Saudi Arabia Electronic Toll Collection Market Size, Share, Trends and Forecast by Technology, System, Subsystem, Offering, Toll Charging, Application, and Region, 2026-2034

Saudi Arabia Electronic Toll Collection Market Overview:

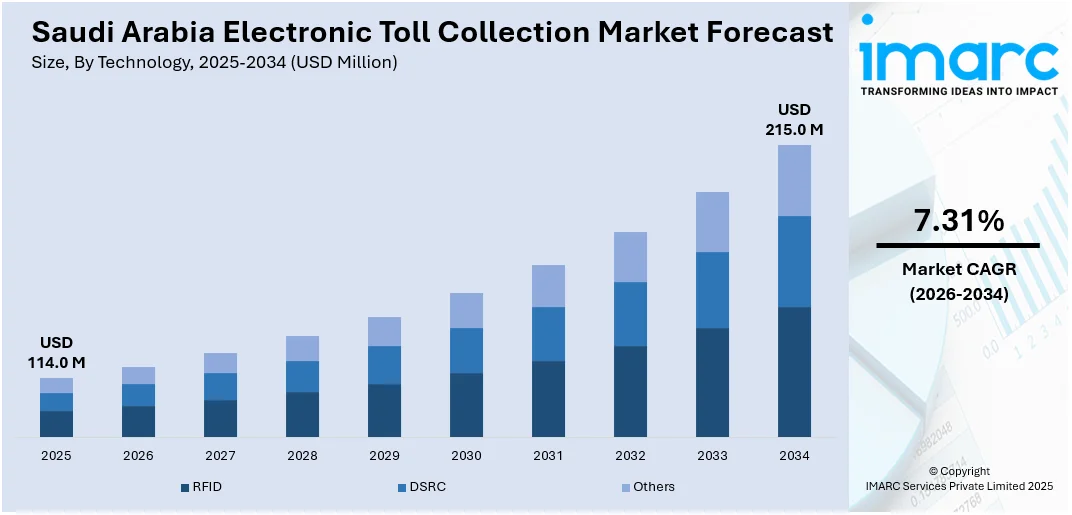

The Saudi Arabia electronic toll collection market size reached USD 114.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 215.0 Million by 2034, exhibiting a growth rate (CAGR) of 7.31% during 2026-2034. The market is driven by the growing focus on upgrading road infrastructure, which helps in streamlining traffic flow, and enhancing general transport efficiency, along with the rising private car ownership and increasing involvement of private operators and technology providers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 114.0 Million |

| Market Forecast in 2034 | USD 215.0 Million |

| Market Growth Rate 2026-2034 | 7.31% |

Saudi Arabia Electronic Toll Collection Market Trends:

Government Initiatives for Smart Transportation Infrastructure under Vision 2030

Saudi Arabia's Vision 2030 program is facilitating the expansion of the digital infrastructure in the country, including the take-up of advanced intelligent transportation solutions, such as electronic toll collection (ETC). The government is focusing to upgrade road infrastructure, streamline traffic flow, and enhance general transport efficiency. In pursuit of these objectives, the Ministry of Transport and Logistic Services is making serious investments in smart mobility solutions. Electronic tolling systems lower the bottlenecks at toll plazas, reduce cash handling, and enhance operation transparency, all of which fall in line with Vision 2030's overarching goals of enhancing public services and raising non-oil revenues. Furthermore, privatization of transportation infrastructure is encouraging public-private collaboration, spurring innovation and more rapid deployment of ETC. With multiple highway projects already being planned or built, demand for hassle-free toll collection is rising. For instance, in 2025, The Royal Commission for Riyadh City (RCRC) declared the start of eight projects under the second phase of the Main and Ring Road Development Program, with a total grant o over SAR 8 billion.

To get more information on this market Request Sample

Rapid Growth in Vehicle Ownership and Intercity Travel

At present, the country is witnessing a rise in private car ownership, driven by migration of people and expansion of various urban developments. Moreover, policy moves like the removal of the female driver ban have further increased the number of licensed drivers as well as vehicles on Saudi roads. This rise in traffic is pressurizing the nation's intercity roadways, especially along large corridors between Riyadh, Jeddah, Dammam, and Makkah. In order to manage the large volumes of traffic and keep the roads in good condition, tolling is now a vital component. ETC systems provide an extendable, automated means to accept toll payments efficiently over long distances without bringing vehicles to a halt. Additionally, with added freight movement arising from the industrial areas and commercial centers, comes a corresponding need for intelligent toll solutions for business logistics fleets. Arthur D. Little's 2024 Report, 89% of individuals in the country expressed that owning a car is going to become more crucial in the next decade. This is projected to increase the need for ETC systems.

Private Sector Involvement and Technological Advancements

The involvement of private operators and technology providers into the Saudi infrastructure space is facilitating the implementation of high-end tolling systems. Private sector funding is encouraged using build-operate-transfer (BOT) and public-private partnership (PPP) structures, particularly for road development and operation. Technology firms are collaborating with local players to bring in advanced ETC systems, such as radio frequency identification (RFID) tags, automatic number plate recognition (ANPR), GPS-based tolling, and mobile payment integrations. These partnerships are shortening system deployment periods and maintaining international standards for toll interoperability. With decreasing costs of technology and easier-to-use systems, adoption hurdles are reduced. The Saudi Arabia mobile payments market size is expected to reach USD 59.8 Billion by 2033, according to the IMARC Group.

Saudi Arabia Electronic Toll Collection Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on technology, system, subsystem, offering, toll charging, and application.

Technology Insights:

- RFID

- DSRC

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes RFID, DSRC, and others.

System Insights:

- Transponder - or Tag-Based Toll Collection Systems

- Other Toll Collection Systems

A detailed breakup and analysis of the market based on the system have also been provided in the report. This includes transponder - or tag-based toll collection systems and other toll collection systems.

Subsystem Insights:

- Automated Vehicle Identification

- Automated Vehicle Classification

- Violation Enforcement System

- Transaction Processing

A detailed breakup and analysis of the market based on the subsystem have also been provided in the report. This includes automated vehicle identification, automated vehicle classification, violation enforcement system, and transaction processing.

Offering Insights:

- Hardware

- Back Office and Other Services

A detailed breakup and analysis of the market based on the offering have also been provided in the report. This includes hardware and back office and other services.

Toll Charging Insights:

- Distance Based

- Point Based

- Time Based

- Perimeter Based

A detailed breakup and analysis of the market based on the toll charging have also been provided in the report. This includes distance based, point based, time based, and perimeter based.

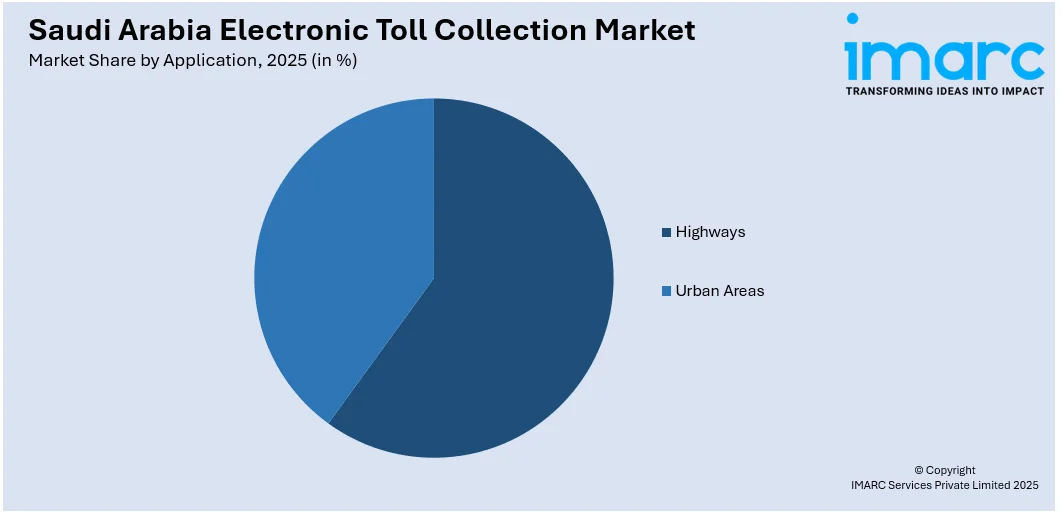

Application Insights:

Access the comprehensive market breakdown Request Sample

- Highways

- Urban Areas

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes highways and urban areas.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Electronic Toll Collection Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | RFID, DSRC, Others |

| Systems Covered | Transponder - or Tag-Based Toll Collection Systems, Other Toll Collection Systems |

| Subsystems Covered | Automated Vehicle Identification, Automated Vehicle Classification, Violation Enforcement System, Transaction Processing |

| Offerings Covered | Hardware, Back Office and Other Services |

| Toll Chargings Covered | Distance Based, Point Based, Time Based, Perimeter Based |

| Applications Covered | Highways, Urban Areas |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia electronic toll collection market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia electronic toll collection market on the basis of technology?

- What is the breakup of the Saudi Arabia electronic toll collection market on the basis of system?

- What is the breakup of the Saudi Arabia electronic toll collection market on the basis of subsystem?

- What is the breakup of the Saudi Arabia electronic toll collection market on the basis of offering?

- What is the breakup of the Saudi Arabia electronic toll collection market on the basis of toll charging?

- What is the breakup of the Saudi Arabia electronic toll collection market on the basis of application?

- What is the breakup of the Saudi Arabia electronic toll collection market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia electronic toll collection market?

- What are the key driving factors and challenges in the Saudi Arabia electronic toll collection market?

- What is the structure of the Saudi Arabia electronic toll collection market and who are the key players?

- What is the degree of competition in the Saudi Arabia electronic toll collection market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia electronic toll collection market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia electronic toll collection market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia electronic toll collection industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)