Saudi Arabia Express Cargo Market Size, Share, Trends and Forecast by Service Type, Mode of Transportation, Cargo Type, Customer Type, End-User Industry, and Region, 2026-2034

Saudi Arabia Express Cargo Market Overview:

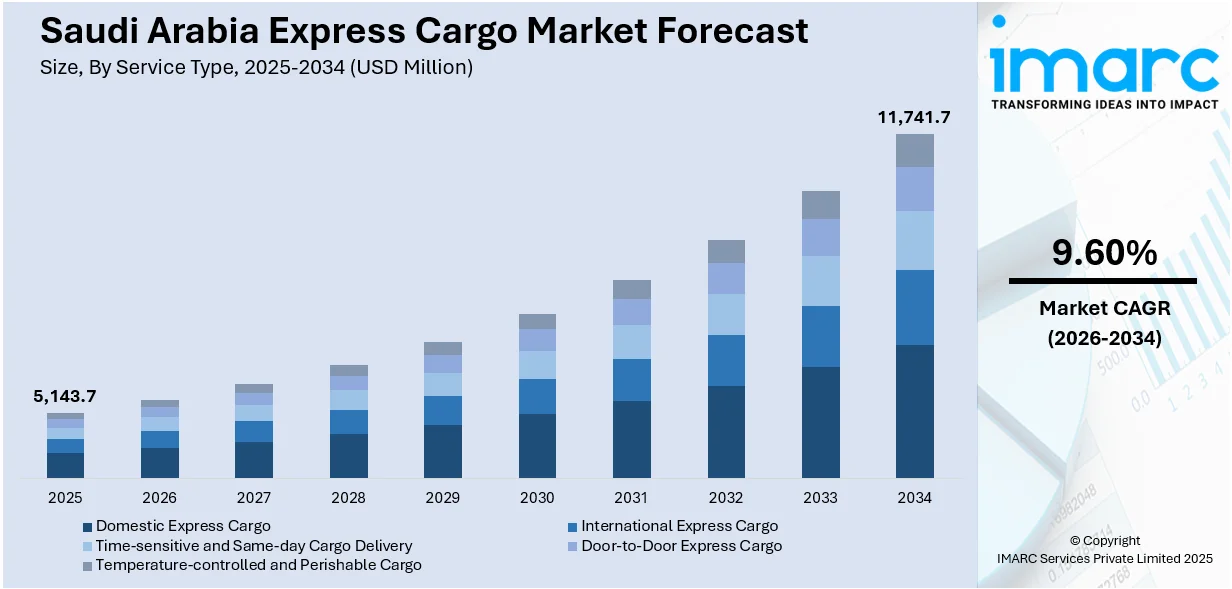

The Saudi Arabia express cargo market size reached USD 5,143.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 11,741.7 Million by 2034, exhibiting a growth rate (CAGR) of 9.60% during 2026-2034. The market is driven by the rapid growth of e-commerce, fueled by high internet penetration, a young demographic, and platforms accelerating demand for fast, last-mile deliveries. Government initiatives under Vision 2030, promoting digital transformation and food security, further stimulate the need for efficient express cargo and cold chain logistics. Additionally, technological advancements, such as AI-driven route optimization and refrigerated transport, enhance operational efficiency, further augmenting the Saudi Arabia express cargo market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 5,143.7 Million |

| Market Forecast in 2034 | USD 11,741.7 Million |

| Market Growth Rate 2026-2034 | 9.60% |

Saudi Arabia Express Cargo Market Trends:

Growth of E-commerce Driving Demand for Express Cargo Services

The rapid expansion of e-commerce in Saudi Arabia is significantly propelling the market. Saudi Arabia's online commerce sector is growing exponentially, with estimates foreseeing it reaching USD 69 Billion in turnover and 34.5 million users by 2025 and thus contributing 12% to the GDP of the Kingdom. Such rapid growth, with 35.44% of goods being imported, indicates enormous opportunities and a growing need for speedy cargo and efficient logistics services to serve the 42,900 online stores and many e-commerce businesses. Though there are 191 shipping suppliers, issues are still seen in logistics infrastructure and same-day delivery, which reflects vital areas of investment in the express cargo industry. With increasing internet penetration and a young, tech-savvy population, online shopping has accelerated, leading to higher demand for fast and reliable delivery services. Major platforms and local retailers are expanding their logistics networks to ensure same-day or next-day deliveries. The government’s Vision 2030 initiative, which promotes digital transformation, further supports this trend by encouraging investments in last-mile delivery solutions. Additionally, the rise of cross-border e-commerce has increased the need for efficient international express cargo services. Companies are adopting advanced technologies such as AI-driven route optimization and automated warehouses to enhance efficiency. As consumer expectations for speed and convenience grow, express cargo providers are expected to invest more in infrastructure and technology to maintain competitiveness in this rapidly changing market.

To get more information on this market Request Sample

Expansion of Cold Chain Logistics for Perishable Goods

The growing demand for cold chain logistics, particularly for perishable goods such as pharmaceuticals, fresh produce, and frozen foods, is supporting the Saudi Arabia express cargo market growth. According to a research report by IMARC Group, the Saudi Arabian cold chain logistics market is forecast to reach USD 14.34 Million by 2033, a robust compound annual growth rate (CAGR) of 19.27% from its 2024 worth of USD 2.94 Million. This impressive growth underscores the increasing demand for temperature-controlled express cargo products, driven by the growing e-commerce sector and increasing usage of temperature-sensitive products such as pharmaceuticals and fresh produce in the Kingdom. This growth presents great opportunities for enhancing express logistics infrastructure and technology in Saudi Arabia. With the government focusing on food security and healthcare improvements under Vision 2030, there is an increasing need for temperature-controlled transportation. The rise of online grocery platforms such as Nana and PandaMart has further accelerated this demand, requiring reliable express delivery of perishable items. To meet these needs, logistics companies are investing in refrigerated trucks, cold storage facilities, and real-time temperature monitoring systems. Additionally, the expansion of Saudi Arabia’s pharmaceutical sector, driven by local manufacturing initiatives, is increasing the demand for specialized medical logistics. As regulations on food and drug safety become stricter, express cargo providers must enhance their cold chain capabilities to ensure compliance and customer satisfaction, making this a high-growth segment in the market.

Saudi Arabia Express Cargo Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on service type, mode of transportation, cargo type, customer type, and end-user industry.

Service Type Insights:

- Domestic Express Cargo

- International Express Cargo

- Time-sensitive and Same-day Cargo Delivery

- Door-to-Door Express Cargo

- Temperature-controlled and Perishable Cargo

The report has provided a detailed breakup and analysis of the market based on the service type. This includes domestic express cargo, international express cargo, time-sensitive and same-day cargo delivery, door-to-door express cargo, and temperature-controlled and perishable cargo.

Mode of Transportation Insights:

- Air Express Cargo

- Road Express Cargo

- Rail Express Cargo

- Sea and Inland Waterways Express Cargo

A detailed breakup and analysis of the market based on the mode of transportation have also been provided in the report. This includes air express cargo, road express cargo, rail express cargo, and sea and inland waterways express cargo.

Cargo Type Insights:

- General Cargo

- High-value and Secured Cargo

- Hazardous Materials (HAZMAT)

- Perishable Goods

- Documents and Parcels

The report has provided a detailed breakup and analysis of the market based on the cargo type. This includes general cargo, high-value and secured cargo, hazardous materials (HAZMAT), perishable goods, and documents and parcels.

Customer Type Insights:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- Individual Consumers

A detailed breakup and analysis of the market based on the customer type have also been provided in the report. This includes small and medium enterprises (SMEs), large enterprises, and individual consumers.

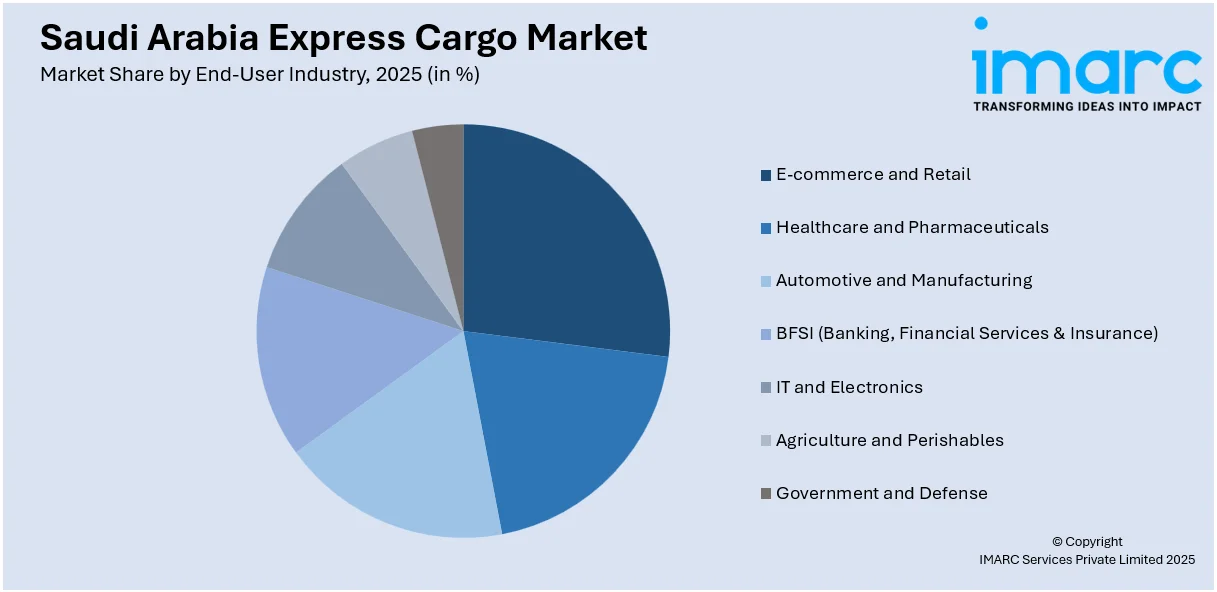

End-User Industry Insights:

Access the comprehensive market breakdown Request Sample

- E-commerce and Retail

- Healthcare and Pharmaceuticals

- Automotive and Manufacturing

- BFSI (Banking, Financial Services & Insurance)

- IT and Electronics

- Agriculture and Perishables

- Government and Defense

The report has provided a detailed breakup and analysis of the market based on the end-user industry. This includes e-commerce and retail, healthcare and pharmaceuticals, automotive and manufacturing, BFSI (banking, financial services and insurance), IT and electronics, agriculture and perishables, government and defense.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Express Cargo Market News:

- April 02, 2025: Emirates launched Emirates Courier Express, a new end-to-end express cargo service with an average delivery time of below 48 hours, which is already available in seven markets, including Saudi Arabia. Emirates Courier Express leverages Emirates' fleet of over 250 widebody aircraft to offer businesses in the Kingdom and globally a new level of speed and reliability in the express delivery market, offering significant benefits to businesses in the Kingdom.

- June 27, 2024: J&T Express launched J&T SPEED in Saudi Arabia, offering upgraded express cargo services with an average delivery time of 58 hours and city-to-city deliveries as fast as 14 hours. This new service, which meets the increasing demand for personal parcel delivery, saw a 30% rise in order volumes in major cities in its first month, upgrading Saudi Arabia's logistics structure in line with Vision 2030.

Saudi Arabia Express Cargo Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Domestic Express Cargo, International Express Cargo, Time-sensitive and Same-day Cargo Delivery, Door-to-Door Express Cargo, Temperature-controlled and Perishable Cargo |

| Modes of Transportation Covered | Air Express Cargo, Road Express Cargo, Rail Express Cargo, Sea and Inland Waterways Express Cargo |

| Cargo Types Covered | General Cargo, High-value and Secured Cargo, Hazardous Materials (HAZMAT), Perishable Goods, Documents and Parcels |

| Customer Types Covered | Small and Medium Enterprises (SMEs), Large Enterprises, Individual Consumers |

| End-User Industries Covered | E-commerce and Retail, Healthcare and Pharmaceuticals, Automotive and Manufacturing, BFSI (Banking, Financial Services & Insurance), IT and Electronics, Agriculture and Perishables, Government and Defense |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia express cargo market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia express cargo market on the basis of service type?

- What is the breakup of the Saudi Arabia express cargo market on the basis of mode of transportation?

- What is the breakup of the Saudi Arabia express cargo market on the basis of cargo type?

- What is the breakup of the Saudi Arabia express cargo market on the basis of customer type?

- What is the breakup of the Saudi Arabia express cargo market on the basis of end-user industry?

- What is the breakup of the Saudi Arabia express cargo market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia express cargo market?

- What are the key driving factors and challenges in the Saudi Arabia express cargo market?

- What is the structure of the Saudi Arabia express cargo market and who are the key players?

- What is the degree of competition in the Saudi Arabia express cargo market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia express cargo market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia express cargo market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia express cargo industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)