Saudi Arabia Floating Solar Farms Market Size, Share, Trends and Forecast by Location, Capacity, Size, Connectivity, Application, and Region, 2026-2034

Saudi Arabia Floating Solar Farms Market Overview:

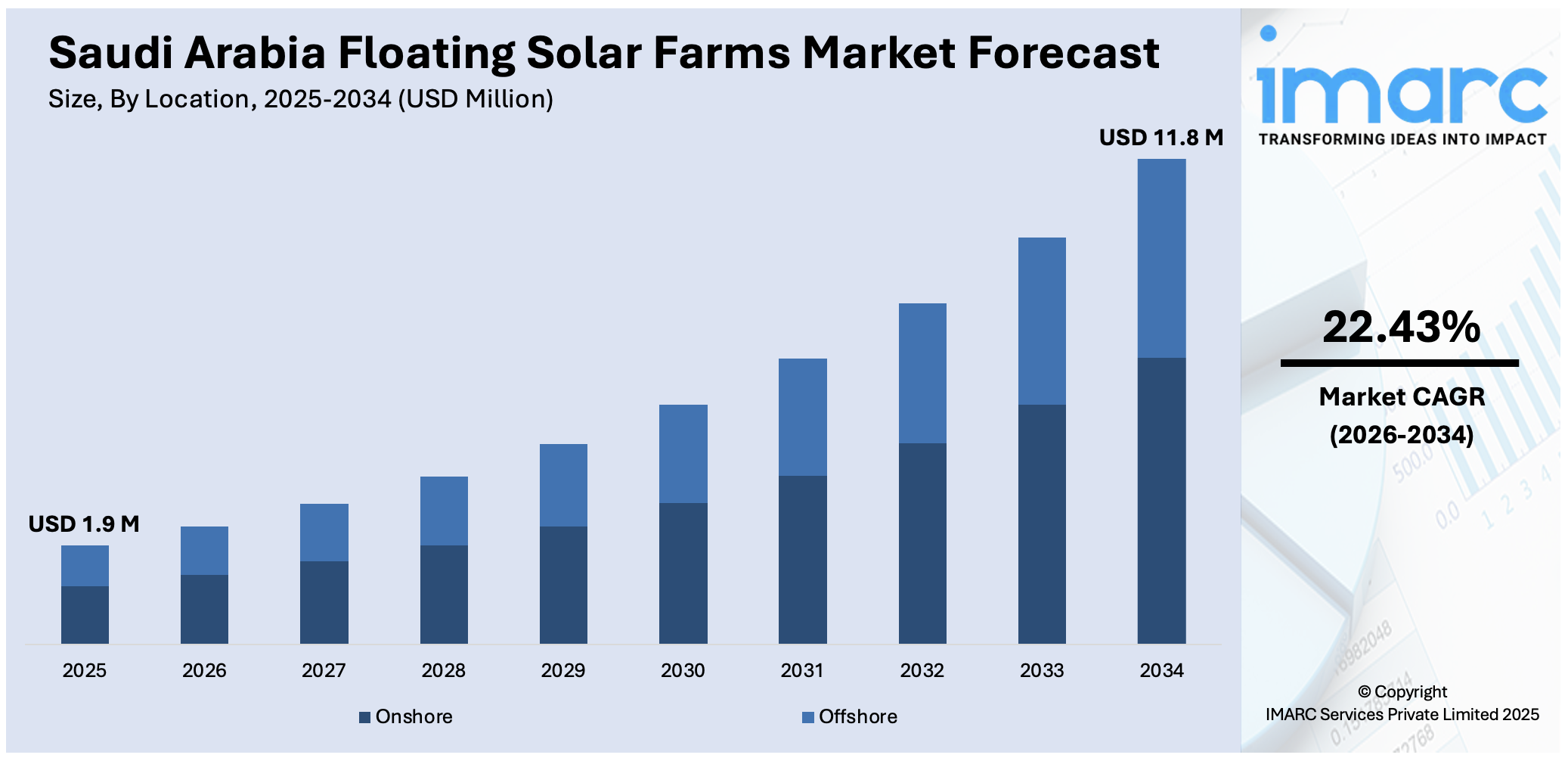

The Saudi Arabia floating solar farms market size reached USD 1.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 11.8 Million by 2034, exhibiting a growth rate (CAGR) of 22.43% during 2026-2034. Floating solar development in Saudi Arabia is gaining momentum through dam-based installations, improved project economics, and support for clean energy under Vision 2030. Collaborative ventures and site feasibility studies are also pushing adoption. These factors are expected to boost Saudi Arabia floating solar farms market share significantly.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.9 Million |

| Market Forecast in 2034 | USD 11.8 Million |

| Market Growth Rate 2026-2034 | 22.43% |

Saudi Arabia Floating Solar Farms Market Trends:

Improved Project Feasibility Through Localized Research

Growing technical assessments and data-backed feasibility studies are increasingly shaping Saudi Arabia’s floating solar strategy. With high solar irradiation levels and a scarcity of usable land in some areas, leveraging water surfaces for solar deployment is becoming a logical solution. Government and academic institutions are now focusing on understanding performance metrics at potential sites to ensure practical and profitable implementation. In January 2025, researchers evaluated floating solar installations at three Saudi dam sites King Fahd, Wadi Namar, and Wadi Hali. The analysis found that the King Fahd site, in particular, achieved a competitive LCOE of USD 0.053/kWh, with projected returns in 12–13 years. These insights gave confidence to stakeholders that floating solar is not only technically viable but also cost-efficient within the local climate and resource conditions. Such studies are accelerating the transition from planning to execution. They are expected to influence upcoming energy infrastructure investments focused on non-land-based solutions, directly contributing to Saudi Arabia floating solar farms market growth.

To get more information on this market Request Sample

International Collaboration Enhancing Market Competence

Strategic international ventures are helping Saudi developers refine their approach to floating solar deployment. By working with global partners, local firms are gaining exposure to diverse engineering practices and operational environments, which in turn supports more robust and scalable domestic projects. In August 2024, ACWA Power formed a joint venture with Indonesia’s PLN Indonesia Power to build a 60 MW floating solar facility on the Saguling Reservoir. This collaboration allowed Saudi entities to apply their project development experience beyond their borders while absorbing technical and logistical insights from Southeast Asian market conditions. The knowledge gained through such global engagement is expected to directly feed into domestic project planning, helping overcome regional challenges related to water body suitability, weather resilience, and supply chain design. This trend reflects a broader movement where Saudi Arabia is not only building internal capacity but also positioning itself as a capable contributor to the global clean energy space, particularly in specialized segments like floating solar.

Saudi Arabia Floating Solar Farms Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2026-2034. Our report has categorized the market based on location, capacity, size, connectivity, and application.

Location Insights:

- Onshore

- Offshore

The report has provided a detailed breakup and analysis of the market based on the location. This includes onshore and offshore.

Capacity Insights:

- Up to 1MW

- 1MW - 5MW

- Above 5MW

A detailed breakup and analysis of the market based on the capacity have also been provided in the report. This includes up to 1MW, 1MW - 5MW, and above 5MW.

Size Insights:

- Utility Scale

- Community

The report has provided a detailed breakup and analysis of the market based on the size. This includes utility scale and community.

Connectivity Insights:

- On grid

- Off grid

A detailed breakup and analysis of the market based on the connectivity have also been provided in the report. This includes on grid and off grid.

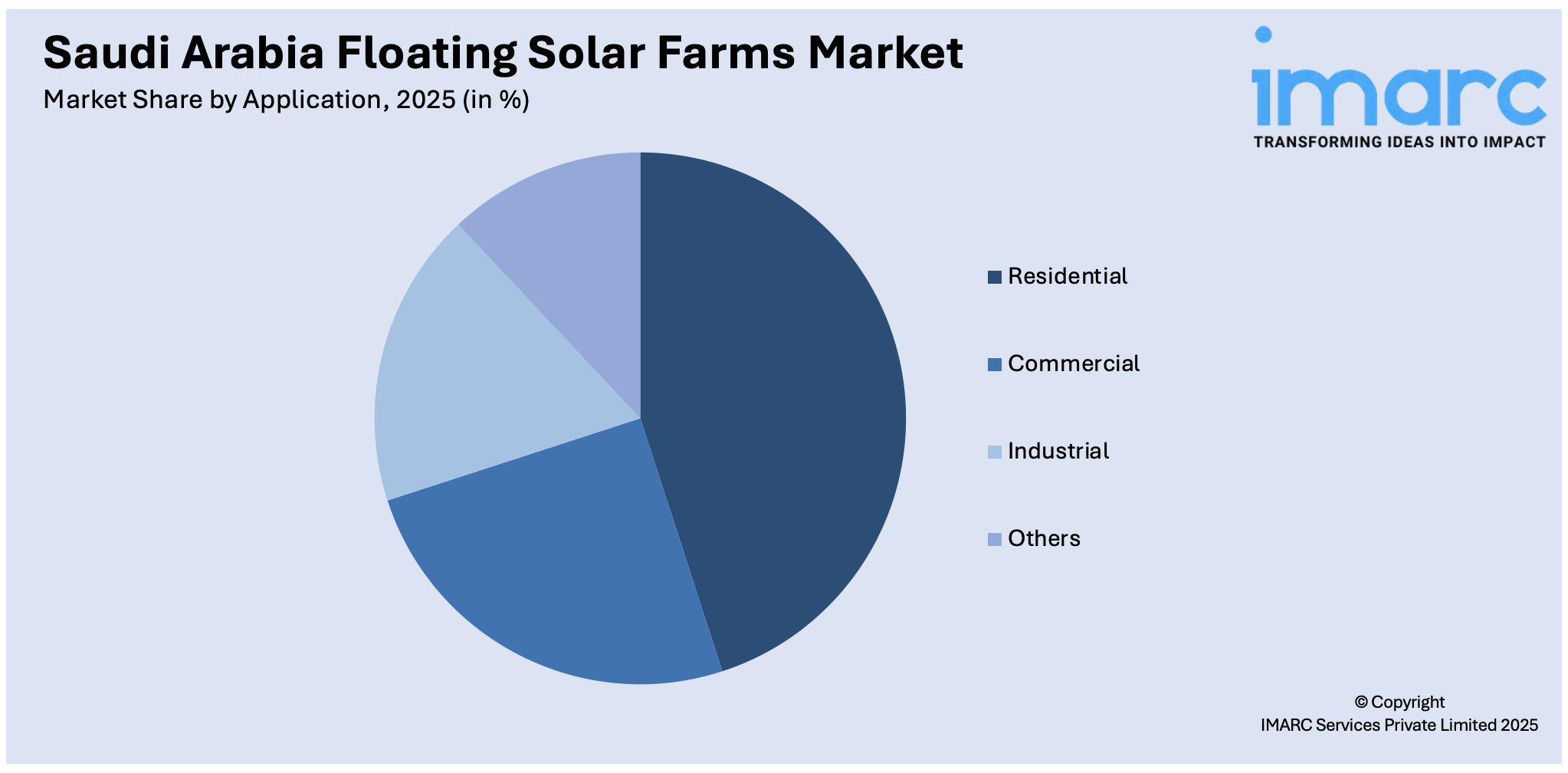

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

- Industrial

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential, commercial, industrial, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Floating Solar Farms Market News:

- April 2025: SWCC awarded Alfanar a contract to build a 110 MW floating solar plant to power the Jubail Desalination Plant. The project, including a 380 kV substation and 172 km transmission lines, reduced crude oil use and advanced Saudi Arabia's floating solar market momentum.

- August 2024: Saudi Arabia’s ACWA Power partnered with Indonesia’s PLN Indonesia Power to develop a 60 MW floating solar plant on Saguling Reservoir, West Java. This joint venture expanded Saudi Arabia’s floating solar footprint globally, enhancing its market presence and fostering international renewable energy collaboration.

Saudi Arabia Floating Solar Farms Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Locations Covered | Onshore, Offshore |

| Capacities Covered | Up to 1MW, 1MW - 5MW, Above 5MW |

| Sizes Covered | Utility Scale, Community |

| Connectivities Covered | On grid, Off grid |

| Applications Covered | Residential, Commercial, Industrial, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia floating solar farms market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia floating solar farms market on the basis of location?

- What is the breakup of the Saudi Arabia floating solar farms market on the basis of capacity?

- What is the breakup of the Saudi Arabia floating solar farms market on the basis of size?

- What is the breakup of the Saudi Arabia floating solar farms market on the basis of connectivity?

- What is the breakup of the Saudi Arabia floating solar farms market on the basis of application?

- What is the breakup of the Saudi Arabia floating solar farms market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia floating solar farms market?

- What are the key driving factors and challenges in the Saudi Arabia floating solar farms?

- What is the structure of the Saudi Arabia floating solar farms market and who are the key players?

- What is the degree of competition in the Saudi Arabia floating solar farms market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia floating solar farms market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia floating solar farms market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia floating solar farms industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)