Saudi Arabia Endpoint Security Market Size, Share, Trends and Forecast by Component, Deployment Mode, Organization Size, Vertical, and Region, 2026-2034

Saudi Arabia Endpoint Security Market Overview:

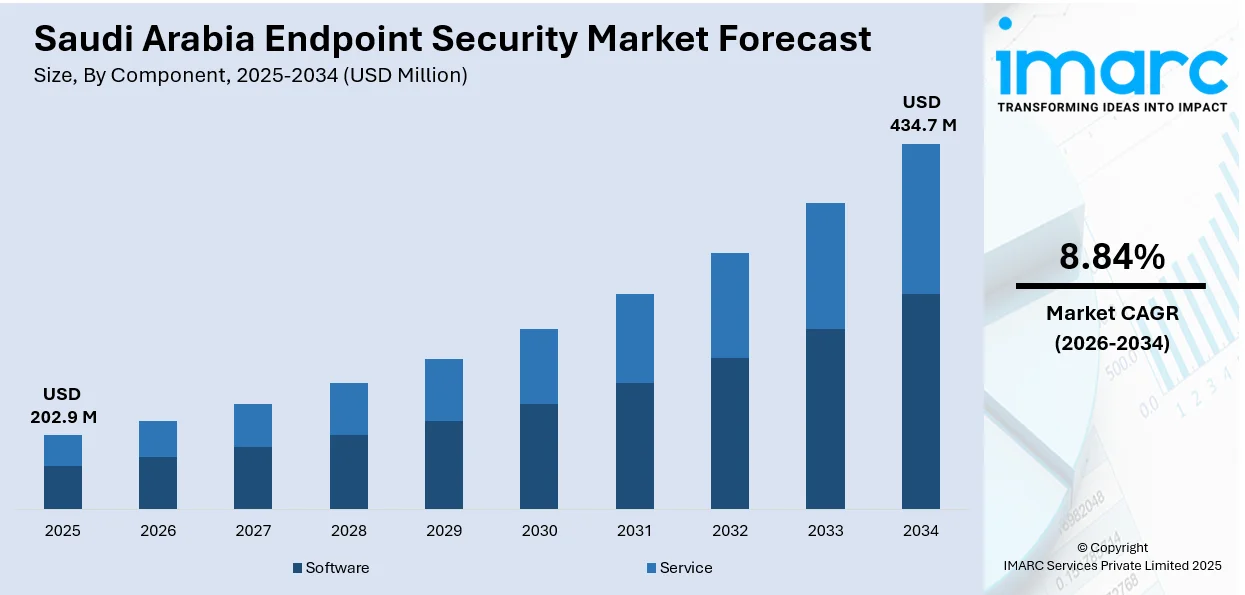

The Saudi Arabia endpoint security market size reached USD 202.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 434.7 Million by 2034, exhibiting a growth rate (CAGR) of 8.84% during 2026-2034. The market is driven by rapid digital transformation, increasing cyber threats, and stringent regulatory mandates such as the essential cybersecurity controls (ECC). The shift to remote work and cloud adoption fuels demand for scalable, cloud-based security solutions. Additionally, AI-powered threat detection gains traction as businesses seek proactive defense mechanisms. The implementation of government initiatives under Vision 2030 further accelerates investments in advanced endpoint security to safeguard critical infrastructure and data, augmenting the Saudi Arabia endpoint security market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 202.9 Million |

| Market Forecast in 2034 | USD 434.7 Million |

| Market Growth Rate 2026-2034 | 8.84% |

Saudi Arabia Endpoint Security Market Trends:

Rising Cybersecurity Threats and Attacks

Increasing number of cyberattacks, ransomware incidents, and phishing activities is one of the strongest drivers of the market growth in Saudi Arabia. A worldwide industry analysis by Tenable showed that from September 2024 to August 2025, 95% of organizations in Saudi Arabia faced a cyberattack that affected their businesses. As businesses, government agencies, and financial institutions are digitizing operations, endpoints, such as laptops and mobile devices, are becoming critical entry points for cybercriminals. The frequency and sophistication of attacks targeting sensitive data, intellectual property, and financial resources are encouraging organizations to invest heavily in advanced endpoint security solutions. Endpoint detection and response (EDR), threat intelligence, and real-time monitoring systems are in high demand to address these threats. Companies are adopting multi-layered defense approaches to ensure resilience against cyber risks.

To get more information on this market Request Sample

Increasing Internet of Things (IoT)

The rapid adoption of the IoT devices is catalyzing the demand for endpoint security solutions. As per the IMARC Group, the Saudi Arabia IoT market size reached USD 9,490.7 Million in 2024. IoT devices, such as smart sensors, connected machinery, and wearables, often lack strong built-in security, making them attractive targets for hackers. Similarly, bring your own device (BYOD) policies, while improving workplace flexibility, introduce a wide variety of unmanaged devices into corporate networks. These trends are increasing the number of endpoints susceptible to attacks, requiring businesses to deploy endpoint security solutions capable of handling diverse device ecosystems. Endpoint security technologies like network segmentation, device authentication, and artificial intelligence (AI)-based anomaly detection are gaining adoption.

Growth of Remote and Hybrid Work Models

The ongoing shift towards remote and hybrid work models is increasing the reliance on endpoint devices, making endpoint security a top priority in Saudi Arabia. The Ministry of Human Resources and Social Development (HRSD) reported that by the end of Q2 2025, Saudi Arabia had 190,000 remote employees. Employees are accessing organizational networks through personal laptops, tablets, and mobile phones, often outside the secure office environment. This is creating vulnerabilities that cybercriminals exploit through malware, unsecured wireless fidelity (Wi-Fi), and phishing attempts. Organizations are investing in endpoint security solutions, such as mobile device management (MDM) and multi-factor authentication (MFA), to secure remote access. The hybrid work model also necessitates real-time monitoring and data encryption to safeguard sensitive company information.

Key Growth Drivers of Saudi Arabia Endpoint Security Market:

Digital Transformation and Cloud Adoption

Saudi Arabia’s rapid digital transformation, supported by Vision 2030, is driving the demand for endpoint security solutions. Organizations are migrating workloads to the cloud, adopting hybrid information technology (IT) environments, and deploying digital applications across sectors, such as banking, healthcare, retail, and government. This shift is significantly expanding the number of endpoints that need protection, from mobile devices to virtual workstations. Cloud adoption is also increasing the exposure to potential cyber vulnerabilities, driving businesses to prioritize advanced endpoint protection. Solutions like cloud-based endpoint management, identity access control, and zero-trust security models are gaining traction. The expansion of digital ecosystems, combined with the reliance on data-driven operations, is making endpoint security a cornerstone of secure digital growth.

Regulatory Compliance and Data Protection Laws

Stringent government regulations and data protection requirements in Saudi Arabia are encouraging businesses to adopt advanced endpoint security solutions. Regulations, such as the National Cybersecurity Authority (NCA) guidelines, mandate stringent data protection and cybersecurity measures for organizations across sectors. Non-compliance may result in monetary fines, harm to reputation, and interruptions in operations. To meet these regulatory obligations, companies are prioritizing the implementation of comprehensive endpoint protection measures, including real-time monitoring, data encryption, and threat intelligence integration. The growing importance of compliance in financial services, healthcare, and government sectors is motivating organizations to strengthen security at the device level. As regulations are becoming more rigorous with the rise of digital transformation, endpoint security solutions will remain essential for ensuring compliance, maintaining consumer trust, and protecting sensitive national and organizational data in Saudi Arabia.

Rising Awareness and Training Programs

The growing awareness among enterprises and employees about cybersecurity threats is propelling the market growth in Saudi Arabia. Organizations are realizing that human error is one of the biggest causes of data breaches, leading to increased investments in awareness campaigns and training initiatives. Cybersecurity training programs are being conducted across sectors to educate employees about safe practices, phishing identification, and device management. Businesses are aligning training with technology adoption by integrating endpoint security solutions that require minimal user intervention while providing maximum protection. The government and private organizations are also hosting cybersecurity workshops, seminars, and certifications, enhancing national awareness. As knowledge about risks spreads, organizations are more proactive in deploying endpoint security solutions to mitigate human-related vulnerabilities.

Saudi Arabia Endpoint Security Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on component, deployment mode, organization size, and vertical.

Component Insights:

- Software

- Service

The report has provided a detailed breakup and analysis of the market based on the component. This includes software and service.

Deployment Mode Insights:

- On-premises

- Cloud-based

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes on-premises and cloud-based.

Organization Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes large enterprises, and small and medium-sized enterprises.

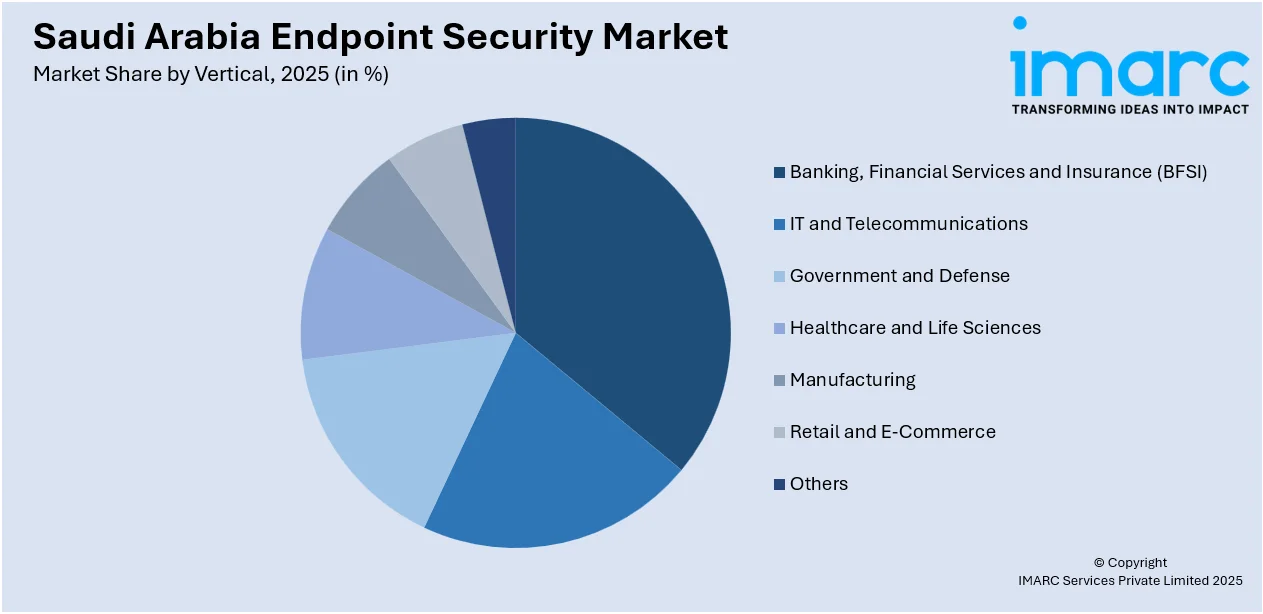

Vertical Insights:

Access the comprehensive market breakdown Request Sample

- Banking, Financial Services and Insurance (BFSI)

- IT and Telecommunications

- Government and Defense

- Healthcare and Life Sciences

- Manufacturing

- Retail and E-Commerce

- Others

A detailed breakup and analysis of the market based on the vertical have also been provided in the report. This includes banking, financial services and insurance (BFSI), IT and telecommunications, government and defense, healthcare and life sciences, manufacturing, retail and e-commerce, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Endpoint Security Market News:

- May 2025: Resecurity, a cybersecurity firm providing integrated endpoint security and fraud prevention, revealed its involvement in the Saudi-US Investment Forum 2025, taking place at the King Abdulaziz International Conference Center in Riyadh, Saudi Arabia. The company’s involvement emphasized its dedication to protecting digital infrastructure and fostering reliable innovation internationally.

- April 2025: ThreatLocker opened a new data center in Saudi Arabia to advance its global expansion plan, enhancing local cybersecurity solutions with its Zero Trust security framework. The investment aligned with Saudi Arabia's Vision 2030 by providing scalable, compliant, and locally hosted endpoint security services to companies. This action demonstrated ThreatLocker's dedication to strengthening cybersecurity resilience amid the Kingdom's digital transformation.

- October 2024: AhnLab and SITE from Saudi Arabia officially introduced 'Rakeen,' a newly established cybersecurity joint venture in Riyadh concentrating on endpoint protection for personal computers, mobile devices, and servers. The initiative sought to offer advanced security solutions, such as XDR and cloud-based threat assessment, to companies throughout Saudi Arabia and the MENA area.

Saudi Arabia Endpoint Security Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Software, Service |

| Deployment Modes Covered | On-premises, Cloud-based |

| Organization Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| Verticals Covered | Banking, Financial Services and Insurance (BFSI), IT and Telecommunications, Government and Defense, Healthcare and Life Sciences, Manufacturing, Retail and E-Commerce, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia endpoint security market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia endpoint security market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia endpoint security industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The endpoint security market in Saudi Arabia was valued at USD 202.9 Million in 2025.

The Saudi Arabia endpoint security market is projected to exhibit a CAGR of 8.84% during 2026-2034, reaching a value of USD 434.7 Million by 2034.

Organizations across finance, energy, healthcare, and government are prioritizing strong endpoint protection to safeguard sensitive data and operations. With increasing remote work and connected devices, the risks of cyberattacks have multiplied, leading to investments in advanced solutions like artificial intelligence (AI)-driven endpoint encryption. Regulatory frameworks in the Kingdom are also strengthening cybersecurity standards, encouraging companies to adopt robust security measures.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)