Saudi Arabia Energy Efficiency Retrofits Market Size, Share, Trends and Forecast by Product, Application, and Region, 2026-2034

Saudi Arabia Energy Efficiency Retrofits Market Summary:

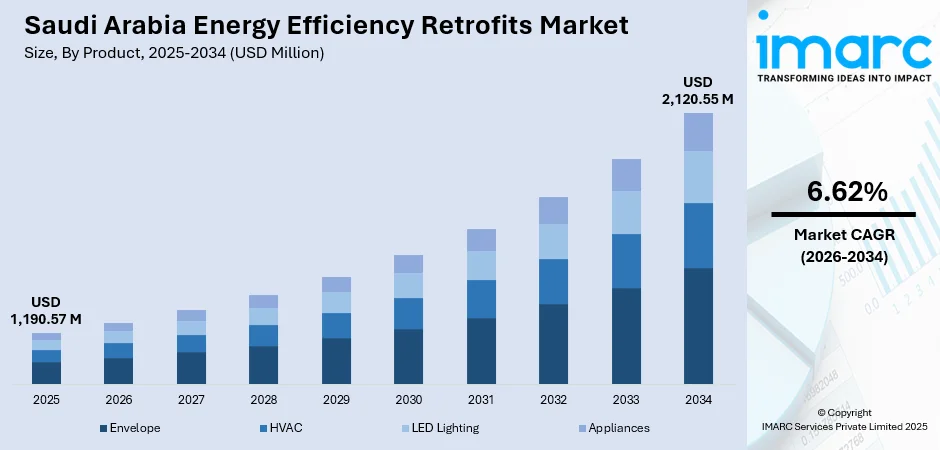

The Saudi Arabia energy efficiency retrofits market size was valued at USD 1,190.57 Million in 2025 and is projected to reach USD 2,120.55 Million by 2034, growing at a compound annual growth rate of 6.62% from 2026-2034.

The Saudi Arabia energy efficiency retrofits market is experiencing substantial momentum as the Kingdom accelerates its transition toward sustainable infrastructure under Vision 2030. Significant investments in smart building technologies, advanced HVAC systems, and thermal insulation solutions are reshaping energy utilization patterns across residential, commercial, and institutional sectors. The convergence of stringent regulatory mandates, rising energy costs, and environmental sustainability objectives is fundamentally transforming building performance standards and creating extensive opportunities for retrofit solution providers across the Kingdom.

Key Takeaways and Insights:

- By Product: Envelope dominates the market with a share of 36% in 2025, driven by the critical importance of thermal insulation in Saudi Arabia's extreme climate conditions and mandatory building code requirements for improved wall, roof, and window performance.

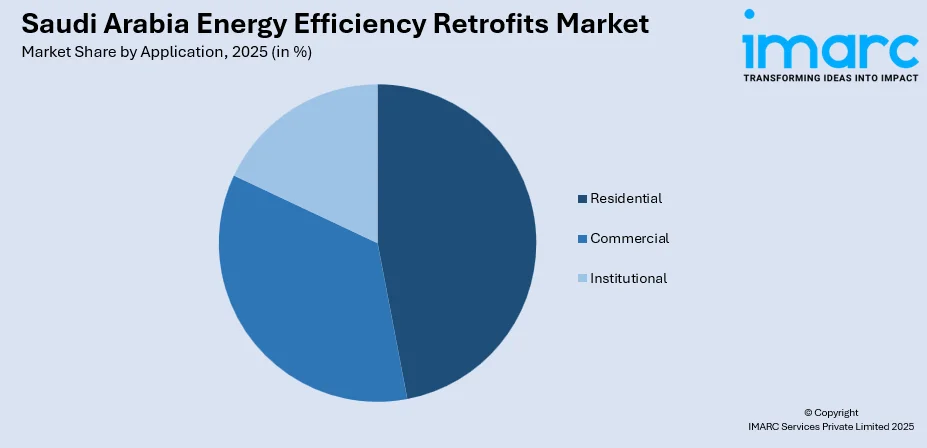

- By Application: Residential leads the market with a share of 40% in 2025, reflecting the substantial housing stock requiring energy efficiency upgrades and government initiatives promoting home insulation and efficient appliance adoption among Saudi households.

- Key Players: The Saudi Arabia energy efficiency retrofits market exhibits dynamic competitive intensity, with established energy service companies, international technology providers, and specialized contractors competing across government and private sector projects through strategic partnerships and innovative solution offerings.

To get more information on this market Request Sample

The Saudi Arabia energy efficiency retrofits market is advancing rapidly as the Kingdom prioritizes sustainable development and energy conservation across all building sectors. Government-backed initiatives are driving systematic retrofitting programs targeting public facilities, transportation infrastructure, and educational institutions. The market benefits from robust regulatory frameworks including the Saudi Building Code and energy efficiency labeling requirements that mandate performance improvements. In December 2024, Tarshid and Saudi Arabia Railways signed a comprehensive retrofit contract targeting annual energy savings of approximately 7 GWh, demonstrating the expanding scope of energy efficiency investments across diverse infrastructure segments and reinforcing the Saudi Arabia energy efficiency retrofits market growth trajectory.

Saudi Arabia Energy Efficiency Retrofits Market Trends:

Rising Adoption in Public and Institutional Buildings

Public and institutional buildings in Saudi Arabia are increasingly prioritizing energy efficiency upgrades to modernize infrastructure, lower operating costs, and align with national sustainability objectives. These facilities typically have high energy demands, making retrofits highly effective in improving long-term performance and system reliability. This momentum strengthened in November 2024 when Tarshid initiated an efficiency retrofit at Imam Abdulrahman Al Faisal Hospital in Riyadh, targeting a 30% reduction in energy use through HVAC, lighting, and control upgrades. Such initiatives reflect a growing national commitment to sustainable building performance, driving continued expansion of the energy efficiency retrofits market across the Kingdom.

Growing Focus on Energy Optimization in Transportation and Corporate Facilities

Large transportation networks and corporate facilities in Saudi Arabia are intensifying investments in energy efficiency upgrades to reduce operational costs, enhance system reliability, and support long-term sustainability objectives. These buildings operate continuously and employ significant energy, making retrofits particularly effective in improving performance. This trend was reinforced in December 2024 when Tarshid initiated an energy efficiency project for Saudi Arabia Railways, targeting major reductions through HVAC improvements, solar integration, and LED lighting upgrades aimed at achieving a 7 GWh annual saving. As organizations prioritize energy optimization, demand for comprehensive retrofit solutions continues to strengthen across commercial and transport-related infrastructure.

Increasing Adoption by Logistics and Warehousing Sector

Logistics operators in Saudi Arabia are pursuing energy efficiency upgrades to reduce utilization, improve operational performance, and align with wider sustainability goals. Warehouses, distribution hubs, and cargo terminals have substantial cooling and lighting requirements, making retrofits an effective means of lowering long-term costs and strengthening system reliability. This sector-wide shift gained further momentum in 2024, when Saudi Logistics Services (SAL) signed an MOU with Tarshid Energy Solutions to undertake a comprehensive retrofit program aimed at reducing energy use and operational expenses. As logistics companies prioritize efficiency and environmental stewardship, demand for targeted retrofit solutions is growing across the sector.

Market Outlook 2026-2034:

The Saudi Arabia energy efficiency retrofits market is positioned for notable growth as national policies prioritize reduced energy usage and modernization of existing infrastructure. Public and private sectors are actively upgrading buildings and industrial facilities to meet performance standards, lower operational costs, and support sustainability targets. The market generated a revenue of USD 1,190.57 Million in 2025 and is projected to reach a revenue of USD 2,120.55 Million by 2034, growing at a compound annual growth rate of 6.62% from 2026-2034.

Saudi Arabia Energy Efficiency Retrofits Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product | Envelope | 36% |

| Application | Residential | 40% |

Product Insights:

- Envelope

- HVAC

- LED Lighting

- Appliances

Envelope dominates with a market share of 36% of the total Saudi Arabia energy efficiency retrofits market in 2025.

Envelope represents the largest segment, as upgrading insulation, windows, roofing, and external sealing delivers immediate reductions in cooling and heating loads. These improvements significantly cut energy usage, enhance indoor comfort, and help buildings meet national efficiency requirements, making envelope enhancements a priority across residential and commercial sectors.

Its dominance is further supported by the Kingdom’s high temperatures intensify the need for robust thermal protection, which as per the National Center of Meteorology reported that from July 1 to July 12, 2024, Riyadh and the Eastern Province were expected to experience extreme heat, with maximum temperatures rising to 47 C in Riyadh and 49-50 C in Dammam. Building envelope offers long-lasting performance benefits and integrate easily with broader retrofit programs, encouraging consistent adoption among property owners seeking durable, cost-effective solutions that improve overall energy efficiency.

Application Insights:

Access the Comprehensive Market Breakdown Request Sample

- Residential

- Single-Family

- 2+ Unit Building

- Mobile Home

- Commercial

- Food Sales & Service

- Lodging

- Mercantile

- Office Buildings

- Public Assembly

- Warehouse/Storage

- Others

- Institutional

- Education

- Healthcare

- Public Order & Safety

- Worship Buildings

Residential leads with a market share of 40% of the total Saudi Arabia energy efficiency retrofits market in 2025.

Residential (single-family, 2+ unit building, and mobile home) dominates the market, as households increasingly prioritize lower utility costs, improved comfort, and better building performance. Many older homes require upgrades to insulation, windows, lighting, and cooling systems, driving the demand for retrofit solutions that offer immediate and long-term efficiency gains.

Growth is also supported by rising homeownership, which according to the Housing Program’s Annual Report released in 2024, revealed that Saudi Arabia’s homeownership rate reached 65.4%. Residents are more aware about the financial and environmental value of efficient homes, prompting broader adoption of retrofit measures that enhance indoor conditions and reduce overall energy use across Saudi neighborhoods.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The Northern and Central Region is a crucial segment in the market owing to dense urban populations, extensive commercial development, and strong government investment in building upgrades. Large public facilities and residential communities increasingly adopt retrofit measures to reduce energy use and meet evolving national efficiency standards.

The Western Region shows strong uptake driven by active tourism, hospitality, and real estate sectors requiring improved building performance. High cooling loads and modern infrastructure projects encourage widespread adoption of energy-efficient retrofits across hotels, commercial centers, and residential complexes.

The Eastern Region benefits from its industrial concentration and the growing commercial base, where retrofits help reduce operational costs and enhance facility resilience. Rising energy management requirements across petrochemical, manufacturing, and service sectors further drive the demand for building and system efficiency improvements.

The Southern Region is gradually expanding adoption as infrastructure modernization accelerates and awareness of energy savings grows. Residential and public buildings increasingly implement retrofit solutions to enhance comfort, reduce utility expenses, and support regional sustainability goals.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Energy Efficiency Retrofits Market Growing?

Growing Adoption in Educational Institutions

Universities and academic institutions in Saudi Arabia are increasingly prioritizing energy efficiency upgrades to reduce operating costs, modernize aging infrastructure, and support national sustainability objectives. Their large, multi-building campuses use significant energy, making retrofits an effective way to achieve notable reductions and improve long-term performance. This trend was further reinforced in 2024 when Tarshid initiated an energy retrofit project at Yanbu University College, targeting a 16% reduction in electricity use across 13 buildings and delivering substantial savings and emissions reductions. As educational institutions emphasize environmental stewardship and fiscal efficiency, there is a rise in the demand for comprehensive retrofit solutions across the sector.

Rising Residential Electricity Demand

Rising household electricity usage is catalyzing the demand for energy efficiency retrofits within Saudi Arabia’s residential sector, as families seek practical measures to reduce utility costs and improve indoor comfort. Household Energy Statistics 2024 revealed that total electricity usage in the residential sector in Saudi Arabia reached 161,207 gigawatt-hours (GWh), underscoring the scale of utilization driving this shift. Higher cooling requirements and aging building structures further motivate homeowners to adopt insulation upgrades, efficient lighting, and optimized cooling systems to lower energy waste. As awareness about long-term financial and environmental benefits increases, retrofit adoption continues to accelerate, contributing significantly to the market growth across the Kingdom’s residential landscape.

Expansion of Energy Efficiency Measures

Government and defense institutions in Saudi Arabia are increasingly implementing energy efficiency upgrades to reduce usage, enhance operational reliability, and support national sustainability commitments. These facilities operate continuously, making retrofits especially effective in lowering long-term costs and improving system performance. This trend advanced further in 2024 when Tarshid, in collaboration with the Royal Saudi Naval Forces, launched an efficiency project targeting 19% savings across 16 naval buildings in Riyadh through upgraded HVAC, lighting, and control systems. Such initiatives underscore the growing focus on modernizing strategic infrastructure, driving the demand for comprehensive retrofit solutions across the public sector.

Market Restraints:

What Challenges the Saudi Arabia Energy Efficiency Retrofits Market is Facing?

High Upfront Investment Costs for Comprehensive Retrofits

High initial costs remain a major barrier to widespread adoption of energy efficiency retrofits, especially among homeowners and small commercial operators with limited financing options. Although retrofits offer meaningful long-term savings, the immediate financial commitment required for insulation upgrades, HVAC replacements, and building envelope improvements discourages participation. This challenge is more pronounced in lower-income residential districts and smaller business properties, where budget constraints slow decision-making and reduce overall market penetration despite strong national sustainability targets.

Limited Availability of Skilled Workforce for Retrofit Implementation

The market growth is constrained by the shortage of qualified professionals capable of conducting energy audits, preparing retrofit designs, and implementing technically demanding upgrades. Existing workforce capacity remains insufficient relative to the scale of buildings requiring modernization. As demand accelerates, these limitations lead to extended project timelines, uneven implementation quality, and reduced efficiency in delivering high-performance retrofit solutions across the Kingdom.

Existing Building Stock Challenges and Legacy Infrastructure Complexities

Saudi Arabia’s varied and aging building stock presents significant technical hurdles for standardized retrofit implementation. Many older structures lack proper records, rely on unconventional materials, or include designs that complicate insulation improvements, window replacements, or mechanical system upgrades. These legacy conditions necessitate tailored engineering solutions, increasing both project costs and execution complexity. Such structural and documentation limitations slow retrofit adoption, requiring careful assessment and specialized approaches to ensure safety, durability, and effective energy performance enhancements.

Competitive Landscape:

The Saudi Arabia energy efficiency retrofits market exhibits dynamic competitive characteristics shaped by rising regulatory expectations, increasing private-sector participation, and expanding technical capabilities among service providers. Competition is intensifying as engineering firms, technology suppliers, construction companies, and specialized energy service providers seek to capture opportunities across residential, commercial, and industrial segments. Market participants differentiate themselves through advanced auditing tools, high-performance materials, integrated retrofit solutions, and strong execution capacity. As sustainability targets tighten and building owners prioritize long-term cost reduction, firms offering reliable performance guarantees and measurable energy savings gain a competitive advantage. This evolving landscape continues to encourage innovation, partnerships, and broader market engagement.

Recent Developments:

- In July 2025, Tarshid launched an energy efficiency retrofit project at the Technical College in Hail. The project, covering 22 buildings, will upgrade HVAC, lighting, and control systems to reduce electricity usage by 14%, from 7 million kWh to 6 million kWh. This initiative supports Saudi Arabia's Vision 2030 sustainability goals by enhancing energy efficiency and reducing carbon emissions.

- In February 2025, Tarshid and King Abdulaziz Specialist Hospital launched a large-scale energy efficiency retrofitting project in Al-Jouf. The initiative includes upgrades to HVAC, lighting, and control systems, with the goal of reducing the hospital's annual energy consumption by 22%. This project aligns with Saudi Vision 2030's goals for sustainability and carbon footprint reduction.

Saudi Arabia Energy Efficiency Retrofits Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Envelope, HVAC, LED Lighting, Appliances |

| Applications Covered |

|

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia energy efficiency retrofits market size was valued at USD 1,190.57 Million in 2025.

The Saudi Arabia energy efficiency retrofits market is expected to grow at a compound annual growth rate of 6.62% from 2026-2034 to reach USD 2,120.55 Million by 2034.

Envelope dominates the market with 36% revenue share in 2025, driven by the critical importance of thermal insulation in Saudi Arabia's extreme climate conditions and mandatory building code compliance requirements.

Key factors driving the Saudi Arabia energy efficiency retrofits market include rising efforts by public and institutional buildings to reduce costs and meet sustainability goals. This trend grew in November 2024 when Tarshid’s hospital retrofit targeted a 30% energy cut, reinforcing nationwide commitment to improved performance.

Major challenges include high upfront investment costs for comprehensive retrofit projects, limited availability of skilled workforce for energy auditing and implementation, existing building stock complexities requiring customized solutions, and access barriers to retrofit financing for residential and small commercial operators.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)