Saudi Arabia Food Additives Market Size, Share, Trends and Forecast by Product Type, Source, Application, and Region, 2026-2034

Saudi Arabia Food Additives Market Overview:

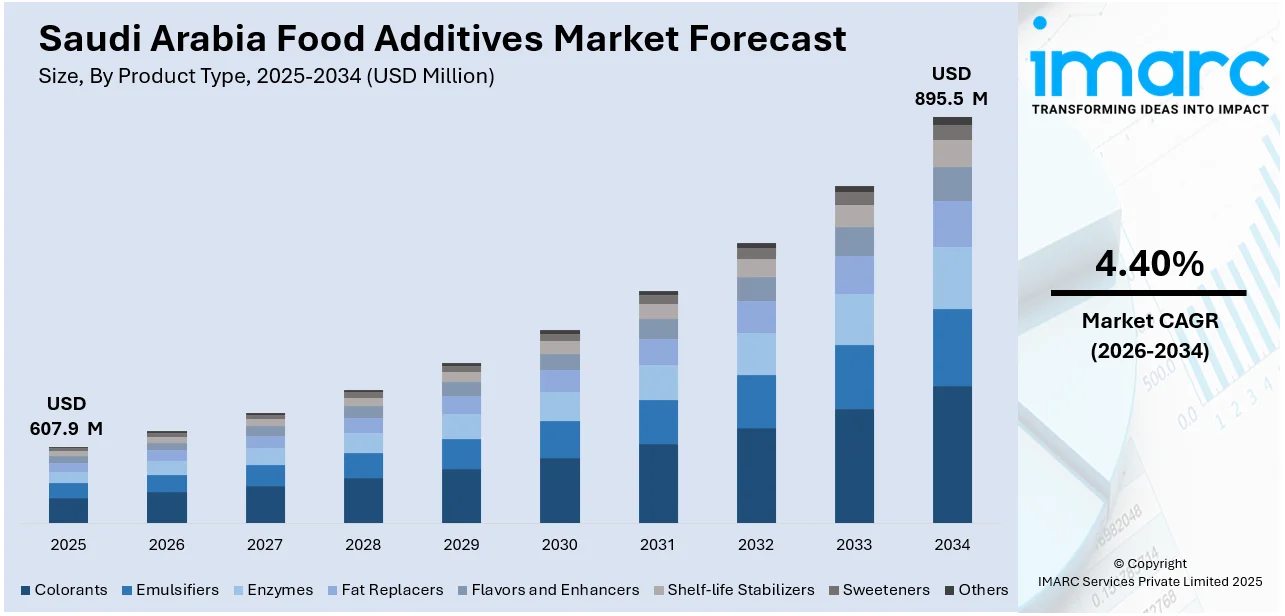

The Saudi Arabia food additives market size reached USD 607.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 895.5 Million by 2034, exhibiting a growth rate (CAGR) of 4.40% during 2026-2034. The market is witnessing significant growth, driven by rising demand for packaged, processed, and convenience foods amid changing dietary habits and urban lifestyles. Growth in the bakery, beverage, and dairy sectors is also increasing the use of additives for flavor, preservation, and texture enhancement. Regulatory focus on food safety and rising consumer interest in functional ingredients are further positively contribute to the Saudi Arabia food additives market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 607.9 Million |

| Market Forecast in 2034 | USD 895.5 Million |

| Market Growth Rate 2026-2034 | 4.40% |

Saudi Arabia Food Additives Market Trends:

Rising Demand for Processed and Convenience Foods

In Saudi Arabia, rapid urbanization and evolving consumer lifestyles are fueling a growing demand for processed and convenience foods. With more dual-income households and busy work routines, consumers are increasingly opting for ready-to-eat meals, frozen items, snacks, and packaged foods that offer time-saving meal solutions. This shift has significantly increased the use of food additives, which help enhance product shelf life, maintain flavor and texture, and ensure food safety during distribution and storage. The expanding retail sector, along with the popularity of modern grocery formats and e-commerce, is also making processed foods more accessible across urban and semi-urban areas. Food manufacturers are actively reformulating products to meet rising expectations for taste, appearance, and convenience, all of which depend heavily on additive technologies. This trend is becoming a key growth driver for the Saudi Arabia food additives market.

To get more information on this market Request Sample

Shift Toward Clean-Label Ingredients

The growing health awareness among consumers in Saudi Arabia is driving a noticeable shift toward clean-label food products. Shoppers are increasingly scrutinizing ingredient lists, favoring natural and minimally processed additives derived from plant, fruit, or microbial sources. Additives such as natural colorants, plant-based preservatives, and organic emulsifiers are gaining popularity in bakery, dairy, and beverage categories. This demand is further fueled by concerns over artificial chemicals, allergens, and long-term health effects associated with synthetic compounds. Food companies are responding by reformulating existing products, highlighting clean-label claims on packaging, and ensuring transparency in labeling practices. Regulatory support and retailer emphasis on natural formulations are reinforcing this transition. As clean-label preferences become mainstream, they are not only reshaping product development but also playing a key role in driving consumer trust and accelerating Saudi Arabia food additives market growth.

Growth in Halal-Certified Additives

In Saudi Arabia, where halal dietary compliance is a fundamental consumer requirement, the demand for halal-certified food additives is witnessing strong growth. Food manufacturers are increasingly prioritizing the use of ingredients that meet Islamic dietary laws, covering not just the final product but also all processing agents and additives involved in production. This includes emulsifiers, enzymes, colorants, and preservatives that are free from non-halal sources such as pork derivatives or alcohol-based solvents. Certification from recognized halal authorities has become essential for ensuring product acceptability among consumers and retailers. Additionally, the rising export potential of Saudi-made halal food products to other Muslim-majority markets is reinforcing the importance of certified additives. As awareness and enforcement of halal standards intensify, the adoption of halal-compliant additives is becoming a key trend, supporting both product integrity and competitive advantage in the regional food additives market.

Saudi Arabia Food Additives Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type, source, and application.

Product Type Insights:

- Colorants

- Synthetic Food Colorants

- Natural Food Colorants

- Emulsifiers

- Mono, Di-glycerides and Derivatives

- Lecithin

- Sorbate Esters

- Enzymes

- Carbohydrase

- Protease

- Lipase

- Fat Replacers

- Protein

- Starch

- Others

- Flavors and Enhancers

- Natural Flavors

- Artificial Flavors and Enhancers

- Shelf-life Stabilizers

- Sweeteners

- HIS

- HFCS

- Others

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes colorants (synthetic food colorants and natural food colorants), emulsifiers (mono, di-glycerides and derivatives, lecithin and sorbate esters), enzymes (carbohydrase, protease, and lipase), fat replacers (protein, starch, and others), flavors and enhancers (natural flavors and artificial flavors, and enhancers), shelf-life stabilizers, sweeteners (HIS, HFCS, and others), and others.

Source Insights:

- Natural

- Synthetic

A detailed breakup and analysis of the market based on the source have also been provided in the report. This includes natural and synthetic.

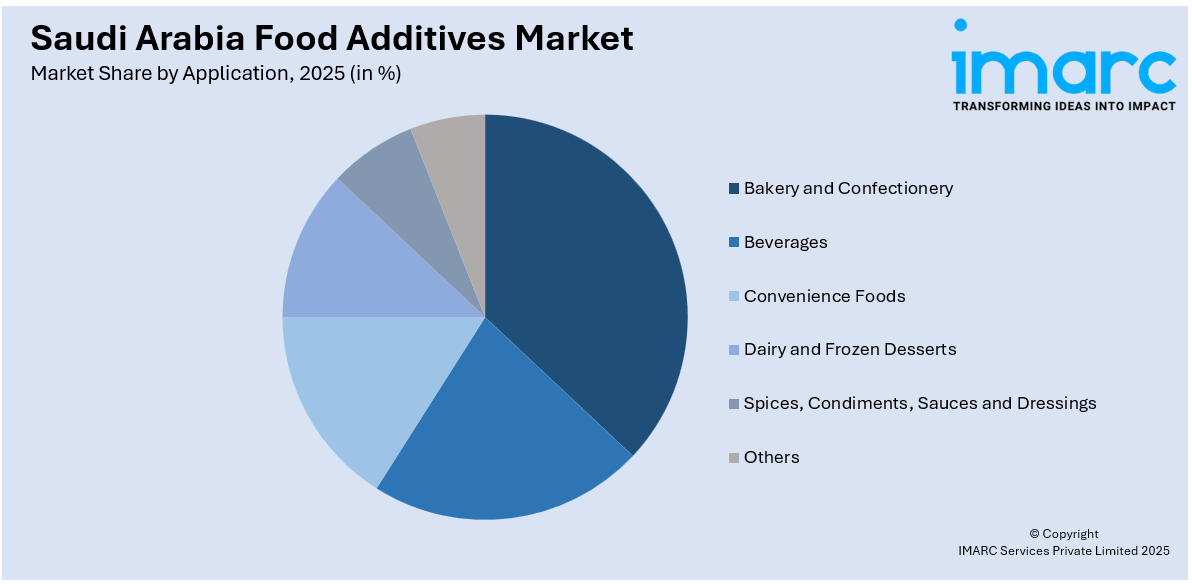

Application Insights:

Access the comprehensive market breakdown Request Sample

- Bakery and Confectionery

- Beverages

- Convenience Foods

- Dairy and Frozen Desserts

- Spices, Condiments, Sauces and Dressings

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes bakery and confectionery, beverages, convenience foods, dairy and frozen desserts, spices, condiments, sauces and dressings, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Food Additives Market News:

- In April 2025, Food Specialities Limited (FSL) and Kerry Group announced a strategic partnership at SaudiFood Manufacturing 2025, aiming to enhance product offerings in the food industry. The collaboration focuses on emulsifiers and shelf life solutions, leveraging local expertise and distribution networks to improve service for bakery, confectionery, and dairy sectors in the region.

- In April 2025, Saudi Arabia launched a major dairy industrial cluster in Al-Kharj as part of its National Industrial Strategy. Spanning 1 million sq. m, it aims to enhance food security and attract investments, focusing on dairy production and related sectors, including food additives. The initiative highlights Saudi Arabia's resilience in dairy output.

Saudi Arabia Food Additives Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Sources Covered | Natural, Synthetic |

| Applications Covered | Bakery and Confectionery, Beverages, Convenience Foods, Dairy and Frozen Desserts, Spices, Condiments, Sauces and Dressings, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia food additives market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia food additives market on the basis of product type?

- What is the breakup of the Saudi Arabia food additives market on the basis of source?

- What is the breakup of the Saudi Arabia food additives market on the basis of application?

- What is the breakup of the Saudi Arabia food additives market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia food additives market?

- What are the key driving factors and challenges in the Saudi Arabia food additives market?

- What is the structure of the Saudi Arabia food additives market and who are the key players?

- What is the degree of competition in the Saudi Arabia food additives market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia food additives market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia food additives market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia food additives industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)