Saudi Arabia Fleet Management Market Size, Share, Trends and Forecast by Component, Vehicle Type, Technology, Deployment Type, End Use Sector, and Region, 2026-2034

Saudi Arabia Fleet Management Market Overview:

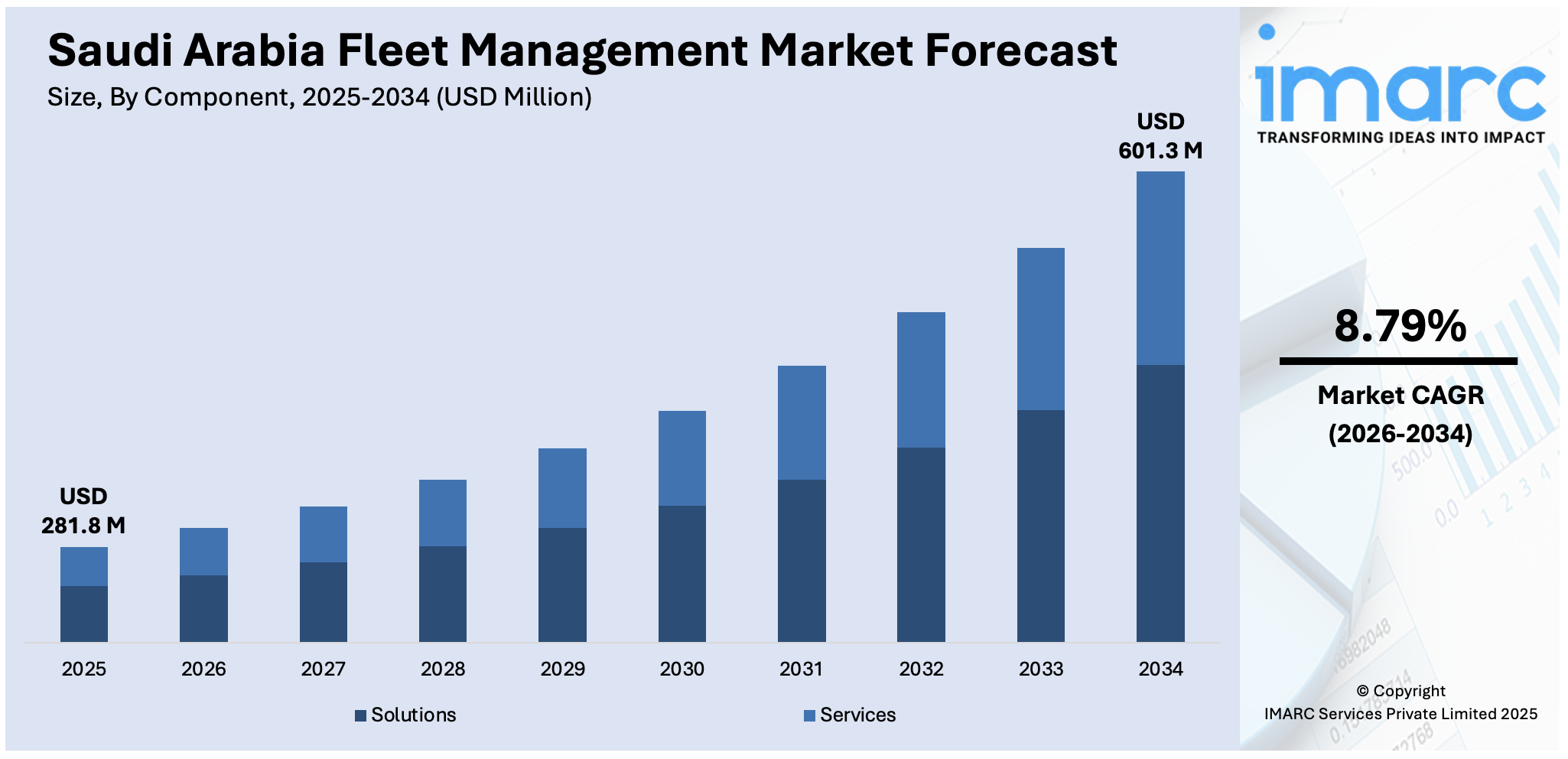

The Saudi Arabia fleet management market size reached USD 281.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 601.3 Million by 2034, exhibiting a growth rate (CAGR) of 8.79% during 2026-2034. The market is driven by technology advancements, demand expansion for effective transport, and the cost-effective need. Also, government regulations to fuel consumption, security needs, and environmental sustainability support the adoption of fleet management solutions to cut costs and optimize operational efficiency and consequently influence Saudi Arabia fleet management market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 281.8 Million |

| Market Forecast in 2034 | USD 601.3 Million |

| Market Growth Rate 2026-2034 | 8.79% |

Saudi Arabia Fleet Management Market Trends:

Growing Demand for Real-Time Data and Telemetry Solutions

In Saudi Arabia, the need for real-time data and telemetry solutions is strongly propelling the fleet management market. Telematics systems are being adopted by companies in greater numbers to track vehicle performance, fuel consumption, and driver behavior in real-time. The sophisticated systems assist fleet managers in optimizing routes, lowering fuel costs, and enhancing overall operational efficiency. In addition, the incorporation of data analytics enables companies to detect inefficiencies, anticipate maintenance requirements, and verify regulatory compliance. The real-time monitoring also improves fleet security since fleet managers can immediately respond to vehicle theft or accidents. As the demand for improved monitoring and reporting grows, the use of telemetry and data-driven insights continues to grow, fueling growth in the fleet management industry. For instance, in April 2025, Galileosky TLT showcased its advanced fleet solutions in Saudi Arabia. The company demonstrated its Galileosky 10 telematics system, focusing on critical operational challenges in the oil and gas sector. Key solutions include intelligent fuel monitoring, driver safety systems, and customizable platforms. The tour aims to highlight the system’s ability to reduce fuel costs, improve driver safety, and integrate with existing infrastructure, offering tailored solutions for fleet modernization.

To get more information on this market Request Sample

Regulatory Push for Sustainability and Environmental Compliance

The growing focus on sustainability and environmental regulations is a key trend influencing the Saudi Arabia fleet management market growth. With increasing government pressure to reduce carbon emissions, businesses are seeking fleet solutions that support eco-friendly practices. Fleet operators are adopting electric and hybrid vehicles to comply with emission standards and reduce their carbon footprint. Additionally, the introduction of more stringent regulations concerning fuel efficiency and environmental impact has prompted companies to use fleet management solutions that provide insights into energy consumption and emissions. This transition towards greener fleet solutions is not only driven by regulatory compliance but also by the desire to improve corporate social responsibility profiles and appeal to environmentally-conscious customers. For instance, in November 2024, Zain KSA launched a 100% Saudi-made fleet management system, incorporating local tracking devices and cloud capabilities. The system aims to streamline logistics, reduce fuel consumption, and lower carbon emissions, supporting sustainability efforts. Zain's commitment aligns with Saudi Vision 2030, promoting local content and innovation. This move supports the "Made in Saudi" program, contributing to the Kingdom's economic diversification by enhancing non-oil GDP. Additionally, Zain emphasizes the role of local talent and strategic partnerships to drive technological innovation.

Saudi Arabia Fleet Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2026-2034. Our report has categorized the market based on component, vehicle type, technology, deployment type, and end use sector. .

Component Insights:

- Solutions

- Fleet Telematics

- Driver Information Management

- Vehicle Maintenance

- Safety and Compliance Management

- Others

- Services

- Installation and Integration Services

- After-Sales Support Services

- Consulting Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solutions (fleet telematics, driver information management, vehicle maintenance, safety and compliance management, and others) and services (installation and integration services, after-sales support services, and consulting services).

Vehicle Type Insights:

- Commercial Vehicles

- Passenger Cars

- Aircrafts

- Watercrafts

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes commercial vehicles, passenger cars, aircrafts, and watercrafts.

Technology Insights:

- GNSS

- Cellular Systems

The report has provided a detailed breakup and analysis of the market based on the technology. This includes GNSS and cellular systems.

Deployment Type Insights:

- Cloud-based

- On-premises

- Hybrid

A detailed breakup and analysis of the market based on the deployment type have also been provided in the report. This includes cloud-based, on-premises, and hybrid.

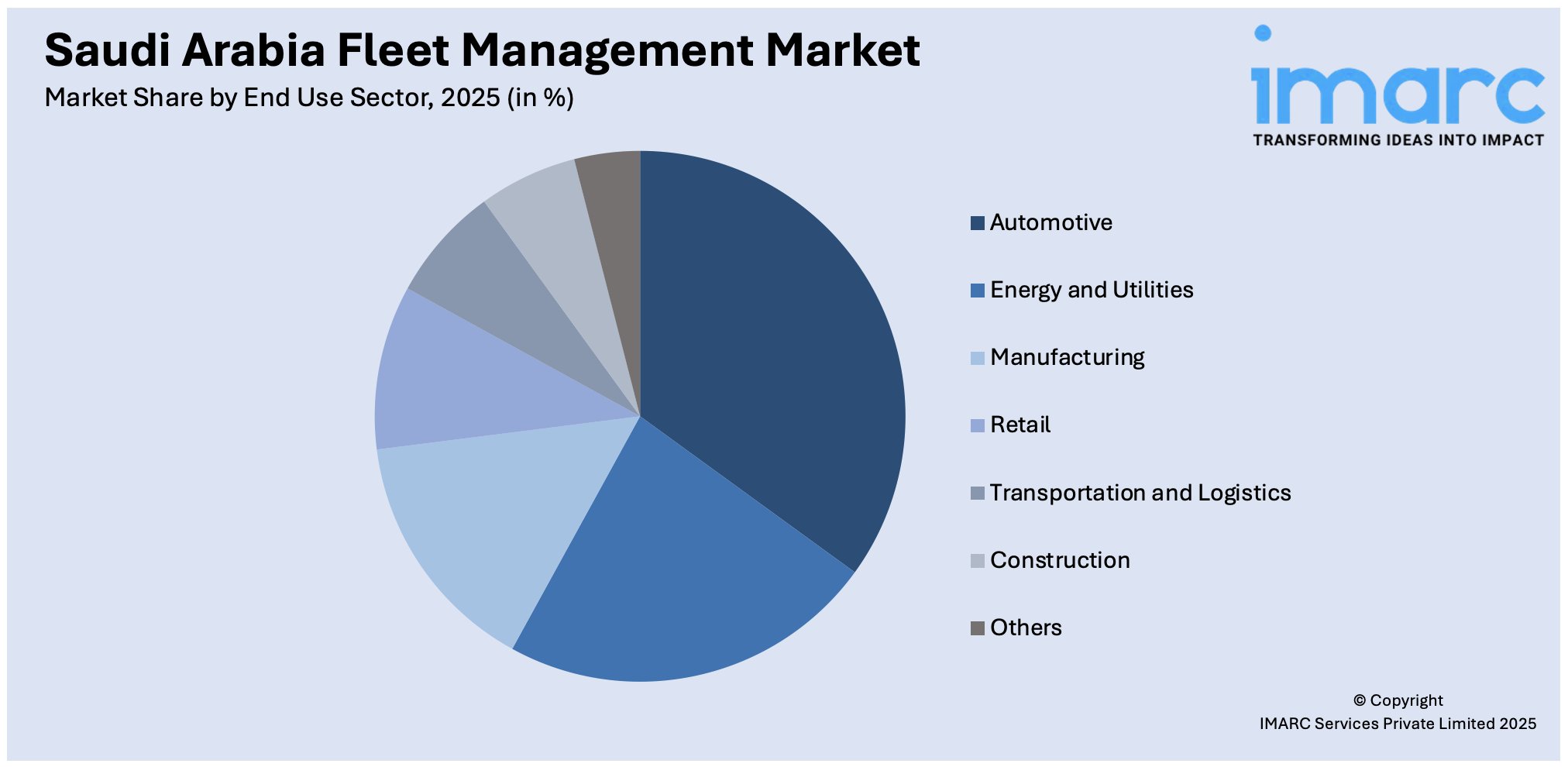

End Use Sector Insights:

Access the comprehensive market breakdown Request Sample

- Automotive

- Energy and Utilities

- Manufacturing

- Retail

- Transportation and Logistics

- Construction

- Others

The report has provided a detailed breakup and analysis of the market based on the end use sector. This includes automotive, energy and utilities, manufacturing, retail, transportation and logistics, construction, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Fleet Management Market News:

- In December 2024, Elm and Petromin formed a strategic partnership to deliver advanced digital fleet management solutions. This collaboration aims to enhance operational efficiency, support digital transformation, and foster a sustainable transportation system. Both companies are committed to contributing to Saudi Arabia’s Vision 2030 by improving fleet management technology and supporting the Kingdom's broader digital and sustainability goals. Elm's spokesperson highlighted the importance of this partnership in advancing technological capabilities and aligning with the Kingdom's objectives for digital transformation in transportation.

- In November 2024, Swvl signed a three-year contract with G4S in Saudi Arabia to provide SaaS-based mobility solutions. The agreement covers operations in Riyadh, Jeddah, and Dammam, managing over 14,000 monthly trips. Swvl will deliver a platform focused on route optimization, real-time fleet tracking, and advanced analytics to enhance fleet efficiency, reduce costs, and improve service quality. This partnership strengthens Swvl's presence in the Saudi market, aligning with the growing demand for efficient fleet management solutions.

Saudi Arabia Fleet Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Vehicle Types Covered | Commercial Vehicles, Passenger Cars, Aircrafts, Watercrafts |

| Technologies Covered | GNSS, Cellular Systems |

| Deployment Types Covered | Cloud-based, On-premises, Hybrid |

| End Use Sectors Covered | Automotive, Energy and Utilities, Manufacturing, Retail, Transportation and Logistics, Construction, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia fleet management market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia fleet management market on the basis of component?

- What is the breakup of the Saudi Arabia fleet management market on the basis of vehicle type?

- What is the breakup of the Saudi Arabia fleet management market on the basis of technology?

- What is the breakup of the Saudi Arabia fleet management market on the basis of deployment type?

- What is the breakup of the Saudi Arabia fleet management market on the basis of end use sector?

- What is the breakup of the Saudi Arabia fleet management market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia fleet management market?

- What are the key driving factors and challenges in the Saudi Arabia fleet management?

- What is the structure of the Saudi Arabia fleet management market and who are the key players?

- What is the degree of competition in the Saudi Arabia fleet management market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia fleet management market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia fleet management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia fleet management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)