Saudi Arabia Energy Efficient Transformers Market Size, Share, Trends and Forecast by Type, Cooling Type, Efficiency Level, Application, and Region, 2026-2034

Saudi Arabia Energy Efficient Transformers Market Overview:

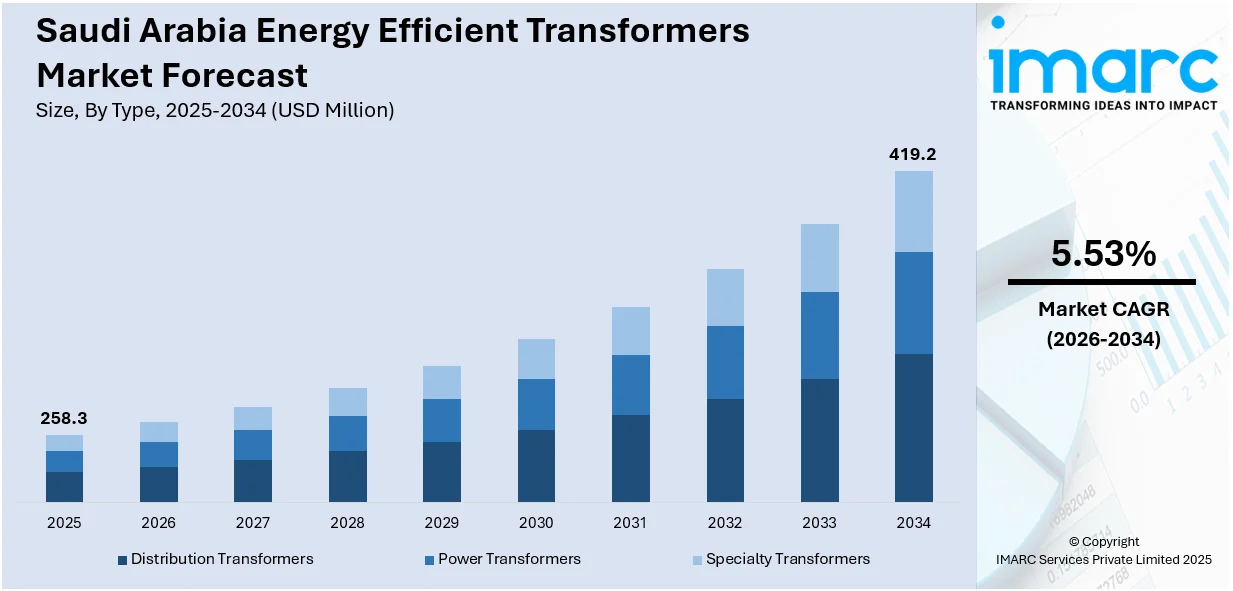

The Saudi Arabia energy efficient transformers market size reached USD 258.3 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 419.2 Million by 2034, exhibiting a growth rate (CAGR) of 5.53% during 2026-2034. The market is driven by government-led reforms under Vision 2030 emphasizing energy efficiency and grid modernization. The rapid expansion of renewable energy projects and smart grid initiatives requires advanced transformers with superior loss reduction and monitoring capabilities, thereby fueling the market. Additionally, growing industrial electrification and EV infrastructure development support demand for reliable, high-performance transformers, further augmenting the Saudi Arabia energy efficient transformers market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 258.3 Million |

| Market Forecast in 2034 | USD 419.2 Million |

| Market Growth Rate 2026-2034 | 5.53% |

Saudi Arabia Energy Efficient Transformers Market Trends:

Government Initiatives and Vision 2030 Energy Reforms

Saudi Arabia’s Vision 2030 agenda is driving significant reforms in the energy sector, with a focus on enhancing energy efficiency, sustainability, and diversification. The government has introduced policies aimed at reducing power transmission losses, promoting renewable energy integration, and upgrading grid infrastructure. The National Renewable Energy Program (NREP) and other strategic frameworks encourage utilities and private stakeholders to adopt energy-efficient equipment, including transformers designed to minimize no-load and load losses. Regulatory bodies enforce stringent standards for electrical equipment to align with environmental and economic goals. Substantial investments in modernizing aging transmission and distribution networks across urban and industrial regions are underway, fostering demand for transformers with advanced core materials and insulation technologies. Moreover, public-private partnerships are supporting innovation and localization of energy technologies to reduce dependency on fossil fuels. On April 23, 2025, Saudi Electricity Company (SEC) advanced a USD 200 million infrastructure project to construct the Mawqaq PV 380 kV substation and associated transmission lines in central Saudi Arabia. This project supports the integration of 4,500 MW of renewable capacity under Round Six of the National Renewable Energy Program, reinforcing Saudi Arabia’s energy-efficient grid modernization aligned with Vision 2030. These combined factors establish a robust environment for Saudi Arabia energy efficient transformers market growth by mandating efficient and reliable power delivery systems that contribute to national sustainability objectives.

To get more information on this market Request Sample

Expansion of Renewable Energy and Grid Infrastructure

Saudi Arabia is aggressively expanding its renewable energy capacity, particularly solar and wind, as part of its efforts to diversify its energy mix. This growth requires the deployment of transformers that can efficiently handle variable power inputs and facilitate smooth integration into the national grid. The need to reduce technical losses and improve grid stability has accelerated the replacement of conventional transformers with energy-efficient models. Furthermore, the government is investing in smart grid technologies and advanced monitoring systems that rely on transformers with superior thermal performance and real-time communication capabilities. On June 24, 2024, Siemens Energy secured a USD 1.5 billion order to supply and maintain two highly efficient combined cycle power plants, Taiba 2 and Qassim 2, in Saudi Arabia. These plants will deliver approximately 4 gigawatts of electricity and are expected to reduce CO2 emissions by up to 60% compared to oil-fueled power plants, supporting Saudi Arabia’s net zero goal by 2060. The project includes a 25-year maintenance contract and aligns with the Kingdom’s strategy to modernize its energy infrastructure with advanced, energy-efficient technology. Infrastructure development in economic zones and new cities further drives transformer demand as power distribution systems are built or upgraded to support new industries and residential developments. These factors collectively stimulate the procurement of high-efficiency transformers capable of managing bi-directional energy flows and maintaining voltage quality, key considerations in the evolving grid architecture of the kingdom.

Saudi Arabia Energy Efficient Transformers Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, cooling type, efficiency level, and application.

Type Insights:

- Distribution Transformers

- Power Transformers

- Specialty Transformers

The report has provided a detailed breakup and analysis of the market based on the type. This includes distribution transformers, power transformers, and specialty transformers.

Cooling Type Insights:

- Oil-Cooled Transformers

- Dry-Type Transformers

The report has provided a detailed breakup and analysis of the market based on the cooling type. This includes oil-cooled transformers and dry-type transformers.

Efficiency Level Insights:

- Low-Efficiency Transformers

- High-Efficiency Transformers

- Ultra-High-Efficiency Transformers

The report has provided a detailed breakup and analysis of the market based on the efficiency level. This includes low-efficiency transformers, high-efficiency transformers, and ultra-high-efficiency transformers.

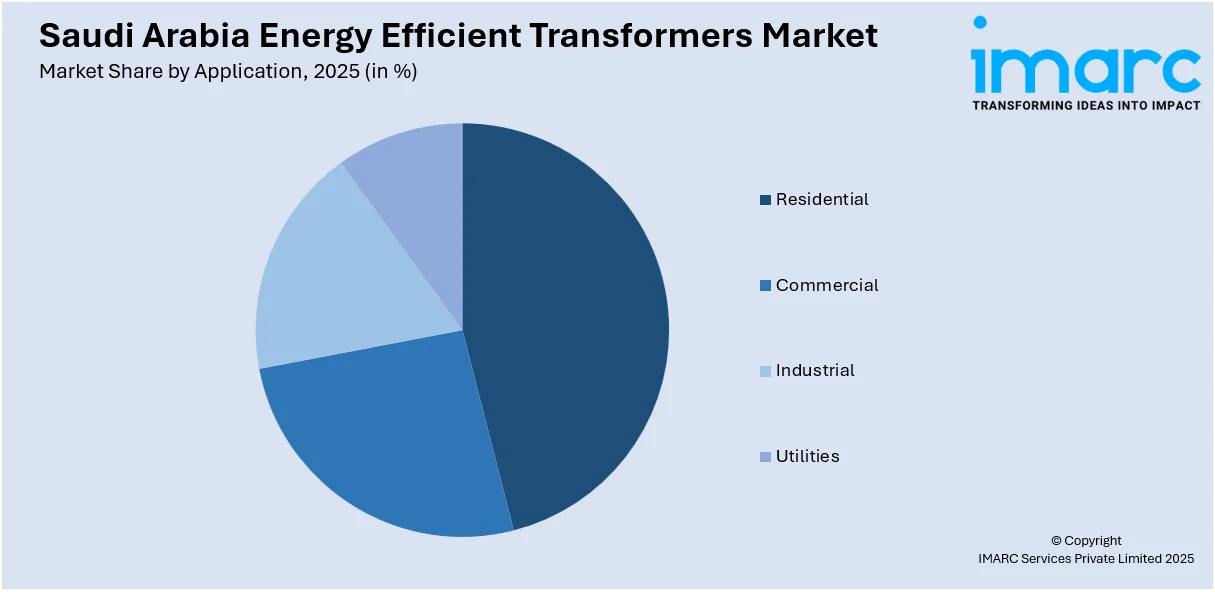

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

- Industrial

- Utilities

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential, commercial, industrial, and utilities.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all major regional markets. This includes Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Energy Efficient Transformers Market News:

- On May 30, 2023, Hitachi Energy entered into agreements with ENOWA and Saudi Electricity Company (SEC) to design and build three high-voltage direct current (HVDC) transmission systems, collectively delivering a total power capacity of 9 GW. The initial phase involves a 3 GW, 525 kV HVDC Light® link spanning over 650 km between Oxagon and Yanbu, supported by converter stations and transformers critical for integrating clean energy into the national grid.

Saudi Arabia Energy Efficient Transformers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Distribution Transformers, Power Transformers, Specialty Transformers |

| Cooling Types Covered | Oil-Cooled Transformers, Dry-Type Transformers |

| Efficiency Levels Covered | Low-Efficiency Transformers, High-Efficiency Transformers, Ultra-High-Efficiency Transformers |

| Applications Covered | Residential, Commercial, Industrial, Utilities |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia energy efficient transformers market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia energy efficient transformers market on the basis of type?

- What is the breakup of the Saudi Arabia energy efficient transformers market on the basis of cooling type?

- What is the breakup of the Saudi Arabia energy efficient transformers market on the basis of efficiency level?

- What is the breakup of the Saudi Arabia energy efficient transformers market on the basis of application?

- What is the breakup of the Saudi Arabia energy efficient transformers market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia energy efficient transformers market?

- What are the key driving factors and challenges in the Saudi Arabia energy efficient transformers market?

- What is the structure of the Saudi Arabia energy efficient transformers market and who are the key players?

- What is the degree of competition in the Saudi Arabia energy efficient transformers market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia energy efficient transformers market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia energy efficient transformers market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia energy efficient transformers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)