Saudi Arabia Fantasy Sports Market Size, Share, Trends and Forecast by Sports Type, Platform, Demographics, and Region, 2026-2034

Saudi Arabia Fantasy Sports Market Summary:

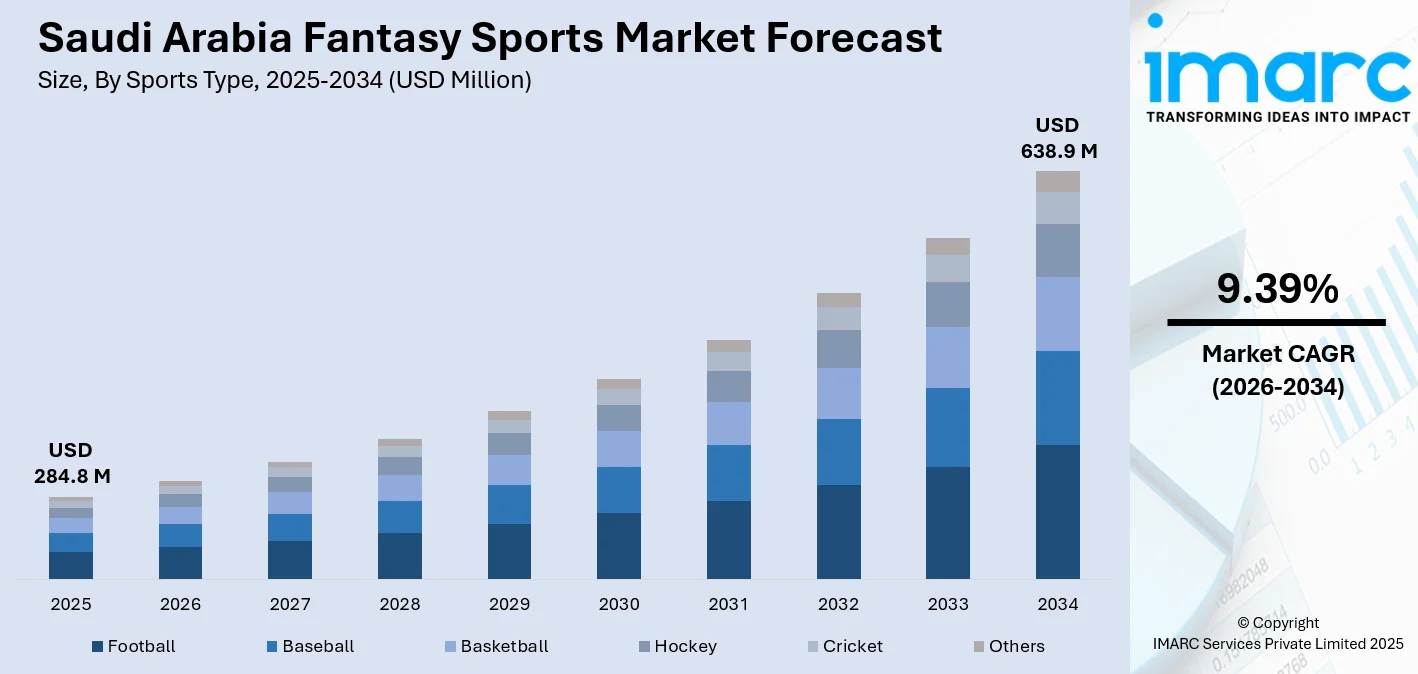

The Saudi Arabia fantasy sports market size was valued at USD 284.8 Million in 2025 and is projected to reach USD 638.9 Million by 2034, growing at a compound annual growth rate of 9.39% from 2026-2034.

Saudi Arabia's fantasy sports market is experiencing robust expansion driven by increasing smartphone penetration, growing youth engagement with digital entertainment platforms, and the nation's broader diversification initiatives under Vision 2030 that promote sports and entertainment sectors as economic pillars beyond traditional hydrocarbon revenues. The market benefits from substantial government investments in professional sports leagues, international tournament hosting ambitions, and regulatory evolution supporting digital entertainment formats that create enabling environments for fantasy sports operators targeting technologically sophisticated individuals, thereby expanding the Saudi Arabia fantasy sports market share.

Key Takeaways and Insights:

- By Sports Type: Football dominates the market with a share of 27.9% in 2025, reflecting the sport's cultural significance and passionate fan base across the Kingdom's diverse geographic regions.

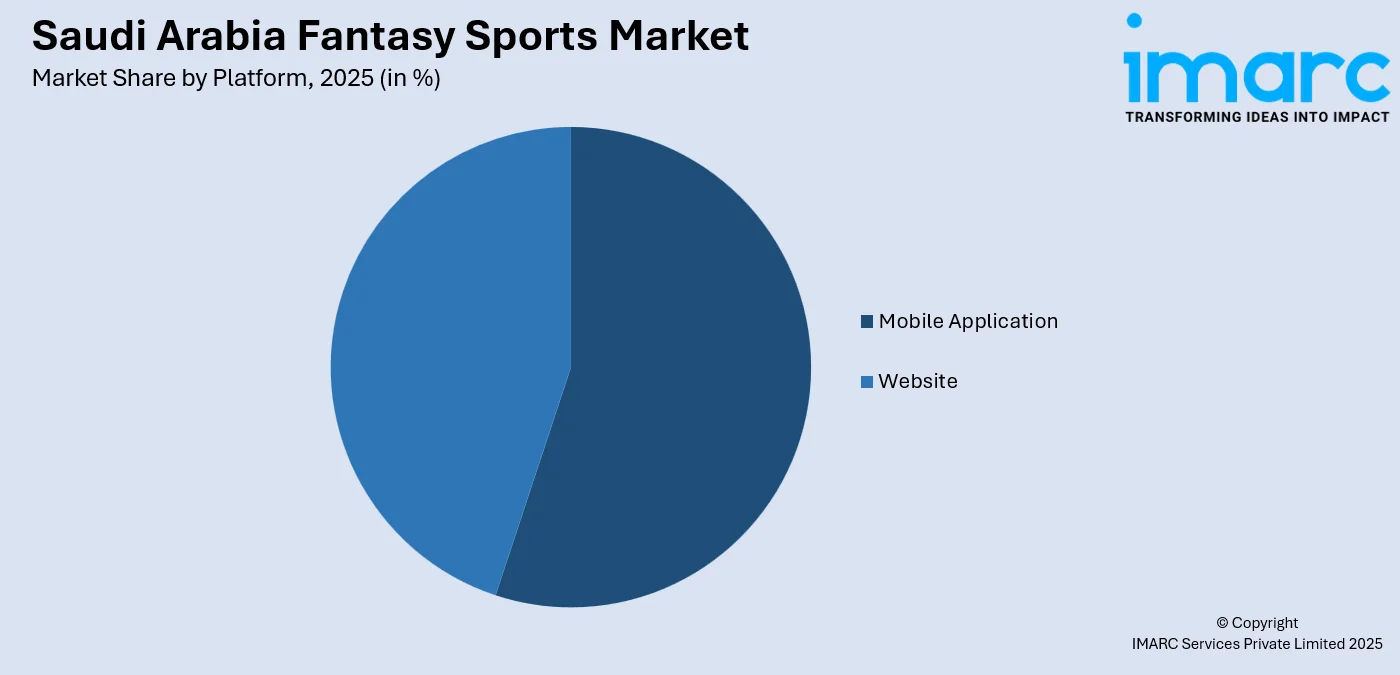

- By Platform: Mobile application leads the market with a share of 55.18% in 2025, capitalizing on widespread smartphone adoption and consumers' preference for on-the-go engagement with fantasy gaming experiences.

- By Demographics: 25-40 years represent the largest segment with a market share of 29.8% in 2025, driven by this cohort's digital literacy, disposable income levels, and recreational engagement patterns.

- By Region: Northern and central region accounts for the largest share at 28% in 2025, benefiting from concentrated urban populations, higher technology infrastructure density, and proximity to major metropolitan centers.

- Key Players: The Saudi Arabia fantasy sports market demonstrates evolving competitive dynamics with both international platforms and emerging regional providers competing across user acquisition strategies, platform functionality enhancements, partnership ecosystems with sports leagues, and localized content offerings tailored to Arabian Gulf preferences.

To get more information on this market Request Sample

The Saudi Arabian fantasy sports ecosystem has transformed dramatically as regulatory frameworks evolve alongside cultural shifts toward digital entertainment consumption. The convergence of high-speed internet accessibility, ambitious government-led sports development programs, and generational preferences for interactive entertainment formats positions the Kingdom as an emerging hotspot for fantasy sports growth within the Middle East and North Africa region. The market demonstrates particular momentum following Saudi Arabia's aggressive investments in domestic football infrastructure, including the Saudi Pro League's recruitment of international stars that generated unprecedented public attention and fan engagement opportunities. The fixture list for the 2025-26 Roshn Saudi League has been released by the Saudi Pro League, with the new season starting on August 2025. After their impressive journey to the FIFA Club World Cup quarterfinals, Al-Hilal begin their campaign with a local derby matchup against Al-Riyadh. This triggered substantial spikes in sports viewership, social media conversations, and digital platform registrations as fans sought deeper connections with teams and athletes through fantasy competitions that enable virtual team ownership and strategic gameplay experiences extending beyond passive match watching.

Saudi Arabia Fantasy Sports Market Trends:

Digital Payment Infrastructure Maturation Enabling Seamless Transactions

The rapid advancement of digital payment ecosystems throughout Saudi Arabia facilitates frictionless financial transactions within fantasy sports platforms, reducing barriers to entry for new participants and enhancing user retention through simplified deposit and withdrawal mechanisms that align with consumer expectations for instant, secure monetary exchanges in mobile-first environments. In 2025, Google Pay is set to launch throughout Saudi Arabia, as announced by the Kingdom’s central bank at the Money20/20 Middle East conference. The bank, referred to as SAMA, also entered into a partnership with Ant International to facilitate the acceptance of Alipay+ payments by 2026. As per a statement, the two companies will make use of the Kingdom’s National Payment System, mada. These advancements are in line with Saudi Arabia’s Vision 2030 goals to strengthen the digital economy, enhance financial inclusion, and raise the proportion of cashless transactions to 70 percent by 2025.

Strategic Partnerships Between Fantasy Platforms and Sports Organizations

Fantasy sports operators increasingly forge collaborative relationships with established sports leagues, teams, and broadcasting networks to access exclusive content, leverage official branding assets, and create integrated marketing campaigns that enhance platform credibility while providing sports organizations with additional revenue streams and deeper fan engagement metrics beyond traditional viewership measurements. The Esports World Cup Foundation (EWCF), alongside Genius Sports, has launched an exciting new fantasy league experience in anticipation of the 2025 Esports World Cup, which will be held in Riyadh, Saudi Arabia. This cutting-edge platform enables fans to assemble virtual teams made up of professional esports players from diverse game franchises. Taking place from 7 July to 24 August, the 2025 Esports World Cup showcased top-tier competitions in prominent games like DOTA 2 and Tekken 8. Over the course of eight weeks, the event united elite esports players from all over the world. A notable advancement occurred with the launch of a fantasy sports platform concurrent with the tournament. Although fantasy sports are firmly rooted in traditional sports such as football and basketball, their occurrence in esports has been comparatively minimal. This innovative platform seeks to enhance fan involvement by allowing users to create virtual teams featuring actual esports players and monitor their performance during the tournament.

Gamification Elements Enhancing User Engagement and Retention

Fantasy sports platforms incorporate sophisticated gamification strategies including achievement badges, leaderboard rankings, social sharing features, and progressive reward systems that transform casual participants into committed users by tapping into competitive instincts, social validation desires, and intrinsic motivations for skill development within strategic team-building frameworks. In 2025, Copa Fantasy, a football platform based in Saudi Arabia, secured 1.1 million riyals ($300,000) to expand and become the premier gaming hub for sports enthusiasts. The team shared with PocketGamer.biz that the funding will aid its goal to “become the area's first genuine football super-app." Established in 2018, Copa Fantasy originated as a concept that had a soft launch in 2022, transitioned to alpha in 2023, and reached beta in 2024. Included in the beta release was a new Predictor game and a free-to-play revenue model, which Copa Fantasy reported had strong initial engagement, with average revenue per paying user already anticipated to surpass customer acquisition expenses. The platform’s community, comprising more than 100,000 users, has participated in 1.5 million contests focused on their favorite players and teams.

How Vision 2030 is Transforming the Saudi Arabia Fantasy Sports Market:

Vision 2030 is fundamentally reshaping Saudi Arabia's fantasy sports landscape through strategic economic diversification that positions digital entertainment and sports as central growth pillars. The initiative capitalizes on the Kingdom's predominantly young, tech-savvy population, creating fertile ground for fantasy sports adoption and engagement. The transformation is driven by comprehensive infrastructure development, including enhanced digital connectivity and advanced technological platforms that facilitate seamless fantasy sports participation. Cultural shifts toward increased sports engagement and recreational activities have created an enthusiastic audience base eager to connect with their favorite teams and athletes through interactive platforms. Government-backed initiatives supporting the gaming and esports ecosystem have established regulatory frameworks, investment incentives, and youth empowerment programs that attract both domestic entrepreneurs and international operators. This holistic approach, combining policy support, infrastructure investment, and cultural evolution, is positioning Saudi Arabia as an emerging regional hub for fantasy sports. The convergence of demographic advantages, technological advancement, and strategic national priorities is creating unprecedented opportunities for market expansion, innovation, and long-term sustainability in the fantasy sports sector.

Market Outlook 2026-2034:

The Saudi Arabia fantasy sports market is positioned for sustained expansion as regulatory clarity improves, technological infrastructure advances, and cultural acceptance of digital gaming formats broadens across demographic segments. The intersection of government initiatives promoting sports as entertainment pillars, multinational platform investments recognizing the Kingdom's strategic importance, and evolving consumer preferences for interactive digital experiences creates favorable conditions for market deepening and diversification. Emerging opportunities include integration with live sports broadcasting platforms that enable synchronized fantasy gameplay during matches. The market generated a revenue of USD 284.8 Million in 2025 and is projected to reach a revenue of USD 638.9 Million by 2034, growing at a compound annual growth rate of 9.39% from 2026-2034. The market's trajectory benefits from Saudi Arabia's unique position as a wealthy nation with young demographics, technological sophistication, and government commitment to entertainment sector growth that distinguishes it from regional markets with more constrained resources or conservative policy environments.

Saudi Arabia Fantasy Sports Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Sports Type |

Football |

27.9% |

|

Platform |

Mobile Applications |

55.18% |

|

Demographics |

25-40 Years |

29.8% |

|

Region |

Northern and Central Region |

28% |

Sports Type Insights:

- Football

- Baseball

- Basketball

- Hockey

- Cricket

- Others

Football dominates with a market share of 27.9% of the total Saudi Arabia fantasy sports market in 2025.

Football's commanding position within Saudi Arabia's fantasy sports landscape stems from deep-rooted cultural passion for the sport that transcends generational boundaries and geographic divisions throughout the Kingdom. The sport's universal appeal creates broad participant bases spanning casual fans seeking weekend entertainment to dedicated enthusiasts analyzing player statistics and tactical formations with professional-level scrutiny. Saudi Arabia's substantial investments in domestic football infrastructure, international player acquisitions for the Saudi Pro League, and hosting ambitions for major global tournaments amplify public attention and create continuous content streams that fantasy platforms leverage for sustained user engagement.

The football segment benefits from established global fantasy football frameworks that require minimal localization while offering familiar gameplay mechanics that reduce onboarding friction for new participants. Fantasy football platforms capitalize on weekly match schedules that create regular engagement cycles, extensive statistical databases enabling sophisticated team-building strategies, and emotional connections fans maintain with favorite clubs and players that translate into persistent platform usage patterns extending beyond individual matches or tournaments.

Platform Insights:

Access the comprehensive market breakdown Request Sample

- Website

- Mobile Application

Mobile application leads with a share of 55.18% of the total Saudi Arabia fantasy sports market in 2025.

Mobile applications dominate Saudi Arabia's fantasy sports ecosystem by aligning perfectly with consumer behavior patterns characterized by constant smartphone connectivity, preference for app-based service interactions, and expectations for immediate access to entertainment options regardless of physical location or time constraints. The Kingdom's exceptional mobile internet penetration rates and widespread availability of high-speed wireless networks create ideal conditions for mobile-first fantasy sports experiences that deliver real-time updates, instant notifications about player performances, and seamless navigation across platform features optimized for smaller screens and touch-based interactions.

Mobile applications provide fantasy sports operators with superior user engagement mechanisms through push notifications that prompt daily logins, location-based features enabling localized content delivery, and integration with device functionalities like biometric authentication that enhance security while reducing login friction. The mobile format facilitates social sharing through native integration with messaging platforms and social networks, enabling users to easily invite friends, share achievements, and participate in private leagues that strengthen community bonds and increase platform stickiness through network effects that grow participant value proportionally with user base expansion.

Demographics Insights:

- Under 25 Years

- 25-40 Years

- Above 40 Years

25-40 years exhibit a clear dominance with a 29.8% share of the total Saudi Arabia fantasy sports market in 2025.

The demographic cohort spanning ages twenty-five through forty represents the optimal intersection of disposable income availability, digital platform fluency, and recreational time allocation patterns that drive sustained fantasy sports participation. This segment demonstrates financial capacity for entry fees and premium subscriptions without household budget constraints that affect younger participants, while maintaining technological comfort levels that older demographics may lack when navigating complex platform interfaces and understanding evolving digital entertainment formats. Professional stability and established income streams within this age bracket enable consistent participation patterns rather than sporadic engagement dictated by financial volatility.

This demographic segment exhibits strong sports fandom developed through formative years watching domestic and international competitions, creating emotional foundations that fantasy sports platforms activate through strategic team-building opportunities and competitive ranking systems. The cohort's life stage characteristics, including established social networks, work-related stress seeking entertainment outlets, and balanced lifestyle approaches incorporating leisure activities, position fantasy sports as accessible recreational pursuits requiring moderate time commitments while delivering social interaction, intellectual stimulation through statistical analysis, and achievement satisfaction through successful team performance outcomes.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and central region leads with a share of 28% of the total Saudi Arabia fantasy sports market in 2025.

The Northern and central region's market leadership reflects concentrated population densities in major metropolitan centers including Riyadh, where higher education levels, cosmopolitan cultural orientations, and advanced digital infrastructure create fertile environments for fantasy sports adoption. The region benefits from proximity to government institutions, major corporations, and international business operations that attract demographics with higher disposable incomes and greater exposure to global entertainment trends including fantasy sports platforms that originated in Western markets before expanding into Middle Eastern territories.

Urban concentration within this region facilitates community formation around fantasy sports through workplace leagues, university competitions, and social group tournaments that leverage geographic proximity for offline interactions complementing digital platform engagement. Superior telecommunications infrastructure ensures reliable connectivity supporting real-time platform interactions, while cultural diversity stemming from domestic migration patterns and expatriate populations introduces varied sports preferences and fantasy gaming traditions that platform operators accommodate through diverse sports offerings and flexible competition formats appealing to heterogeneous user bases.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Fantasy Sports Market Growing?

Vision 2030 Initiatives Prioritizing Sports and Entertainment Sector Development

Saudi Arabia's comprehensive national transformation strategy explicitly identifies sports and entertainment industries as critical diversification pillars beyond hydrocarbon dependency, triggering substantial government investments in sports infrastructure, international event hosting, professional league development, and regulatory frameworks supporting digital entertainment platforms. These deliberate policy interventions create enabling environments for fantasy sports growth through enhanced sports visibility, increased fan engagement opportunities, and legitimized pathways for digital gaming platforms that previously faced uncertain regulatory landscapes. The government's proactive stance signals long-term commitment to sports sector expansion, attracting international platform investments and encouraging domestic entrepreneurship within fantasy sports ecosystems that benefit from policy stability and institutional support mechanisms. In 2025, Saudi Arabia announced an SR1.7 billion ($453 million) investment in three sports projects for the 2024–2025 season, intended to enhance club development and elevate the Kingdom's status in the industry. This is part of the Kingdom's Clubs Support Strategy, emphasizing the development of five main initiatives like governance, diverse sports, direct aid, along with fan engagement and digital transformation.

Accelerating Youth Population Engagement with Digital Entertainment Platforms

Saudi Arabia's demographic composition featuring substantial youth populations exhibits strong preferences for digital-native entertainment formats including fantasy sports that blend athletic passion with technological interfaces and competitive gaming elements. The Saudi Family Statistics Report 2024 published on GASTAT’s website indicated that 71 percent of Saudi citizens are under the age of 35. The mean age in the Kingdom is 26.6 years, whereas the median age is at 23.5 years. Younger generations demonstrate comfort navigating complex digital platforms, understanding statistical analysis concepts, and participating in virtual communities that transcend geographic boundaries, competencies perfectly aligned with fantasy sports requirements. Educational improvements and global connectivity exposure familiarize Saudi youth with international sports leagues and fantasy gaming traditions, reducing cultural barriers while creating aspirational desires to participate in globally recognized entertainment formats that enhance social status and peer group integration.

Mobile Technology Proliferation Enabling Ubiquitous Platform Access

Exceptional smartphone penetration rates throughout Saudi Arabia combined with competitive telecommunications markets delivering affordable high-speed data plans eliminate technological barriers preventing fantasy sports participation. The General Authority for Statistics (GASTAT) has published the findings of the 2025 survey on ICT Access and Usage by Households and Individuals, showing that internet utilization in Saudi Arabia stays remarkably elevated. In total, 99.0% of people aged 15–74 indicated they use the internet, with 99.0% of men and 98.9% of women reporting usage. For Saudi nationals, the rate was 99.3%, while 98.6% of non-Saudis indicated they used the internet. The adoption of the Internet among Saudi men and women was nearly identical, at 99.5% and 99.2%, respectively. Mobile devices serve as primary internet access points for most Saudi consumers, making mobile-optimized fantasy platforms the natural engagement channel rather than secondary alternatives to desktop experiences. Continuous device upgrades driven by consumer preferences for latest technology ensure user bases possess hardware capabilities supporting sophisticated platform features including real-time notifications, video content integration, and complex data visualizations enhancing fantasy sports experiences beyond basic team selection and scoring functions.

Market Restraints:

What Challenges the Saudi Arabia Fantasy Sports Market is Facing?

Cultural Sensitivities Surrounding Gambling-Adjacent Entertainment Formats

Fantasy sports platforms navigate complex cultural landscapes where traditional values emphasize cautious approaches toward activities resembling gambling despite skill-based differentiations that separate fantasy sports from pure chance-based wagering. Conservative social segments maintain reservations about paid-entry fantasy competitions that involve monetary stakes and prize distributions, creating perception challenges that platforms must address through careful positioning, transparent gameplay mechanics, and education initiatives distinguishing strategic skill applications from prohibited gambling activities.

Regulatory Ambiguities Creating Operational Uncertainties

Evolving legal frameworks governing digital entertainment and online competitions introduce uncertainties for fantasy sports operators regarding permissible business models, prize structure limitations, advertising restrictions, and licensing requirements that may shift as regulatory bodies develop comprehensive approaches to emerging digital entertainment categories. Platform operators face challenges making long-term strategic investments when regulatory parameters remain fluid, while users may exhibit participation hesitancy if legal statuses appear unclear or potentially subject to unfavorable policy changes affecting platform availability or prize accessibility.

Limited Sports Statistical Literacy Among Broader Consumer Segments

Fantasy sports success requires participants possess baseline understanding of sports statistics, performance metrics, and analytical frameworks translating athletic achievements into quantifiable scoring systems. Segments lacking exposure to data-driven sports analysis or unfamiliar with fantasy gaming conventions face steeper learning curves that discourage platform adoption, while operators must invest resources developing educational content and simplified interfaces accommodating novice users without alienating experienced participants seeking sophisticated analytical tools and complex competition formats.

Competitive Landscape:

The Saudi Arabia fantasy sports market demonstrates dynamic competitive structures as established international platforms recognize the Kingdom's strategic importance within broader Middle East expansion strategies while regional operators leverage localized knowledge and cultural insights to differentiate offerings. Competition centers on user acquisition through aggressive marketing campaigns, exclusive sports league partnerships, and promotional incentives alongside platform differentiation via superior user interfaces, comprehensive statistical databases, innovative competition formats, and integrated social features enhancing community engagement. Operators increasingly pursue multi-sport coverage strategies acknowledging diverse consumer preferences while investing in Arabic language support, localized payment integrations, and culturally appropriate content frameworks that resonate with Saudi user expectations and behavioral patterns distinct from Western markets where fantasy sports traditions originated.

Saudi Arabia Fantasy Sports Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sports Types Covered | Football, Baseball, Basketball, Hockey, Cricket, Others |

| Platforms Covered | Website, Mobile Application |

| Demographics Covered | Under 25 Years, 25-40 Years, Above 40 Years |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia fantasy sports market size was valued at USD 284.8 Million in 2025.

The Saudi Arabia fantasy sports market is expected to grow at a compound annual growth rate of 9.39% from 2026-2034 to reach USD 638.9 Million by 2034.

Football dominated the Saudi Arabia fantasy sports market in 2025, commanding the largest segment share driven by the sport's deep cultural significance, widespread fan base across all demographic groups, substantial domestic league investments, and continuous engagement opportunities created by regular match schedules and comprehensive statistical coverage supporting sophisticated fantasy gameplay experiences.

Key factors driving the Saudi Arabia fantasy sports market include government Vision 2030 initiatives prioritizing sports sector development, accelerating youth engagement with digital entertainment platforms, mobile technology proliferation enabling ubiquitous access, improving digital payment infrastructure, and strategic partnerships between fantasy operators and established sports organizations.

Major challenges include cultural sensitivities surrounding gambling-adjacent entertainment formats, regulatory ambiguities creating operational uncertainties, limited sports statistical literacy among broader consumer segments, competition from alternative digital entertainment options, and platform differentiation difficulties in increasingly crowded marketplace environments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)