Saudi Arabia Electrical Wires and Cables Market Size, Share, Trends and Forecast by Type, End User, and Region, 2026-2034

Saudi Arabia Electrical Wires and Cables Market Overview:

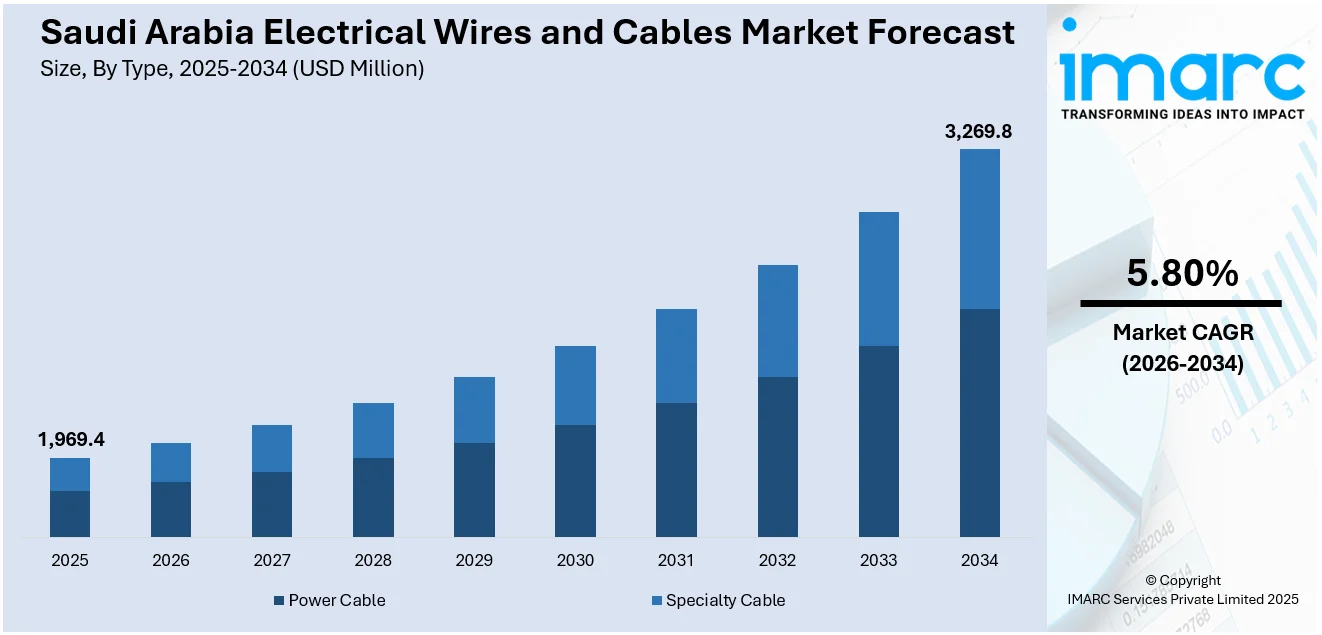

The Saudi Arabia electrical wires and cables market size reached USD 1,969.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 3,269.8 Million by 2034, exhibiting a growth rate (CAGR) of 5.80% during 2026-2034. The market is growing on account of the rising adoption of electric vehicles, renewable energy systems, and industrial automation. These products, coupled with the evolution in fuse technology, are fueling the growth in the market. As demand for reliable and efficient power systems grows, the Saudi Arabia electrical wires and cables market share is expanding further.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 1,969.4 Million |

|

Market Forecast in 2034

|

USD 3,269.8 Million |

| Market Growth Rate 2026-2034 | 5.80% |

Saudi Arabia Electrical Wires and Cables Market Trends:

Local Manufacturing Expansion

Saudi Arabia's electrical wires and cables market is witnessing considerable growth due to rising investments in local manufacturing units. In an effort to realize the country's Vision 2030, some leading players are increasing their production capacity to ensure domestic demand. For example, in January 2024, Elsewedy Cables KSA agreed with the Royal Commission for Jubail and Yanbu to set up a Special Cables and Copper Rod factory at Yanbu Industrial City. This new plant is designed to satisfy the increasing local need for energy sector equipment and assist Saudi Arabia's economic diversification. Through the enhancement of its production capabilities, Elsewedy Cables is positioned to become a major player in the kingdom's power and infrastructure sectors. The development will also generate job opportunities and drive the local economy in the long term. Focusing on the objectives of Vision 2030, the expansion will also make the kingdom self-sufficient in terms of electrical cable manufacturing, less reliant on imports, and serve to boost vital industries such as energy, building and construction, and manufacturing.

To get more information on this market Request Sample

Growing Demand for Specialized Cables

The demand for specialized cables, such as low-voltage cables, is increasing in Saudi Arabia due to the growing energy sector and infrastructure development. The country's emphasis on innovation and infrastructure is encouraging new ventures to meet rising local demand. For instance, in June 2024, Al Ojaimi Industrial Group inaugurated the Union Paths Cable Factory, specializing in low-voltage cables with an annual capacity of 5,000 tons of aluminum and 10,000 tons of copper. This factory will help meet the energy sector's specific requirements, such as power distribution and industrial operations, by providing high-quality cables. The Ministry of Energy's support for this initiative reflects the growing importance of local production in Saudi Arabia's energy and infrastructure sectors. With an increasing focus on energy-efficient solutions, this expansion will strengthen the electrical wires and cables market, especially in the low-voltage segment. As local production increases, Saudi Arabia's market for specialized cables is expected to grow, creating opportunities for manufacturers and contributing to the nation's economic development. The launch also aligns with the government's broader efforts to support local industry and reduce reliance on imports, further impelling Saudi Arabia electrical wires and cables market growth.

Saudi Arabia Electrical Wires and Cables Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2026-2034. Our report has categorized the market based on type and end user.

Type Insights:

- Power Cable

- Specialty Cable

The report has provided a detailed breakup and analysis of the market based on the type. This includes power cable and specialty cable.

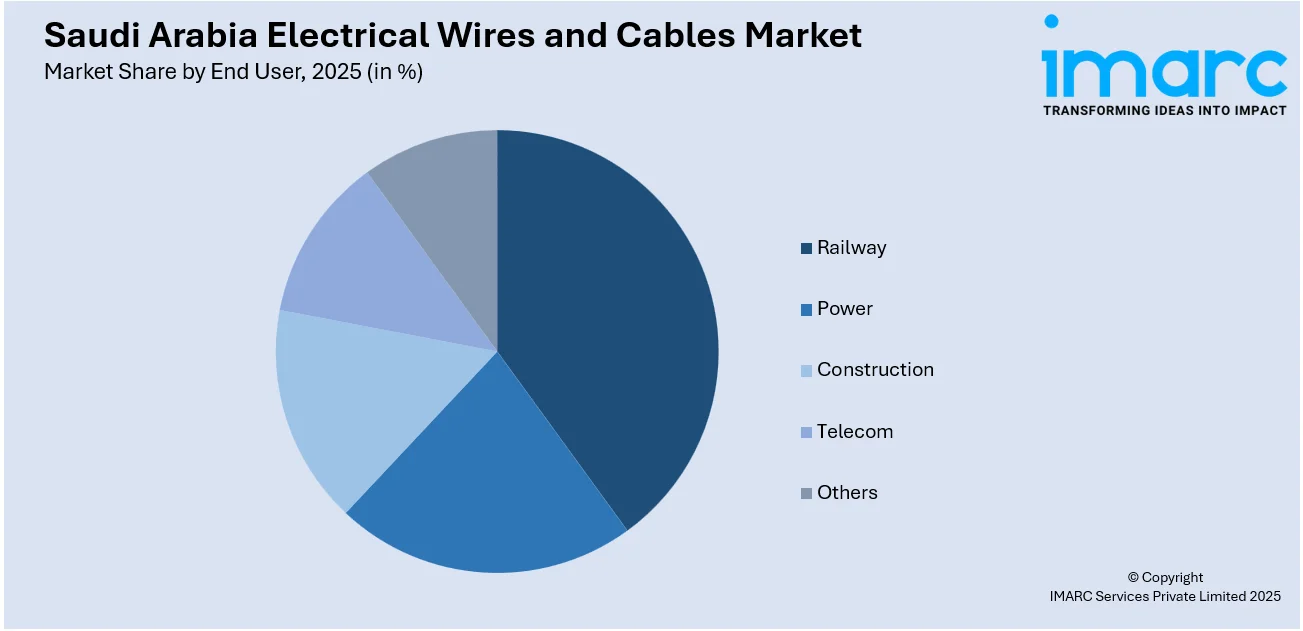

End User Insights:

Access the comprehensive market breakdown Request Sample

- Railway

- Power

- Construction

- Telecom

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes railway, power, construction, telecom, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central region, Western region, Eastern region, and Southern region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Electrical Wires and Cables Market News:

- April 2025: Ducab launched the region's first High Voltage (HV) Fiber Optic cable at the Middle East Energy exhibition. Combining high-voltage transmission with fiber optic technology, the cable enhances grid stability and efficiency. Its eco-friendly design and compliance with European standards contribute to the growing demand for sustainable electrical cables in the GCC and globally.

- February 2025: Mobily landed the Africa-1 subsea cable in Duba, Saudi Arabia. Spanning over 10,000 km with 96Tbps capacity, this project enhances digital connectivity between East Africa, the Middle East, and Europe. It boosts demand for high-performance electrical cables, driving growth in Saudi Arabia's subsea cable infrastructure market.

Saudi Arabia Electrical Wires and Cables Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Power Cable, Specialty Cable |

| End Users Covered | Railway, Power, Construction, Telecom, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia electrical wires and cables market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia electrical wires and cables market on the basis of type?

- What is the breakup of the Saudi Arabia electrical wires and cables market on the basis of end user?

- What is the breakup of the Saudi Arabia electrical wires and cables market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia electrical wires and cables market?

- What are the key driving factors and challenges in the Saudi Arabia electrical wires and cables market?

- What is the structure of the Saudi Arabia electrical wires and cables market and who are the key players?

- What is the degree of competition in the Saudi Arabia electrical wires and cables market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia electrical wires and cables market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia electrical wires and cables market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia electrical wires and cables industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)