Saudi Arabia Ethanol Market Size, Share, Trends and Forecast by Type, Raw Material, Purity, Application, and Region, 2026-2034

Saudi Arabia Ethanol Market Summary:

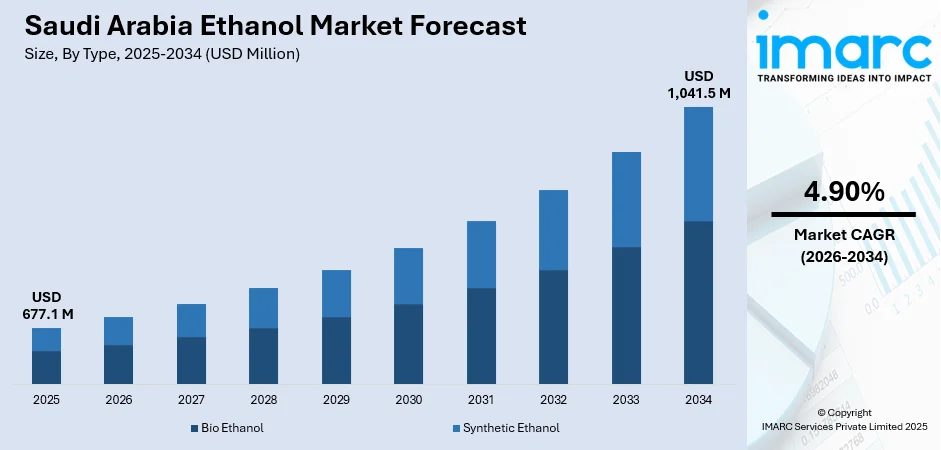

The Saudi Arabia ethanol market size was valued at USD 677.1 Million in 2025 and is projected to reach USD 1,041.5 Million by 2034, growing at a compound annual growth rate of 4.90% from 2026-2034.

The Saudi Arabia ethanol market is experiencing sustained growth, driven by increasing demand across the pharmaceutical, personal care, and industrial sectors. Vision 2030 initiatives are accelerating interest in renewable energy alternatives and sustainable chemical solutions. The market benefits from expanding manufacturing capabilities, evolving regulatory frameworks supporting biofuel development, and rising consumption in disinfectant and solvent applications across the Kingdom's diversifying economy.

Key Takeaways and Insights:

- By Type: Bio ethanol dominates the market with a share of 64% in 2025, owing to increasing sustainability initiatives, government support for renewable energy alternatives, and growing adoption in pharmaceutical and personal care formulations. Rising environmental consciousness is further driving the market expansion.

- By Raw Material: Ethylene leads the market with a share of 39% in 2025, driven by the Kingdom's established petrochemical infrastructure, cost-effective production capabilities, and integration with existing refinery operations. Abundant feedstock availability supports sustained demand.

- By Purity: Denatured exhibits a clear dominance in the market with 71% share in 2025, reflecting widespread industrial applications in solvents, disinfectants, and fuel additives where non-beverage grade ethanol is required. Regulatory frameworks favor denatured formulations.

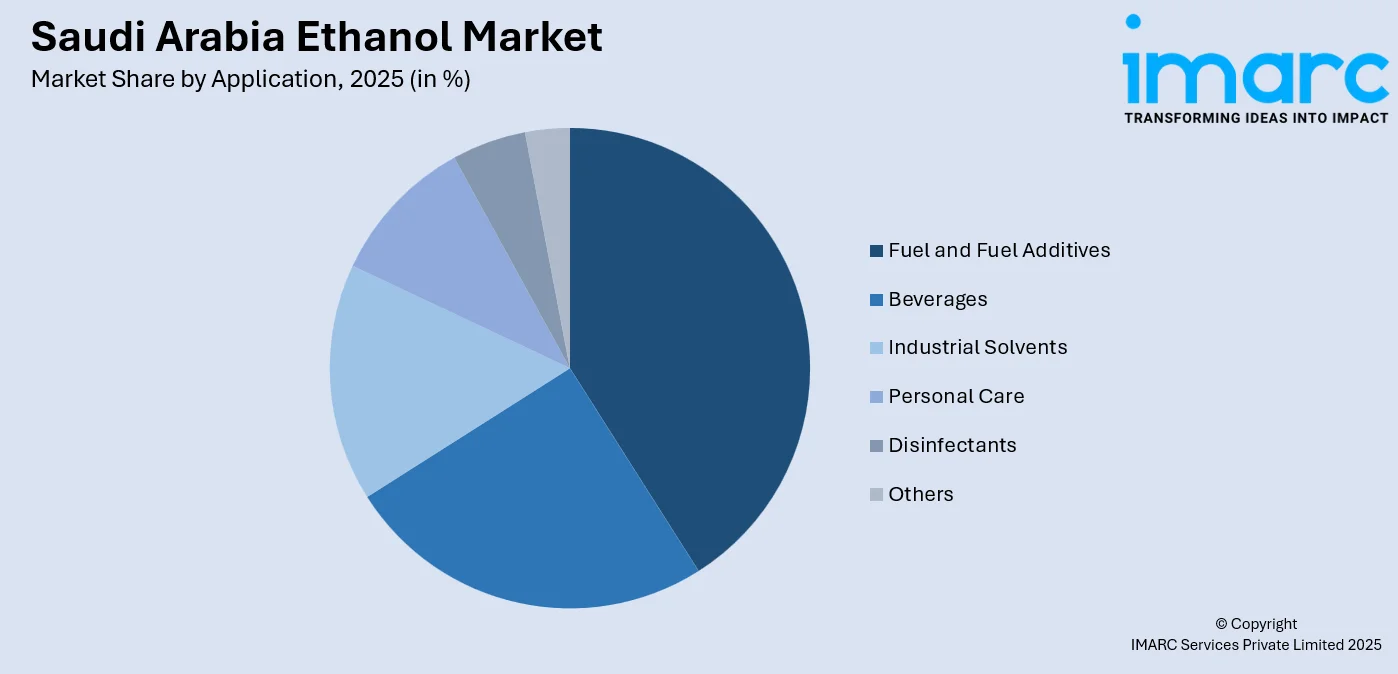

- By Application: Fuel and fuel additives represent the biggest segment with a market share of 41% in 2025, reflecting the growing emphasis on energy diversification and sustainable fuel alternatives aligned with national environmental objectives and transportation sector decarbonization goals.

- By Region: Northern and Central Region comprises the largest region with 37% share in 2025, driven by concentration of pharmaceutical manufacturing, personal care industries, and industrial facilities in Riyadh metropolitan area alongside advanced logistics infrastructure.

- Key Players: Key players drive the Saudi Arabia ethanol market by expanding production capabilities, investing in sustainable manufacturing technologies, and strengthening distribution networks. Their strategic partnerships with international suppliers, research collaborations with local institutions, and compliance with evolving regulatory standards ensure consistent product availability across diverse industrial applications.

To get more information on this market Request Sample

The Saudi Arabia ethanol market demonstrates robust growth potential supported by the Kingdom's comprehensive economic diversification strategy and expanding industrial base. The expansion of the pharmaceutical industry, with the market projected to reach USD 11.7 Billion by 2033, creates substantial demand for high-purity ethanol in drug formulation and manufacturing processes. Additionally, the beauty and personal care industry's growth trajectory drives consistent consumption of ethanol as a key ingredient in cosmetic formulations, sanitizers, and skincare products. The industrial solvents segment benefits from expanding manufacturing activities across the paints, coatings, and chemical processing sectors, where ethanol serves as an effective and environmentally preferable solvent alternative. Government initiatives aimed at promoting sustainable practices and reduced volatile organic compound emissions further enhance ethanol adoption across industrial applications.

Saudi Arabia Ethanol Market Trends:

Growing Integration with Renewable Energy Initiatives

The Saudi Arabia ethanol market is witnessing increased alignment with national renewable energy objectives as part of Vision 2030's sustainability framework. Government bodies are exploring potential ethanol blends in transport fuels while research partnerships emerge at universities and technology parks to explore ethanol production from agricultural residues and municipal waste. Industrial players are experimenting with ethanol-based green solvents in coatings and cleaning products to reduce emissions, positioning ethanol as a strategic component of the Kingdom's energy transition roadmap.

Rising Demand from Pharmaceutical and Healthcare Sectors

The pharmaceutical industry's expansion significantly influences ethanol consumption patterns across Saudi Arabia. Healthcare sector modernization and increased local drug manufacturing drive demand for pharmaceutical-grade ethanol in formulations, extraction processes, and sanitization applications. The growing emphasis on biotechnology and specialty medicines, coupled with government initiatives to boost local pharmaceutical production capabilities, creates sustained requirements for high-purity ethanol supplies. Enhanced healthcare infrastructure development further accelerates consumption in hospital sterilization and medical device cleaning applications. In 2024, the government of Saudi Arabia allocated SAR 214 Billion (USD 57.04 billion) for health and social development, emphasizing new hospitals, the expansion of health services, and the automation of ambulance connectivity.

Expansion of Personal Care and Hygiene Applications

The personal care sector's evolution drives increased ethanol utilization in cosmetics, skincare products, and hygiene formulations throughout Saudi Arabia. Rising consumer awareness regarding personal hygiene, combined with the beauty industry's shift towards natural and organic products, enhances demand for ethanol-based formulations. The sanitizer and disinfectant segment maintains sustained consumption following heightened hygiene consciousness, while growing acceptance of cosmetics and grooming products among younger demographics creates additional market opportunities for ethanol in personal care manufacturing.

How Vision 2030 is Transforming the Saudi Arabia Ethanol Market:

Vision 2030 is driving a transformative shift in the Saudi Arabia ethanol market by emphasizing industrial diversification, sustainable energy, and domestic chemical production. Government initiatives aim to reduce reliance on imported raw materials and promote local manufacturing of bio-based chemicals, including ethanol, to support downstream industries, such as pharmaceutical, cosmetic, and biofuel. Investments in advanced production facilities, research, and technology transfer are enhancing domestic capacity and improving cost competitiveness. Policies promoting renewable feedstocks and circular economy practices encourage the adoption of bioethanol in industrial and energy applications. Additionally, public-private partnerships (PPPs) and sovereign-backed funding are accelerating project execution, creating a robust supply chain.

Market Outlook 2026-2034:

The Saudi Arabia ethanol market outlook remains positive, supported by favorable policy frameworks, expanding end-use industries, and strategic infrastructure investments. Government commitment to economic diversification under Vision 2030 creates substantial opportunities for ethanol adoption across the fuel, pharmaceutical, personal care, and industrial sectors. The market generated a revenue of USD 677.1 Million in 2025 and is projected to reach a revenue of USD 1,041.5 Million by 2034, growing at a compound annual growth rate of 4.90% from 2026-2034. Continued investments in local manufacturing capabilities, regulatory reforms supporting sustainable chemical production, and rising demand from the expanding healthcare and personal care industries reinforce the market's growth trajectory.

Saudi Arabia Ethanol Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Bio Ethanol | 64% |

| Raw Material | Ethylene | 39% |

| Purity | Denatured | 71% |

| Application | Fuel and Fuel Additives | 41% |

| Region | Northern and Central Region | 37% |

Type Insights:

- Bio Ethanol

- Synthetic Ethanol

Bio ethanol dominates with a market share of 64% of the total Saudi Arabia ethanol market in 2025.

Bio ethanol maintains its dominant position in the Saudi Arabia market, driven by increasing sustainability mandates and growing preference for renewable chemical feedstocks across multiple industries. The Kingdom's commitment to producing 9.5 Million liters of bioethanol annually by 2030 underscores government support for this segment. Vision 2030 initiatives promote biofuel development as part of broader energy diversification strategies, creating favorable conditions for bio ethanol adoption in fuel blending, pharmaceutical manufacturing, and personal care formulations throughout the country.

The segment benefits from evolving regulatory frameworks that encourage sustainable chemical production and reduced carbon emissions across industrial operations. Research partnerships between government bodies, universities, and technology parks explore bio ethanol production from agricultural residues and municipal waste streams, expanding potential feedstock sources. Growing consumer preferences for natural and environmentally responsible products in the personal care and cosmetics industries further accelerate bio ethanol demand, positioning this segment for continued expansion throughout the forecast period.

Raw Material Insights:

- Sugar and Molasses

- Cassava

- Rice

- Algal Biomass

- Ethylene

- Lignocellulosic Biomass

Ethylene leads with a share of 39% of the total Saudi Arabia ethanol market in 2025.

Ethylene dominates the market because of the Kingdom’s strong petrochemical base and easy availability of ethylene feedstock. Saudi Arabia is a global hub for ethylene production, supported by large-scale refining and petrochemical complexes. Ethylene-based ethanol production offers consistent quality, large-volume output, and cost efficiency compared to bio-based alternatives. This makes it highly suitable for industrial applications, such as solvents, chemicals, pharmaceuticals, and intermediate manufacturing, where purity and supply reliability are critical. The established infrastructure for ethylene processing further strengthens its dominance.

The preference for ethylene-derived ethanol is also driven by industrial demand patterns and operational scalability. Large manufacturers favor ethylene routes due to predictable pricing, year-round production, and seamless integration with existing petrochemical value chains. Unlike agricultural feedstocks, ethylene supply is not exposed to seasonal variability, ensuring stable output. Additionally, advanced technology adoption and economies of scale reduce production costs, making ethylene-based ethanol the most commercially viable option. These advantages collectively position ethylene as the leading source in the Saudi Arabia ethanol market.

Purity Insights:

- Denatured

- Undenatured

Denatured exhibits a clear dominance with a 71% share of the total Saudi Arabia ethanol market in 2025.

Denatured maintains substantial market leadership, driven by extensive applications in industrial solvents, disinfectants, fuel additives, and personal care products where non-beverage grade formulations are required. The thriving industrial solvents industry in Saudi Arabia creates consistent demand for denatured ethanol in paints, coatings, and cleaning chemical formulations. Regulatory frameworks in the Kingdom favor denatured products for industrial and commercial applications, supporting this segment's dominant positioning.

The segment benefits from rising hygiene awareness and sustained demand for sanitizers and disinfectants across the healthcare, hospitality, and commercial sectors throughout Saudi Arabia. Growing manufacturing activities in the automotive, construction, and electronics industries further drive demand for denatured ethanol in cleaning, coating, and processing applications across the Kingdom's expanding industrial base. Sales of motor vehicles in Saudi Arabia reached 805,034 units in December 2024, up from 758,791 units in December 2024.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Fuel and Fuel Additives

- Beverages

- Industrial Solvents

- Personal Care

- Disinfectants

- Others

Fuel and fuel additives comprise the leading segment with a 41% share of the total Saudi Arabia ethanol market in 2025.

The fuel and fuel additives segment commands the largest market share, driven by government initiatives promoting energy diversification and sustainable transportation solutions under Vision 2030. Government bodies are actively exploring potential ethanol blends in transport fuels as part of broader carbon emission reduction strategies. The Kingdom's commitment to achieving 50% of electricity from renewable sources by 2030 creates spillover support for biofuel alternatives, positioning ethanol as a strategic component in transportation sector decarbonization efforts.

The segment benefits from strategic investments in sustainable fuel infrastructure and research partnerships exploring ethanol applications in various fuel formulations. Maritime sector adoption of biofuels under stricter emission standards creates additional growth opportunities for ethanol-based fuel additives throughout the Kingdom's transportation and logistics networks. Rising awareness among fleet operators about emission reduction and fuel efficiency further supports ethanol adoption in blended fuels. In addition, collaborations between energy companies and research institutions are accelerating pilot projects and regulatory frameworks for wider ethanol usage across transport segments.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region represents the largest region with 37% share of the total Saudi Arabia ethanol market in 2025.

Northern and Central Region maintain market leadership, driven by concentration of pharmaceutical manufacturing, personal care industries, and diverse industrial facilities in the Riyadh metropolitan area. Riyadh commands significant market presence with its population projected to exceed 9.6 Million by 2030, driving consistent demand across consumer and industrial applications. The region has advanced logistics infrastructure, government projects like Qiddiya, New Murabba, and Diriyah developments, and easy connectivity to the principal distribution hubs in the Kingdom.

Sudir Industrial and Business City in central Saudi Arabia is a specialized hub for the pharmaceutical, food processing, and light manufacturing sectors, which have high demand for large volumes of ethanol. Mega projects and developments in the Kingdom result in the continuous requirement for construction chemicals, paints, coatings, and cleaning agents containing ethanol as an active component. Strong connectivity to ports, highways, and national distribution corridors also enables efficient ethanol supply across Saudi Arabia.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Ethanol Market Growing?

Vision 2030 Sustainability Initiatives Driving Renewable Energy Adoption

The Saudi Arabia ethanol market benefits substantially from government sustainability initiatives under Vision 2030 framework that promote renewable energy alternatives and economic diversification. The Kingdom's commitment to achieving energy transition targets creates favorable policy environments for biofuel development and ethanol adoption across multiple sectors. Government investment programs support research partnerships exploring ethanol production from agricultural residues and municipal waste streams, expanding potential feedstock sources. The National Renewable Energy Program establishes targets for renewable energy integration that indirectly support ethanol market expansion through emphasis on sustainable chemical alternatives. Strategic initiatives to reduce crude oil dependency encourage development of alternative fuel sources, including ethanol-based blends for transportation applications. Policy frameworks supporting clean energy and carbon emission reduction create sustained momentum for ethanol adoption in fuel additives and industrial solvent applications throughout the Kingdom.

Expanding Pharmaceutical Industry Creating Sustained Demand

The pharmaceutical sector's robust expansion significantly drives ethanol consumption across Saudi Arabia as drug manufacturing, formulation, and healthcare applications require substantial high-purity ethanol supplies. Government healthcare transformation initiatives under Vision 2030 promote investments in local pharmaceutical manufacturing capabilities and biotechnology research, creating sustained demand for pharmaceutical-grade ethanol. The establishment of new manufacturing facilities, including cancer pharmaceutical plants and biopharmaceutical centers, requires consistent ethanol supplies for production processes. The Saudi Pharmaceutical Industries & Medical Appliances Corporation (SPIMACO) launched a state-of-the-art cancer medication facility in Qassim. Constructed for SAR 272 Million, the building covers 2,800 square meters. Healthcare infrastructure development across hospitals, clinics, and research centers generates additional demand for ethanol in sterilization and sanitization applications. Strategic partnerships between local and international pharmaceutical companies facilitate technology transfer and capacity expansion that increase ethanol consumption. The growing emphasis on biotechnology and specialty medicines aligns with increased requirements for high-purity ethanol in advanced drug development and manufacturing processes throughout the Kingdom.

Growing Personal Care and Cosmetics Industry Accelerating Consumption

The personal care and cosmetics industry's rapid growth trajectory drives substantial ethanol demand, as skincare, haircare, and hygiene products incorporate ethanol as a key formulation ingredient. Rising consumer awareness regarding personal grooming, combined with increasing female workforce participation and evolving cultural norms, expands market opportunities for ethanol-containing products. The growing preferences for natural and organic beauty products create the demand for bio-based ethanol in clean beauty formulations. Social media influence and global beauty trend adoption among the Kingdom's young population accelerate consumption of cosmetics and personal care products containing ethanol. Heightened hygiene consciousness sustains demand for sanitizers and disinfectants across commercial, healthcare, and residential applications. International and local brand expansion through physical retail and e-commerce platforms ensures widespread availability of ethanol-based personal care products throughout Saudi Arabia's diverse consumer markets.

Market Restraints:

What Challenges the Saudi Arabia Ethanol Market is Facing?

Limited Domestic Feedstock Availability and Production Capacity

Saudi Arabia faces significant constraints in domestic bio ethanol production due to limited availability of traditional feedstocks such as sugarcane, corn, and other agricultural materials. Water scarcity and climate conditions restrict cultivation of biomass feedstocks, creating dependence on imported ethanol supplies. The lack of established large-scale ethanol production infrastructure increases vulnerability to international supply chain disruptions and price fluctuations. Economic feasibility challenges associated with developing local production pathways from alternative feedstocks constrain market development potential.

Stringent Regulatory Requirements and Compliance Complexity

In Saudi Arabia, the ethanol market faces challenges from complex regulatory frameworks governing production, import, distribution, and end use applications across different sectors. Evolving standards for pharmaceutical-grade ethanol require continuous compliance investments while varying requirements across industrial, food, and beverage applications create operational complexities. The Saudi Food and Drug Authority's stringent product registration and quality control processes demand significant time and resources from market participants seeking approvals for new formulations and applications.

Import Dependency and Supply Chain Vulnerabilities

Heavy reliance on imported ethanol supplies exposes the market to international price volatility, geopolitical risks, and logistics disruptions affecting availability and cost stability. Global market fluctuations in feedstock prices and production capacity directly impact Saudi Arabia's ethanol supply chain economics. Competition from established ethanol-producing countries with lower production costs creates pricing pressures for domestic market participants, while currency exchange rate variations add further uncertainty to import-dependent supply chains.

Competitive Landscape:

The Saudi Arabia ethanol market exhibits a moderately consolidated competitive structure, characterized by the presence of established petrochemical manufacturers, specialized chemical distributors, and international suppliers serving diverse end-use industries. Major players leverage integrated production capabilities, extensive distribution networks, and strategic partnerships to maintain market positioning across pharmaceutical, personal care, industrial, and fuel applications. Competition intensifies around product quality, supply reliability, technical support services, and compliance with evolving regulatory requirements. Market participants differentiate through application-specific formulations, sustainable production practices, and value-added services, including technical consultation and logistics solutions. Strategic investments in local production capacity, research collaborations with academic institutions, and partnerships with international technology providers strengthen competitive positioning.

Saudi Arabia Ethanol Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Bio Ethanol, Synthetic Ethanol |

| Raw Materials Covered | Sugar and Molasses, Cassava, Rice, Algal Biomass, Ethylene, Lignocellulosic Biomass |

| Purities Covered | Denatured, Undenatured |

| Applications Covered | Fuel and Fuel Additives, Beverages, Industrial Solvents, Personal Care, Disinfectants, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia ethanol market size was valued at USD 677.1 Million in 2025.

The Saudi Arabia ethanol market is expected to grow at a compound annual growth rate of 4.90% from 2026-2034 to reach USD 1,041.5 Million by 2034.

Bio ethanol dominated the market with a share of 64%, driven by increasing sustainability initiatives, government support for renewable energy alternatives, and growing adoption in pharmaceutical and personal care formulations across the Kingdom.

Key factors driving the Saudi Arabia ethanol market include Vision 2030 sustainability initiatives promoting renewable energy adoption, expanding pharmaceutical industry creating sustained demand for high-purity ethanol, and growing personal care and cosmetics sector accelerating consumption.

Major challenges include limited domestic feedstock availability constraining local production capacity, stringent regulatory requirements creating compliance complexities, import dependency exposing the market to international supply chain vulnerabilities, and economic feasibility concerns for developing alternative production pathways.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)