Saudi Arabia EV Battery Cooling Systems Market Size, Share, Trends and Forecast by Cooling Technology, Battery Type, Vehicle Type, Propulsion Type, End User, and Region, 2026-2034

Saudi Arabia EV Battery Cooling Systems Market Summary:

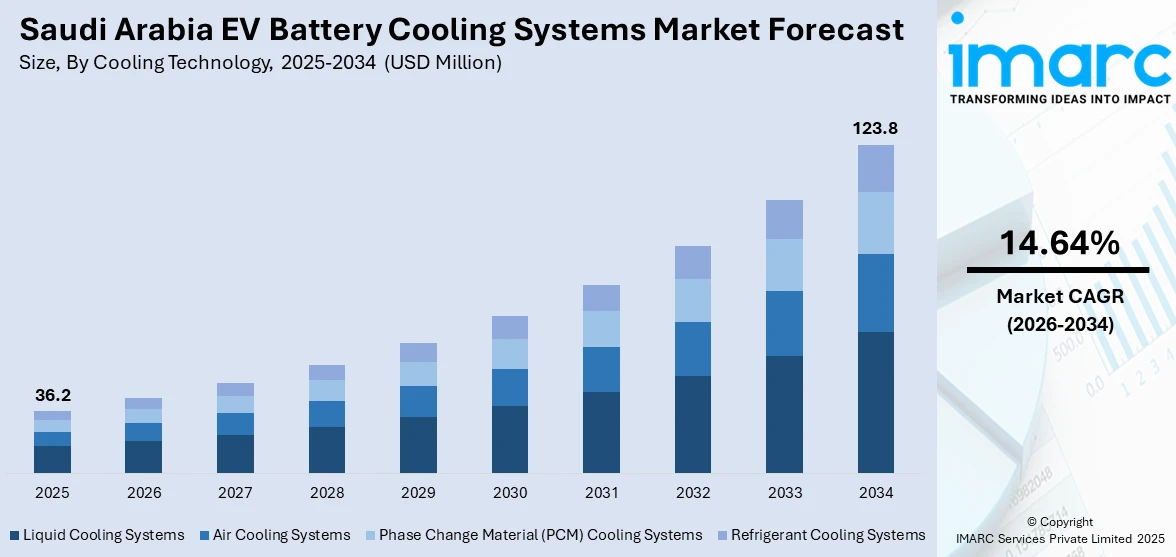

The Saudi Arabia EV battery cooling systems market size was valued at USD 36.2 Million in 2025 and is projected to reach USD 123.8 Million by 2034, growing at a compound annual growth rate of 14.64% from 2026-2034.

The Saudi Arabia EV battery cooling systems market is expanding rapidly, driven by the Kingdom's ambitious Vision 2030 initiative that prioritizes electric mobility adoption and sustainable transportation solutions. Rising demand for advanced thermal management technologies is fueled by the extreme desert climate conditions that necessitate efficient battery temperature regulation for optimal performance and longevity. Government-supported localization initiatives and strategic alliances with global automotive producers are enhancing domestic manufacturing capacity, while increasing investments in EV infrastructure and research and development (R&D) further bolster the market presence.

Key Takeaways and Insights:

- By Cooling Technology: Liquid cooling systems dominate the market with a share of 42% in 2025, owing to their superior heat dissipation capabilities and efficiency in managing high thermal loads generated during fast charging and extended driving operations under extreme temperature conditions.

- By Battery Type: Lithium-ion batteries lead the market with a share of 69% in 2025, driven by their high energy density, longer cycle life, and widespread adoption across all EV segments manufactured and sold within the Kingdom.

- By Vehicle Type: Passenger vehicles comprise the largest segment with a market share of 60% in 2025, reflecting strong consumer interest in personal electric transportation solutions supported by government incentives and expanding charging infrastructure networks.

- By Propulsion Type: Battery electric vehicles (BEVs) exhibit a clear dominance with 54% share in 2025, attributed to the growing preference for zero-emission transportation and substantial investments in pure electric mobility solutions across the Kingdom.

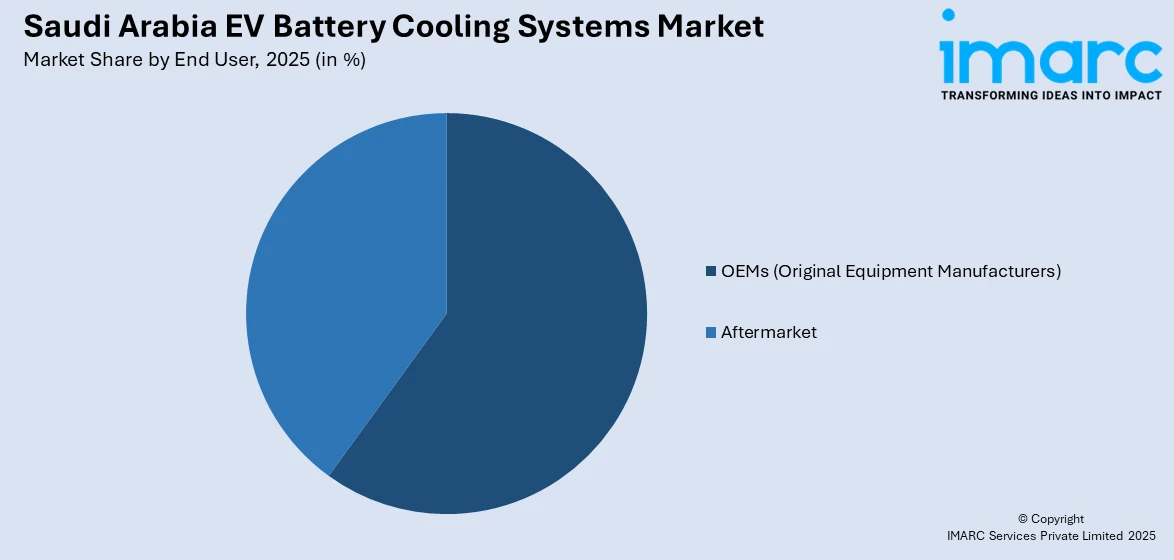

- By End User: OEMs (original equipment manufacturers) prevail the market with a share of 80% in 2025, driven by domestic EV manufacturing initiatives and partnerships between local entities and global automotive manufacturers establishing production facilities.

- By Region: Northern and Central Region represents the largest region with a market share of 35% in 2025, owing to Riyadh's concentration of government initiatives, corporate headquarters, and the high EV adoption rates. The presence of advanced charging infrastructure and strong policy support further accelerates EV penetration, reinforcing the region’s leadership in the market.

- Key Players: Key players are driving the Saudi Arabia EV battery cooling systems market through strategic technology partnerships, localized manufacturing investments, and research collaborations. Their focus on developing desert-grade thermal solutions optimized for extreme temperatures ensures reliable battery performance and safety compliance.

To get more information on this market Request Sample

The Saudi Arabia EV battery cooling systems market is undergoing significant transformation, as the Kingdom accelerates its transition towards sustainable mobility under Vision 2030. The government's commitment to reducing carbon emissions by 278 Million Tons per annum (mtpa) by 2030 has positioned EV adoption as a national priority, directly driving demand for sophisticated thermal management solutions. The extreme desert climate, where surface temperatures frequently exceed 50 degrees Celsius, creates unique challenges for battery performance that necessitate advanced cooling technologies capable of maintaining optimal operating temperatures. As a result, automakers and fleet operators are paying closer attention to battery safety and long-term reliability. Cooling systems are no longer seen as optional features but as core components of EV design in Saudi Arabia. Manufacturers are adapting advanced technologies to suit local heat conditions.

Saudi Arabia EV Battery Cooling Systems Market Trends:

Integration of Artificial Intelligence (AI) in Thermal Management Systems

The market is witnessing increasing adoption of AI-driven predictive thermal management solutions that optimize cooling performance in real-time based on driving conditions and ambient temperatures. These intelligent systems utilize machine learning (ML) algorithms to anticipate thermal loads and adjust cooling parameters proactively, enhancing energy efficiency while preventing battery degradation. The technology enables optimized cold-weather performance and improved range by dynamically managing heat distribution across battery modules, representing a significant advancement in thermal control sophistication.

Development of Desert-Grade Thermal Solutions

Manufacturers are increasingly developing specialized cooling systems, engineered specifically for harsh desert environments prevalent across the Arabian Peninsula. These solutions incorporate enhanced liquid cooling circuits, advanced heat-reflective materials, and automated ventilation systems designed to operate reliably under extreme ambient temperatures. The focus on regional customization ensures battery safety and longevity in conditions where conventional thermal management approaches may prove inadequate for maintaining optimal battery operating temperatures. In May 2025, Lucid Group announced a strategic partnership with King Abdullah University of Science and Technology to develop advanced thermal management and battery optimization technologies, leveraging KAUST's supercomputing capabilities to enhance material science research and heat transfer modeling for next-generation cooling solutions, specifically designed for regional climate conditions.

Expansion of Localized Manufacturing and Supply Chains

The market is experiencing accelerated efforts to establish domestic manufacturing capabilities for thermal management components as part of broader industrial self-sufficiency strategies. National initiatives are focusing on developing local supply chains for essential components, including cooling plates, heat exchangers, and thermal interface materials. This trend is supported by government-backed industrial zones in King Abdullah Economic City and NEOM, which are being developed to accommodate EV component suppliers and advanced manufacturing facilities.

How Vision 2030 is Transforming the Saudi Arabia EV Battery Cooling Systems Market:

Saudi Vision 2030 is bringing a shift in the Saudi Arabia EV battery cooling systems market with the promotion of electric mobility, localization, and advanced automotive technology. Government-supported EV initiatives, the development of charging stations, and smart city projects are catalyzing the demand for energy-efficient cooling systems. Battery safety, efficiency optimization, and the ability to perform in hot climatic conditions have boosted the need for liquid cooling, phase change materials, and intelligent thermal controls. The Vision 2030 initiative, through localization, promotes in-country, world-class production of cooling systems to overcome the challenge of component import dependence. Besides this, the demand for electric buses, fleet electrification, and last-mile delivery EVs is fueling market expansion. Environmental and energy efficiency requirements have accelerated the advent of light weight and energy-efficient cooling systems.

Market Outlook 2026-2034:

The Saudi Arabia EV battery cooling systems market is poised for substantial expansion throughout the forecast period, supported by robust government initiatives, increasing EV adoption, and growing investments in domestic manufacturing capabilities. The Kingdom's strategic positioning as a regional hub for electric mobility is attracting significant foreign direct investment (FDI) and technology partnerships that are accelerating the development of advanced thermal management solutions. The market generated a revenue of USD 36.2 Million in 2025 and is projected to reach a revenue of USD 123.8 Million by 2034, growing at a compound annual growth rate of 14.64% from 2026-2034. The proliferation of ultra-fast charging infrastructure, expansion of domestic EV production facilities, and continued emphasis on sustainable transportation solutions will drive sustained demand for high-efficiency cooling technologies capable of ensuring optimal battery performance under extreme operational conditions.

Saudi Arabia EV Battery Cooling Systems Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Cooling Technology |

Liquid Cooling Systems |

42% |

|

Battery Type |

Lithium-Ion Batteries |

69% |

|

Vehicle Type |

Passenger Vehicles |

60% |

|

Propulsion Type |

Battery Electric Vehicles (BEVs) |

54% |

|

End User |

OEMs (Original Equipment Manufacturers) |

80% |

|

Region |

Northern and Central Region |

35% |

Cooling Technology Insights:

- Air Cooling Systems

- Liquid Cooling Systems

- Phase Change Material (PCM) Cooling Systems

- Refrigerant Cooling Systems

Liquid cooling systems dominate with a market share of 42% of the total Saudi Arabia EV battery cooling systems market in 2025.

Liquid cooling systems are considered the most preferred cooling technology for EV batteries in the Kingdom of Saudi Arabia because of the excellent efficiency of heat dissipation offered by these solutions, along with the capability of maintaining equal temperatures throughout the battery pack. These systems use fluids, which are pumped through channels or cold plates, thereby enabling the absorption of heat from battery cells, which helps ensure optimal temperatures of the batteries, even during rapid charging. Such systems are ideally suited for the climate of the Kingdom of Saudi Arabia due to the capability of withstanding extreme heat.

The adoption of liquid cooling technology is accelerating as automakers prioritize high-performance thermal management solutions capable of supporting ultra-fast charging capabilities. Leading EV manufacturers utilize advanced liquid cooling architectures in their battery systems, setting industry standards for thermal efficiency and safety. In September 2024, Yutong Bus successfully completed extreme heat testing of its E11 Pro electric bus in Saudi Arabia, demonstrating advanced liquid cooling technology that maintained optimal battery temperatures at surface conditions exceeding 60 degrees Celsius while achieving energy consumption of only 0.74 kilowatt-hours per kilometer.

Battery Type Insights:

- Lithium-Ion Batteries

- Nickel-Metal Hydride Batteries

- Solid-State Batteries

- Others

Lithium-ion batteries lead with a share of 69% of the total Saudi Arabia EV battery cooling systems market in 2025.

Lithium-ion batteries maintain their dominant position in the Saudi Arabia market, due to their superior energy density, longer cycle life, and established manufacturing ecosystem that supports widespread EV deployment. These batteries require precise thermal management to operate within the optimal temperature range of 20 to 45 degrees Celsius, driving substantial demand for sophisticated cooling systems. High ambient temperatures increase the risk of performance degradation and thermal runaway, making effective cooling essential.

The lithium-ion batteries segment continues to attract significant investment as manufacturers focus on improving energy density and thermal stability for regional climate conditions. Advanced chemistries, including lithium iron phosphate and nickel manganese cobalt formulations, are being optimized for enhanced heat tolerance and safety performance in extreme environments. Research efforts are also targeting longer battery lifespans under high-temperature operation. These advancements are strengthening the role of lithium-ion batteries in Saudi Arabia’s long-term electric mobility strategy.

Vehicle Type Insights:

- Passenger Vehicles

- Commercial Vehicles

- Two-Wheelers

- Three-Wheelers

Passenger vehicles prevail the market with a 60% share of the total Saudi Arabia EV battery cooling systems market in 2025.

Passenger vehicles represent the primary demand driver for EV battery cooling systems, as consumer adoption of personal electric transportation accelerates across the Kingdom. The segment benefits from strong government incentives, including customs duty exemptions, preferential parking privileges, and reduced electricity rates for home charging that encourage EV ownership. Rising consumer awareness around battery safety and driving range is further increasing demand for efficient cooling solutions. Urban commuting needs and high daily usage patterns make reliable thermal management especially important for passenger vehicles.

The passenger vehicles segment is experiencing rapid expansion, as domestic manufacturing capabilities develop through strategic initiatives involving local and international partnerships. Luxury EVs capture a substantial share of new EV registrations, setting high standards for thermal management performance and battery longevity. These premium models often integrate advanced liquid cooling and intelligent thermal control systems. As a result, technology adoption in the passenger vehicles segment is influencing broader market standards and expectations.

Propulsion Type Insights:

- Battery Electric Vehicles (BEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Hybrid Electric Vehicles (HEVs)

Battery electric vehicles (BEVs) exhibit a clear dominance with a 54% share of the total Saudi Arabia EV battery cooling systems market in 2025.

Battery electric vehicles (BEVs) represent the fastest-growing propulsion segment, as the Kingdom prioritizes zero-emission transportation solutions aligned with environmental sustainability objectives. These vehicles rely exclusively on battery power for propulsion, necessitating robust thermal management systems capable of handling continuous high-load operations without compromising performance or safety. High ambient temperatures and frequent fast-charging cycles further increase thermal stress on BEV batteries. As a result, advanced cooling systems are critical to ensuring driving range stability and long-term battery health.

BEVs benefit from significant infrastructure investments supporting widespread adoption, including the deployment of ultra-fast charging networks across major urban centers and highway corridors. In July 2023, Electromin, a smart mobility solutions company within Petromin Corporation, revealed plans to deploy more ultra-fast DC chargers for EVs at strategic sites nationwide, creating charging corridors that could link major urban areas. BEVs require more sophisticated cooling systems than hybrids due to their larger battery capacities and higher thermal loads during rapid charging and sustained driving. This rapid charging expansion is intensifying the need for efficient battery cooling to manage heat spikes during high-power charging sessions.

End User Insights:

Access the comprehensive market breakdown Request Sample

- OEMs (Original Equipment Manufacturers)

- Aftermarket

OEMs (original equipment manufacturers) comprise the leading segment with an 80% share of the total Saudi Arabia EV battery cooling systems market in 2025.

OEMs (original equipment manufacturers) dominate the Saudi Arabia EV battery cooling systems market, as domestic EV production capabilities expand through strategic government-backed initiatives and international partnerships. OEMs integrate thermal management systems during vehicle assembly, ensuring optimal compatibility and performance characteristics tailored to specific vehicle platforms and regional operating conditions. This integrated approach allows OEMs to meet strict safety, efficiency, and warranty requirements from the outset. It also enables better control over system costs and long-term reliability.

The segment is strengthening through localization efforts that are developing domestic supply chains for thermal management components and reducing dependence on imported systems. Major manufacturers are establishing joint ventures and technology licensing agreements to build regional production capabilities, creating opportunities for local suppliers to participate in the EV value chain. These initiatives also support faster innovation cycles and improved responsiveness to Saudi Arabia’s unique climate and market needs.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region represents the largest segment with a 35% share of the total Saudi Arabia EV battery cooling systems market in 2025.

Northern and Central Region maintains market leadership, driven by Riyadh's position as the capital city and primary hub for government initiatives, corporate headquarters, and consumer EV adoption. The region benefits from concentrated infrastructure investments and the highest density of public charging stations, supporting practical EV ownership for urban residents and commuters. High disposable incomes and strong fleet electrification initiatives further boost EV penetration in the region. The presence of early adopters and corporate EV fleets is accelerating demand for advanced charging and cooling solutions.

The regional market is expanding through strategic initiatives that position the Northern and Central Region as the Kingdom's primary center for electric mobility development and innovation. Electric Vehicle Infrastructure Co. revealed plans to install 60 new charging stations across Riyadh, Jeddah, and the Eastern Province by the end of 2025, with the Northern and Central Region receiving priority allocation to support accelerating adoption rates. These investments are strengthening the region’s role as a testing ground for large-scale EV battery cooling system deployment.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia EV Battery Cooling Systems Market Growing?

Vision 2030 and Government Initiatives Driving Electric Mobility Adoption

The Saudi Arabia EV battery cooling systems market is gaining strong momentum, as the Kingdom advances its Vision 2030 agenda, which places electric mobility at the center of long-term sustainable growth. Government support for EV adoption is visible through investments in local manufacturing, charging infrastructure, and technology development. As per IMARC Group, the Saudi Arabia EV charging station market size reached USD 191.0 Million in 2025. Policies encouraging cleaner transportation are pushing automakers and suppliers to focus on reliable and efficient battery systems suited to local conditions. As EVs are becoming more common, effective battery cooling is increasingly critical to ensure safety, performance, and long service life, especially in Saudi Arabia’s hot climate. The growing role of public sector initiatives and state-backed investments is helping build a complete EV ecosystem, from vehicle production to supporting components. Together, these developments are positioning Saudi Arabia as an emerging regional center for electric mobility while steadily increasing demand for advanced battery thermal management solutions.

Extreme Climate Conditions Necessitating Advanced Thermal Management Solutions

The harsh desert climate prevalent across Saudi Arabia creates unique operational challenges for EV batteries that necessitate sophisticated cooling technologies engineered for extreme temperature conditions. Between June 16th and June 18th, during the Hajj pilgrimage, temperatures in Saudi Arabia soared to 47°C, with Mecca and Medina, the focal points of Hajj, experiencing temperatures that were at least 1.5 to 2°C higher. Surface temperatures frequently exceed 50 degrees Celsius during summer months, substantially increasing thermal stress on battery systems and accelerating degradation without proper temperature regulation. These environmental factors drive strong demand for high-performance liquid cooling systems, advanced thermal interface materials, and intelligent thermal management architectures capable of maintaining batteries within optimal operating ranges. Manufacturers are developing specialized desert-grade solutions incorporating enhanced heat dissipation capabilities, fire-resistant insulation, and automated ventilation systems specifically designed for regional conditions, creating substantial market opportunities for innovative thermal management technologies.

Expansion of Domestic EV Manufacturing and Localized Supply Chains

The growth of domestic EV manufacturing in Saudi Arabia is driving strong demand for locally produced battery cooling system components as the Kingdom works towards industrial self-sufficiency. Partnerships between government-backed entities and international automakers are creating integrated production networks that rely on robust thermal management supply chains. Leading EV manufacturers have established advanced production facilities in key economic zones, producing large volumes of vehicles that require sophisticated cooling systems installed during assembly. This trend is fueling demand from OEMs for high-quality thermal management components and encouraging the development of local supplier capabilities. By focusing on building a complete domestic ecosystem for EV production, including batteries, cooling systems, and related components, Saudi Arabia is positioning itself as a regional hub for electric mobility. These developments are helping ensure that the market for advanced battery thermal management solutions continues to expand alongside vehicle production growth.

Market Restraints:

What Challenges the Saudi Arabia EV Battery Cooling Systems Market is Facing?

High Development and Manufacturing Costs for Advanced Cooling Technologies

The development and production of sophisticated battery thermal management systems involves substantial capital investments in specialized equipment, materials, and engineering expertise that challenge market accessibility. Advanced liquid cooling systems require complex networks of coolant channels, precision-engineered cold plates, and high-quality thermal interface materials that increase production costs. These expenses are compounded by the need for specialized testing facilities capable of validating performance under extreme temperature conditions, creating financial barriers for new market entrants and limiting the pace of technology deployment.

Limited Local Technical Expertise and Skilled Workforce Availability

The nascent stage of domestic EV manufacturing creates challenges in developing sufficient local technical expertise for battery thermal management system design, production, and maintenance. The specialized knowledge required for advanced cooling technologies demands extensive training and experience that currently relies heavily on international expertise. Workforce development programs are underway but require time to generate adequate numbers of skilled professionals capable of supporting the expanding thermal management industry, potentially constraining the pace of localization efforts.

Dependence on Imported Components and Raw Materials

In Saudi Arabia, the market currently relies significantly on imported thermal management components, specialized coolants, and raw materials that expose supply chains to international market volatility and logistical disruptions. Critical materials, including copper for heat exchangers, aluminum for cooling plates, and specialized polymers for thermal interface applications, are predominantly sourced from overseas suppliers. This dependence creates vulnerability to supply chain interruptions, currency fluctuations, and extended lead times that can impact production schedules and cost competitiveness for domestic manufacturers.

Competitive Landscape:

The Saudi Arabia EV battery cooling systems market is characterized by a mix of international technology providers, automotive OEMs with integrated thermal management capabilities, and emerging local suppliers developing domestic production capacity. Competition centers on technological differentiation, regional customization for extreme climate conditions, and supply chain integration with local manufacturing initiatives. Key market participants are investing in R&D partnerships with academic institutions and technology centers to advance cooling efficiency and safety features tailored for desert environments, while simultaneously establishing local presence through joint ventures and manufacturing agreements that support the Kingdom's industrial localization objectives.

Recent Developments:

- In November 2025, XCharge Europe and XCharge North America partnered with Electromin, Saudi Arabia's largest EV charging network operator, to deploy sophisticated charging infrastructure featuring GridLink systems with integrated liquid-cooled thermal management technology designed for extreme environmental conditions.

Saudi Arabia EV Battery Cooling Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Cooling Technologies Covered | Air Cooling Systems, Liquid Cooling Systems, Phase Change Material (PCM) Cooling Systems, Refrigerant Cooling Systems |

| Battery Types Covered | Lithium-Ion Batteries, Nickel-Metal Hydride Batteries, Solid-State Batteries, Others |

| Vehicle Types Covered | Passenger Vehicles, Commercial Vehicles, Two-Wheelers, Three-Wheelers |

| Propulsion Types Covered | Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), Hybrid Electric Vehicles (HEVs) |

| End Users Covered | OEMs (Original Equipment Manufacturers), Aftermarket |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia EV battery cooling systems market size was valued at USD 36.2 Million in 2025.

The Saudi Arabia EV battery cooling systems market is expected to grow at a compound annual growth rate of 14.64% from 2026-2034 to reach USD 123.8 Million by 2034.

Liquid cooling systems dominated the market with a share of 42%, driven by their superior heat dissipation capabilities and efficiency in maintaining optimal battery temperatures under extreme regional climate conditions.

Key factors driving the Saudi Arabia EV battery cooling systems market include Vision 2030 electric mobility initiatives, extreme climate conditions necessitating advanced thermal management, and expansion of domestic EV manufacturing capabilities.

Major challenges include high development costs for advanced cooling technologies, limited local technical expertise, dependence on imported components and materials, and the complexity of designing systems optimized for extreme desert environmental conditions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)