Saudi Arabia Ferroalloys Market Size, Share, Trends and Forecast by Product, Application, and Region, 2026-2034

Saudi Arabia Ferroalloys Market Summary:

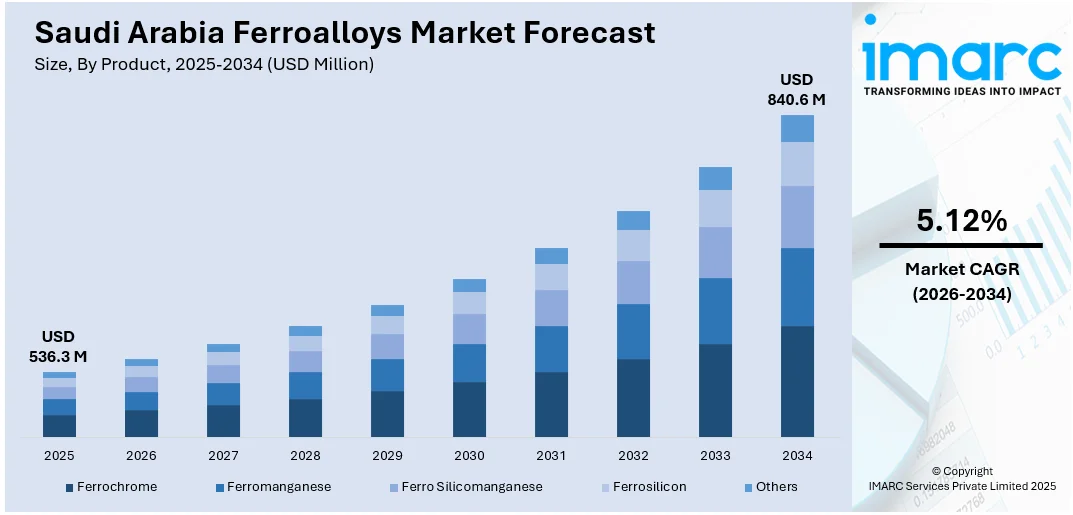

The Saudi Arabia ferroalloys market size was valued at USD 536.3 Million in 2025 and is projected to reach USD 840.6 Million by 2034, growing at a compound annual growth rate of 5.12% from 2026-2034.

The Saudi Arabia ferroalloys market is experiencing robust expansion, driven by the Kingdom's transformative infrastructure development initiatives and economic diversification programs. Growing steel production requirements across the construction, industrial manufacturing, and energy sectors are propelling ferroalloy consumption. The market benefits from strategic geographic positioning, supportive government policies promoting domestic manufacturing, and increasing adoption of advanced metallurgical processes for producing high-quality steel products.

Key Takeaways and Insights:

- By Product: Ferromanganese dominates the market with a share of 32% in 2025, owing to its essential role as a deoxidizer and desulfurizer in steel production processes. Ferromanganese enhances steel strength, hardness, and wear resistance, making it indispensable for construction-grade and automotive-grade steel manufacturing across the Kingdom.

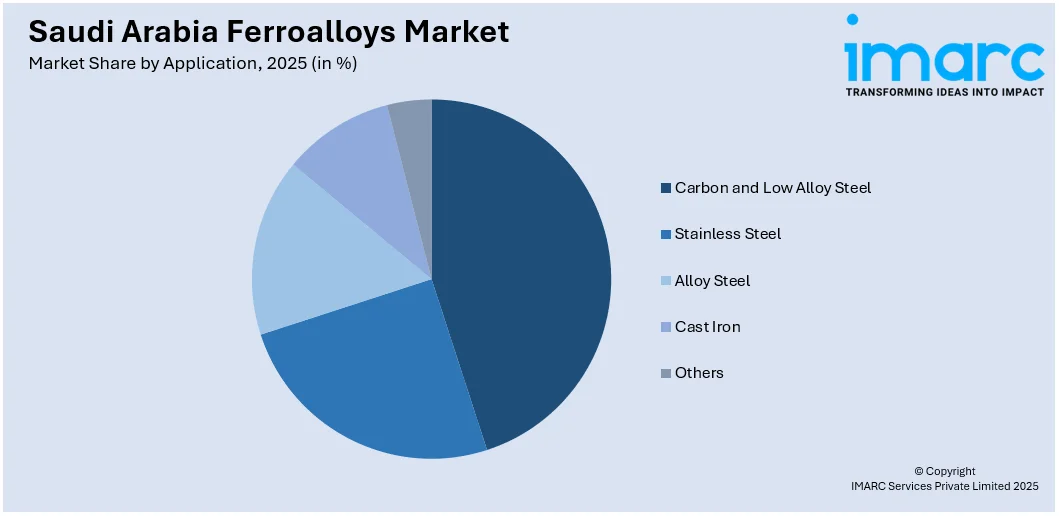

- By Application: Carbon and low alloy steel leads the market with a share of 36% in 2025. This dominance reflects the extensive use of ferroalloys in producing construction steel, reinforcement bars, and structural components essential for infrastructure mega-projects, residential developments, and industrial facilities throughout Saudi Arabia.

- By Region: Eastern Region comprises the largest region with 35% share in 2025, driven by the concentration of major steel manufacturing facilities, petrochemical complexes, and industrial cities in Dammam, Jubail, and Ras Al-Khair. The region's strategic port access facilitates raw material imports and finished product distribution.

- Key Players: Key players drive the Saudi Arabia ferroalloys market by expanding production capacities, investing in advanced smelting technologies, and strengthening supply chain networks. Their strategic partnerships with steel manufacturers and focus on quality certification enhance market penetration and support the Kingdom's industrial localization objectives.

To get more information on this market Request Sample

The Saudi Arabia ferroalloys market is witnessing substantial growth momentum, fueled by the Kingdom's unprecedented infrastructure transformation under Vision 2030. The construction sector's rapid expansion, encompassing mega-projects, smart city developments, and transportation networks, is generating sustained demand for high-quality steel products that require ferroalloy additives for enhanced mechanical properties. The automotive manufacturing sector is emerging as a significant growth catalyst, with domestic vehicle production initiatives creating new demand channels for specialized ferroalloys used in automotive-grade steel production. In August 2024, Saudi Arabia launched the Boulevard Business Park project in Riyadh valued at USD 266 Million, exemplifying the scale of infrastructure investments driving ferroalloy consumption. The energy sector modernization, including renewable energy installations and petrochemical facility expansions, further contributes to market growth by requiring corrosion-resistant and high-strength steel components.

Saudi Arabia Ferroalloys Market Trends:

Mega-Project Infrastructure Development Accelerating Demand

The Kingdom's ambitious mega-project portfolio is fundamentally reshaping ferroalloy consumption patterns. Transformative developments, including NEOM, the Red Sea tourism destination, Qiddiya entertainment complex, and Diriyah Gate, are generating unprecedented demand for structural steel requiring ferroalloy enhancement. These projects necessitate specialized steel grades with superior strength, corrosion resistance, and durability characteristics achieved through precise ferroalloy additions during steelmaking processes. Consequently, domestic ferroalloy production and import strategies are being aligned to meet the heightened quality and volume requirements of these landmark developments.

Renewable Energy Sector Driving Specialized Steel Requirements

Saudi Arabia's aggressive renewable energy expansion is creating new demand vectors for ferroalloys. Solar power installations require extensive steel frameworks for panel support structures, while wind energy projects demand substantial steel components for turbine foundations and towers. The Kingdom's goal of achieving 50% electricity production from renewable sources by 2030 is driving the demand for ferroalloy-reinforced steel products tailored for outdoor strength and weather resilience. This is encouraging manufacturers to innovate ferroalloy formulations that optimize strength-to-weight ratios for renewable energy infrastructure.

Automotive Manufacturing Localization Stimulating Market Growth

The emergence of domestic automotive manufacturing represents a transformative trend for the Saudi Arabia ferroalloys market. Electric vehicle (EV) production initiatives are establishing new supply chain requirements for automotive-grade steel containing precise ferroalloy compositions. Saudi Arabia aims for 30% uptake of EVs by 2030, as part of Vision 2030. Manufacturing facilities are being developed with advanced capabilities for producing vehicle components, frames, and structural elements that demand high-performance steel enhanced with ferromanganese, ferrosilicon, and ferrochrome for optimal mechanical properties.

How Vision 2030 is Transforming the Saudi Arabia Ferroalloys Market:

Saudi Vision 2030 is transforming the Saudi Arabia ferroalloys market by driving industrial diversification, downstream metal production, and domestic value addition. Large investments in steel manufacturing, automotive components, construction materials, and renewable energy infrastructure are increasing demand for ferroalloys such as ferromanganese, ferrosilicon, and ferrochrome. Vision 2030’s focus on reducing import dependency is encouraging local alloy production, smelting capacity expansion, and joint ventures with global metallurgical players. Infrastructure megaprojects and urban development programs are further supporting steady consumption of alloyed steel products. Additionally, energy efficiency goals and cleaner production practices are influencing technology upgrades in ferroalloy processing. The strategy’s emphasis on mining sector development is also improving raw material availability, strengthening long term market sustainability.

Market Outlook 2026-2034:

The Saudi Arabia ferroalloys market outlook remains robust, underpinned by sustained infrastructure investments and industrial diversification initiatives. Steel production expansion across the Kingdom is creating consistent demand for ferroalloy inputs essential for manufacturing construction-grade, automotive, and specialty steel products. The market generated a revenue of USD 536.3 Million in 2025 and is projected to reach a revenue of USD 840.6 Million by 2034, growing at a compound annual growth rate of 5.12% from 2026-2034. The competitive landscape is evolving with increased focus on domestic production capabilities, technological modernization, and strategic partnerships between ferroalloy suppliers and steel manufacturers. Growing emphasis on sustainable production methods and energy-efficient smelting processes is shaping investment priorities across the value chain.

Saudi Arabia Ferroalloys Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product |

Ferromanganese |

32% |

|

Application |

Carbon and Low Alloy Steel |

36% |

|

Region |

Eastern Region |

35% |

Product Insights:

- Ferrochrome

- Ferromanganese

- Ferro Silicomanganese

- Ferrosilicon

- Others

Ferromanganese dominates with a market share of 32% of the total Saudi Arabia ferroalloys market in 2025.

Ferromanganese serves as the predominant product in the market, driven by its critical function as a deoxidizer and desulfurizer during steel production processes. The alloy significantly enhances steel properties, including tensile strength, hardness, and wear resistance, making it indispensable for manufacturing construction-grade steel products. Its ability to improve weldability and resistance to cracking further reinforces its importance in large-scale infrastructure and industrial projects. Rising construction activities under Vision 2030 are driving sustained consumption of ferromanganese-enhanced steel. As per IMARC Group, the Saudi Arabia construction market size was valued at USD 101.4 Billion in 2025.

The segment benefits from robust demand across multiple end use applications, encompassing carbon steel, stainless steel, and specialty alloy production. High-carbon ferromanganese accounts for a significant share within this category, primarily utilized in flat carbon steel manufacturing for construction and automotive sectors. Medium-carbon grades are also gaining traction for structural steel and machinery components requiring a balance of strength and ductility. The steel-making industry’s focus on high-performance alloys ensures consistent demand for ferromanganese across diverse applications.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Carbon and Low Alloy Steel

- Stainless Steel

- Alloy Steel

- Cast Iron

- Others

Carbon and low alloy steel leads with a share of 36% of the total Saudi Arabia ferroalloys market in 2025.

Carbon and low alloy steel represents the dominant application for ferroalloys in Saudi Arabia, reflecting the extensive construction and infrastructure development activities across the Kingdom. Ferroalloys, including ferromanganese and ferrosilicon, are essential additives that enhance carbon steel mechanical properties, providing improved strength, toughness, and workability required for structural applications. Rising industrial and manufacturing activities further reinforce the demand for high-quality ferroalloy-enhanced steel in fabrication and machinery components across the Kingdom.

The segment's dominance is reinforced by massive steel requirements for Vision 2030 mega-projects, including NEOM, Qiddiya, and the Red Sea development. Construction steel applications encompass reinforcement bars, structural sections, beams, and columns that form the backbone of residential, commercial, and infrastructure projects. Saudi initiative provided over 12,000 housing units for families in need in 2024, generating substantial demand for ferroalloy-enhanced carbon steel products. The ongoing urbanization trend and population growth further support sustained consumption of carbon and low alloy steel across the Kingdom.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Eastern Region exhibits a clear dominance with a 35% share of the total Saudi Arabia ferroalloys market in 2025.

Eastern Region's market leadership stems from its concentration of major steel manufacturing facilities and industrial complexes in Dammam, Jubail, and Ras Al-Khair. The region hosts the Kingdom's largest integrated steel plants and downstream petrochemical facilities that consume substantial ferroalloy volumes. In 2024, Essar revealed plans to commence construction on a USD 4 Billion low-carbon steel complex at Ras Al-Khair Industrial City, exemplifying the region's strategic importance for steel production.

Easy access to the King Abdulaziz Seaport helps in effectively importing raw materials and distributing the finished products, thus enabling the region to have better competitive advantage. The Eastern Region acts as the hub of the oil, gas, and petrochemical operations in the Kingdom, which are major users of specialty steels in the form of pipelining, storage tanks, and factory buildings. The region also provides easy access to major industrial centers, thus decreasing the cost and time associated with the delivery of ferroalloys. Increased petrochemical and energy investments will continue to fuel the demand for quality steel and ferroalloys in the region.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Ferroalloys Market Growing?

Vision 2030 Infrastructure Development Programs

Saudi Arabia's transformative Vision 2030 initiative is setting a completely transformative outlook on the ferroalloys market landscape with unparalleled infrastructure investments. The Kingdom's commitment to economic diversification has catalyzed unprecedented building of smart cities, transportation networks, entertainment destinations, and industrial facilities. All these developments require quantities of high-quality steel products enriched with ferroalloy additives that give them special mechanical properties. The rapid growth of the building sector ensures lasting demand for ferromanganese, ferrochrome, and ferrosilicon in the manufacturing of reinforcement bars, structural steel, and special steels. Consistent consumption of steel is also contributed by government-initiated housing projects, as well as urban redevelopment initiatives. Moreover, joint efforts with global suppliers and the investment in progressive steelmaking technologies further advance the domestic ferroalloys market, positioning Saudi Arabia as a key regional hub for high-quality alloy production.

Expanding Energy Sector and Petrochemical Industry Modernization

The energy sector's continuous expansion and modernization represent a significant growth driver for ferroalloys consumption in Saudi Arabia. Oil and gas infrastructure projects require specialized corrosion-resistant and high-strength steel products manufactured using ferroalloy additives. Refineries, pipelines, drilling platforms, and storage facilities demand steel grades enhanced with ferrochrome and ferromanganese for optimal performance in harsh extraction and transportation environments. Petrochemical facility expansions in Jubail and Yanbu industrial cities are generating substantial demand for industrial-grade steel components. The renewable energy sector emergence adds new growth dimensions, with solar power installations requiring extensive steel frameworks and wind energy projects demanding substantial steel for turbine structures. Saudi Arabia's renewable energy capacity reached 2.1 Gigawatt between 2022 and 2024, with aggressive expansion planned to support the Kingdom's energy transition objectives.

Automotive Manufacturing Sector Emergence and Localization Initiatives

The emergence of domestic automotive manufacturing represents a transformative growth driver for the Saudi Arabia ferroalloys market. EV production initiatives are establishing new supply chain requirements for automotive-grade steel containing precise ferroalloy compositions essential for vehicle frames, body panels, and structural components. Manufacturing facilities are being developed with advanced capabilities for producing lightweight yet durable steel products that demand specific ferromanganese and ferrosilicon additions. The automotive sector's localization objectives are creating demand for specialty steel grades previously imported, encouraging domestic ferroalloy processing capabilities. In February 2025, Ceer signed partnership agreements valued at SAR 5.5 Billion with Saudi companies for localized component manufacturing, including aluminum casting and forging operations that complement ferroalloy-enhanced steel production. This industrial development trajectory positions ferroalloys as essential inputs supporting the Kingdom's automotive manufacturing ambitions.

Market Restraints:

What Challenges the Saudi Arabia Ferroalloys Market is Facing?

Raw Material Price Volatility and Supply Chain Disruptions

In Saudi Arabia, the ferroalloys market faces significant challenges from raw material price volatility affecting production economics and profitability. Manganese, chromium, and silicon ore prices fluctuate substantially due to geopolitical tensions, supply chain disruptions, and trade policy changes in major producing countries. These price variations create uncertainty for manufacturers and end-users in budgeting and contract negotiations. Global logistics disruptions and shipping route challenges further compound supply chain vulnerabilities, impacting raw material availability and transportation costs for Saudi Arabian importers.

Energy-Intensive Production Processes and Environmental Regulations

Ferroalloy production processes are inherently energy-intensive, requiring substantial electrical power for smelting operations in electric arc furnaces and submerged arc furnaces. High energy consumption contributes to elevated production costs and environmental concerns regarding carbon emissions and greenhouse gas generation. Increasingly stringent environmental regulations globally are pressuring manufacturers to adopt cleaner technologies and sustainable practices. The transition towards low-carbon production methods requires significant capital investments in equipment modernization and process optimization.

Import Dependency and Limited Domestic Production Capacity

The Saudi Arabia ferroalloys market faces constraints from significant import dependency for meeting domestic consumption requirements. Limited local ferroalloy production capacity necessitates substantial imports from international suppliers, exposing the market to currency fluctuations, trade policy changes, and supply disruptions. The concentration of global ferroalloy production in specific countries creates geo-political vulnerabilities affecting supply security. Building domestic production capabilities requires substantial investments in mining, processing infrastructure, and skilled workforce development.

Competitive Landscape:

The Saudi Arabia ferroalloys market exhibits a competitive landscape, characterized by the presence of domestic steel manufacturers, international ferroalloy suppliers, and trading companies serving the Kingdom's industrial requirements. Market participants are increasingly focusing on establishing strategic partnerships with local steel producers to secure long-term supply agreements. Investments in production capacity expansion, quality certification programs, and supply chain optimization represent key competitive strategies. Companies are emphasizing product quality consistency, technical support services, and delivery reliability to differentiate their offerings. The government's industrial localization objectives are encouraging foreign suppliers to consider domestic processing facilities and joint venture partnerships with Saudi entities.

Saudi Arabia Ferroalloys Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Ferrochrome, Ferromanganese, Ferro Silicomanganese, Ferrosilicon, Others |

| Applications Covered | Carbon and Low Alloy Steel, Stainless Steel, Alloy Steel, Cast Iron, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia ferroalloys market size was valued at USD 536.3 Million in 2025.

The Saudi Arabia ferroalloys market is expected to grow at a compound annual growth rate of 5.12% from 2026-2034 to reach USD 840.6 Million by 2034.

Ferromanganese dominated the market with a share of 32%, driven by its essential role as a deoxidizer and desulfurizer in steel production processes across the construction and industrial manufacturing sectors.

Key factors driving the Saudi Arabia ferroalloys market include Vision 2030 infrastructure development programs, expanding energy sector modernization, growing automotive manufacturing initiatives, and increasing domestic steel production capacity.

Major challenges include raw material price volatility, energy-intensive production processes requiring significant power consumption, import dependency for specialized ferroalloys, supply chain disruptions, and the need for substantial capital investments in domestic production infrastructure.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)