Saudi Arabia Flexible Paper Packaging Market Size, Share, Trends and Forecast by Packaging Type, Application, and Region, 2026-2034

Saudi Arabia Flexible Paper Packaging Market Overview:

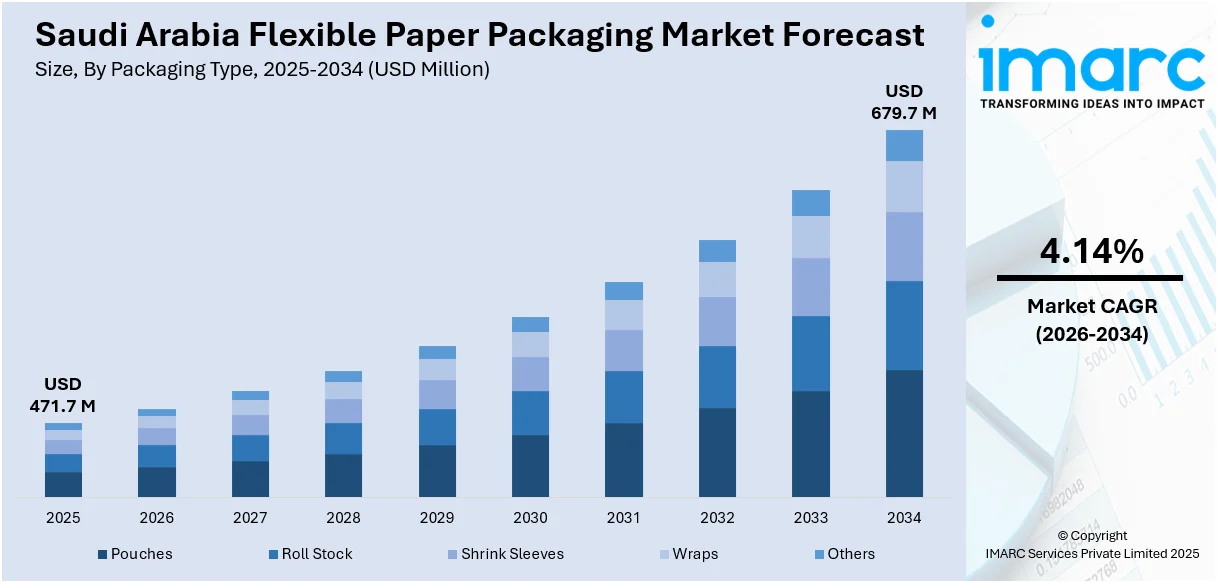

The Saudi Arabia flexible paper packaging market size reached USD 471.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 679.7 Million by 2034, exhibiting a growth rate (CAGR) of 4.14% during 2026-2034. The market is expanding steadily, driven by demand for sustainable alternatives, increased use in food and retail sectors, and support for environmentally friendly materials. Government-led green initiatives are also helping encourage adoption across industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 471.7 Million |

| Market Forecast in 2034 | USD 679.7 Million |

| Market Growth Rate 2026-2034 | 4.14% |

Saudi Arabia Flexible Paper Packaging Market Trends:

Increasing Demand for Green Packaging Solutions

Saudi Arabia is placing increasing emphasis on sustainability, and demand for environment friendly flexible paper packaging is on the rise. Businesses and end-users are becoming increasingly eco-friendly, choosing packaging that can be recycled as well as biodegradable. Companies are shifting from plastic to paper packaging to cater to global sustainability trends. The government is enforcing stricter plastic usage regulations, which is nudging the creation of green alternatives. This change is encouraging the development of the flexible paper packaging industry, as enterprises are trying to comply with regulations and the demands of green consumerism for eco-friendly packaging. The increased consciousness about environmental concerns, as well as growing green consumerism, is driving demand for flexible paper packaging in Saudi Arabia. In 2024, SABIC, a worldwide frontrunner in the chemical sector, declared the triumphant launch of the initial circular packaging initiative in Saudi Arabia as a component of its TRUCIRCLE™ program to speed up the establishment of a circular plastic economy. FONTE, a key participant in the bakery sector in the Kingdom of Saudi Arabia (KSA), has launched bread bags produced from SABIC's certified circular polyethylene (PE) for their Oat Arabic Bread. The bags are produced by Napco National, a Saudi manufacturer of flexible film and packaging solutions, utilizing two food-contact certified circular polyethylene resin grades (LLDPE) from SABIC’s TRUCIRCLE™ range.

To get more information on this market Request Sample

Increase in E-commerce and Online Shopping

The growth of online shopping and e-commerce in Saudi Arabia is directly responsible for the expansion of the flexible paper packaging market. With online shopping continuing to expand, the demand for effective, lightweight, and secure packaging is rising. Flexible paper packaging is emerging as the most suitable choice because it can offer cost-effective, protection, and light solutions for shipping products. E-commerce companies are opting for paper packaging in place of conventional plastic packaging, as it is seen to be eco-friendlier, in line with customer expectations. This growth in the market is also being driven by the high frequency of deliveries and a higher number of packaged items, both of which need flexible paper packaging for safety during transit. IMARC Group predicts that the Saudi Arabia E-commerce market is expected to attain USD 708.7 Billion by 2033.

Growing Customer Demand for Packaged Foods

Demand for packaged foods is growing in Saudi Arabia due to changing lifestyle and an increasing need for convenience. Urban working people are looking for quick, convenient-to-consume foods, which are driving demand for packaged food products. Flexible packaging paper is gaining popularity in the food industry due to the ability to safeguard the contents with product freshness. Moreover, it is a cost-effective and viable option for food manufacturers to provide packaged food products. Since consumer trends are moving toward convenience food consumption, the flexible paper packaging market is also witnessing steady growth, with packaging solutions forming an integral part of food distribution. In 2025, PepsiCo has launched its expanded facility in Dammam’s 2nd Industrial City, Saudi Arabia, after an investment of US$80 million. The facility, opened by His Excellency Bandar AlKhorayef, Minister of Industry and Mineral Resources, highlights the company’s dedication to promoting sustainable practices in the Middle East.

Saudi Arabia Flexible Paper Packaging Market Growth Drivers:

Technological Developments in Packaging Solutions

The ongoing developments in packaging technology are also propelling the flexible paper packaging market in Saudi Arabia in a major way. New technologies are enabling the production of stronger, tougher, and more versatile paper packaging material. Advances in printing technology are also making it possible for brands to add more appealing, high-quality graphics to their packaging, which is attractive to consumers. In addition, advances in barrier coatings are enabling flexible paper packaging to become better adapted to a wider variety of products, including liquids and fresh food. As technology advances, the market is moving towards more efficient manufacturing processes, cutting costs while enhancing packaging performance.

Support from the Government for the Manufacturing Industry

The government of Saudi Arabia is strongly supporting the development of the domestic manufacturing industry, including the packaging industry. Through programs such as Vision 2030, the government is promoting investment in sustainable industries, technological innovation, and local manufacturing capability. Such support is enabling the growth of flexible paper packaging manufacturing capabilities. Further, government policies are forcing manufacturers to meet environmental requirements, further driving the use of paper-based packaging. Such initiatives are encouraging the growth of innovative packaging solutions, enabling local businesses to reach both domestic and global markets for environmentally friendly packaging. Government policies and incentives are now becoming the driving forces for the growth of the flexible paper packaging industry.

Retail and Consumer Goods Sector Growth

The retail and consumer goods sector of Saudi Arabia is growing immensely, and this is driving the demand for flexible paper packaging directly. With the retail environment changing, as both conventional stores and new retail forms grow, the need for packaging that is not just functional but also attractive and convenient for consumer goods is on the rise. Flexible paper packaging is becoming increasingly appealing to retailers because it is light in weight, can be branded through printed patterns, and is versatile enough for products ranging from clothes to domestic items. As customers are increasingly becoming ready to buy packaged products from retail stores, packaging solutions that ensure convenience as well as sustainability are in increasing demand. This expanding market segment is thus playing a major role in the continued growth of the flexible paper packaging market in Saudi Arabia.

Saudi Arabia Flexible Paper Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on packaging type and application.

Packaging Type Insights:

- Pouches

- Roll Stock

- Shrink Sleeves

- Wraps

- Others

A detailed breakup and analysis of the market based on the packaging type have also been provided in the report. This includes pouches, roll stock, shrink sleeves, wraps, and others.

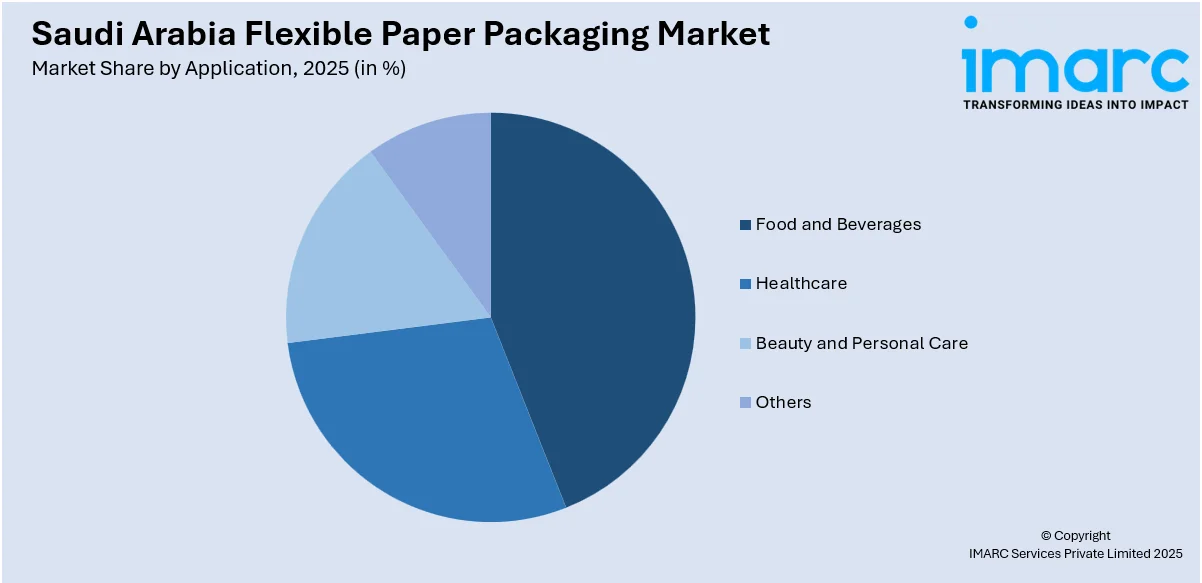

Application Insights:

Access the comprehensive market breakdown Request Sample

- Food and Beverages

- Healthcare

- Beauty and Personal Care

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes food and beverages, healthcare, beauty and personal care, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central region, Western region, Eastern region, and Southern region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Flexible Paper Packaging Market News:

- August 2025: Napco National has purchased Arabian Flexible Packaging, a well-established company in the flexible packaging industry. The agreement, starting August 1, 2025, via its Dubai-affiliated subsidiary Napco Investment LLC, aims to enhance the company’s regional growth while conforming to the UAE’s In-Country Value localization guidelines. Company officials stated that this acquisition combines Arabian Flexible Packaging’s skills in rotogravure printing with various substrates including polypropylene, polyester, nylon, polyethylene, foil, and paper.

- March 2025: SOMA appointed Printech Middle East as its official representative in Saudi Arabia and Kuwait for flexographic printing equipment. This move enhanced local access to advanced flexo press technology, supporting flexible paper packaging production and boosting technical support for regional converters and printers.

- August 2024: Alesayi Beverage Corporation, a leading Saudi beverage producer, is partnering with SIG to enhance product and packaging offerings. They will debut innovative bag-in-box products in hotels, restaurants, and cafes using the SIG SureFill 42 Aseptic BIB filling system. This initiative introduces Alesayi to the BIB market, leveraging SIG's expertise. The partnership includes supplying the SIG SureFill 42 Aseptic filling line and 10L SIG bags made from the SIG 2Pure Film, ensuring high-quality water preservation for a year without flavor alteration, complemented by the SIG OptiTap 2300 fitment for user-friendly dispensing.

Saudi Arabia Flexible Paper Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Packaging Types Covered | Pouches, Roll Stock, Shrink Sleeves, Wraps, Others |

| Applications Covered | Food and Beverages, Healthcare, Beauty and Personal Care, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia flexible paper packaging market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia flexible paper packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia flexible paper packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The flexible paper packaging market in Saudi Arabia was valued at USD 471.7 Million in 2025.

The Saudi Arabia flexible paper packaging market is projected to exhibit a CAGR of 4.14% during 2026-2034, reaching a value of USD 679.7 Million by 2034.

Key factors driving the Saudi Arabia flexible paper packaging market include the growing demand for sustainable packaging, expansion of e-commerce, increased consumer preference for packaged food, advancements in packaging technology, government support for local manufacturing, and heightened awareness of health and hygiene standards post-pandemic.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)