Saudi Arabia Event Management Software Market Size, Share, Trends and Forecast by Component, Deployment Type, Organization Size, End User, and Region, 2026-2034

Saudi Arabia Event Management Software Market Overview:

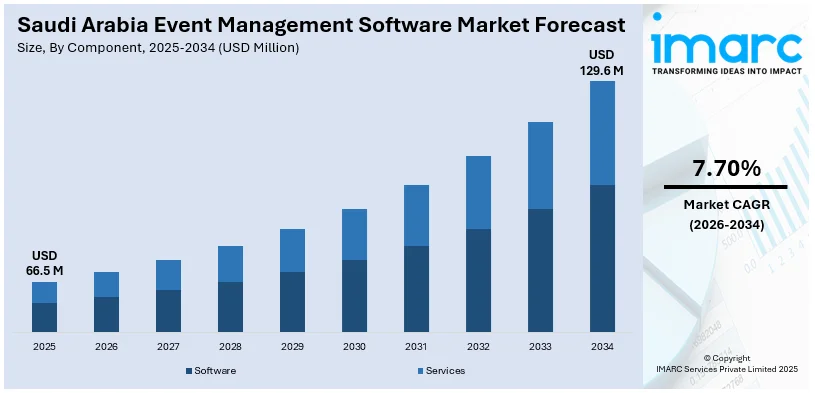

The Saudi Arabia event management software market size reached USD 66.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 129.6 Million by 2034, exhibiting a growth rate (CAGR) of 7.70% during 2026-2034. The growing number for corporate events, along with the increasing focus on collaboration and networking within the expanding event industry, is driving the need for sophisticated event management software to streamline complex logistics, enhance attendee experiences, and facilitate business and international partnerships.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 66.5 Million |

| Market Forecast in 2034 | USD 129.6 Million |

| Market Growth Rate 2026-2034 | 7.70% |

Saudi Arabia Event Management Software Market Trends:

Rising Demand for Corporate and Meetings, Incentives, Conferences, and Exhibitions (MICE) Events

The increasing significance of corporate gatherings, conferences, and meetings, incentives, conferences, and exhibitions (MICE) events in Saudi Arabia is driving the need for event management software. In line with the Saudi Arabia’s Vision 2030 initiative, intended to diversify the economy and enhance business and tourism efforts, corporate events are becoming vital for nurturing business connections, partnerships, and international collaborations. These occurrences are growing more intricate, necessitating sophisticated instruments to handle extensive operations smoothly. Event management software facilitates the optimization of multiple elements, including venue organization, guest monitoring, scheduling, and post-event analysis, guaranteeing efficient execution and positive results. The International MICE Summit (IMS24) was held from December 15–17, 2024, in Riyadh, hosted by the Saudi Conventions & Exhibitions General Authority (SCEGA). The summit brought together over 1,000 global leaders to explore the future of the MICE sector, with Saudi Arabia positioned as the fastest-growing MICE destination in the G20. The event highlighted the country’s Vision 2030 investments in infrastructure and the MICE industry. The magnitude and global involvement of IMS24 demonstrate the rising need for advanced event management tools to manage significant, prominent corporate events, thus propelling the adoption of event management software solutions in Saudi Arabia’s swiftly growing events industry.

To get more information on this market, Request Sample

Collaboration and Networking Opportunities in the Event Industry

The rise in the number of networking opportunities and collaborative efforts within Saudi Arabia’s event industry is leading to the adoption of event management software. As the business and entertainment sectors continue to expand, more events are being organized to facilitate partnerships, networking, and knowledge sharing among industry leaders, businesses, and influencers. Event management software offers vital tools for coordinating these events, featuring matchmaking capabilities, networking areas, and collaborative spaces that enable participants to connect, exchange resources, and participate in significant conversations. This capability to effortlessly blend and promote teamwork via digital solutions is assisting event organizers in drawing elite attendees and crafting significant, unforgettable experiences. In 2023, Comma, a leading Saudi PR and event management agency, signed a strategic partnership agreement with ALTER, a UK-based communications agency. The collaboration aimed to enhance ALTER's operations in Saudi Arabia, supporting events like conferences and sporting events, including the America's Cup in Jeddah. The partnership aligned with Saudi Arabia’s Vision 2030, aiming to strengthen the private sector's role in the economy. With the rise of these collaborations, the need for event management software that handles intricate event logistics and improves networking opportunities also grows, highlighting the significance of these solutions in the evolving event scene of Saudi Arabia.

Saudi Arabia Event Management Software Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on component, deployment type, organization size, and end user.

Component Insights:

- Software

- Venue Management Software

- Ticketing Software

- Event Registration Software

- Event Marketing Software

- Event Planning Software

- Others

- Services

- Professional Services

- Managed Service

The report has provided a detailed breakup and analysis of the market based on the component. This includes software (venue management software, ticketing software, event registration software, event marketing software, event planning software, and others) and services (professional services and managed service).

Deployment Type Insights:

- On-premises

- Cloud

A detailed breakup and analysis of the market based on the deployment type have also been provided in the report. This includes on-premises and cloud.

Organization Size Insights:

- Large Enterprises

- Small and Medium Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes large enterprises and small and medium enterprises.

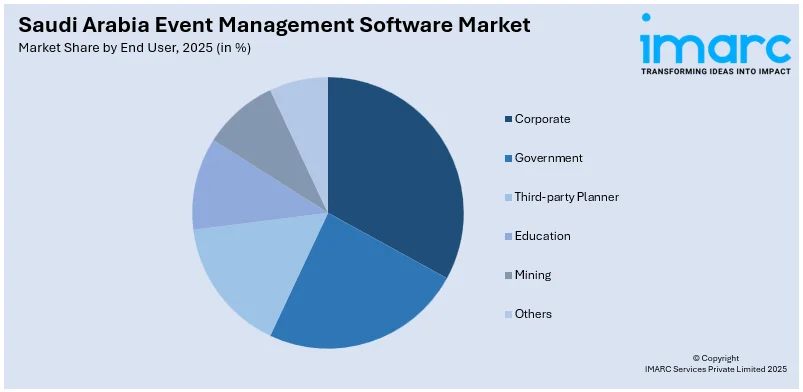

End User Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Corporate

- Government

- Third-party Planner

- Education

- Mining

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes corporate, government, third-party planner, education, mining, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Event Management Software Market News:

- In September 2024, Omniboost revealed a collaboration with Venuesuite at HITEC 2024 to merge their platforms, improving venue management effectiveness. The collaboration with Mews, a top cloud-based PMS, streamlined workflows and enhanced operational efficiency. This partnership sought to enhance revenue potential and optimize hospitality and event management processes.

Saudi Arabia Event Management Software Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Deployment Types Covered | On-premises, Cloud |

| Organization Sizes Covered | Large Enterprises, Small and Medium Enterprises |

| End Users Covered | Corporate, Government, Third-party Planner, Education, Mining, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia event management software market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia event management software market on the basis of component?

- What is the breakup of the Saudi Arabia event management software market on the basis of deployment type?

- What is the breakup of the Saudi Arabia event management software market on the basis of organization size?

- What is the breakup of the Saudi Arabia event management software market on the basis of end user?

- What is the breakup of the Saudi Arabia event management software market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia event management software market?

- What are the key driving factors and challenges in the Saudi Arabia event management software?

- What is the structure of the Saudi Arabia event management software market and who are the key players?

- What is the degree of competition in the Saudi Arabia event management software market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia event management software market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia event management software market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia event management software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)