Saudi Arabia Electronic Security Market Size, Share, Trends and Forecast by Product Type, Service Type, End-Use Sector, and Region, 2026-2034

Saudi Arabia Electronic Security Market Overview:

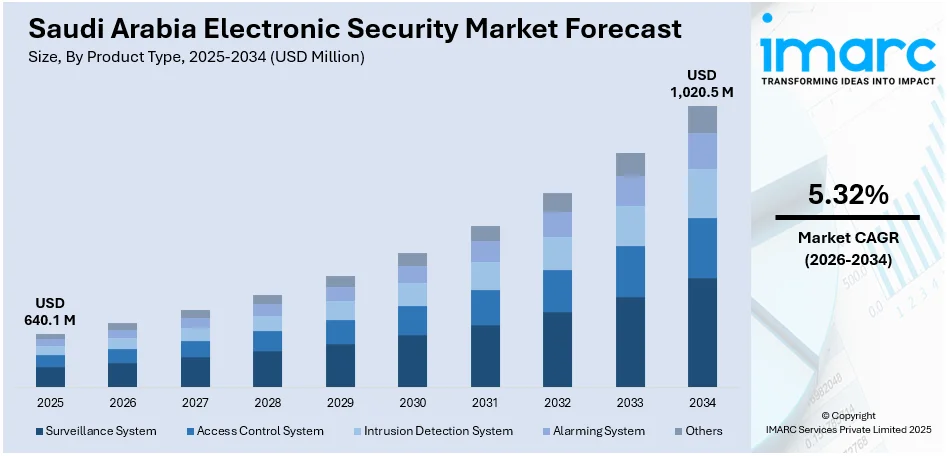

The Saudi Arabia electronic security market size reached USD 640.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,020.5 Million by 2034, exhibiting a growth rate (CAGR) of 5.32% during 2026-2034. The market share is expanding, driven by the growing investments in critical infrastructure, along with the rising need for advanced technology that can aid in keeping people, property, and information safe.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 640.1 Million |

| Market Forecast in 2034 | USD 1,020.5 Million |

| Market Growth Rate 2026-2034 | 5.32% |

Saudi Arabia Electronic Security Market Trends:

Increasing expenditure on critical infrastructure

Rising investments in critical infrastructure are offering a favorable Saudi Arabia electronic security market outlook. As the nation is launching initiatives to support the advancement of vital areas, such as transportation, energy, healthcare, and smart urban developments, the need to protect these assets has become more important. In January 2024, the King Abdullah Financial District Development and Management Company (KAFD DMC) teamed up with the Saudi Company for Artificial Intelligence (SCAI) to launch a smart city initiative aimed at transforming the district's future functions. The fully owned subsidiaries of the public investment fund (PIF) were set to implement smart traffic and mobility solutions to enhance KAFD’s urban experience. These large-scale projects often involve high-value facilities and sensitive data, making them prime targets for security threats. Because of that, electronic security systems like biometric scanners, surveillance cameras, alarm systems, and access control systems are being widely adopted. With new airports, metro systems, industrial zones, and energy facilities being built, strong security measures are a must to ensure operational continuity. Developers and contractors are incorporating electronic security from the planning phase to ensure compliance standards and foster public trust. Private sector projects, such as malls, hotels, and corporate buildings, also follow suit to stay competitive and secure. Overall, the ongoing shift towards modern infrastructure in Saudi Arabia is creating a solid foundation for the electronic security market to expand, as risk management is becoming a top priority across several sectors.

To get more information on this market Request Sample

Growing cyber and physical threats

Increasing cyber and physical threats are impelling the Saudi Arabia electronic security market growth. As per industry reports, in 2024, Saudi Arabia faced 88 ransomware attacks, primarily affecting sectors inculcating manufacturing (25.41%), information (10.50%), and construction (9.94%). With more businesses and government sectors going digital and handling sensitive information, the risk of cyberattacks keeps rising. From data breaches to ransomware, these threats are encouraging organizations to invest in better security systems to protect their networks and assets. Physical security is also important, especially for key sites like oil facilities, government buildings, transportation hubs, and commercial centers. The potential for theft, vandalism, and terrorism creates the need for surveillance systems, access control, and intrusion detection. Companies and institutions have become more aware about the requirement to combine both digital and physical security for complete protection. This is where electronic security solutions come in, offering smart tools to monitor, detect, and respond to all kinds of threats.

Saudi Arabia Electronic Security Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on product type, service type, and end-use sector.

Product Type Insights:

- Surveillance System

- Access Control System

- Intrusion Detection System

- Alarming System

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes surveillance system, access control system, intrusion detection system, alarming system, and others.

Service Type Insights:

- Installation Services

- Managed Services

- Consulting Services

A detailed breakup and analysis of the market based on the service type have also been provided in the report. This includes installation services, managed services, and consulting services.

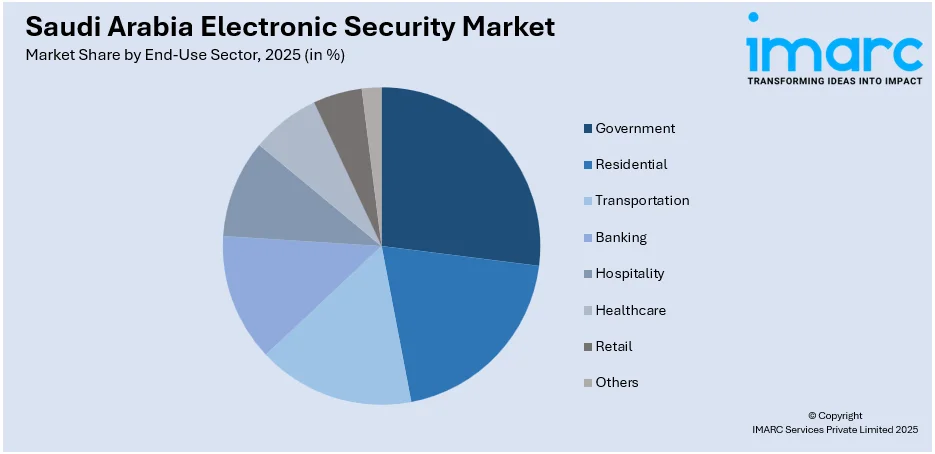

End-Use Sector Insights:

Access the comprehensive market breakdown Request Sample

- Government

- Residential

- Transportation

- Banking

- Hospitality

- Healthcare

- Retail

- Others

The report has provided a detailed breakup and analysis of the market based on the end-use sector. This includes government, residential, transportation, banking, hospitality, healthcare, retail, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Electronic Security Market News:

- In March 2025, Teledyne FLIR Defense obtained a USD 7.8 Million contract to offer its mobile surveillance systems to an important military organization in Saudi Arabia. The system, referred to as the ‘Lightweight Vehicle Surveillance System’ (LVSS), combined cutting-edge technologies within a light pickup truck framework, providing quick setup and elevated mobility for tactical settings. It came with the TacFLIR® 380HD long-distance thermal imaging sensor and the ranger® R20SS radar, capable of tracking as many as 500 targets at ranges greater than 10 Miles simultaneously.

- In September 2024, Eagle Eye Networks, the world leader in cloud video surveillance, revealed the launch of a new data center in Riyadh, Saudi Arabia. The data center was set to provide companies throughout the country with secure and scalable cloud-based video surveillance solutions. The firm offered advanced cybersecurity, performance, and dependability.

Saudi Arabia Electronic Security Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Surveillance System, Access Control System, Intrusion Detection System, Alarming System, Others |

| Service Types Covered | Installation Services, Managed Services, Consulting Services |

| End-Use Sectors Covered | Government, Residential, Transportation, Banking, Hospitality, Healthcare, Retail, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia electronic security market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia electronic security market on the basis of product type?

- What is the breakup of the Saudi Arabia electronic security market on the basis of service type?

- What is the breakup of the Saudi Arabia electronic security market on the basis of end-use sector?

- What is the breakup of the Saudi Arabia electronic security market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia electronic security market?

- What are the key driving factors and challenges in the Saudi Arabia electronic security?

- What is the structure of the Saudi Arabia electronic security market and who are the key players?

- What is the degree of competition in the Saudi Arabia electronic security market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia electronic security market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia electronic security market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia electronic security industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)