Saudi Arabia Fire Sprinklers Market Size, Share, Trends and Forecast by Component, Product Type, Service, Technology, Application, and Region, 2026-2034

Saudi Arabia Fire Sprinklers Market Overview:

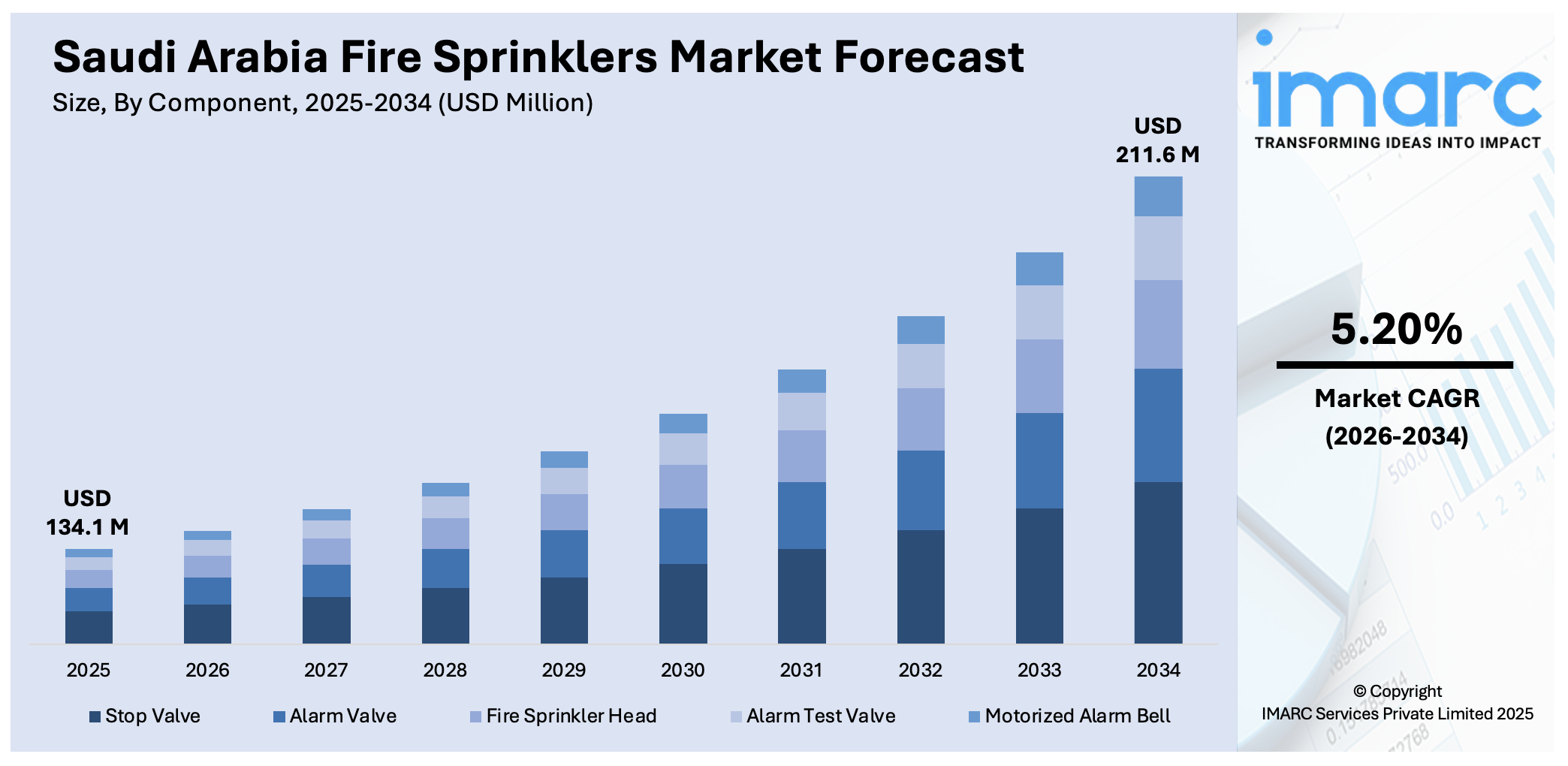

The Saudi Arabia fire sprinklers market size reached USD 134.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 211.6 Million by 2034, exhibiting a growth rate (CAGR) of 5.20% during 2026-2034. The market is experiencing significant growth due to stringent government fire safety laws, increasing construction activities, and rising awareness about mitigating the risk of fires. The need for smart building infrastructure under Vision 2030 and demand for high-end safety systems in residential, commercial, and industrial spaces also influence the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 134.1 Million |

| Market Forecast in 2034 | USD 211.6 Million |

| Market Growth Rate 2026-2034 | 5.20% |

Saudi Arabia Fire Sprinklers Market Trends:

Focus on Fire Safety Codes and Compliance

The fire sprinkler market in Saudi Arabia is growing strongly, fueled by strict fire safety codes and increased emphasis on compliance in all sectors. The government's focus on public safety has resulted in the adoption of strict building codes requiring the installation of fire suppression systems, such as sprinklers, in new and existing buildings. This regulatory pressure makes sure that residential, commercial, and industrial structures follow standardized safety protocols, thus minimizing the risk of fire incidents. Recently, in March 2025, Saudi Arabia declared its plans to implement revised Saudi Building Code (SBC) and Saudi Fire Code (SFC) regulations by mid-2025, as the nation's construction industry keeps expanding. To prepare for the regulatory changes, AESG has grown its Fire & Life Safety division in Saudi Arabia, recruiting fire protection engineers, senior fire protection engineers, and principal fire protection engineers. The company announced that these enhancements will bolster its ability to assist in large-scale projects with fire protection knowledge. Consequently, property developers, building owners, and facility managers are investing more in sophisticated fire sprinkler systems to comply with these regulations and protect occupants. This movement increases the Saudi Arabia fire sprinklers market share for current infrastructure and the wider public safety pledge of the Kingdom.

To get more information on this market Request Sample

Adoption of Intelligent Fire Sprinkler Technologies

The Saudi Arabian fire sprinkler market is also undergoing a technological revolution with the adoption of smart fire sprinkler technologies. The modern systems come with sensors and IoT connectivity, making it possible to monitor the sprinklers in real-time and also manage them remotely. These capabilities enable timely fire hazard detection, quick sprinkler activation, and instant notification of emergency responders, all of which greatly improves the efficiency of fire extinguishing efforts. Adoption of smart technology also enables predictive maintenance, minimizing downtime and guaranteeing the reliability of fire protection systems. This innovation is consistent with the Kingdom's Vision 2030 strategy, which prioritizes the growth of smart cities and the use of innovative technologies to enhance the standards of urban life. The result is a burgeoning market along with an increasing demand for smart safety solutions in different industries, that continue to shape the Saudi Arabia fire sprinklers market outlook.

Growth of Fire Sprinkler Applications Across Sectors

The use of fire sprinkler systems in Saudi Arabia is expanding beyond conventional commercial and industrial applications to cover residential and specialty buildings. The move is prompted by growing acknowledgment of fire safety as an essential element of building construction and operation. At residential properties, the use of fire sprinklers is increasingly common, with property owners desiring to safeguard homes and family from possible fire danger. Moreover, specialized buildings like data centers, healthcare facilities, and education buildings are also bringing in sophisticated fire sprinkler systems to protect vital infrastructure and sensitive environments. This expansion of applications is indicative of an integrated strategy for fire safety where different industries are actively putting in place fire protection measures to reduce risks and provide safety to occupants and assets. Consequently, the Saudi Arabia fire sprinklers market growth is influenced by sectors who are realizing the significance of strong fire suppression systems. Recently, the fire protection sector in Saudi Arabia grew as the Energy Capital Group (ECG) revealed the purchase of Dar Al Balad Contracting (DAB) via its investment fund, ECG2.0-Fund2. As per ECG, the acquisition enhances its standing in the industrial services sector for power and water in Saudi Arabia. DAB offers engineering and maintenance solutions, encompassing fire protection systems that uphold the operational integrity of essential infrastructure.

Saudi Arabia Fire Sprinklers Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on component, product type, service, technology, and application.

Component Insights:

- Stop Valve

- Alarm Valve

- Fire Sprinkler Head

- Alarm Test Valve

- Motorized Alarm Bell

The report has provided a detailed breakup and analysis of the market based on the component. This includes stop valve, alarm valve, fire sprinkler head, alarm test valve, and motorized alarm bell.

Product Type Insights:

- Wet Pipe Fire Sprinklers

- Dry Pipe Fire Sprinklers

- Deluge Systems

- Pre-Action Systems

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes wet pipe fire sprinklers, dry pipe fire sprinklers, deluge systems, pre-action systems, and others.

Service Insights:

- Engineering Services

- Installation

- Design Maintenance

- Inspection

- Managed Services

- Others

A detailed breakup and analysis of the market based on the service has also been provided in the report. This includes engineering services, installation, design maintenance, inspection, managed services, and others.

Technology Insights:

- Active Fire Protection

- Passive Fire Protection

The report has provided a detailed breakup and analysis of the market based on the technology. This includes active fire protection and passive fire protection.

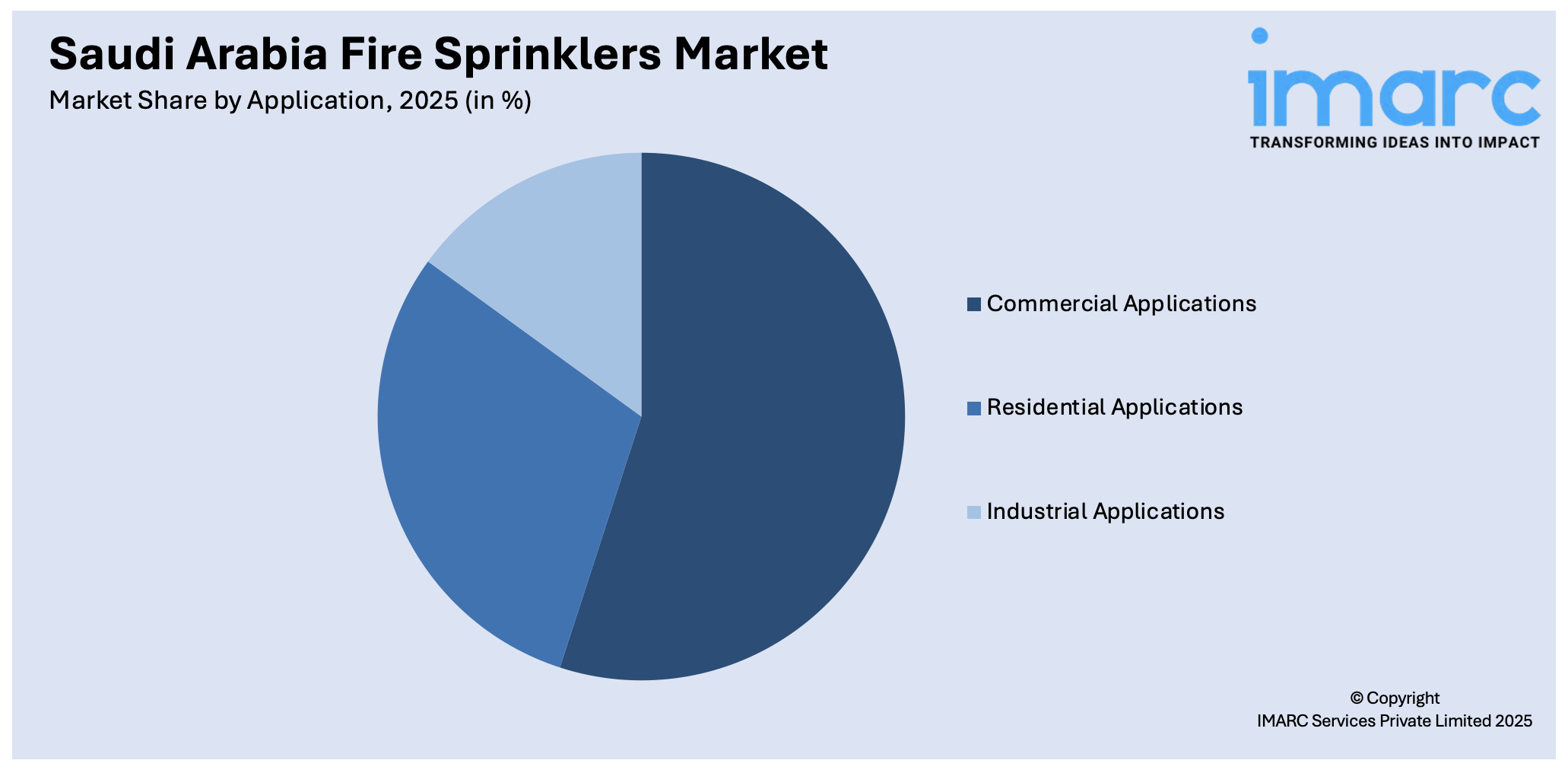

Application Insights:

Access the comprehensive market breakdown Request Sample

- Commercial Applications

- Residential Applications

- Industrial Applications

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes commercial applications, residential applications, and industrial applications.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Fire Sprinklers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Stop Valve, Alarm Valve, Fire Sprinkler Head, Alarm Test Valve, Motorized Alarm Bell |

| Product Types Covered | Wet Pipe Fire Sprinklers, Dry Pipe Fire Sprinklers, Deluge Systems, Pre-Action Systems, Others |

| Services Covered | Engineering Services, Installation, Design Maintenance, Inspection, Managed Services, Others |

| Technologies Covered | Active Fire Protection, Passive Fire Protection |

| Applications Covered | Commercial Applications, Residential Applications, Industrial Applications |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia fire sprinklers market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia fire sprinklers market on the basis of component?

- What is the breakup of the Saudi Arabia fire sprinklers market on the basis of product type?

- What is the breakup of the Saudi Arabia fire sprinklers market on the basis of service?

- What is the breakup of the Saudi Arabia fire sprinklers market on the basis of technology?

- What is the breakup of the Saudi Arabia fire sprinklers market on the basis of application?

- What is the breakup of the Saudi Arabia fire sprinklers market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia fire sprinklers market?

- What are the key driving factors and challenges in the Saudi Arabia fire sprinklers?

- What is the structure of the Saudi Arabia fire sprinklers market and who are the key players?

- What is the degree of competition in the Saudi Arabia fire sprinklers market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia fire sprinklers market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia fire sprinklers market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia fire sprinklers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)