Saudi Arabia Extended Warranty Market Size, Share, Trends and Forecast by Coverage, Application, Distribution Channel, End User, and Region, 2026-2034

Saudi Arabia Extended Warranty Market Overview:

The Saudi Arabia extended warranty market size reached USD 1,441.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 2,343.0 Million by 2034, exhibiting a growth rate (CAGR) of 5.54% during 2026-2034. The market share is expanding on account of the escalating demand for consumer electronics and car ownership, rising interest in long-term product ownership expense and risk avoidance, and expansion of the organized retail outlets and the emergence of e-commerce platforms.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,441.7 Million |

| Market Forecast in 2034 | USD 2,343.0 Million |

| Market Growth Rate 2026-2034 | 5.54% |

Saudi Arabia Extended Warranty Market Trends:

Rising Consumer Electronics and Automotive Sales

The increasing demand for consumer electronics and car ownership in Saudi Arabia are playing a major role in driving the demand for extended warranties. As people spend money on high-value products like smartphones, TVs, refrigerators, and personal vehicles, there is a corresponding tendency to safeguard these assets from unforeseen repair expenses after the manufacturer's warranty period. With the fast rate of technological updates and the expense of replacing faulty parts, extended warranties come as a comfort. In the automotive industry, the trend towards premium and technology-savvy cars has further catalyzed the overall demand as repairs for units such as infotainment systems and electric drivetrains are expensive. Moreover, the unforgiving desert weather in most parts of Saudi Arabia hastens wear and tear, leading people to look for extended warranty protection. According to a news article by Arab News, published in 2024, Saudi Arabia imported over 1 million vehicles in the fifteen months to March.

To get more information on this market, Request Sample

Expansion of Organized Retail and E-commerce Channels

Expansion of the organized retail outlets and the emergence of e-commerce platforms are vital for propelling the market growth in Saudi Arabia. Retailers are bundling extended warranty products as value-added services with key electronic appliances, gadgets, and automobiles. Contemporary retail settings like hypermarkets, electronic retail chains, and showroom dealerships promote the warranty products actively at the point of sale, thus enhancing consumer adoption. Correspondingly, e-commerce sites simplified the online warranty purchase process through seamless integration while checking out. This digital facilitation has created ease for internet-savvy people to realize the terms, compare coverage policies, and decide accordingly. Partnerships between retail and third-party warranty sellers also have come with customized and adaptive coverage packages. The IMARC Group states that the Saudi Arabia retail market size is expected to reach USD 408.7 Billion by 2033.

Growing Awareness About Product Lifecycle Costs and Risk Mitigation

A rising consumer interest in long-term product ownership expense and risk avoidance is contributing to the market growth. Purchasers are more informed than ever before on the total cost of ownership (TCO), particularly in categories, such as home appliances and cars, where repairing and maintaining the products may be very high over the long run. As per the data provided by Central Bank in 2024, individuals in Saudi Arabia spent SR247.2 million on electronics, showing 18.3% increase compared to the previous week. As people move away from reactive to preventive measures in dealing with their assets, extended warranties provide a good way of preventing surprise financial outlays. This is particularly the case in an economy such as Saudi Arabia's, where most goods are imported and repair services for branded items tend to be costly and logistically challenging.

Saudi Arabia Extended Warranty Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on coverage, application, distribution channel, and end user.

Coverage Insights:

- Standard Protection Plan

- Accidental Protection Plan

The report has provided a detailed breakup and analysis of the market based on the coverage. This includes standard protection plan and accidental protection plan.

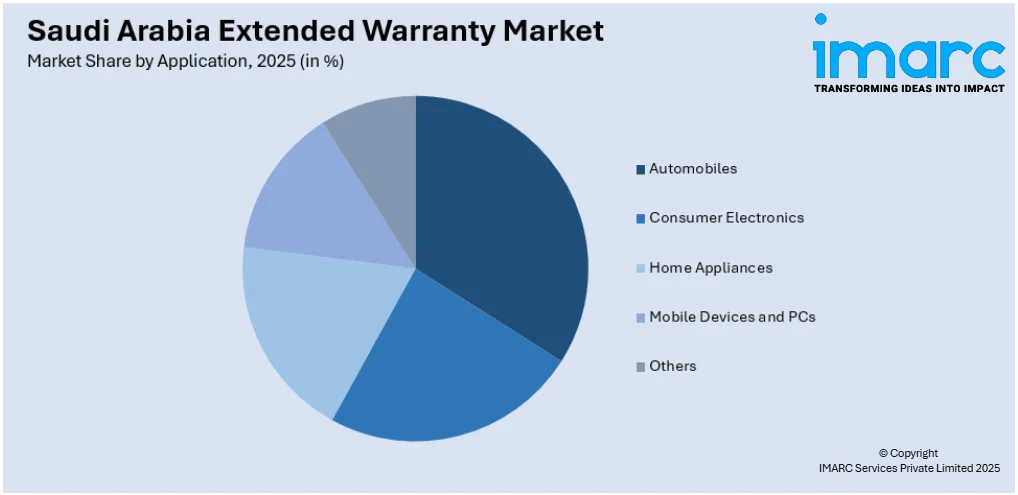

Application Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Automobiles

- Consumer Electronics

- Home Appliances

- Mobile Devices and PCs

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes automobiles, consumer electronics, home appliances, mobile devices and PCs, and others.

Distribution Channel Insights:

- Manufacturers

- Retailers

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes manufacturers, retailers, and others.

End User Insights:

- Individuals

- Business

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes individuals and business.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include northern and central region, western region, eastern region, and southern region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Extended Warranty Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Coverages Covered | Standard Protection Plan, Accidental Protection Plan |

| Applications Covered | Automobiles, Consumer Electronics, Home Appliances, Mobile Devices and PCs, Others |

| Distribution Channels Covered | Manufacturers, Retailers, Others |

| End Users Covered | Individuals, Business |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia extended warranty market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia extended warranty market on the basis of coverage?

- What is the breakup of the Saudi Arabia extended warranty market on the basis of application?

- What is the breakup of the Saudi Arabia extended warranty market on the basis of distribution channel?

- What is the breakup of the Saudi Arabia extended warranty market on the basis of end user?

- What is the breakup of the Saudi Arabia extended warranty market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia extended warranty market?

- What are the key driving factors and challenges in the Saudi Arabia extended warranty?

- What is the structure of the Saudi Arabia extended warranty market and who are the key players?

- What is the degree of competition in the Saudi Arabia extended warranty market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia extended warranty market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia extended warranty market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia extended warranty industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)