Saudi Arabia Flavors and Fragrances Market Size, Share, Trends and Forecast by Product Type, Form, Application, Ingredients, and Region, 2026-2034

Saudi Arabia Flavors and Fragrances Market Overview:

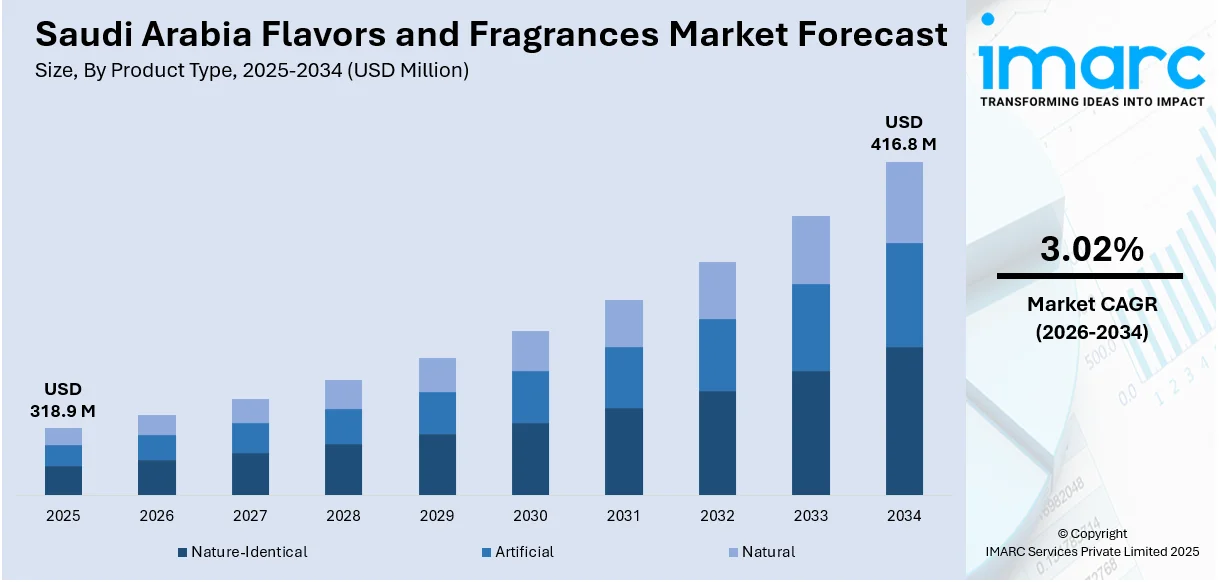

The Saudi Arabia flavors and fragrances market size reached USD 318.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 416.8 Million by 2034, exhibiting a growth rate (CAGR) of 3.02% during 2026-2034. Health-conscious consumption and cultural identity are jointly shaping the flavors and fragrances market, with growing demand for clean-label, natural ingredients and personalized, oriental-inspired formulations that reflect tradition, luxury, and individuality across both food and personal care segments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 318.9 Million |

| Market Forecast in 2034 | USD 416.8 Million |

| Market Growth Rate 2026-2034 | 3.02% |

Saudi Arabia Flavors and Fragrances Market Trends:

Increasing Awareness about Health and Wellness Trends

The rising emphasis on health and wellness in Saudi Arabia is progressively influencing the flavors and fragrances sector. As shoppers increasingly prioritize health, there is a noticeable shift towards natural, organic, and clean-label items. This change is especially noticeable in the food and beverage (F&B) sector, where there is a strong demand for alternatives such as sugar-free, gluten-free, and low-calorie products. Apart from this, in the fragrance market, there is a rise in preference for products that use natural ingredients, free from harmful chemicals, aligning with the wellness values of users. This growing emphasis on healthier options is encouraging companies to innovate and offer products that cater to a more health-conscious user base. As consumer awareness expands, the need for cleaner, healthier, and more sustainable scents and flavors across different market segments is rising, driving ongoing innovation in these sectors. In line with this trend, in 2024, Saudi Arabia launched Milaf Cola, the world’s first date-based soft drink, made without added sugar and harnessing the health benefits of dates. The drink, developed by Thurath Al-Madina, was positioned as a healthier alternative to traditional sodas. It was crafted from premium locally sourced dates and supported sustainable production.

To get more information on this market Request Sample

Growing Preferences for Oriental and Signature Fragrance and Flavors

The rising demand for personalized and culturally inspired sensory experiences is influencing the flavors and fragrances market in Saudi Arabia. There is a distinct preference for oriental scent profiles like lush, warm, and intricate notes that align with local customs and flavors. These choices are grounded in tradition yet also embody a contemporary reimagining of identity and luxury. Likewise, in the flavor category, brands are developing unique blends that appeal to regional tastes while incorporating a creative or high-end twist. This demand is encouraging fragrance and flavor companies to create distinctive, enduring formulas that differentiate themselves in both personal care and F&B sectors. Individuals are progressively linking scent and taste to self-expression, uniqueness, and emotional ties, which boosts interest in exclusive releases, handcrafted formats, and personalized creations. The changing product landscape now features impactful, memory-connected formulations that extend past functionality into experience-driven uniqueness. This change promotes cooperation among local developers, international experts, and retail collaborators to develop solutions that harmonize tradition, innovation, and identity. As an increasing number of people look for distinctive scent and flavor experiences, the market is enhancing its ability for complexity, personalization, and cultural significance in product creation. In 2024, Perfume Palace in Riyadh launched three new oriental fragrances, including Island 77, Panther 22, and Ana Yours 11. Each fragrance offered a unique blend, combining elements like forest woods, cardamom, and mango to create lasting, elegant scents for both men and women.

Saudi Arabia Flavors and Fragrances Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on product type, form, application, and ingredients.

Product Type Insights:

- Nature-Identical

- Artificial

- Natural

The report has provided a detailed breakup and analysis of the market based on the product type. This includes nature-identical, artificial, and natural.

Form Insights:

- Liquid

- Dry

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes liquid and dry.

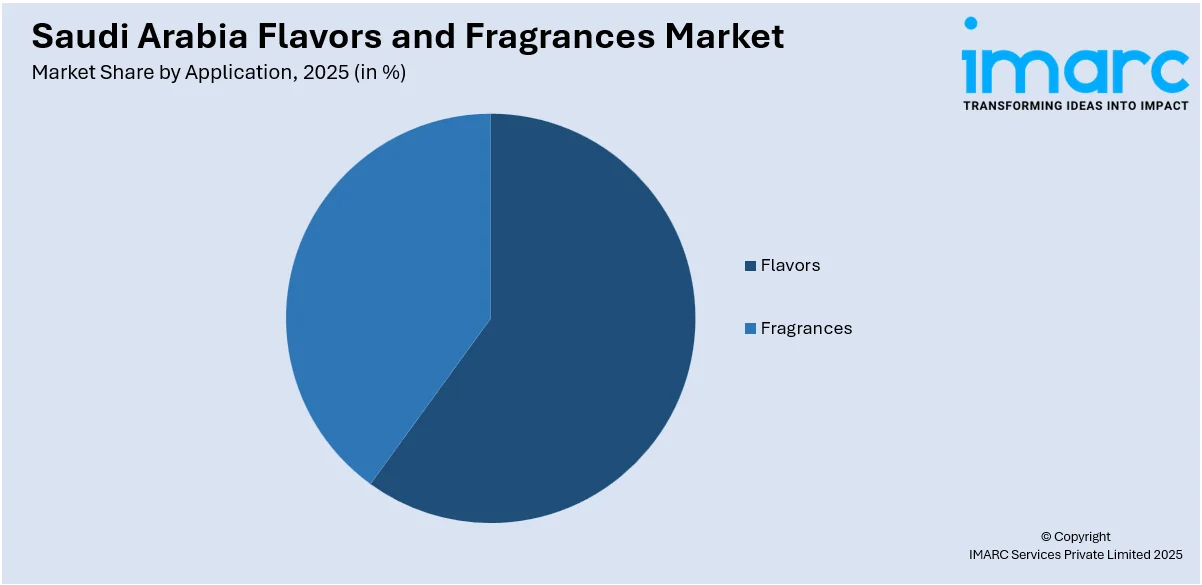

Application Insights:

Access the comprehensive market breakdown Request Sample

- Flavors

- Beverages

- Dairy and Frozen Desserts

- Bakery and Confectionery Products

- Savories and Snacks

- Fragrances

- Soap and Detergents

- Cosmetics and Toiletries

- Fine Fragrances

- Household Cleaners and Air Fresheners

The report has provided a detailed breakup and analysis of the market based on the application. This includes flavors (beverages, dairy and frozen desserts, bakery and confectionery products, and savories and snacks) and fragrances (soap and detergents, cosmetics and toiletries, fine fragrances, and household cleaners and air fresheners).

Ingredients Insights:

- Natural

- Synthetic

A detailed breakup and analysis of the market based on the ingredients have also been provided in the report. This includes natural and synthetic.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Flavors and Fragrances Market News:

- In June 2024, SCG International and Tamimi Markets signed a strategic alliance to introduce the Siam Signature brand, featuring premium Thai and Asian flavors, to Saudi Arabia's food and beverage market. The partnership leveraged Tamimi's distribution network across 32 locations. This collaboration marked SCG International's expansion into the Saudi market, building on its success in other sectors.

- In February 2024, Fragrance World Perfumes announced its participation in Beautyworld Saudi Arabia 2024, taking place from February 11 to 13, 2024, at the Riyadh International Convention and Exhibition Centre. The event showcased Fragrance World, French Avenue, Athoor Al Alam, and Maison Des Parfums.

Saudi Arabia Flavors and Fragrances Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Nature-Identical, Artificial, Natural |

| Forms Covered | Liquid, Dry |

| Applications Covered |

|

| Ingredients Covered | Natural, Synthetic |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia flavors and fragrances market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia flavors and fragrances market on the basis of product type?

- What is the breakup of the Saudi Arabia flavors and fragrances market on the basis of form?

- What is the breakup of the Saudi Arabia flavors and fragrances market on the basis of application?

- What is the breakup of the Saudi Arabia flavors and fragrances market on the basis of ingredients?

- What is the breakup of the Saudi Arabia flavors and fragrances market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia flavors and fragrances market?

- What are the key driving factors and challenges in the Saudi Arabia flavors and fragrances market?

- What is the structure of the Saudi Arabia flavors and fragrances market and who are the key players?

- What is the degree of competition in the Saudi Arabia flavors and fragrances market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia flavors and fragrances market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia flavors and fragrances market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia flavors and fragrances industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)