Saudi Arabia Electroplating Market Size, Share, Trends and Forecast by Type, Metal Type, End Use Industry, and Region, 2026-2034

Saudi Arabia Electroplating Market Overview:

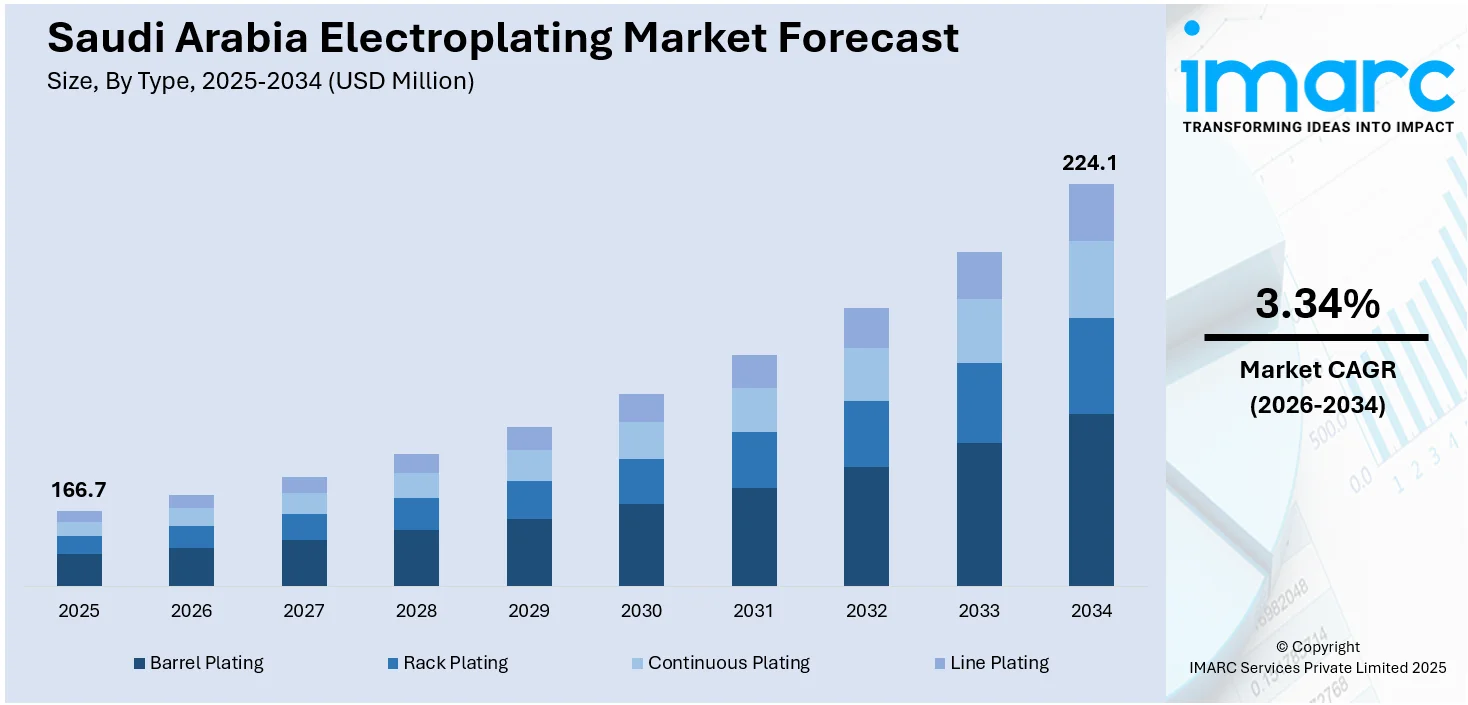

The Saudi Arabia electroplating market size reached USD 166.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 224.1 Million by 2034, exhibiting a growth rate (CAGR) of 3.34% during 2026-2034. At present, Saudi Arabia is undergoing high industrial development, which is driving the need for electroplating services. Moreover, the heightened focus on sustainability and environmental issues is impelling the growth of the market. Apart from this, rising investments in industrial development projects is expanding the Saudi Arabia electroplating market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 166.7 Million |

| Market Forecast in 2034 | USD 224.1 Million |

| Market Growth Rate 2026-2034 | 3.34% |

Saudi Arabia Electroplating Market Trends:

Growing Industrialization and Demand for Electronics

Saudi Arabia is undergoing high industrial development, which is driving the need for electroplating services. Automotive, electronics, and manufacturing industries are growing, requiring the application of electroplating to improve the longevity, corrosion resistance, and appearance of different parts. Businesses are now demanding more electroplated components to satisfy the requirements for high-performance products. As technology continues to transform the electronics industry, manufacturers are relying more on electroplating for small components such as connectors, switches, and circuit boards. With increasing emphasis on creating high-quality and durable electronics, the Saudi Arabian electroplating industry is innovating to serve these industries. This constant industrialization, driven by initiatives such as Vision 2030 by the government, is creating a demand for electroplating services, making it one of the central drivers of Saudi Arabia's changing manufacturing scene.

To get more information on this market Request Sample

Government Initiatives and Vision 2030

The Saudi Arabian government is rolling out numerous initiatives in its Vision 2030 plan, which is fast-tracking the growth of the nation's non-oil sectors, such as manufacturing and infrastructure. Vision 2030 entered into its final phase in 2025, with 674 initiatives completed out of 1502 and 596 going forward as scheduled. These efforts are creating a need for electroplating as companies look to enhance the quality and durability of their products. Through emphasizing economic diversification, the government is encouraging the utilization of sophisticated technologies and materials in manufacturing. Electroplating is regarded as critical in the manufacture of high-quality, long-lasting components for industries like automotive, construction, and defense. In a bid to keep up with international standards of quality and performance, local manufacturers are readily embracing electroplating techniques. The continued support for industrial development under Vision 2030 is propelling the Saudi Arabia electroplating market growth.

Increasing Demand for Eco-Friendly and Corrosion-Resistant Materials

The growing focus on sustainability and environmental issues is catalyzing the demand for electroplating in Saudi Arabia. With industries looking to enhance the recyclability and longevity of their products, electroplating is also gaining popularity because of its capability to deliver corrosion-resistant coatings. Automotive, construction, and the energy sector are specifically interested in making metal components that are exposed to extreme environmental conditions more durable. Electroplating not only enhances the lifespan of these components but also decreases the frequency of replacements, being part of more environment friendly production operations. With the country still working to minimize its environmental impact, electroplating is increasingly being noted for its assistance in green manufacturing. The Saudi Social Responsibility Day, observed every year on March 23, provides a platform for increasing awareness among individuals, businesses, and the community regarding the significance of social responsibility in fostering community development and sustainable progress. This day, recognized by the Cabinet as Saudi Social Responsibility Day on March 23 annually, centers on addressing topics and ideas concerning social responsibility, examining scientific research and studies, and consolidating efforts on matters of social responsibility.

Key Growth Drivers of Saudi Arabia Electroplating Market:

Expanding Automotive and Transportation Industries

One of the main drivers of the market expansion is the growth of the transportation and automotive sectors. The need for electroplated components is steadily rising, as investments in vehicle assembly, spare parts manufacturing, and the broadening of automotive aftermarkets are increasing. Engine parts, bumpers, wheels, and decorative trims are among the car components that electroplating enhances in terms of longevity, corrosion resistance, and attractiveness. Electroplating meets a critical user requirement by ensuring increased vehicle longevity and reliability in a desert environment that is marked by extreme heat, dust, and corrosion risks. Furthermore, regional automotive manufacturing and industrial projects are gaining traction as a result of the Kingdom's Vision 2030 economic diversification, which is catalyzing the demand for electroplating.

Rising Construction and Infrastructure Development

The thriving construction industry, fueled by mega projects such as NEOM, is significantly driving the demand for electroplating services. Electroplated steel, aluminum, and other metals are widely used in construction equipment, building materials, fixtures, pipelines, and decorative elements to improve durability and corrosion resistance. Given the harsh desert environment, electroplating ensures that metal components withstand wear, tear, and weathering, making them crucial for long-term sustainability of infrastructure. Additionally, the luxury construction segment, including hotels, malls, and high-end residences, is demanding aesthetically enhanced electroplated finishes for decorative applications. Electroplating also supports the oil and gas infrastructure sector, where coated pipelines and machinery reduce maintenance costs. With continued government spending on infrastructure and urbanization projects, the electroplating market is set to see strong growth aligned with Saudi Arabia’s ambitious development agenda.

Increasing Demand from Jewelry and Luxury Goods Sector

Saudi Arabia’s cultural affinity for jewelry, gold, and luxury goods is a major contributor to the market growth. Electroplating enhances the visual appeal of ornaments by adding gold, silver, and platinum coatings while reducing the overall use of precious metals, making products more affordable and accessible. Beyond cost efficiency, electroplating also provides durability, preventing tarnish and wear on luxury items. The expanding retail landscape, with international jewelry brands entering the Saudi market, is further catalyzing the demand for electroplated products. Moreover, younger generations, impacted by fashion trends and social media, are promoting the use of stylish, affordable, and customized accessories. With tourism and retail expansion under Vision 2030, the luxury goods sector is poised for rapid growth, directly fueling electroplating requirements.

Saudi Arabia Electroplating Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, metal type, and end use industry.

Type Insights:

- Barrel Plating

- Rack Plating

- Continuous Plating

- Line Plating

The report has provided a detailed breakup and analysis of the market based on the type. This includes barrel plating, rack plating, continuous plating, and line plating.

Metal Type Insights:

- Gold

- Zinc

- Platinum

- Copper

- Nickel

- Chromium

- Others

The report has provided a detailed breakup and analysis of the market based on the metal type. This includes gold, zinc, platinum, copper, nickel, chromium, and others.

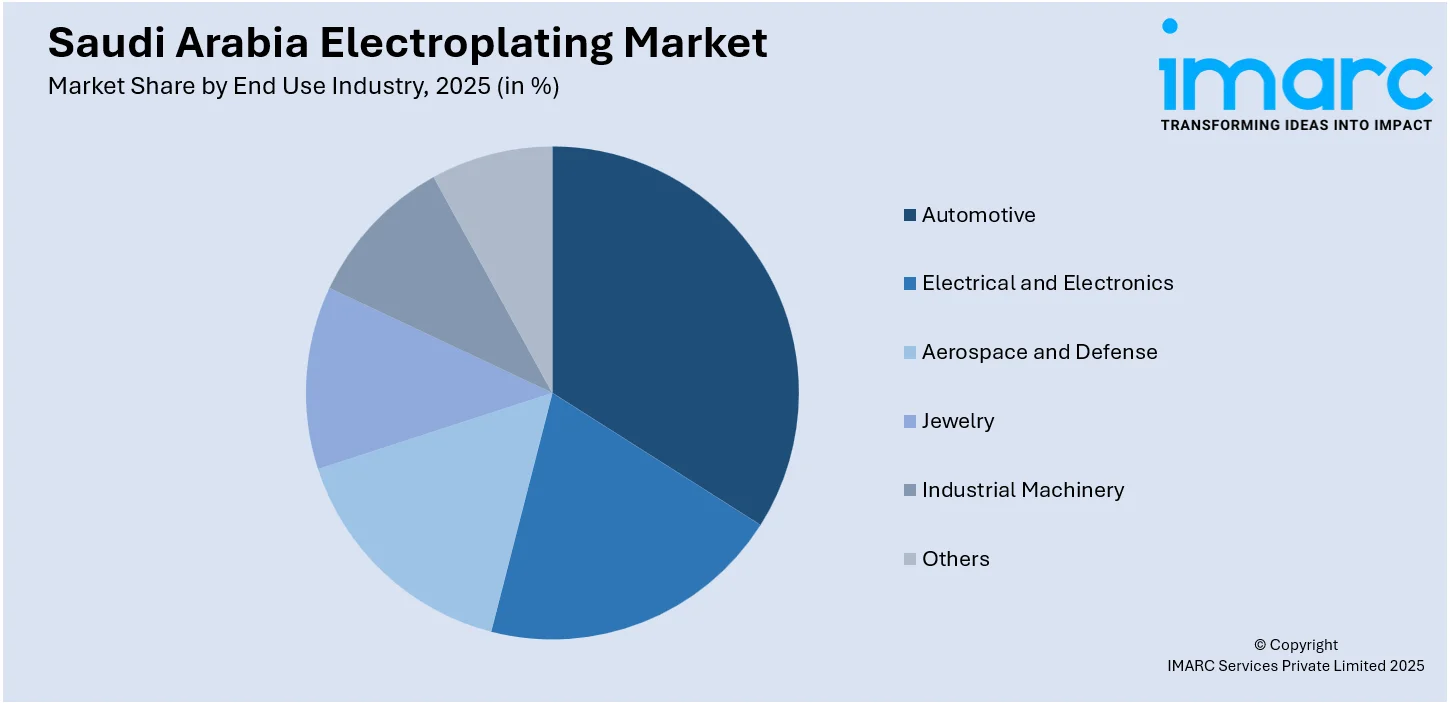

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Automotive

- Electrical and Electronics

- Aerospace and Defense

- Jewelry

- Industrial Machinery

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes automotive, electrical and electronics, aerospace and defense, jewelry, industrial machinery, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Electroplating Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Barrel Plating, Rack Plating, Continuous Plating, Line Plating |

| Metal Types Covered | Gold, Zinc, Platinum, Copper, Nickel, Chromium, Others |

| End Use Industries Covered | Automotive, Electrical and Electronics, Aerospace and Defense, Jewelry, Industrial Machinery, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia electroplating market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia electroplating market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia electroplating industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The electroplating market in Saudi Arabia was valued at USD 166.7 Million in 2025.

The Saudi Arabia electroplating market is projected to exhibit a CAGR of 3.34% during 2026-2034, reaching a value of USD 224.1 Million by 2034.

With the government’s Vision 2030 focusing on localizing production and reducing dependency on imports, the demand for electroplating services is increasing within domestic industries. Additionally, the growing preferences for premium finishes in jewelry, home decor, and luxury goods are boosting the applications of electroplating in decorative segments. Advancements in eco-friendly plating technologies are also encouraging wider adoption, as companies align with sustainability goals.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)