient and technologically advanced products to accommodate the increasing user needs. They are putting money into research and development (R&D) to improve product features, including smart connectivity and energy-saving abilities, which appeal to the evolving preferences of users. Moreover, these companies are expanding their distribution networks and enhancing collaborations with local suppliers in order to enhance their market reach. Marketing tactics focusing on enhancing brand recognition, in combination with competitive pricing, are being utilized to attract a bigger portion of the market, especially in residential and commercial areas. In 2024, Ariston introduced the BLU R Electric Water Heater in Saudi Arabia, providing a cost-effective and effective water heating option with Italian style. Produced at Ariston's Wuxi plant, the BLU R series consists of models with 50, 80, and 100-liter sizes, recognized for their dependability and resistance against corrosion.

Saudi Arabia Electric Water Heater Market News:

- March 2023: Ariston Middle East announced its support for Saudi Arabia's healthcare infrastructure by supplying hot water to key hospitals as part of Saudi Vision 2030. Al-Magrabi Specialised Hospital and King Abdullah Hospital had installed Ariston water heaters to fulfill their large hot water requirements.

- June 2023: EcoSmart, a brand under the Rheem family, introduced its latest tankless electric water heaters called EcoSmart Element™. These heaters come in 12 kW, 18 kW, and 27 kW options, providing energy-efficient and instant hot water for residential use.

Saudi Arabia Electric Water Heater Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Storage, Instant |

| Capacities Covered | Small Water Heater, Medium Water Heater, Large Water Heater |

| End-Users Covered | Residential, Commercial, Industrial |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia electric water heater market performed so far, and how will it perform in the coming years?

- What has been the impact of COVID-19 on the market?

- What is the breakup of the market on the basis of product?

- What is the breakup of the market on the basis of capacity?

- What is the breakup of the market on the basis of end-users?

- What are the various stages in the value chain of the market?

- What are the key driving factors and challenges in the market?

- What is the structure of the market, and who are the key players?

- What is the degree of competition in the Saudi Arabia electric water heater market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia electric water heater market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia electric water heater market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia electric water heater industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)