Saudi Arabia Eyewear Market Size, Share, Trends and Forecast by Product, Gender, Distribution Channel, and Region, 2026-2034

Saudi Arabia Eyewear Market Summary:

The Saudi Arabia eyewear market size was valued at USD 1.38 Billion in 2025 and is projected to reach USD 2.29 Billion by 2034, growing at a compound annual growth rate of 5.80% from 2026-2034.

The Saudi Arabia eyewear market is experiencing robust expansion, driven by increasing awareness about eye health, evolving fashion preferences, and the integration of digital technologies in retail. Rising screen time among the population has elevated demand for corrective and protective eyewear, while growing urbanization and disposable incomes support premium product adoption. The convergence of functional vision correction with fashion-forward designs continues to reshape consumer expectations across the market share.

Key Takeaways and Insights:

- By Product: Spectacles dominate the market with a share of 47% in 2025, owing to increasing prevalence of refractive errors among the population, rising demand for corrective vision solutions, and growing preferences for fashionable prescription frames.

- By Gender: Women lead the market with a share of 43% in 2025. This dominance is driven by increasing fashion consciousness, rising female workforce participation, and growing preference for designer eyewear as a style statement.

- By Distribution Channel: Optical stores represent the largest segment with a market share of 39% in 2025, reflecting consumer preferences for professional eye examinations, personalized fitting services, and access to comprehensive product ranges under expert guidance.

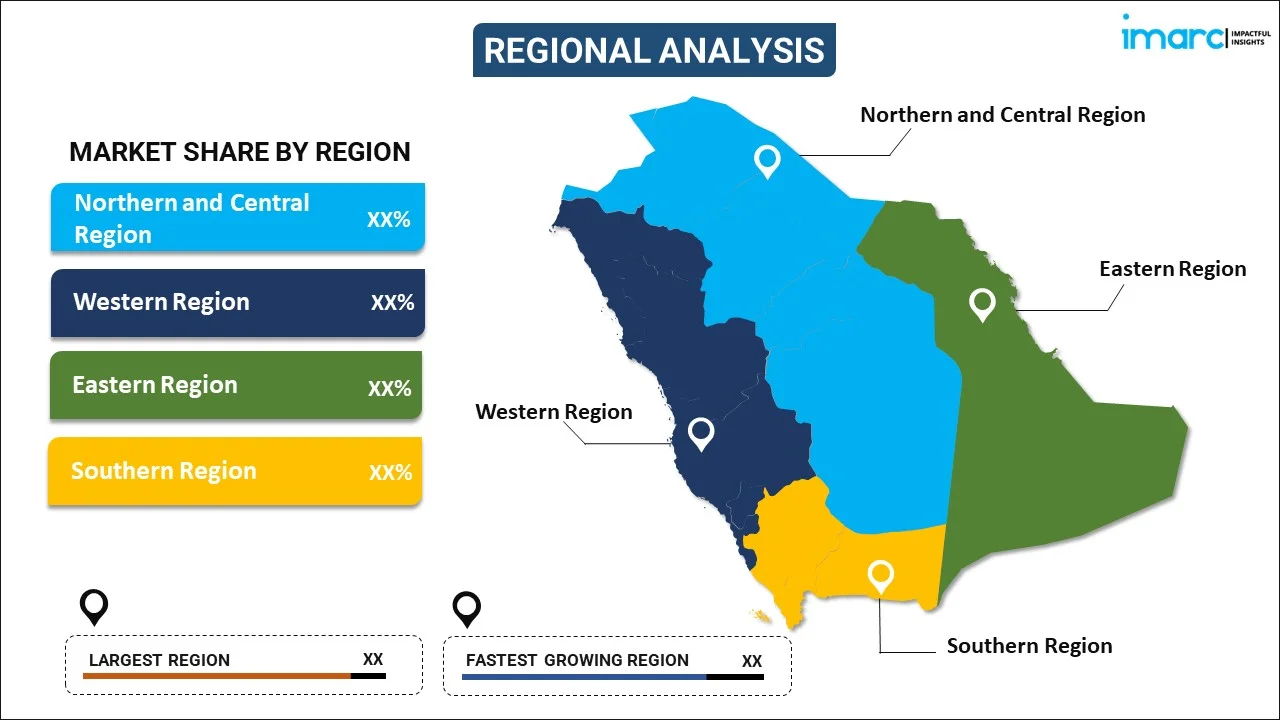

- By Region: Northern and Central Region comprises the largest region with 31% share in 2025, driven by concentration of population in Riyadh metropolitan area, higher purchasing power, and extensive presence of retail infrastructure and optical chains.

- Key Players: Key players drive the Saudi Arabia eyewear market by expanding retail networks, introducing innovative lens technologies, and strengthening partnerships with international brands. Their investments in e-commerce platforms, virtual try-on technologies, and customer experience enhancement accelerate market penetration across diverse consumer segments.

The Saudi Arabia eyewear market demonstrates remarkable transformation as consumers increasingly perceive eyewear as both functional necessity and fashion accessory. The Kingdom's young, digitally connected population actively engages with social media platforms that influence purchasing decisions, particularly for premium and designer eyewear. Government healthcare initiatives under Vision 2030 have enhanced awareness about preventive eye care, driving regular ophthalmological consultations and prescription eyewear adoption. According to General Authority for Statistics (GASTAT), 20.5% of Saudi consumers, aged 15 years and above, utilized internet platforms for health-related information, reflecting digital channels' influence on eyewear purchasing behavior. International eyewear brands continue to expand their presence through strategic partnerships with established local retailers, creating diversified product portfolios spanning luxury, premium, and mass-market categories. The integration of advanced technologies, such as virtual try-on capabilities and blue-light filtering lenses, addresses evolving consumer requirements while supporting healthy lifestyle choices.

Saudi Arabia Eyewear Market Trends:

Rising Fashion Consciousness and Designer Eyewear Adoption

Saudi Arabian consumers increasingly perceive eyewear as essential fashion accessories that complement personal style statements. Younger generations, particularly women, actively seek branded and designer frames that reflect contemporary fashion sensibilities. Social media platforms and influencer endorsements significantly shape purchasing preferences, transforming eyewear from purely functional items into aspirational lifestyle products. Luxury brands are capitalizing on this cultural shift by introducing high-end, fashion-forward designs tailored to regional aesthetic preferences.

Digital Transformation and E-commerce Expansion

The eyewear retail landscape is undergoing significant digital transformation with e-commerce platforms gaining substantial traction among Saudi consumers. As per IMARC Group, the Saudi Arabia e-commerce market size reached USD 222.9 Billion in 2024 and is projected to reach USD 708.7 Billion by 2033. Online eyewear shopping offers convenience, competitive pricing, virtual try-on capabilities, and extensive product variety that traditional retail cannot match. Major market players are investing heavily in omnichannel strategies that integrate physical stores with robust digital platforms.

Growing Demand for Blue-Light Blocking Eyewear

Increasing digital screen exposure has elevated consumer awareness about eye strain and related health concerns, driving demand for protective eyewear solutions. Blue-light filtering lenses have gained popularity among students, professionals, and individuals who spend extended hours using electronic devices. Healthcare campaigns promoting preventive eye care further reinforce consumer interest in protective eyewear options. Saudi Arabia's population spends considerable time on the internet, with digital engagement driving awareness about screen-related eye health. According to the ‘Saudi Internet 2024’ report released by the Communications, Space, and Technology Commission, about 48.6% of internet users in Saudi Arabia utilized the internet for seven hours or more daily.

How Vision 2030 is Transforming the Saudi Arabia Eyewear Market:

Vision 2030 is transforming the Saudi Arabia eyewear market by reshaping consumer behavior, healthcare priorities, and retail structures. Rising disposable incomes and lifestyle upgrades are increasing spending on fashion-oriented and premium eyewear products. The program’s strong focus on healthcare modernization is expanding eye-care services, screenings, and optical clinics, boosting demand for prescription glasses and contact lenses. Vision 2030 also supports localization and private sector participation, encouraging international eyewear brands to enter through joint ventures and organized retail formats. Growth of malls, e-commerce platforms, and digital payments is improving product accessibility across urban and semi-urban areas. In addition, awareness campaigns around vision health, workplace safety, and road safety are driving preventive eyewear adoption.

Market Outlook 2026-2034:

The Saudi Arabia eyewear market outlook remains positive with sustained growth anticipated across all product categories and distribution channels throughout the forecast period. Favorable demographic trends including young population structure, increasing urbanization, and rising disposable incomes continue to support market expansion. The market generated a revenue of USD 1.38 Billion in 2025 and is projected to reach a revenue of USD 2.29 Billion by 2034, growing at a compound annual growth rate of 5.80% from 2026-2034. Government healthcare initiatives under Vision 2030 emphasizing preventive care and eye health awareness are expected to sustain prescription eyewear demand. Technological advancements in lens manufacturing and increasing availability of premium products through expanded retail networks will further strengthen market growth trajectory.

Saudi Arabia Eyewear Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product |

Spectacles |

47% |

|

Gender |

Women |

43% |

|

Distribution Channel |

Optical Stores |

39% |

|

Region |

Northern and Central Region |

31% |

Product Insights:

To get Detailed anlysis of this market, Request Sample

- Spectacles

- Sunglasses

- Contact Lenses

Spectacles dominate with a market share of 47% of the total Saudi Arabia eyewear market in 2025.

The spectacles segment maintains commanding market presence, driven by high prevalence of refractive errors among the Saudi population. Myopia, astigmatism, and hyperopia affect substantial portions of the population, creating consistent demand for corrective eyewear solutions. Research conducted in Saudi Arabia revealed that in 2023, myopia accounted for 69.2% of diagnosed vision problems, making it the most common refractive error requiring prescription spectacles. Increasing screen time exposure and changing lifestyle patterns contribute to rising vision correction requirements across all age demographics.

Fashion trends have transformed spectacles from purely functional items into style statements that reflect personal aesthetics and social identity. Consumers increasingly seek premium frames that combine optical precision with contemporary designs, driving growth in both prescription and non-prescription segments. The proliferation of retail outlets and online platforms has expanded product accessibility while enhancing consumer choice across diverse price points. Additionally, growing awareness about regular eye checkups and vision care, supported by broadening optical clinics and healthcare initiatives, is further reinforcing sustained demand for spectacles across the Kingdom.

Gender Insights:

- Men

- Women

- Unisex

Women lead with a share of 43% of the total Saudi Arabia eyewear market in 2025.

Saudi Arabian women increasingly perceive eyewear as essential fashion accessories that complement personal style and professional appearance. Growing female workforce participation has elevated demand for functional yet fashionable eyewear solutions suitable for workplace environments. The percentage of female labor force participation in Saudi Arabia was recorded at 19.66% in 2024, as per the World Bank's development indicators database. Social trends, influencer endorsements, and cultural emphasis on personal presentation amplify demand for designer frames and luxury sunglasses. Seasonal collections and limited-edition launches further stimulate repeat purchases among style-conscious female consumers.

Urban centers, including Riyadh and Jeddah, serve as primary markets where women's preferences for luxury and fashion-oriented eyewear significantly influence retail strategies. Optical stores respond to this demand by providing exclusive collections, personalized styling services, and curated brand selections targeting female consumers. Rising disposable incomes and changing lifestyle patterns continue supporting premium product adoption among female consumer segments. Omnichannel retail experiences and digital try-on tools are also enhancing engagement and purchase confidence.

Distribution Channel Insights:

- Optical Stores

- Independent Brand Showrooms

- Online Stores

- Retail Stores

Optical stores exhibit a clear dominance with a 39% share of the total Saudi Arabia eyewear market in 2025.

Optical stores maintain market leadership by providing comprehensive services, including professional eye examinations, personalized consultations, and precise fitting services that online channels cannot replicate. These establishments serve diverse customer segments, ranging from economy-conscious consumers to premium clientele seeking luxury products. The combination of medical expertise with retail convenience creates compelling value propositions for consumers. Strategic locations in premium malls, commercial centers, and airports ensure accessibility while maintaining brand prestige and customer experience standards.

Optical stores increasingly integrate digital technologies, including online appointment booking, digital catalogues, and customer loyalty programs, to enhance service delivery. In November 2024, eyewa, Riyadh-based eyewear retailer, secured USD 100 Million in Series C funding to strengthen its position as regional leader and fuel innovations, demonstrating strong investor confidence in the retail eyewear sector. Physical retail remains essential for prescription verification and professional fitting services that ensure optimal product performance.

Regional Insights:

To get Detailed anlysis of this market, Request Sample

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region represents the leading segment with a 31% share of the total Saudi Arabia eyewear market in 2025.

Northern and Central Region maintains market leadership due to concentration of Saudi Arabia's population in Riyadh metropolitan area, which serves as the Kingdom's administrative and commercial hub. Higher disposable incomes, extensive retail infrastructure, and presence of major optical chains create favorable conditions for eyewear market development. Premium shopping destinations and luxury malls provide ideal platforms for international eyewear brands targeting affluent consumers. High urbanization levels and fashion-conscious consumer behavior also contribute to higher eyewear spending and faster adoption of new styles in the region.

Advanced healthcare infrastructure, including specialized eye hospitals and vision care centers, supports prescription eyewear demand through regular eye examinations and vision screening programs. In May 2024, Lenskart opened its store at Riyadh Gallery Mall, marking the brand's 24th store in the GCC region, reflecting the region's strategic importance for eyewear retail expansion. The concentration of educational institutions and corporate offices generates sustained demand for corrective and protective eyewear solutions.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Eyewear Market Growing?

Rising Prevalence of Vision Disorders and Eye Health Awareness

Saudi Arabia is experiencing increasing incidence of vision-related health conditions, including myopia, astigmatism, and hyperopia, primarily driven by extended screen time and changing lifestyle patterns. Government healthcare initiatives and medical awareness campaigns promoting regular eye examinations have significantly enhanced demand for prescription eyewear across all demographic segments. The aging population further contributes to rising presbyopia prevalence, creating sustained demand for reading glasses and multifocal lenses. Healthcare transformation under Vision 2030 emphasizes preventive care measures that encourage proactive vision correction, with the Seha Virtual Hospital performing over 1.6 Million teleconsultations as of February 2025. Better health coverage and easy access to eye care services have continued to increase the addressable market for corrective eyewear products. Further, emerging joint ventures between optical stores and healthcare providers are enhancing early detection and promoting the uptake of corrective eyewear products through eye care services.

Growing Fashion Consciousness and Lifestyle Changes

The shift in the use of eyewear from a practical requirement to a fashion item is a paradigm shift in the perception of consumers. Younger consumers are demanding fashion-forward, branded optical wear that symbolizes identity and social standing, thereby driving the market for high-end, designer products. Social media platforms and influencer marketing significantly impact purchasing decisions, particularly among fashion-conscious consumers who view eyewear as integral to personal style expression. The cultural emphasis on personal appearance and brand recognition in Saudi society amplifies effectiveness of marketing initiatives targeting aspirational consumers. International luxury brands are capitalizing on this trend by introducing fashion-forward designs tailored to regional aesthetic preferences, expanding their presence through strategic retail partnerships. Rising female workforce participation and increasing emphasis on professional appearance further accelerate demand for sophisticated eyewear solutions that combine functionality with contemporary design sensibilities.

Expanding Retail Infrastructure and E-commerce Development

Rapid expansion of retail infrastructure, including shopping malls, specialty optical outlets, and brand showrooms, has significantly enhanced product accessibility across the Kingdom. In January 2024, Lenskart opened its largest flagship store in the Middle East at Park Avenue Mall, Riyadh, offering comprehensive eyewear products. Strategic partnerships between international eyewear manufacturers and established local retailers create diverse product portfolios spanning luxury, premium, and mass-market categories. The e-commerce ecosystem continues to evolve with enhanced payment solutions and improved logistics networks that support seamless online purchasing experiences. Saudi Arabia's expanding digital economy reflects the population's active engagement with online platforms for fashion and health product purchases. Virtual try-on technologies, competitive pricing, and convenient home delivery options are making online eyewear shopping increasingly attractive to tech-savvy consumers. The integration of omnichannel strategies by major market players ensures consistent customer experiences across physical and digital touchpoints, driving overall market expansion and consumer engagement.

Market Restraints:

High Price Sensitivity and Competitive Pressures

The Saudi Arabia eyewear market faces intense competition from local optical outlets, international brands, and online retailers, which creates pricing pressures affecting profitability. While premium consumers prioritize brand and quality, a significant consumer segment remains highly price-conscious and gravitates towards affordable alternatives. Widespread promotional activities and frequent discounting by competitors erode profit margins, challenging brands to maintain sustainable pricing strategies without compromising product quality or service standards.

Counterfeit Products and Quality Concerns

The proliferation of counterfeit eyewear products poses significant challenges to legitimate market participants and consumer confidence. Low-quality imitation products undermine brand integrity while potentially compromising consumer eye health through substandard optical properties. Market participants must invest in authentication measures, consumer education, and regulatory compliance to protect brand reputation and maintain product quality standards across distribution channels.

Fragmented Market Structure and Regulatory Complexity

The market remains highly fragmented with numerous independent opticians competing against established optical chains, complicating brand building and standardization efforts. Navigating regulatory requirements, including import regulations, professional licensing, and health certifications presents challenges for new market entrants and international brands. Regional disparities in healthcare infrastructure and consumer access further complicate market penetration strategies beyond major urban centers.

Competitive Landscape:

The Saudi Arabia eyewear market exhibits a dynamic competitive landscape, characterized by presence of established international brands, regional retail chains, and emerging omnichannel players. Market leaders differentiate through extensive retail networks, premium brand portfolios, and comprehensive service offerings that combine medical expertise with retail excellence. Strategic partnerships between global eyewear manufacturers and regional retailers are reshaping market dynamics while expanding product accessibility. Industry consolidation through mergers and acquisitions is creating larger, more integrated entities capable of delivering enhanced customer experiences across physical and digital channels.

Saudi Arabia Eyewear Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Spectacles, Sunglasses, Contact Lenses |

| Genders Covered | Men, Women, Unisex |

| Distribution Channels Covered | Optical Stores, Independent Brand Showrooms, Online Stores, Retail Stores |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia eyewear market size was valued at USD 1.38 Billion in 2025.

The Saudi Arabia eyewear market is expected to grow at a compound annual growth rate of 5.80% from 2026-2034 to reach USD 2.29 Billion by 2034.

Spectacles dominated the market with a share of 47%, driven by rising prevalence of refractive errors, increasing screen time exposure, and growing demand for fashionable prescription frames.

Key factors driving the Saudi Arabia eyewear market include rising eye health awareness, increasing fashion consciousness among consumers, expanding retail and e-commerce infrastructure, and growing prevalence of vision disorders.

Major challenges include high price sensitivity among consumers, intense competitive pressures, proliferation of counterfeit products, fragmented market structure, and regulatory complexity affecting import and licensing requirements.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)