Saudi Arabia EV Battery Components Market Size, Share, Trends and Forecast by Component Type, Battery Type, Vehicle Type, Propulsion Type, End User, and Region, 2026-2034

Saudi Arabia EV Battery Components Market Overview:

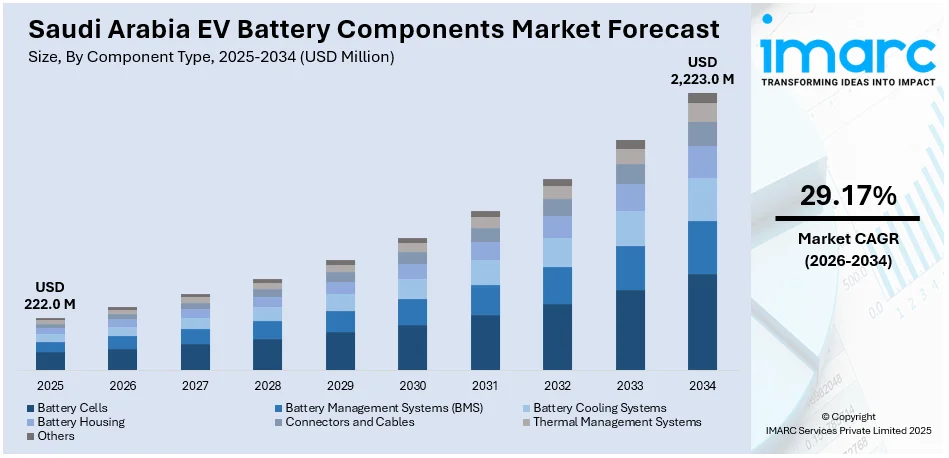

The Saudi Arabia EV battery components market size reached USD 222.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 2,223.0 Million by 2034, exhibiting a growth rate (CAGR) of 29.17% during 2026-2034. Saudi Arabia is advancing electric vehicle (EV) battery component localization through upstream mineral development, domestic manufacturing, and industrial infrastructure. Additionally, a rapidly growing aftermarket for diagnostics and replacements is driving the demand for local parts, strengthening service networks, enhancing the long-term sustainability of the supply ecosystem, and contributing to the expansion of the Saudi Arabia EV battery components market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 222.0 Million |

| Market Forecast in 2034 | USD 2,223.0 Million |

| Market Growth Rate 2026-2034 | 29.17% |

Saudi Arabia EV Battery Components Market Trends:

Localization of Supply Chains

Saudi Arabia is hastening initiatives to localize the supply chain for EV battery parts as a component of its larger strategy for industrial self-sufficiency. This strategy focuses on building national competencies throughout the complete battery value chain, ranging from upstream mineral extraction to midstream and downstream production. National mining initiatives are focusing on essential materials, such as lithium and nickel, aiming to decrease reliance on imports and ensure access to raw materials. At the same time, there is a unified effort to create localized manufacturing of essential components like separators, electrolytes, and cell assemblies to facilitate quicker production cycles and guarantee supply reliability. These initiatives are backed by infrastructure-centric investments in specialized industrial areas like NEOM and King Abdullah Economic City (KAEC), which are being developed to accommodate EV suppliers and cutting-edge manufacturing plants. For example, in 2025, Saudi EV maker Ceer signed $1.4 billion in deals, 80% with local firms, to build a localized supply chain ahead of its 2026 launch. Ceer’s factory at KAEC is expected to produce 240,000 EVs annually and serve as a core pillar of Saudi Arabia’s Vision 2030 goals. The organization's procurement approach covers an extensive array of EV components, infrastructure solutions, and manufacturing technologies, bolstering national goals to establish a comprehensive EV production ecosystem. This combination of policy support, industrial investment, and commercial demand is positioning supply chain localization as a key factor in the Saudi Arabia EV battery components market growth.

To get more information on this market Request Sample

Aftermarket Services and Maintenance Demand

With an increase in EVs on the road, the demand for routine maintenance, diagnostics, component swaps, and battery module overhauls is growing consistently. This encompasses high-wear components like cooling systems, protective housings, sensors, connectors, and electronic control units that need regular maintenance or enhancements. Creating a local supply chain for these components aids in decreasing maintenance lead times and enhances compatibility with changing battery models. It also allows for quicker technical support and better parts availability for service providers and fleet managers. The trend is evident in market growth forecasts, which states that the Saudi Arabia EV aftermarket reached USD 759.2 thousand in 2024 and is anticipated to rise to USD 4,084.8 thousand by 2033, as reported by IMARC Group, expanding at a CAGR of 20.56% from 2025 to 2033. This sharp rise indicates the development of a strong service and support network that relies significantly on local parts sourcing. An increase in aftermarket activity is driving investment in technician training programs, specialized repair facilities, and diagnostic equipment specifically designed for EV battery systems. Collectively, these advancements are expanding the applications for locally produced battery parts, generating additional income sources beyond primary vehicle assembly, and strengthening the enduring feasibility of Saudi Arabia’s EV supply chain approach.

Saudi Arabia EV Battery Components Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on component type, battery type, vehicle type, propulsion type, and end user.

Component Type Insights:

- Battery Cells

- Battery Management Systems (BMS)

- Battery Cooling Systems

- Battery Housing

- Connectors and Cables

- Thermal Management Systems

- Others

The report has provided a detailed breakup and analysis of the market based on the component type. This includes battery cells, battery management systems (BMS), battery cooling systems, battery housing, connectors and cables, thermal management systems, and others.

Battery Type Insights:

- Lithium-Ion Batteries

- Nickel-Metal Hydride Batteries

- Solid-State Batteries

- Lead-Acid Batteries

A detailed breakup and analysis of the market based on the battery type have also been provided in the report. This includes lithium-ion batteries, nickel-metal hydride batteries, solid-state batteries, and lead-acid batteries.

Vehicle Type Insights:

- Passenger Vehicles

- Commercial Vehicles

- Two-Wheelers

- Three-Wheelers

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger vehicles, commercial vehicles, two-wheelers, and three-wheelers.

Propulsion Type Insights:

- Battery Electric Vehicles (BEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Hybrid Electric Vehicles (HEVs)

A detailed breakup and analysis of the market based on the propulsion type have also been provided in the report. This includes battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and hybrid electric vehicles (HEVs).

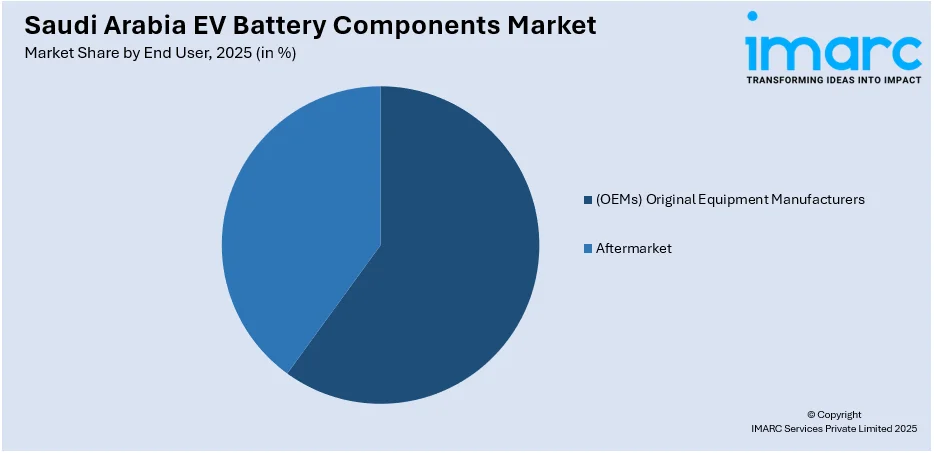

End User Insights:

Access the comprehensive market breakdown Request Sample

- (OEMs) Original Equipment Manufacturers

- Aftermarket

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes (OEMs) original equipment manufacturers and aftermarket.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia EV Battery Components Market News:

- In January 2025, Saudi Arabia commissioned its largest battery energy storage system (500 MW/2000 MWh) in Bisha, Asir province. Supplied by China’s BYD and built by a State Grid-Alfanar consortium, the facility supports Vision 2030 by enhancing grid flexibility and renewable energy integration. It is the world’s largest operational single-phase energy storage project.

Saudi Arabia EV Battery Components Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Component Types Covered | Battery Cells, Battery Management Systems (BMS), Battery Cooling Systems, Battery Housing, Connectors and Cables, Thermal Management Systems, Others |

| Battery Types Covered | Lithium-Ion Batteries, Nickel-Metal Hydride Batteries, Solid-State Batteries, Lead-Acid Batteries |

| Vehicle Types Covered | Passenger Vehicles, Commercial Vehicles, Two-Wheelers, Three-Wheelers |

| Propulsion Types Covered | Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), Hybrid Electric Vehicles (HEVs) |

| End Users Covered | OEMs (Original Equipment Manufacturers), Aftermarket |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia EV battery components market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia EV battery components market on the basis of component type?

- What is the breakup of the Saudi Arabia EV battery components market on the basis of battery type?

- What is the breakup of the Saudi Arabia EV battery components market on the basis of vehicle type?

- What is the breakup of the Saudi Arabia EV battery components market on the basis of propulsion type?

- What is the breakup of the Saudi Arabia EV battery components market on the basis of end user?

- What is the breakup of the Saudi Arabia EV battery components market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia EV battery components market?

- What are the key driving factors and challenges in the Saudi Arabia EV battery components market?

- What is the structure of the Saudi Arabia EV battery components market and who are the key players?

- What is the degree of competition in the Saudi Arabia EV battery components market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia EV battery components market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia EV battery components market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia EV battery components industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)