Saudi Arabia Facial Recognition Market Size, Share, Trends and Forecast by Component, Technology, Application, End Use Industry, and Region, 2026-2034

Saudi Arabia Facial Recognition Market Overview:

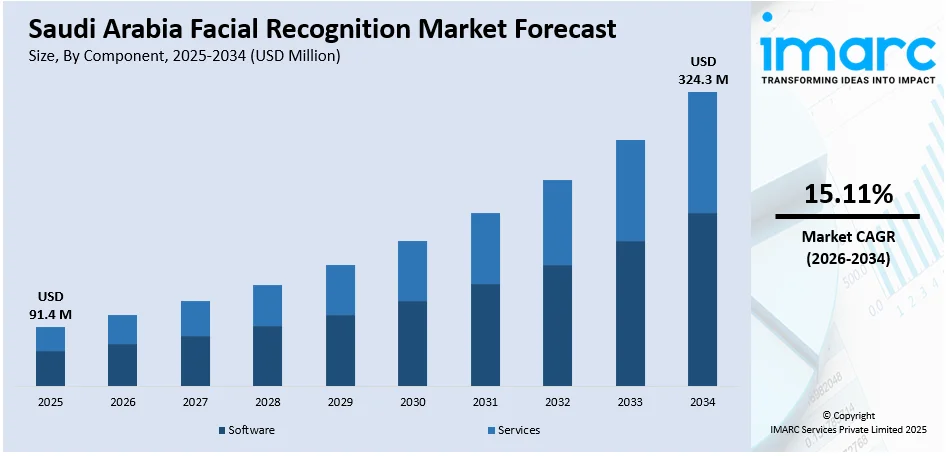

The Saudi Arabia facial recognition market size reached USD 91.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 324.3 Million by 2034, exhibiting a growth rate (CAGR) of 15.11% during 2026-2034. The market is witnessing robust growth, driven by rising demand for advanced security solutions across public, commercial, and government sectors. Increased adoption in surveillance, border control, and smart city projects is also fueling the technology's integration. Technological advancements, along with supportive government initiatives for digital transformation, are further enhancing the Saudi Arabia facial recognition market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 91.4 Million |

| Market Forecast in 2034 | USD 324.3 Million |

| Market Growth Rate 2026-2034 | 15.11% |

Saudi Arabia Facial Recognition Market Trends:

AI-Powered Accuracy Improvements

Improvements in artificial intelligence and deep learning technologies are playing a major role in boosting the performance of Saudi Arabia's facial recognition systems. The enhancements have improved processing speed and accuracy in detecting individuals under different environments and conditions. Advanced facial recognition software is now able to examine fine facial details, take into consideration the effects of aging, and even identify partially occluded or masked faces features that are highly beneficial in real-world security and surveillance use. For instance, in February 2024, Saudi Arabia announced the launch of its first AI-powered electric security vehicle at the World Defense Show, developed with Lucid Motors. Equipped with facial recognition and six cameras, the vehicle enhances security by monitoring violations and communicating with command centers. It also features a drone for capturing crucial footage at crime scenes. Deep learning models improve constantly by being exposed to large sets of data, which enables systems to learn and become better over time. This is particularly significant in industries such as law enforcement, airports, and government agencies, where accuracy matters. Their higher reliability and performance are prompting broad adoption, making facial recognition a reliable and scalable offering that supports Saudi Arabia's wider digital transformation and public safety agendas.

To get more information on this market Request Sample

Integration with Smart City Projects

Facial recognition technology is becoming a fundamental part of Saudi Arabia’s smart city initiatives, particularly under the Vision 2030 framework aimed at modernizing urban infrastructure. Projects like NEOM and other planned urban developments are leveraging facial recognition for enhanced security, traffic management, and efficient public services. The technology enables seamless identification and verification in public spaces, reducing the need for physical IDs and increasing the speed of access control. In transportation hubs, residential complexes, and commercial centers, facial recognition is being deployed to monitor crowd movement, detect suspicious activity, and streamline daily operations. The government’s focus on building data-driven, AI-integrated cities has made facial recognition a priority in its urban planning efforts. This large-scale adoption is playing a significant role in Saudi Arabia facial recognition market growth, positioning the technology as a key enabler of secure and intelligent city environments.

Growing Demand in Banking and Financial Services

Facial recognition technology is picking up in Saudi Arabia's banking and financial services sector as institutions seek secure, efficient, and convenient authentication processes. Banks are using facial recognition for remote onboarding, where customers are opening accounts remotely with the use of biometric authentication. This minimizes the reliance on physical documentation and minimizes identity theft. The technology is also being implemented in ATMs and mobile banking applications to verify users, adding an extra layer of security against unauthorized use. With more cases of cyber fraud and financial scams, facial recognition provides a trusted means of real-time identity verification, particularly in high-value transactions. Moreover, regulatory support for enhanced Know Your Customer (KYC) compliance is compelling banks to implement biometric solutions. These innovations enable quicker, more secure, and more convenient customer experiences, leading to the increased use of biometrics and facial recognition market growth in Saudi Arabia's financial sector.

Saudi Arabia Facial Recognition Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on component, technology, application, and end use industry.

Component Insights:

- Software

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes software and services.

Technology Insights:

- 2D Facial Recognition

- 3D Facial Recognition

- Facial Analytics

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes 2D facial recognition, 3D facial recognition, and facial analytics.

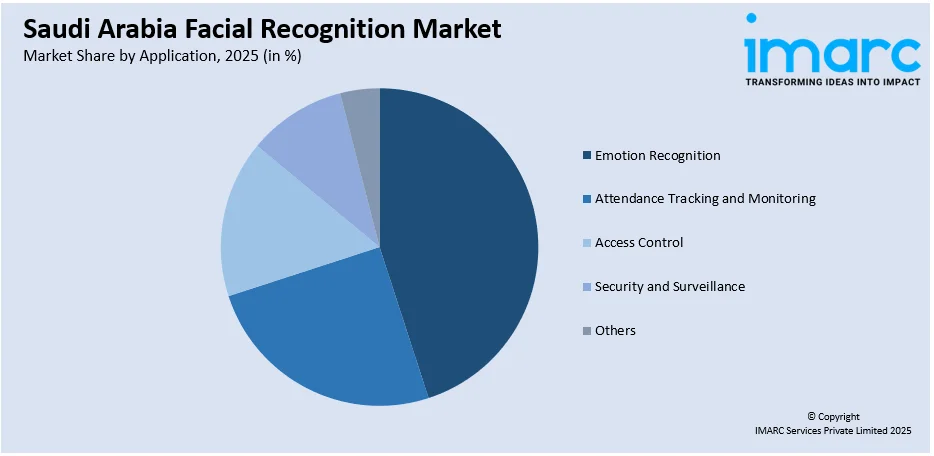

Application Insights:

Access the comprehensive market breakdown Request Sample

- Emotion Recognition

- Attendance Tracking and Monitoring

- Access Control

- Security and Surveillance

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes emotion recognition, attendance tracking and monitoring, access control, security and surveillance, and others.

End Use Industry Insights:

- Retail and E-commerce

- BFSI

- Government and Defense

- Automotive and Transportation

- Media and Entertainment

- Healthcare

- Telecom and IT

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes retail and e-commerce, BFSI, government and defense, automotive and transportation, media and entertainment, healthcare, telecom and IT, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Facial Recognition Market News:

- In April 2025, Saudi Arabia announced its plans to trial new air travel procedures that will allow passengers to use facial recognition and digital travel credentials, eliminating the need for traditional boarding passes. A new feature called the "journey pass" will provide real-time flight updates. While this initiative promises greater efficiency, there are concerns about over-reliance on technology, especially in light of past airport failures.

- In February 2023, Riyadh Airports Company successfully trialed Smart Path, a facial recognition technology, at King Khalid International Airport. This system enhances passenger identification by linking facial images to travel documents, streamlining check-in and boarding. The initiative aims to transform KKIA into a smart airport, improving travel experiences and operational efficiency.

Saudi Arabia Facial Recognition Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Software, Services |

| Technologies Covered | 2D Facial Recognition, 3D Facial Recognition, Facial Analytics |

| Applications Covered | Emotion Recognition, Attendance Tracking and Monitoring, Access Control, Security and Surveillance, Others |

| End Use Industries Covered | Retail and E-commerce, BFSI, Government and Defense, Automotive and Transportation, Media and Entertainment, Healthcare, Telecom and IT, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia facial recognition market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia facial recognition market on the basis of component?

- What is the breakup of the Saudi Arabia facial recognition market on the basis of technology?

- What is the breakup of the Saudi Arabia facial recognition market on the basis of application?

- What is the breakup of the Saudi Arabia facial recognition market on the basis of end use industry?

- What is the breakup of the Saudi Arabia facial recognition market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia facial recognition market?

- What are the key driving factors and challenges in the Saudi Arabia facial recognition market?

- What is the structure of the Saudi Arabia facial recognition market and who are the key players?

- What is the degree of competition in the Saudi Arabia facial recognition market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia facial recognition market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia facial recognition market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia facial recognition industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)