Saudi Arabia Electric Welding Machine Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

Saudi Arabia Electric Welding Machine Market Summary:

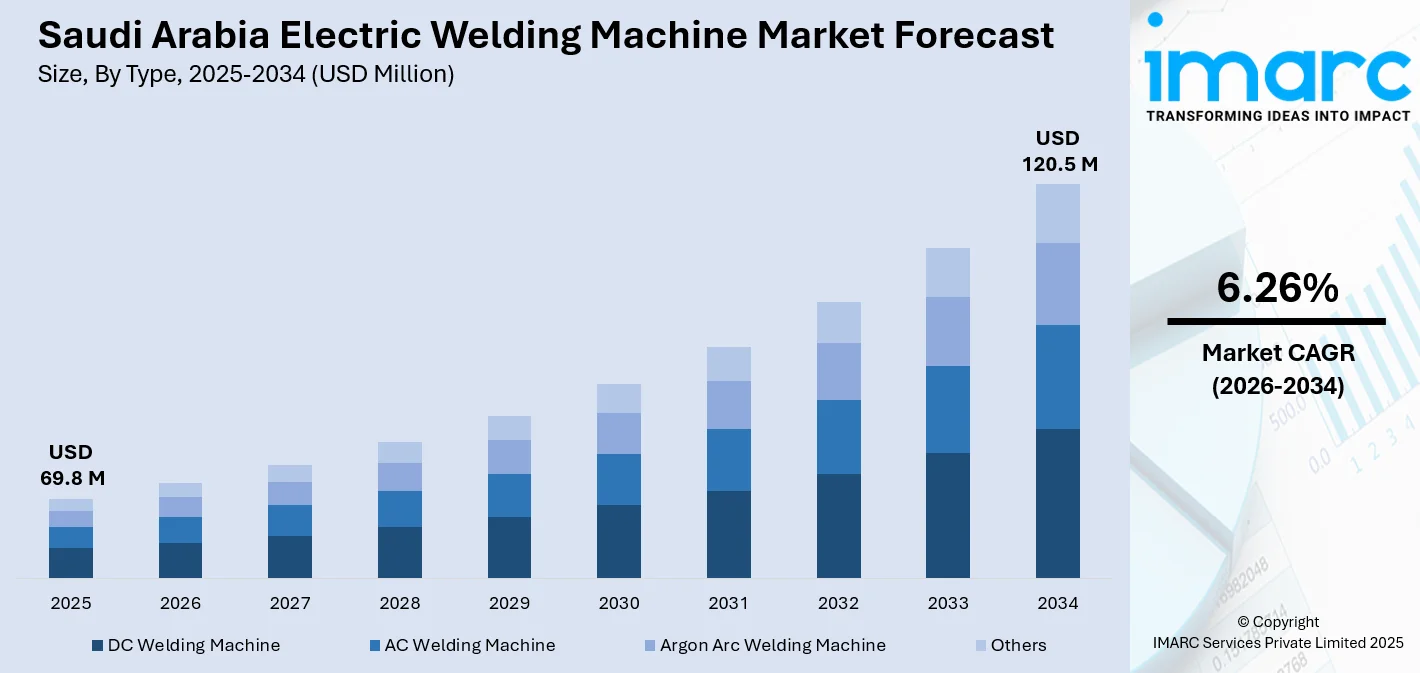

The Saudi Arabia electric welding machine market size was valued at USD 69.8 Million in 2025 and is projected to reach USD 120.5 Million by 2034, growing at a compound annual growth rate of 6.26% from 2026-2034.

The Saudi Arabian industrial sector's ongoing expansion and infrastructure development initiatives continue to drive demand for advanced welding technologies. As the nation diversifies its economy beyond oil and gas, increased investments in manufacturing, automotive production, and construction projects have elevated the need for reliable and efficient welding equipment. The market reflects growing adoption of modern welding solutions across various industrial applications, supported by technological advancements and enhanced operational efficiency requirements, thereby expanding the Saudi Arabia electric welding machine market share.

Key Takeaways and Insights:

- By Type: DC welding machine dominates the market with a share of 41% in 2025, driven by its versatility, cost-effectiveness, and superior performance in precision welding applications across diverse industrial sectors.

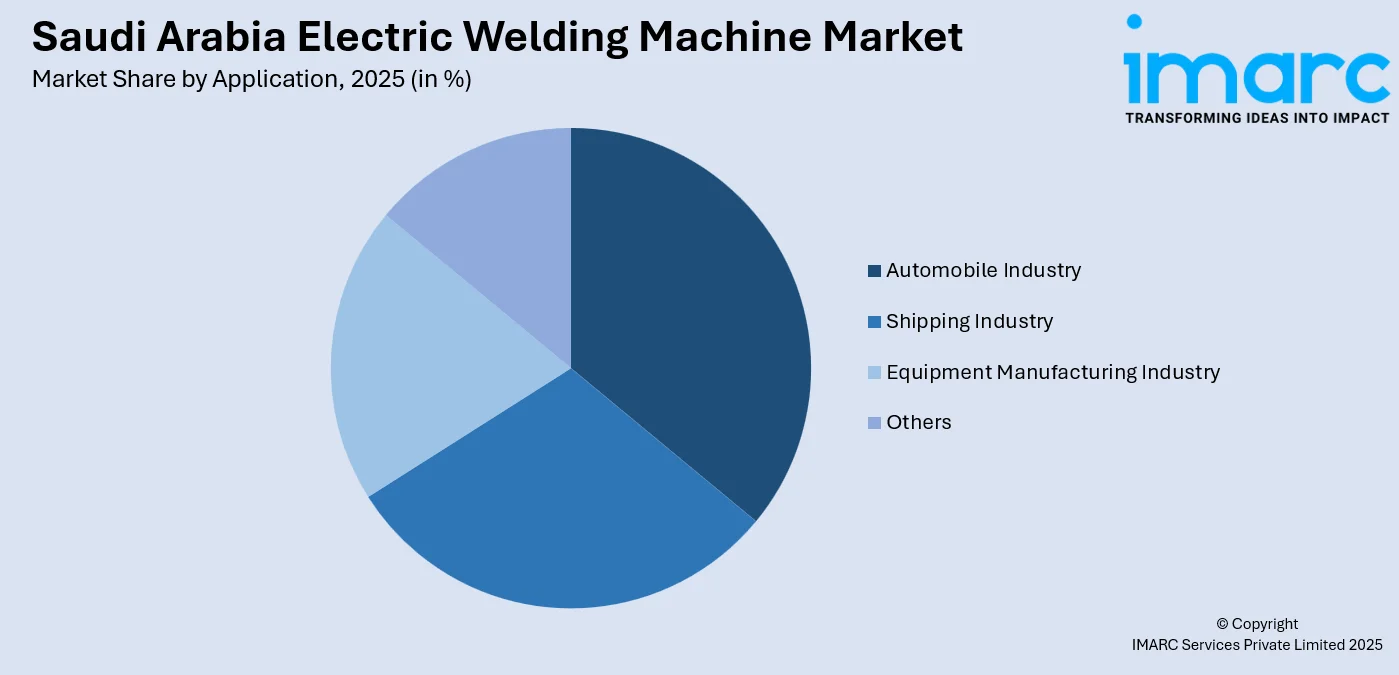

- By Application: Automobile industry leads the market with a share of 36% in 2025, reflecting robust automotive manufacturing growth and increased demand for high-quality welding solutions in vehicle production processes.

- By Region: Northern and central region represents the largest segment with a market share of 30% in 2025, supported by concentrated industrial manufacturing clusters and major infrastructure development projects in this strategically important area.

- Key Players: The Saudi Arabia electric welding machine market demonstrates moderate competitive intensity, with both international manufacturers and regional suppliers competing across different price and technology segments, fostering healthy market dynamics and continuous innovation.

To get more information on this market Request Sample

The competitive landscape is characterized by a mix of established multinational corporations and regional players who collectively serve the diverse needs of Saudi Arabia's expanding industrial base. Market participants employ varied strategies including product innovation, localized service offerings, and strategic partnerships to strengthen their market positions. The presence of multiple competitors at different market tiers ensures product diversity and competitive pricing, benefiting end-users across manufacturing, automotive, shipping, and equipment manufacturing industries. Saudi Arabia's industrial transformation creates compelling opportunities for welding equipment providers. The establishment of automotive assembly plants by international manufacturers, such as regional production facilities initiated through strategic partnerships with Gulf-based entities, exemplifies the scale of manufacturing investments driving equipment demand. These facilities require sophisticated welding systems to support production lines, quality assurance processes, and maintenance operations. Similarly, the expansion of steel fabrication and metal processing sectors supporting construction and infrastructure projects generates substantial demand for versatile welding equipment capable of handling diverse applications and material specifications. In 2025, Saudi Arabia planned to establish a national firm to import scrap metal, aiming to strengthen a sector with SR60 billion ($15.9 billion) in investment prospects. During the third Saudi International Iron and Steel Conference in Riyadh, Minister of Industry and Mineral Resources Bandar Alkhorayef stated that the Kingdom aims to enhance local production and reduce dependence on imports. He mentioned that the ministry evaluated the market to tackle supply shortages and improve domestic manufacturing of high-value steel items.

Saudi Arabia Electric Welding Machine Market Trends:

Increasing Adoption of Advanced Automation Technologies

The Saudi Arabian welding industry is experiencing accelerating integration of automation and robotics in welding processes. Manufacturing facilities are investing in automated welding systems to enhance precision, improve productivity, and reduce labor costs. This shift reflects broader industry recognition that advanced technologies deliver superior weld quality consistency while enabling faster production cycles, making them particularly valuable for high-volume automotive and equipment manufacturing operations. In 2025, ESAB, a global leader in fabrication technology, is excited to unveil its new manufacturing plant in Al Ahsa, Saudi Arabia. The manufacturing facility, spanning 6,028 M2, will create high-quality performance filler metals, greatly increasing ESAB's production capability to meet the rising demand for industrial growth in the area. The development of the facility was executed in partnership with Spark Weld Electrodes, a well-respected supplier of fabrication materials in the region with a strong legacy in Saudi Arabia. Spark Weld Electrodes, located in Al Ahsa, Saudi Arabia, was established to deliver internationally standard welding consumables produced locally for Saudi Arabia, the Gulf Cooperation Council, and additional nations.

Growing Emphasis on Energy Efficiency and Sustainability

Market participants are increasingly prioritizing energy-efficient welding solutions as part of broader sustainability initiatives. Modern electric welding machines with optimized power consumption contribute to reduced operational costs and align with environmental responsibility objectives. This trend is particularly pronounced among multinational corporations operating in Saudi Arabia, who integrate global sustainability standards into their local operations and procurement decisions. In 2024, in its continuous initiatives to boost energy efficiency and enhance market performance, the Saudi Energy Efficiency Center (SEEC) revealed a notable advancement in the Energy Efficiency Product Compliance Index for 2024. This accomplishment was attained through tight cooperation with various pertinent government agencies, as a part of a national strategy focused on reaching environmental and economic sustainability objectives.

Rising Demand for Portable and Lightweight Welding Equipment and Welding Training Programs

There is growing market preference for portable and compact welding machines that offer flexibility in on-site applications. Construction projects, maintenance operations, and field-based manufacturing work drive demand for equipment that combines performance with mobility. This trend reflects the diversification of welding applications beyond traditional factory settings into infrastructure development and project-based industrial work. Moreover, companies are launching various welding training programs, thereby increasing the need for welding machines. For instance, in 2025, Nesma & Partners, alongside Serimax and with Aramco's support, officially initiated the Kingdom’s inaugural Automated Mechanized Welding training program for pipelines at the Nesma High Training Institute (NHTI) in Dhahran. The launch initiates the Memorandum of Understanding signed earlier this year at iktva and showcases Nesma & Partners’ dedication to local workforce development, innovation, and industrial superiority. The six-month program certifies Saudi technicians in automated welding for pipelines via classroom education, hands-on practice, and practical training alongside automated welding teams. It brings top-tier automated welding technologies to the Kingdom and creates a dedicated route for training highly skilled technicians.

How Vision 2030 is Transforming the Saudi Arabia Electric Welding Machine Market:

Saudi Vision 2030 is reshaping the electric welding market by pushing large-scale industrial growth and local manufacturing. Massive investments in infrastructure, including NEOM, Red Sea projects, metros, airports, and renewable energy plants, are driving steady demand for welding machines, electrodes, and automation-ready systems. The push to localize production under the National Industrial Development and Logistics Program has encouraged global welding equipment makers to set up assembly units and partnerships inside the Kingdom, reducing import reliance. At the same time, stricter quality and safety norms across construction, oil and gas, shipbuilding, and fabrication are raising demand for advanced electric welding technologies like inverter-based welders and automated welding lines. Workforce upskilling initiatives are also creating a stronger base of trained welders, supporting adoption of modern equipment. With energy efficiency and productivity gaining attention, buyers are shifting away from conventional systems toward precision-driven electric welding solutions, making the market more technology-focused and investment-led than in the past.

Market Outlook 2026-2034:

The Saudi Arabia electric welding machine market is positioned for steady and sustainable growth over the forecast period, driven by continued industrial diversification and comprehensive infrastructure expansion initiatives across the kingdom. Government initiatives supporting manufacturing sector development, including the National Industrial Development and Logistics Program (NIDLP) and Vision 2030 economic transformation objectives, create sustained and expanding demand for advanced welding equipment across multiple industrial sectors and applications. The market generated a revenue of USD 69.8 Million in 2025 and is projected to reach a revenue of USD 120.5 Million by 2034, growing at a compound annual growth rate of 6.26% from 2026-2034. The market's growth trajectory reflects fundamental shifts in Saudi Arabia's economic strategy, moving away from hydrocarbon dependency toward diversified industrial manufacturing capabilities.

Saudi Arabia Electric Welding Machine Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

DC Welding Machine |

41% |

|

Application |

Automobile Industry |

36% |

|

Region |

Northern and Central Region |

30% |

Type Insights:

- DC Welding Machine

- AC Welding Machine

- Argon Arc Welding Machine

- Others

DC welding machine dominates with a market share of 41% of the total Saudi Arabia electric welding machine market in 2025.

Direct current welding technology provides exceptional control and stability for critical welding operations, making it the preferred choice for automotive manufacturing, equipment assembly, and specialized industrial fabrication. The segment benefits from established supplier networks, technical expertise among operators, and proven reliability in demanding industrial environments. DC welding machines' capability to deliver consistent weld quality across varying material types and thicknesses positions them as the standard for quality-sensitive applications throughout Saudi Arabia's expanding industrial sector.

The DC welding machine segment's dominance is reinforced by competitive pricing, availability of replacement parts, and widespread service infrastructure. Apart from this, as Saudi Arabia's automotive manufacturing sector expands through partnerships with international producers and localized assembly operations, demand for dependable DC welding solutions continues to strengthen. Furthermore, the technology's adaptability to both stationary production lines and portable field applications further extends its market relevance across diverse industrial contexts.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Automobile Industry

- Shipping Industry

- Equipment Manufacturing Industry

- Others

Automobile industry leads with a share of 36% of the total Saudi Arabia electric welding machine market in 2025.

Saudi Arabia's automotive manufacturing ecosystem has expanded significantly with the establishment of assembly plants and component manufacturing facilities by international automotive corporations. These operations demand reliable, high-precision welding equipment to maintain production quality standards and achieve competitive manufacturing costs. The sector's growth trajectory, driven by both domestic market expansion and export opportunities within the GCC region, ensures sustained demand for advanced welding solutions capable of handling complex vehicle assembly requirements.

The automobile industry's leadership in welding equipment demand is supported by stringent quality requirements, high production volumes, and continuous technology upgrades. Apart from this, vehicle manufacturers invest in modern welding systems to achieve operational efficiency, reduce defect rates, and maintain compliance with international quality standards. Furthermore, this commitment to manufacturing excellence creates consistent market demand for cutting-edge welding equipment and drives technological innovation within the broader market ecosystem.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and central region exhibits a clear dominance with a 30% share of the total Saudi Arabia electric welding machine market in 2025.

This region encompasses major industrial clusters, including significant automotive manufacturing operations and equipment production facilities that collectively drive regional welding equipment demand. The region's dominance is anchored in its concentration of industrial zones, manufacturing parks, and infrastructure development projects. The presence of major automotive assembly plants, component manufacturers, and heavy equipment producers creates sustained demand for welding technologies. Additionally, ongoing infrastructure projects, including transportation networks, utilities, and commercial developments, generate additional welding equipment requirements across construction and installation phases.

The Northern and Central Region's established industrial base, coupled with proximity to major markets within Saudi Arabia and the broader Gulf Cooperation Council region, reinforces its position as the primary market hub for welding equipment consumption. The region benefits from well-developed supply chains, established distribution networks, and concentrated technical expertise among service providers and equipment suppliers. This infrastructure advantage ensures reliable equipment availability, comprehensive after-sales support, and access to technical training and maintenance services. As the kingdom continues directing investment toward industrial diversification and manufacturing capacity expansion in this region, the market share advantage is expected to persist throughout the forecast period.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Electric Welding Machine Market Growing?

Industrial Diversification and Manufacturing Expansion

Saudi Arabia's strategic economic diversification away from traditional oil and gas sectors has catalyzed substantial investments in manufacturing infrastructure and industrial capacity. National development initiatives, including Vision 2030 programs and the National Industrial Development and Logistics Program, prioritize domestic manufacturing capability and industrial competitiveness. These policy frameworks have stimulated establishment of manufacturing facilities across automotive, aerospace, equipment production, and specialty manufacturing sectors, each requiring advanced welding equipment for production processes and quality assurance. In 2024, Saudi Arabia’s economy expanded by 1.3 percent, bolstered by growth in non-oil sectors even though there was a decrease in the oil industry, as reported by the General Authority for Statistics. Growth picked up in the fourth quarter of 2024, with gross domestic product increasing by 4.5 percent compared to the previous year, marking the largest quarterly growth in two years, bolstered by a 4.7 percent increase in non-oil sectors and a 3.4 percent rise in oil sectors.

Automotive Sector Growth and Production Scaling

The Saudi Arabian automotive manufacturing sector has experienced significant expansion through partnerships with international vehicle manufacturers establishing local assembly and component production operations. Increasing vehicle production volumes demand proportional growth in welding equipment capacity and technology sophistication. Automotive manufacturers maintain rigorous quality standards requiring precise, consistent welding performance, driving investment in modern, reliable welding systems that support high-volume production while maintaining quality specifications. On 19 November 2025, while Crown Prince Mohammed bin Salman was in Washington, the Ministry of Investment, the National Industrial Development Center (NIDC), Stellantis, and longstanding local partner Petromin Corporation signed a memorandum of understanding to explore the feasibility of establishing a complete vehicle manufacturing facility in the kingdom. The suggested facility would manufacture both passenger and commercial vehicles, utilizing Stellantis' extensive American and European brand range.

Infrastructure Development and Construction Projects

Ongoing large-scale infrastructure development projects throughout Saudi Arabia, including transportation networks, utilities expansion, commercial developments, and industrial facilities, generate substantial welding equipment demand for installation, assembly, and fabrication work. In 2024, Saudi Arabia's gross fixed capital formation hit SR1.33 trillion ($355 billion), indicating a 4.5 percent rise compared to the previous year, based on revised figures from the Ministry of Investment. This figure surpassed the ministry’s initial goal of SR964 billion by 38 percent, highlighting robust activity in the Kingdom's capital investment cycle and indicating ongoing advancement toward Vision 2030 goals. Construction and infrastructure sectors employ welding technologies for structural steel assembly, pipeline installation, and specialized fabrication requirements. This sustained project pipeline ensures continued market demand for portable and versatile welding solutions capable of supporting diverse on-site applications and challenging field conditions.

Market Restraints:

What Challenges the Saudi Arabia Electric Welding Machine Market is Facing?

High Equipment Capital Costs and Investment Requirements

Initial equipment acquisition represents substantial capital investment for small and medium-sized enterprises, creating barriers to technology adoption and market expansion. Extended payback periods and financing challenges limit purchasing capacity among smaller industrial operators, constraining overall market growth potential in segments dependent on smaller-scale manufacturers and service providers.

Technical Skill Shortage and Workforce Development Gaps

Limited availability of skilled welding technicians and operators constrains market expansion despite equipment availability. Training infrastructure gaps result in insufficient numbers of qualified professionals capable of operating advanced welding systems and performing maintenance and calibration services. This skills deficit reduces equipment utilization efficiency and delays adoption of newer technologies requiring specialized technical expertise.

Import Dependency and Supply Chain Vulnerabilities

Saudi Arabia's reliance on imported welding equipment and spare parts creates supply chain dependencies and exposes the market to global logistics disruptions and currency fluctuations. Limited domestic manufacturing of welding equipment restricts competitive sourcing options and sustains higher price points. Supply chain uncertainties and import delays impact customer acquisition timelines and create operational challenges for industrial manufacturers dependent on reliable equipment availability.

Competitive Landscape:

The Saudi Arabia electric welding machine market operates within a moderately competitive environment characterized by participation of international manufacturers, regional distributors, and specialized equipment suppliers. The competitive structure reflects differentiated market positioning across price segments, technology offerings, and service capabilities. Leading multinational corporations leverage global manufacturing expertise, advanced technology platforms, and established distribution networks to serve large-scale industrial customers and automotive manufacturers. Regional and local suppliers compete effectively in price-sensitive segments and specialized applications through localized service advantages and market familiarity. The competitive dynamics encourage continuous innovation in welding technology, cost optimization, and enhanced after-sales support services. Market participants pursue varied strategic approaches including product line expansion, technological differentiation, service excellence, and strategic partnerships to secure market positions and customer loyalty.

Saudi Arabia Electric Welding Machine Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | DC Welding Machine, AC Welding Machine, Argon Arc Welding Machine, Others |

| Applications Covered | Automobile Industry, Shipping Industry, Equipment Manufacturing Industry, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia electric welding machine market size was valued at USD 69.8 Million in 2025.

The Saudi Arabia electric welding machine market is expected to grow at a compound annual growth rate of 6.26% from 2026-2034 to reach USD 120.5 Million by 2034.

DC welding machine holds the largest market share at 41% in 2025, driven by its superior precision capabilities, versatility across industrial applications, and proven reliability in demanding manufacturing environments where consistent, high-quality welds are critical operational requirements.

Key factors driving the Saudi Arabia electric welding machine market include industrial diversification initiatives supporting manufacturing sector expansion, growth in automotive manufacturing and production scaling, and ongoing large-scale infrastructure development projects requiring specialized welding equipment for fabrication and assembly operations.

Major challenges include high equipment capital costs limiting adoption among smaller enterprises, technical skill shortages restricting workforce capacity for advanced system operation, and import dependencies creating supply chain vulnerabilities that impact equipment availability and pricing dynamics.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)