Saudi Arabia Fitness App Market Size, Share, Trends and Forecast by Type, Platform, Device, and Region, 2026-2034

Saudi Arabia Fitness App Market Overview:

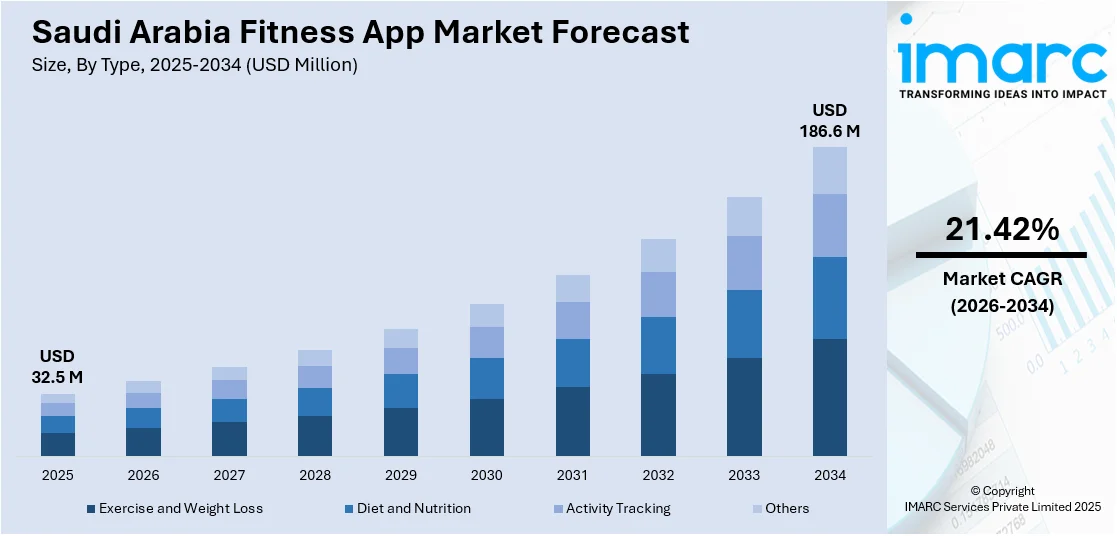

The Saudi Arabia fitness app market size reached USD 32.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 186.6 Million by 2034, exhibiting a growth rate (CAGR) of 21.42% during 2026-2034. The market is growing due to the rising health awareness, government wellness initiatives, and increasing smartphone penetration. Tech-savvy youth and cultural shifts toward active lifestyles further drive market expansion. Augmenting demand for personalized and female-focused fitness solutions, integration with wearables, and post-pandemic digital fitness adoption are also augmenting the Saudi fitness app market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 32.5 Million |

| Market Forecast in 2034 | USD 186.6 Million |

| Market Growth Rate 2026-2034 | 21.42% |

Saudi Arabia Fitness App Market Trends:

Rise of On-Demand and Live Streaming Fitness Content

The rise in demand for on-demand and live-streamed workout sessions, catering to users seeking flexibility and real-time engagement is majorly driving the Saudi fitness app market growth. Busy lifestyles and the preference for home workouts post-pandemic have accelerated this trend. Apps now offer subscription-based access to recorded sessions across various fitness disciplines—from HIIT and yoga to culturally tailored programs such as "Saudi-fit" workouts. Live streaming adds an interactive element, allowing users to train with instructors in real time while receiving instant feedback. Platforms are also partnered with local fitness influencers and certified trainers to enhance credibility and appeal. Saudi Arabia gained 17.06 million Instagram users in April 2024, making up 45.1% of the total population, and men made up 57.3% of users. The top age demographic in 2023 was 25 to 34 years, with 7.3 million users and men surpassing women by 4.3 million. With exciting male representation, this presents an incredible opportunity for fitness app brands and influencers to target active, health-based users within social channels. With improved internet infrastructure and 5G adoption enabling seamless streaming, this trend is reshaping how Saudis engage with digital fitness, making it a key growth area for app developers.

To get more information on this market Request Sample

Increasing Demand for Personalized Fitness Solutions

The escalating demand for personalized workout and nutrition plans is creating a positive Saudi Arabia fitness app market outlook. With increasing health awareness and government initiatives, users are seeking tailored fitness experiences. AI-driven apps that customize workouts based on fitness levels, goals, and dietary preferences are gaining popularity. Additionally, integration with wearable devices allows real-time tracking, enhancing user engagement. The growing youth population and smartphone penetration further fuel this trend, as tech-savvy consumers prefer digital solutions over traditional gym memberships. In early 2025, the mobile connection volume was 48.1 million in Saudi Arabia, representing 140% of the population. Internet penetration was 99.0% and there were 34.1 million active social media accounts, 99.6% of the population. The Kingdom has a dense, interconnected culture that offers healthy prospects for fitness apps targeting mobile phone users on a national level. Fitness apps offering localized content, such as Arabic-language interfaces and culturally relevant workouts, are also seeing higher adoption rates. As competition intensifies, developers are focusing on hyper-personalization through machine learning to retain users, making this a key trend shaping the market’s future.

Saudi Arabia Fitness App Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type, platform, and device.

Type Insights:

- Exercise and Weight Loss

- Diet and Nutrition

- Activity Tracking

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes exercise and weight loss, diet and nutrition, activity tracking, and others.

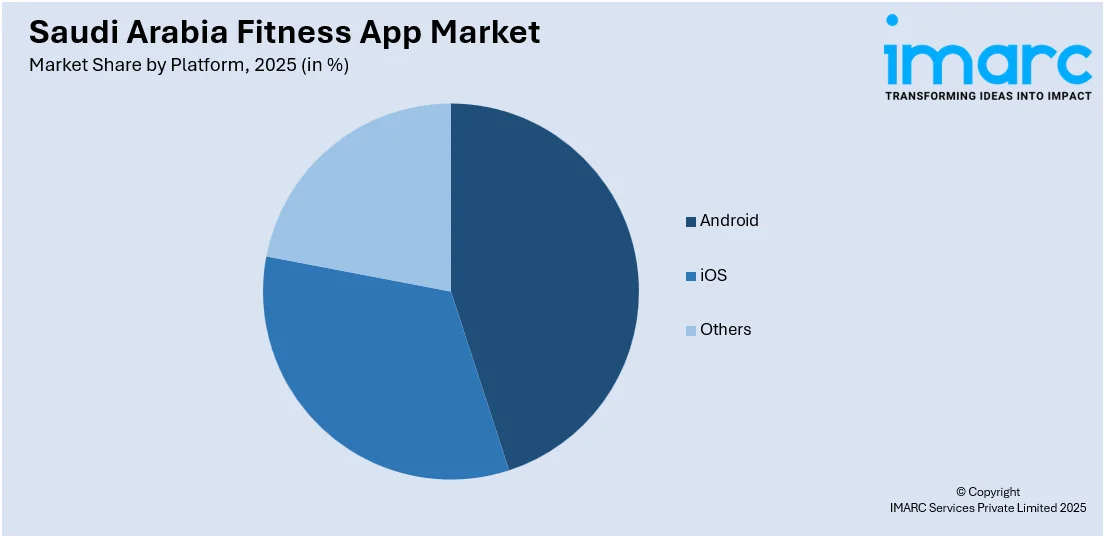

Platform Insights:

Access the comprehensive market breakdown Request Sample

- Android

- iOS

- Others

A detailed breakup and analysis of the market based on the platform have also been provided in the report. This includes android, iOS, and others.

Device Insights:

- Smartphones

- Tablets

- Wearable Devices

The report has provided a detailed breakup and analysis of the market based on the device. This includes smartphones, tablets, and wearable devices.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Fitness App Market News:

- December 25, 2024: Fitness tech startup Portal, based in Hyderabad, launched UltraGym, a portable AI-enabled strength training machine priced at INR 59,990 (approximately USD 719.88) with digital weights of up to 70 kg. Over the next 12 to 18 months, the company will be increasing its footprint in Saudi Arabia and the Middle East to cater to home fitness requirements. Additionally, its companion app offers more than 150 guided workouts, thus increasing Portl's place within the connected fitness app market.

Saudi Arabia Fitness App Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Exercise and Weight Loss, Diet and Nutrition, Activity Tracking, Others |

| Platforms Covered | Android, iOS, Others |

| Devices Covered | Smartphones, Tablets, Wearable Devices |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia fitness app market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia fitness app market on the basis of type?

- What is the breakup of the Saudi Arabia fitness app market on the basis of platform?

- What is the breakup of the Saudi Arabia fitness app market on the basis of device?

- What is the breakup of the Saudi Arabia fitness app market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia fitness app market?

- What are the key driving factors and challenges in the Saudi Arabia fitness app?

- What is the structure of the Saudi Arabia fitness app market and who are the key players?

- What is the degree of competition in the Saudi Arabia fitness app market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia fitness app market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia fitness app market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia fitness app industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)