Saudi Arabia Electric Welding Equipment Market Size, Share, Trends and Forecast by Equipment, Technology, Application, and Region, 2026-2034

Saudi Arabia Electric Welding Equipment Market Overview:

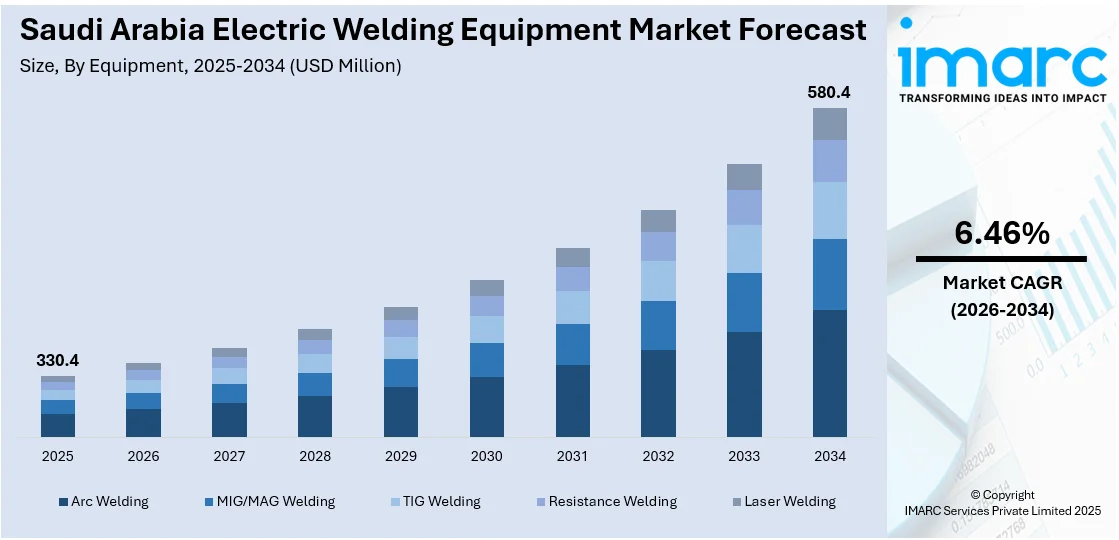

The Saudi Arabia electric welding equipment market size reached USD 330.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 580.4 Million by 2034, exhibiting a growth rate (CAGR) of 6.46% during 2026-2034. Strong demand across oil and gas pipeline construction, Vision 2030-led manufacturing growth, and mega-infrastructure projects are supporting the market growth. Moreover, rapid urbanization, expansion in shipbuilding and marine repair services, rising investments in rail and metro development, and localization of industrial production are accelerating the market growth. Besides this, increasing adoption of renewable energy installations, growing defense and aerospace fabrication activities, government support for technical skill development, and preference for energy-efficient inverter-based systems are bolstering the Saudi Arabia electric welding equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 330.4 Million |

| Market Forecast in 2034 | USD 580.4 Million |

| Market Growth Rate 2026-2034 | 6.46% |

Saudi Arabia Electric Welding Equipment Market Trends:

Oil and Gas Pipeline Projects

Saudi Arabia’s dominance in the global oil and gas sector significantly drives the demand for electric welding equipment. Maintaining this position requires constant investment in pipeline infrastructure, processing units, and export terminals. Welding plays a central role in constructing and repairing pipelines that span across vast desert terrains and link inland production sites with maritime ports. Moreover, Saudi Aramco, the national oil giant, continues to expand its oil and gas pipeline projects, including offshore developments and midstream infrastructure upgrades. In 2024, Aramco announced the commencement of the second phase of its Master Gas System expansion, aiming to enhance gas distribution networks and processing capacities across the Kingdom. Welding technologies such as shielded metal arc welding (SMAW) and gas tungsten arc welding (GTAW) are widely used in this sector due to their reliability and suitability for high-pressure systems. The increased frequency of maintenance work, combined with the push for energy efficiency and environmental safety, is ensuring continuous demand for both conventional and advanced welding systems across the upstream and midstream value chains in Saudi Arabia.

To get more information on this market Request Sample

Vision 2030 Diversification Push

Saudi Arabia’s Vision 2030, launched in 2016, aims to shift the economy from heavy dependence on oil towards more diversified industrial development. As part of this transformation, the country has significantly expanded its manufacturing base. By 2023, the number of registered industrial facilities in the Kingdom had surged to 11,549, an increase of over 60% since the start of Vision 2030. Industrial growth has also been supported by financing initiatives and investment incentives targeting local production of metals, machinery, and electronics. These sectors all rely on electric welding for product assembly, structural fabrication, and heavy equipment maintenance. Additionally, the Saudi Ministry of Industry and Mineral Resources has prioritized the localization of industrial supply chains, including the fabrication of parts for oil rigs, desalination plants, and transportation systems. As the manufacturing sector matures, the need for high-precision, energy-efficient welding technologies continues to rise. Apart from this, new industrial cities like Sudair and Jazan are being developed to support this growth, and their construction and operations are contributing to the Saudi Arabia welding equipment market growth.

Construction Mega-Projects

Saudi Arabia is home to one of the world’s largest construction pipelines, with mega-projects collectively valued at over USD 850 billion under Vision 2030. The most notable among these are NEOM (USD 500 billion), the Red Sea Project, and Qiddiya, which aim to transform the Kingdom into a global hub for tourism, sports, smart cities, and green living. These massive projects are reshaping the urban and industrial landscape and creating high-volume demand for construction equipment—including welding machines and automation tools. Welding is required for steel structure assembly, prefabricated component fabrication, and underground piping networks. The scope and speed of these developments necessitate the use of advanced welding techniques, such as robotic welding arms, and portable inverter-based systems. Projects like the Riyadh Metro and Diriyah Gate also contribute significantly to equipment demand. Skilled welders and modern welding units are essential for maintaining construction timelines and safety standards across these multi-billion-dollar developments, which is creatin a positive market outlook.

Saudi Arabia Electric Welding Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on equipment, technology, and application.

Equipment Insights:

- Arc Welding

- MIG/MAG Welding

- TIG Welding

- Resistance Welding

- Laser Welding

The report has provided a detailed breakup and analysis of the market based on the equipment. This includes arc welding, MIG/MAG welding, TIG welding, resistance welding, and laser welding.

Technology Insights:

- Conventional Welding

- Automated Welding

- Robotic Welding

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes conventional welding, automated welding, and robotic welding.

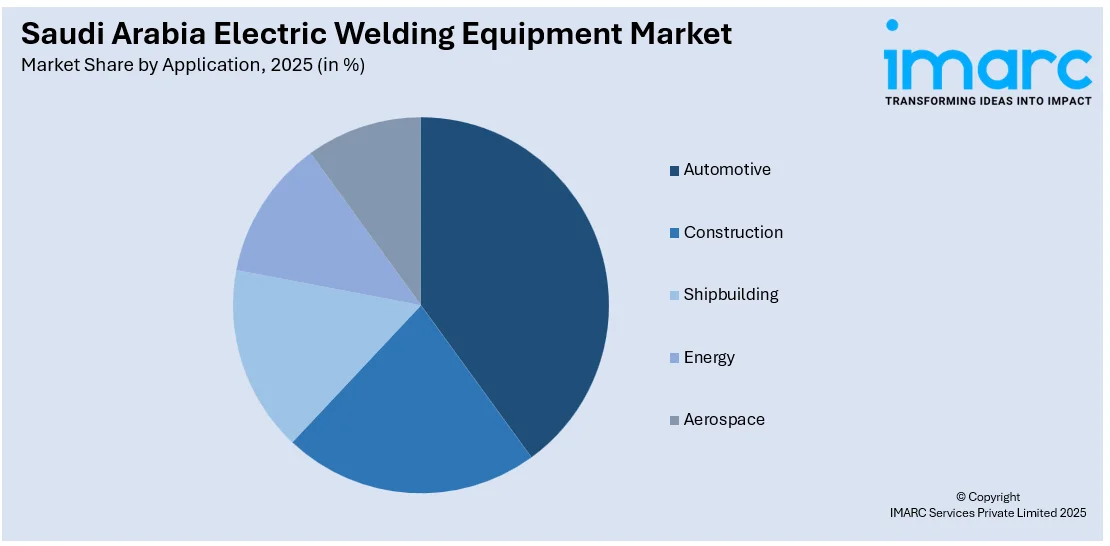

Application Insights:

Access the comprehensive market breakdown Request Sample

- Automotive

- Construction

- Shipbuilding

- Energy

- Aerospace

The report has provided a detailed breakup and analysis of the market based on the application. This includes automotive, construction, shipbuilding, energy, and aerospace.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Electric Welding Equipment Market News:

- In 2024, DXTECH showcased its advanced fiber laser cutting and welding machines to Saudi clients, emphasizing precision, speed, and efficiency. The demonstrations were part of a strategic push to expand DXTECH’s footprint in the Middle East, targeting industrial sectors seeking high-performance, automated welding solutions.

- In 2024, Victor Welding Products expanded its distribution network across Saudi Arabia to improve access to its cutting and welding solutions. The move aims to meet rising industrial demand and ensure faster equipment delivery and local technical support, reinforcing the brand’s presence in the growing Middle East market.

Saudi Arabia Electric Welding Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipments Covered | Arc Welding, MIG/MAG Welding, TIG Welding, Resistance Welding, Laser Welding |

| Technologies Covered | Conventional Welding, Automated Welding, Robotic Welding |

| Applications Covered | Automotive, Construction, Shipbuilding, Energy, Aerospace |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia electric welding equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia electric welding equipment market on the basis of equipment?

- What is the breakup of the Saudi Arabia electric welding equipment market on the basis of technology?

- What is the breakup of the Saudi Arabia electric welding equipment market on the basis of application?

- What is the breakup of the Saudi Arabia electric welding equipment market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia electric welding equipment market?

- What are the key driving factors and challenges in the Saudi Arabia electric welding equipment?

- What is the structure of the Saudi Arabia electric welding equipment market and who are the key players?

- What is the degree of competition in the Saudi Arabia electric welding equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia electric welding equipment market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia electric welding equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia electric welding equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)