Saudi Arabia Family Offices Market Size, Share, Trends and Forecast by Type, Office Type, Asset Class, Service Type, and Region, 2026-2034

Saudi Arabia Family Offices Market Overview:

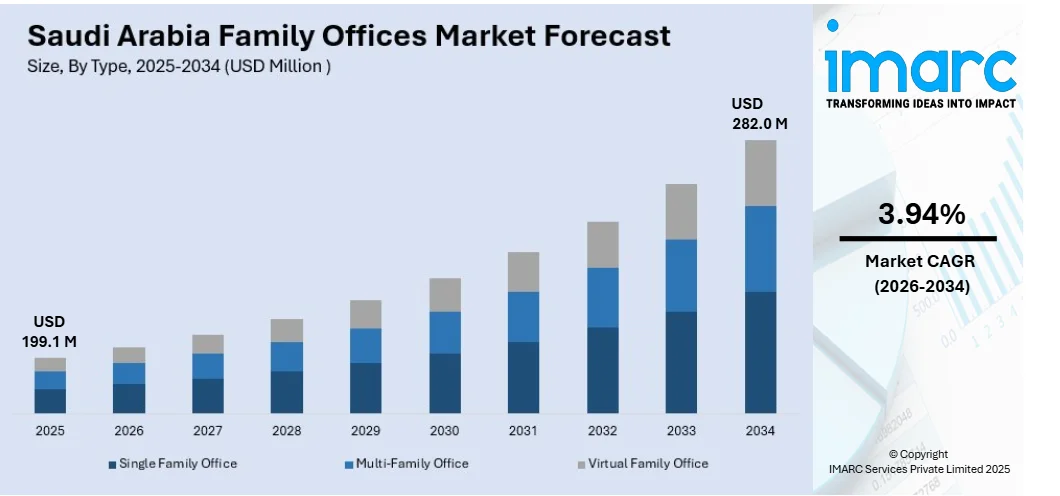

The Saudi Arabia family offices market size reached USD 199.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 282.0 Million by 2034, exhibiting a growth rate (CAGR) of 3.94% during 2026-2034. Rising ultra-high-net-worth individuals, economic diversification, intergenerational wealth transfer, increasing demand for professional wealth management, regulatory reforms, growing interest in alternative investments, and expanding regional and global investment opportunities through institutionalized family structures are some of the factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 199.1 Million |

| Market Forecast in 2034 | USD 282.0 Million |

| Market Growth Rate 2026-2034 | 3.94% |

Saudi Arabia Family Offices Market Trends:

Rise of Venture Capital and Private Equity Investments

Family offices in Saudi Arabia are investing in venture capital and private equity to access high-growth opportunities. As per the IMARC Group, the Saudi Arabia venture capital investment market size reached USD 3.1 Billion in 2024. With the Kingdom encouraging innovations, startups in fintech, e-commerce, and technology are flourishing, attracting family office participation. These investment vehicles allow families to diversify beyond traditional assets and gain exposure to entrepreneurial ecosystems. Family offices also play an active role in supporting local innovation, contributing to job creation and economic diversification. The flexibility and long-term focus of family offices make them ideal investors in illiquid and alternative assets. As the appetite for higher returns is growing, family offices are becoming central players in venture capital and private equity deals, strengthening their position as influential actors in Saudi Arabia’s investment landscape.

To get more information on this market, Request Sample

Increasing Role of Women in Wealth Management

Changing social and economic dynamics in Saudi Arabia, supported by Vision 2030 reforms, are encouraging greater participation of women in business and wealth management. As per industry reports, in 2024, 23.2% of women in Saudi Arabia engaged in startup activities, positioning the Kingdom among the leading global rankings. Women from wealthy families are playing more active roles in decision-making, requiring inclusive governance structures within family offices. This shift is reshaping investment strategies, with more focus on sectors, such as healthcare, education, sustainability, and technology, which align with broader societal goals. Family offices are adapting by providing platforms for women to engage in leadership roles, philanthropy, and strategic planning. This inclusion enhances diversity in perspectives and strengthens decision-making processes. As women continue to take stronger positions in wealth management, family offices are becoming key enablers of gender-inclusive growth in Saudi Arabia’s financial landscape.

Vision 2030 and Economic Diversification

Saudi Arabia’s Vision 2030 strategy is driving private investments in non-oil sectors, such as renewable energy, healthcare, technology, and tourism, creating fertile ground for family offices. According to the report from Saudi Arabia’s National Industrial Development and Logistics Program, non-oil activities contributed 55% to the overall GDP, with the manufacturing sector expanding by 4%, while both the mining and transport/storage sectors grew by 5%. Wealthy families are looking to diversify their portfolios away from oil-dependent assets and seize opportunities in emerging industries. Family offices play a vital role by identifying, managing, and investing in these new areas. With government incentives, partnerships, and mega-projects like NEOM, investment opportunities have broadened significantly. This diversification requires expert financial management, which family offices are uniquely positioned to provide.

Key Growth Drivers of Saudi Arabia Family Offices Market:

Generational Wealth Transfer

The growing transfer of wealth between generations is a key driver of market growth. As older generations pass on large assets to younger heirs, families seek structured financial planning to preserve wealth and ensure smooth succession. Family offices help manage these transitions with strategies for inheritance, governance, and estate distribution. With significant portions of family-owned businesses preparing for leadership changes, professionalized management through family offices ensures continuity. Younger heirs are also keen on diversifying investments into global equities, technology, and sustainable assets, which requires specialized advisory. This generational shift is driving sustained demand for family offices that provide not only financial services but also conflict resolution, tax planning, and wealth preservation strategies, making them crucial for Saudi Arabia’s evolving economy.

Growing Need for Governance and Professionalization

As family wealth and businesses are growing more complex, there is a rising need for structured governance, transparency, and professional management. Family offices address these requirements by creating clear frameworks for decision-making, succession, and conflict resolution. They provide mechanisms to manage differing priorities among family members and ensure long-term alignment of interests. In Saudi Arabia, where family-owned conglomerates dominate the private sector, this shift toward formalized governance is particularly important. The professionalization of wealth management through family offices reduces risks of mismanagement, while also ensuring compliance with regulatory standards. This trend reflects a broader movement towards institutionalized structures in managing family wealth, highlighting why family offices are becoming indispensable in the Kingdom’s business and financial ecosystem.

Regulatory Reforms and Financial Hub Development

Saudi Arabia’s efforts to strengthen its financial sector through reforms and the development of hubs like Riyadh are propelling the family offices market growth. The government is creating more favorable conditions for private investment, tax efficiency, and wealth management services, making it easier to establish family offices. New regulations are also encouraging transparency, governance, and compliance, building trust in structured wealth management. The Kingdom’s ambition to position itself as a regional financial hub is attracting international advisory firms, partnerships, and service providers that further support family office growth. These reforms reduce operational challenges and provide families with access to world-class financial infrastructure. As a result, family offices are emerging as a cornerstone of Saudi Arabia’s wealth management and investment ecosystem.

Saudi Arabia Family Offices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on type, office type, asset class, and service type.

Type Insights:

- Single Family Office

- Multi-Family Office

- Virtual Family Office

The report has provided a detailed breakup and analysis of the market based on the type. This includes single family office, multi-family office, and virtual family office.

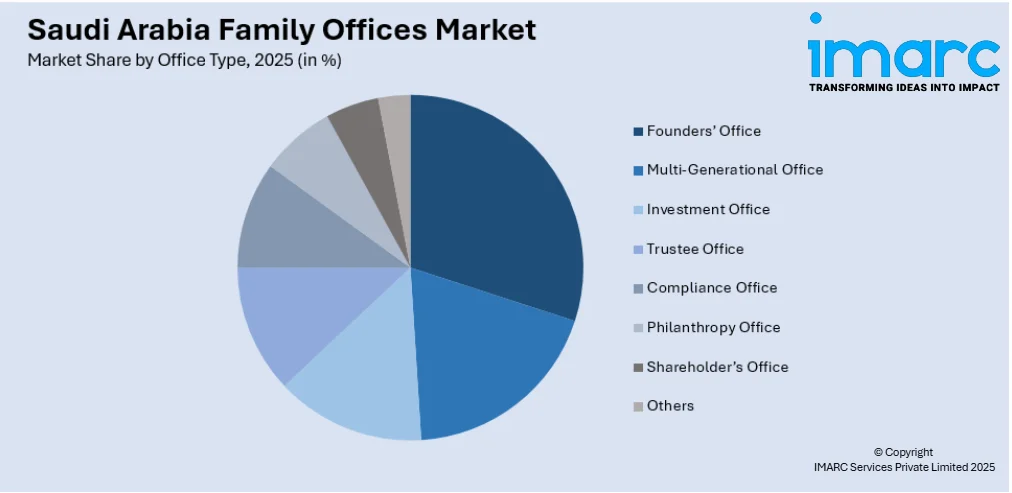

Office Type Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Founders’ Office

- Multi-Generational Office

- Investment Office

- Trustee Office

- Compliance Office

- Philanthropy Office

- Shareholder’s Office

- Others

A detailed breakup and analysis of the market based on the office type have also been provided in the report. This includes founders’ office, multi-generational office, investment office, trustee office, compliance office, philanthropy office, shareholder’s office, and others.

Asset Class Insights:

- Bonds

- Equities

- Alternative Investments

- Commodities

- Cash or Cash Equivalents

The report has provided a detailed breakup and analysis of the market based on the asset class. This includes bonds, equities, alternative investments, commodities, and cash or cash equivalents.

Service Type Insights:

- Financial Planning

- Strategy

- Governance

- Advisory

- Others

A detailed breakup and analysis of the market based on the service type have also been provided in the report. This includes financial planning, strategy, governance, advisory, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include the Northern and Central region, Western region, Eastern region, and Southern region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Family Offices Market News:

- July 2025: Eton Solutions collaborated with Asas Capital to introduce the first Family Office as a Service platform in the Middle East. This innovative solution unified high-standard governance, oversight, and comprehensive wealth management solutions with personalized advisory services. Asas Capital strived to transform family office services in Saudi Arabia, which was among the world's rapidly expanding private wealth markets.

- May 2025: Ray Dalio, the founder of Bridgewater Associates, intended to establish a new family office in Riyadh, Saudi Arabia. This office would represent a significant advancement in Saudi Arabia's initiatives to transform into a global financial center as part of its Vision 2030 initiative.

- December 2024: The Alnahdi Family Office achieved the top spot among small companies to work for in Saudi Arabia in the 2024 Best Places to Work certification program. This acknowledgment signified the organization's dedication to fostering a workplace environment centered on excellence, innovation, and employee welfare.

Saudi Arabia Family Offices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Single Family Office, Multi-Family Office, Virtual Family Office |

| Office Types Covered | Founders’ Office, Multi-Generational Office, Investment Office, Trustee Office, Compliance Office, Philanthropy Office, Shareholder’s Office, Others |

| Asset Classes Covered | Bonds, Equities, Alternative Investments, Commodities, Cash or Cash Equivalents |

| Service Types Covered | Financial Planning, Strategy, Governance, Advisory, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia family offices market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia family offices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia family offices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The family offices market in Saudi Arabia was valued at USD 199.1 Million in 2025.

The Saudi Arabia family offices market is projected to exhibit a CAGR of 3.94% during 2026-2034, reaching a value of USD 282.0 Million by 2034.

The Kingdom’s economic diversification efforts under Vision 2030 are encouraging private investments in sectors, such as real estate, technology, healthcare, and renewable energy, creating new opportunities for family offices. Rising generational wealth transfer is driving the demand for structured governance, estate planning, and portfolio management. Family offices are also becoming important players in venture capital and private equity, supporting innovations and startups.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)