Saudi Arabia Environmental Monitoring Market Size, Share, Trends and Forecast by Component, Product Type, Sampling Method, Application, and Region, 2026-2034

Saudi Arabia Environmental Monitoring Market Overview:

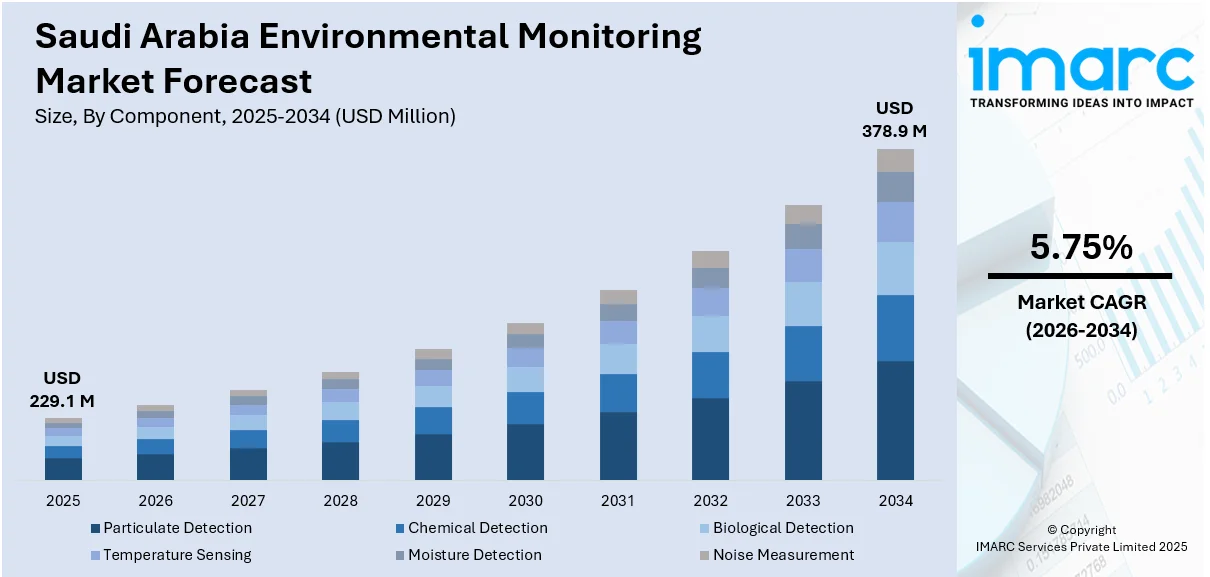

The Saudi Arabia environmental monitoring market size reached USD 229.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 378.9 Million by 2034, exhibiting a growth rate (CAGR) of 5.75% during 2026-2034. The market is growing due to rising afforestation efforts, climate risk management, and digital transformation in ecological tracking. Moreover, real-time monitoring platforms, early warning systems for sandstorms, and increased investment in data-driven sustainability initiatives all contributing to the expansion of Saudi Arabia’s environmental monitoring market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 229.1 Million |

| Market Forecast in 2034 | USD 378.9 Million |

| Market Growth Rate 2026-2034 | 5.75% |

Saudi Arabia Environmental Monitoring Market Trends:

Expansion of Real-Time Monitoring Systems

Saudi Arabia’s environmental monitoring market is increasingly driven by the need for accurate, real-time data to support large-scale ecological initiatives. Government-led programs are turning to digital tools to enhance transparency, field tracking, and decision-making. This push reflects the country’s growing focus on using data systems to oversee ecological restoration and afforestation efforts. The trend highlights a strategic move from manual assessments to digital platforms, enabling more precise measurement of environmental outcomes. With digital tools, ministries, and stakeholders can streamline operations, reduce reporting delays, and ensure alignment with environmental objectives. Integration of these systems also allows for centralized dashboards that track rehabilitation progress, water usage, and species monitoring in real-time. In March 2025, the National Afforestation Program introduced a real-time digital monitoring platform to track tree planting and land rehabilitation progress. This development supported better coordination among stakeholders and improved the accuracy of reporting mechanisms. It marked a shift towards a more data-driven approach in environmental governance, crucial for evaluating program effectiveness. The platform also enables quick identification of gaps or delays in field execution, supporting faster response strategies. With afforestation efforts covering millions of hectares and involving over 200 entities, such tools have become essential. As these initiatives expand, real-time monitoring systems will remain central to Saudi Arabia environmental monitoring market growth.

To get more information on this market Request Sample

Focus on Forecasting and Disaster Preparedness

Environmental monitoring in Saudi Arabia is also being shaped by growing concerns over climate-related hazards, especially sand and dust storms. These conditions pose threats to public health, infrastructure, and agriculture, prompting increased investment in predictive systems. Enhanced early warning capabilities are now considered essential for national resilience planning. With sand and dust affecting visibility, health outcomes, and energy operations, predictive data tools are gaining market traction. Advanced meteorological systems, atmospheric modeling tools, and regional data nodes are key enablers in this shift. The need for cross-border coordination also underlines the importance of regional data sharing and international monitoring networks. In December 2024, Saudi Arabia launched an international initiative during COP16 to monitor sand and dust storms, supported by a USD 10 Million fund and anchored by a new center in Jeddah under the WMO network. The center developed and validated three operational models capable of forecasting storm movements and intensities across the Gulf region. These models significantly improved early warning capabilities and offered valuable inputs to public safety protocols and infrastructure planning. The initiative enhanced Saudi Arabia’s standing in global monitoring efforts and opened opportunities for technology providers in atmospheric sensors, data integration, and modeling software. As climate variability intensifies, investment in disaster readiness tools is expected to sustain demand in the environmental monitoring market.

Saudi Arabia Environmental Monitoring Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2026-2034. Our report has categorized the market based on component, product type, sampling method, and application.

Component Insights:

- Particulate Detection

- Chemical Detection

- Biological Detection

- Temperature Sensing

- Moisture Detection

- Noise Measurement

The report has provided a detailed breakup and analysis of the market based on the component. This includes particulate detection, chemical detection, biological detection, temperature sensing, moisture detection, and noise measurement.

Product Type Insights:

- Environmental Monitoring Sensors

- Environmental Monitors

- Environmental Monitoring Software

- Wearable Environmental Monitors

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes environmental monitoring sensors, environmental monitors, environmental monitoring software, and wearable environmental monitors.

Sampling Method Insights:

- Continuous Monitoring

- Active Monitoring

- Passive Monitoring

- Intermittent Monitoring

A detailed breakup and analysis of the market based on the sampling method have also been provided in the report. This includes continuous monitoring, active monitoring, passive monitoring, and intermittent monitoring.

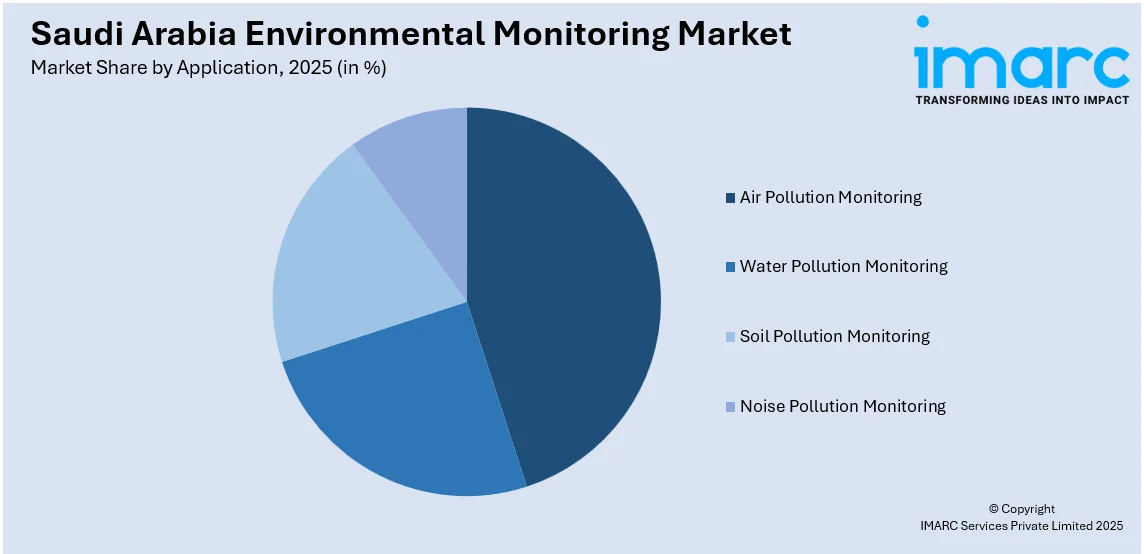

Application Insights:

Access the comprehensive market breakdown Request Sample

- Air Pollution Monitoring

- Water Pollution Monitoring

- Soil Pollution Monitoring

- Noise Pollution Monitoring

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes air pollution monitoring, water pollution monitoring, soil pollution monitoring, and noise pollution monitoring.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central region, Western region, Eastern region, and Southern region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Environmental Monitoring Market News:

- March 2025: Saudi Arabia’s NCVC and KAUST launched SAUDINet to strengthen terrestrial ecology research. The initiative focused on dryland biodiversity, soil carbon, and land restoration, boosting demand for ecological sampling, lab analysis, and biodiversity monitoring, thereby advancing the environmental monitoring market in arid regions.

- March 2025: Saudi Arabia launched a SR1 Billion green financing initiative to boost private sector investment in environmental projects. Supported by a new digital platform, the move enhanced funding access for ecosystem restoration, pollution reduction, and monitoring technologies, accelerating the environmental monitoring market’s expansion nationwide.

Saudi Arabia Environmental Monitoring Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Particulate Detection, Chemical Detection, Biological Detection, Temperature Sensing, Moisture Detection, Noise Measurement |

| Product Types Covered | Environmental Monitoring Sensors, Environmental Monitors, Environmental Monitoring Software, Wearable Environmental Monitors |

| Sampling Methods Covered | Continuous Monitoring, Active Monitoring, Passive Monitoring, Intermittent Monitoring |

| Applications Covered | Air Pollution Monitoring, Water Pollution Monitoring, Soil Pollution Monitoring, Noise Pollution Monitoring |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia environmental monitoring market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia environmental monitoring market on the basis of the component?

- What is the breakup of the Saudi Arabia environmental monitoring market on the basis of the product type?

- What is the breakup of the Saudi Arabia environmental monitoring market on the basis of sampling method?

- What is the breakup of the Saudi Arabia environmental monitoring market on the basis of application?

- What is the breakup of the Saudi Arabia environmental monitoring market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia environmental monitoring market?

- What are the key driving factors and challenges in the Saudi Arabia environmental monitoring market?

- What is the structure of the Saudi Arabia environmental monitoring market and who are the key players?

- What is the degree of competition in the Saudi Arabia environmental monitoring market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia environmental monitoring market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia environmental monitoring market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia environmental monitoring industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)