Saudi Arabia Energy Efficient HVAC Systems Market Size, Share, Trends and Forecast by Product, Application, and Region, 2026-2034

Saudi Arabia Energy Efficient HVAC Systems Market Overview:

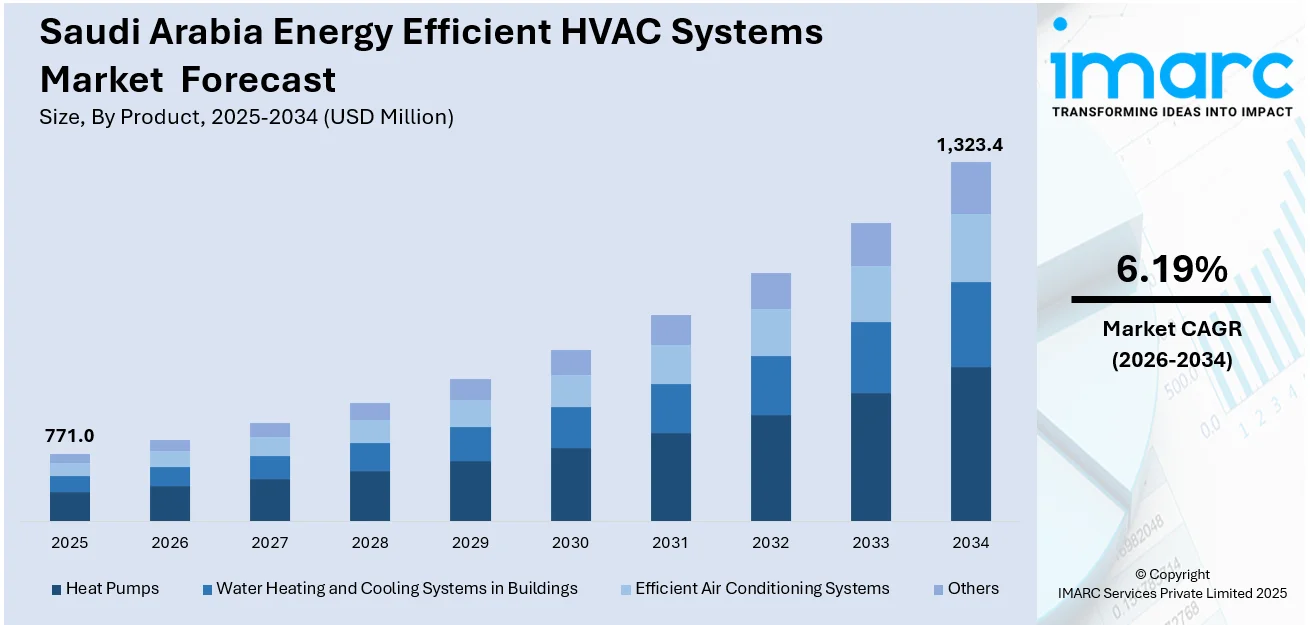

The Saudi Arabia energy efficient HVAC systems market size reached USD 771.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,323.4 Million by 2034, exhibiting a growth rate (CAGR) of 6.19% during 2026-2034. The market is driven by rising energy costs, stringent government regulations, urban development, and growing environmental awareness. Technological advancements and smart building initiatives also contribute to an expanding Saudi Arabia energy efficient HVAC systems market share across residential, commercial, and industrial sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 771.0 Million |

| Market Forecast in 2034 | USD 1,323.4 Million |

| Market Growth Rate 2026-2034 | 6.19% |

Saudi Arabia Energy Efficient HVAC Systems Market Trends:

Integration of Smart HVAC Technologies

A notable trend within the Saudi Arabia energy efficient HVAC systems market is the increasing adoption of smart and IoT-enabled HVAC solutions. These systems are designed to optimize energy consumption through real-time data analytics, remote monitoring, and adaptive control. As the Kingdom promotes digital transformation in its infrastructure under Vision 2030, smart HVAC technologies are becoming integral to sustainable urban development. Public and private sector stakeholders are investing in advanced automation to meet regulatory benchmarks and reduce operational costs. This shift not only enhances user comfort and system reliability but also supports large-scale efficiency in buildings. For instance, in February 2025, LG Electronics Saudi Arabia and Shaker Group celebrated 30 years of partnership in delivering sustainable HVAC solutions. The collaboration emphasizes innovation, energy efficiency, and support for Saudi Vision 2030. Their Riyadh factory produces advanced systems like the AI-powered LG Multi V I, designed for optimized performance and reduced energy use. The alliance showcases a commitment to local manufacturing, cutting-edge technology, and long-term impact, positioning LG and Shaker as leaders in Saudi Arabia’s HVAC market transformation.

To get more information on this market Request Sample

Growing Emphasis on Retrofitting Existing Infrastructure

With a substantial share of Saudi Arabia's urban buildings constructed before modern energy standards, there is a growing push toward retrofitting older HVAC systems. The government, alongside private entities, is prioritizing energy-efficient upgrades as part of nationwide sustainability goals. Retrofitting involves replacing outdated HVAC units with high-efficiency alternatives and integrating advanced components like variable speed drives and high-efficiency filters. For instance, in September 2024, Saudi Arabia launched "Estbdal," a nationwide initiative to replace outdated air conditioners with energy-efficient models, aiming to reduce household energy use and support sustainability goals. Led by the Saudi Energy Efficiency Centre, the program involves 30+ retailers, 350 showrooms, and 4 local factories. This approach not only extends the lifespan of existing buildings but also significantly reduces electricity consumption, aligning with the Kingdom’s climate commitments. Financial incentives and regulatory support are accelerating retrofitting initiatives, thereby boosting demand for upgraded systems and contributing directly to Saudi Arabia energy efficient HVAC systems market growth.

Saudi Arabia Energy Efficient HVAC Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2026-2034. Our report has categorized the market based on product and application.

Product Insights:

- Heat Pumps

- Water Heating and Cooling Systems in Buildings

- Efficient Air Conditioning Systems

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes heat pumps, water heating and cooling systems in buildings, efficient air conditioning systems, and others.

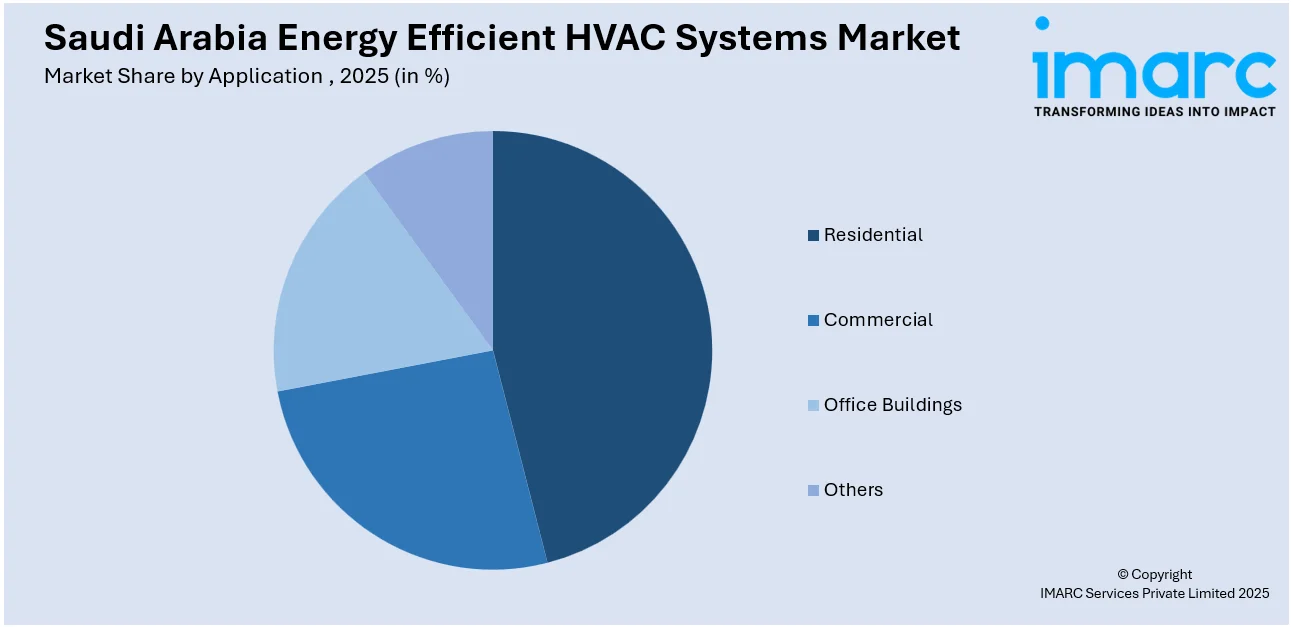

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

- Office Buildings

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential, commercial, office buildings, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Energy Efficient HVAC Systems Market News:

- In February 2025, Saudi Arabia’s ROSHN signed a deal with Johnson Controls Arabia to introduce Variable Refrigerant Flow (VRF) technology, enhancing energy efficiency and promoting local manufacturing. The partnership aligns with Vision 2030 goals to increase renewable energy and industrial output. Johnson Controls aims to manufacture 90% of its HVAC products locally and expand exports.

- In February 2024, Alat, a PIF company, and Carrier partnered to establish a cutting-edge HVAC manufacturing and R&D facility in Saudi Arabia. The venture will support giga-projects like NEOM and serve MENA and global markets with intelligent, energy-efficient climate solutions. The collaboration aligns with Saudi Vision 2030 and will focus on sustainable technologies such as low-GWP refrigerants and VRF systems.

Saudi Arabia Energy Efficient HVAC Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Heat Pumps, Water Heating and Cooling Systems in Buildings, Efficient Air Conditioning Systems, Others |

| Applications Covered | Residential, Commercial, Office Buildings, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia energy efficient HVAC systems market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia energy efficient HVAC systems market on the basis of product?

- What is the breakup of the Saudi Arabia energy efficient HVAC systems market on the basis of application?

- What is the breakup of the Saudi Arabia energy efficient HVAC systems market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia energy efficient HVAC systems market?

- What are the key driving factors and challenges in the Saudi Arabia energy efficient HVAC systems market?

- What is the structure of the Saudi Arabia energy efficient HVAC systems market and who are the key players?

- What is the degree of competition in the Saudi Arabia energy efficient HVAC systems market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia energy efficient HVAC systems market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia energy efficient HVAC systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia energy efficient HVAC systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)