Saudi Arabia Flower Market Size, Share, Trends and Forecast by Product Type, Application, Distribution Channel, and Region, 2026-2034

Saudi Arabia Flower Market Overview:

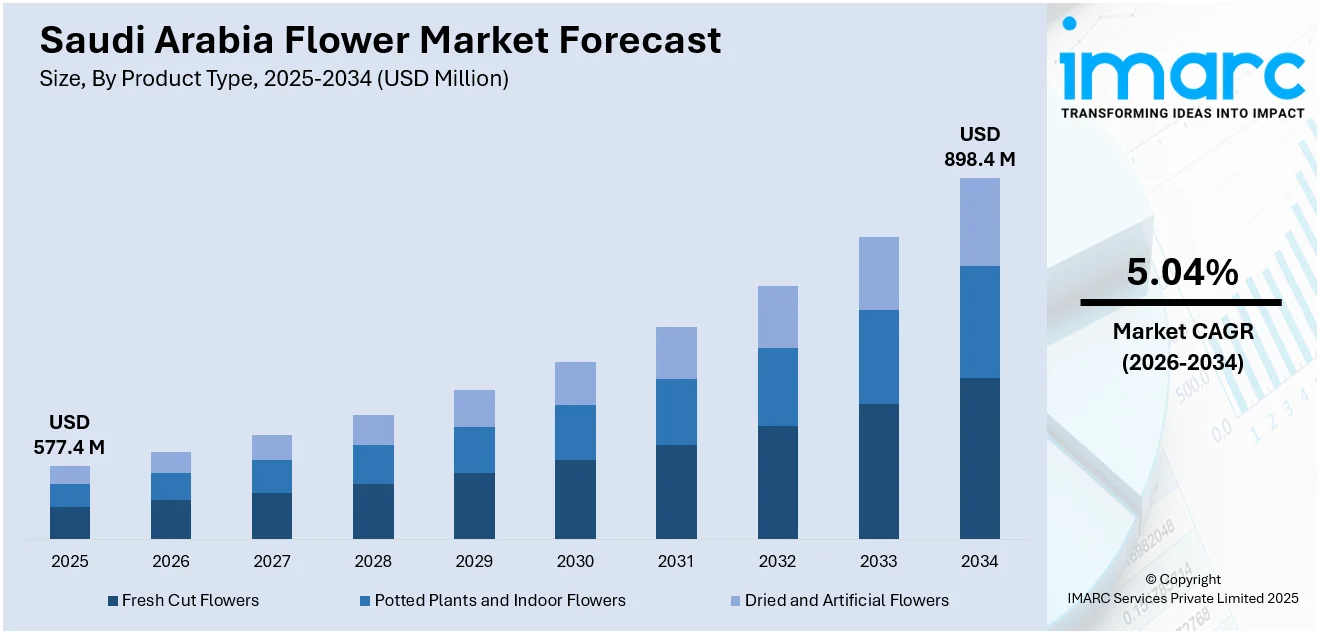

The Saudi Arabia flower market size reached USD 577.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 898.4 Million by 2034, exhibiting a growth rate (CAGR) of 5.04% during 2026-2034. The market is being driven by cultural and religious traditions, escalating demand for luxury floral arrangements at high-profile events, government support for tourism festivals showcasing floriculture, increasing disposable income among consumers, and the growing popularity of flowers in home décor and gifting trends across both urban and rural areas.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 577.4 Million |

| Market Forecast in 2034 | USD 898.4 Million |

| Market Growth Rate 2026-2034 | 5.04% |

Saudi Arabia Flower Market Trends:

Cultural and Religious Importance of Flowers

Flowers have deep cultural and religious importance in Saudi Arabia, particularly during festive occasions such as weddings, festivals, and religious celebrations. Cultural practices in Saudi Arabia are inextricably linked with flower use, and flowers are treated as symbols of beauty, respect, and love. The culture of giving flowers on Eid, weddings, and social gatherings is a long-established practice that enhances the demand for flowers in the domestic market. In Saudi Arabia, flowers such as roses, orchids, and lilies are frequently exchanged as a symbol of goodwill and friendship, and this makes the floriculture market part of cultural representation. Islamic practices also encourage beautifying the environment and using flowers frequently in religious practices and events. Adorning residential areas, mosques, and government buildings with flowers is a time-honored tradition that generates demand for flowers in the nation. This cultural significance has resulted in a consistent demand for local and imported blooms, particularly at peak festival times like Ramadan and Eid. Cultural practices and religious traditions continue to be amongst the most powerful motivations behind the Saudi flower market, with continuous progress and diversification of flowers being offered.

To get more information on this market Request Sample

Increasing Demand for Luxury and Event Flowers

Saudi Arabia boasts a growing luxury market, and this includes the floral market as well. The increase in the number of high-profile events, luxury weddings, corporate events, and private parties has driven the demand for high-end flowers. Luxury hotels, event planners, and affluent individuals require premium-quality flowers for lavish floral arrangements. Exotic and rare flowers like imported orchids, peonies, and hydrangeas are in great demand due to their stunning looks and rarity. High-end hotels and high-end restaurants in prominent cities such as Riyadh and Jeddah frequently adorn themselves with exquisite floral arrangements as part of their interior design, both as a source of attraction for clients and as a symbol of prestige. Growing numbers of high-net-worth individuals (HNWIs) in Saudi Arabia have developed a strong market for high-end floral arrangements and bespoke designs. The need for high-quality flowers with innovative designs has created propelling demand for custom floral services that meet the standards of their upscale customers. The luxury segment of the Saudi flower market has turned out to be one of the most significant contributors to the sector's development as florists and event planners remain keen on innovation to cater to the extravagant requests of their high-end customers.

Saudi Arabia Flower Market Growth Drivers:

Development of Retail Infrastructure and E-commerce Platforms

The development of retail infrastructure in Saudi Arabia, encompassing modern malls, specialized flower boutiques, and dedicated floral sections in large retail chains, are enhancing the accessibility and variety of flowers available to buyers. This expansion is instrumental in offering buyers a more convenient and diverse shopping experience. Furthermore, the rapid rise of e-commerce and digital platforms is transforming purchasing behavior, making it easier for people to browse, select, and order flowers for both everyday use and special occasions. This digital shift accommodates the fast-paced lifestyles of urban individuals by supporting both planned and impulse purchases. Notably, the International Trade Administration (ITA) projected that the number of internet users participating in e-commerce in Saudi Arabia will reach 33.6 million by 2024, underscoring the growing relevance of online retail. In addition, enhanced logistics and delivery services further support this trend by ensuring freshness and timely distribution, reinforcing the market's responsiveness to evolving user expectations.

Government Initiatives

A major factor contributing to the growth of Saudi Arabia’s flower market is the growing investment by governing body on in domestic floriculture, undertaken as part of its broader agricultural and economic diversification agenda under Vision 2030. These efforts seek to improve self-reliance, lessen reliance on flower imports, and encourage sustainable farming methods. Through enhancing local production capabilities, the governing authority aims to boost the accessibility, quality, and cost-effectiveness of floral items in the Kingdom. In 2024, Saudi Arabia's Ministry of Environment, Water, and Agriculture announced five agricultural investment projects in Al-Baha, including the cultivation of coffee, palm trees, and flowers. The projects aimed to boost food security and self-sufficiency in line with Vision 2030. As a result, the growth of local floriculture fosters rural advancement, promotes employment opportunities, and strengthens the lasting stability and competitiveness of the Saudi flower market amid the changing national economy.

Technological Innovation

Technological advancements are becoming a crucial catalyst for expansion in Saudi Arabia’s flower industry, especially with the implementation of progressive agricultural methods like vertical farming. These approaches provide effective solution to the difficulties presented by the area's dry climate and scarce cultivable land. Key players and research institutes are responding by focusing on research operations, which is exemplified by the Saudi researchers at King Abdulaziz City for Science and Technology (KACST) in 2025. They developed innovative vertical farming technologies that allow saffron flowers to be cultivated in just 10 days. This method significantly reduces the time compared to traditional farming, addressing food security and economic sustainability. The effective use of this technology on high-value plants such as saffron showcases the possibility for broader implementation throughout the floriculture industry. With the refinement and scaling of these techniques, they are improving local flower production, reducing dependence on imports, and supporting the broader goals of Saudi Arabia for agricultural and economic diversification.

Saudi Arabia Flower Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on product type, application, and distribution channel.

Product Type Insights:

- Fresh Cut Flowers

- Potted Plants and Indoor Flowers

- Dried and Artificial Flowers

The report has provided a detailed breakup and analysis of the market based on the product type. This includes fresh cut flowers, potted plants and indoor flowers, and dried and artificial flowers.

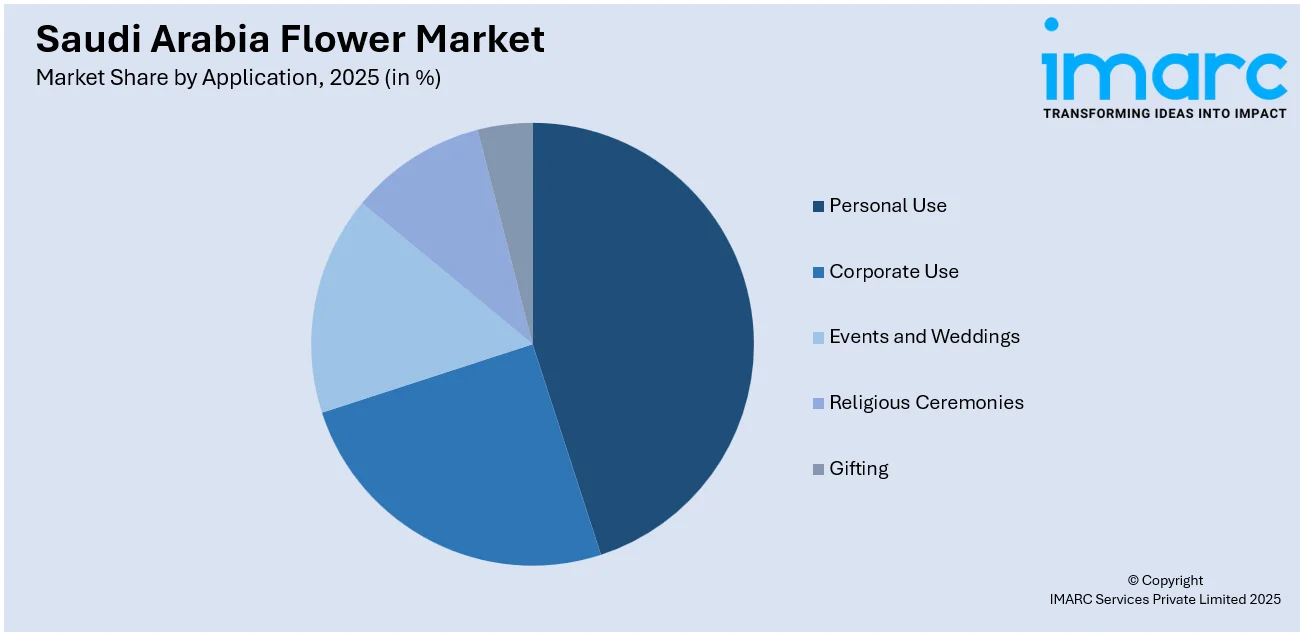

Application Insights:

Access the comprehensive market breakdown Request Sample

- Personal Use

- Corporate Use

- Events and Weddings

- Religious Ceremonies

- Gifting

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes personal use, corporate use, events and weddings, religious ceremonies, and gifting.

Distribution Channel Insights:

- Online Retail

- Offline Retail

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online retail and offline retail.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Flower Market News:

- May 2025: Floward launched MENA’s first robotic flower vending machine, offering a fully automated, tech-enabled shopping experience for flowers in Saudi Arabia, UAE, Qatar, and Kuwait. The machines feature real-time order fulfillment, card printing for personalized messages, and an automated water-spraying system for freshness

- February 2025: The Yanbu Flower Festival 2025 is scheduled to run until February 27, 2025, featuring an array of stunning floral displays, interactive exhibits, and family-oriented activities. Attendees can explore expansive flower carpets, intricate installations, and meticulously curated garden exhibits.

- February 2025: The largest indoor vertical farming facility in Saudi Arabia has been finalized in Riyadh, representing a significant achievement in the nation’s agricultural industry. The facility, covering 20,000 square meters and created through a partnership involving Mowreq, VFCo, and YesHealth Group, employs AI and automation to enhance food security. The farm grows a variety of crops, such as lettuces, cruciferous vegetables, baby greens, and edible blooms.

- February 2025: The fourth edition of the Flower Festival in Qatif, Saudi Arabia, is showcasing over 800,000 seasonal flowers and a variety of activities over 12 days. Organized by the Eastern Province municipality, the event aims to boost local tourism and promote cultural engagement.

- December 2024: Taif roses and henna have been added to UNESCO's Intangible Cultural Heritage list, recognizing their cultural significance in Saudi Arabia. Henna symbolizes joy and community, while the Taif rose, cultivated in the Al-Hada mountains, has been integral to local history and economy.

- March 2024: FLORY, a company focused on transforming Saudi Arabia's floral market, announced the launch of its event in Jeddah from March 20-22. The event, hosted at the historic Sharbatly House, showcased a range of flowers, offering workshops and floral experiences. FLORY aimed to make flowers a daily part of life in the Kingdom, blending tradition with modern floristry.

- January 2025: The Baha Winter Festival in Al-Makhwah governorate featured a 360-square-meter flower carpet made from 50,000 seedlings, attracting visitors and boosting local tourism. This event highlights the region's potential for floral tourism and cultural events. The festival's success underscores the escalating demand for locally produced flowers and the economic benefits of such initiatives.

- April 2024: The 19th Taif Rose Festival, themed 'Qetaf' or 'Picking Time', commenced Al-Raddaf Park, coinciding with the rose harvest season. The festival features a floral carpet of over a million flowers, showcasing the region's rich horticultural heritage.

Saudi Arabia Flower Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Fresh Cut Flowers, Potted Plants and Indoor Flowers, Dried and Artificial Flowers |

| Applications Covered | Personal Use, Corporate Use, Events and Weddings, Religious Ceremonies, Gifting |

| Distribution Channels Covered | Online Retail, Offline Retail |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia flower market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia flower market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia flower industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The flower market in Saudi Arabia was valued at USD 577.4 Million in 2025.

The Saudi Arabia flower market is projected to exhibit a CAGR of 5.04% during 2026-2034, reaching a value of USD 898.4 Million by 2034.

The Saudi Arabia flower market is driven by rising disposable incomes, the growing demand for decorative and gifting purposes, and expanding e-commerce platforms. Changing user preferences toward premium floral products and heightened interest in landscaping and interior aesthetics also contribute to the market growth. Additionally, government initiatives supporting tourism and entertainment sectors further are strengthening the market growth and diversification.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)