Saudi Arabia Food Sweetener Market Size, Share, Trends and Forecast by Product Type, Application, Distribution Channel, and Region, 2026-2034

Saudi Arabia Food Sweetener Market Overview:

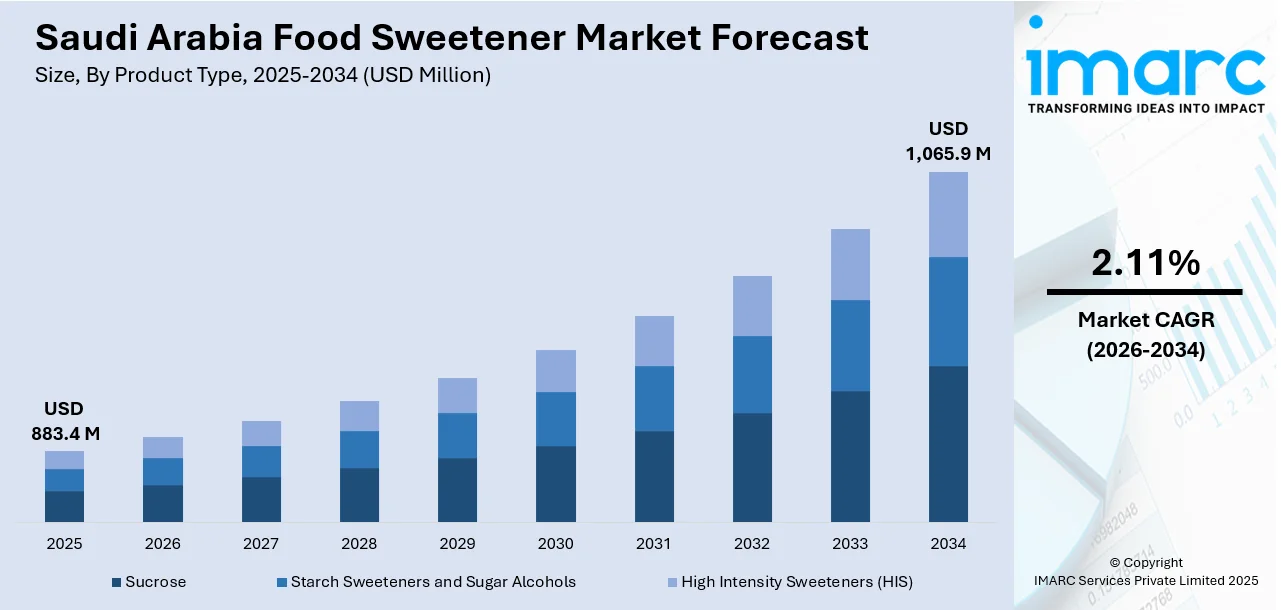

The Saudi Arabia food sweetener market size reached USD 883.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,065.9 Million by 2034, exhibiting a growth rate (CAGR) of 2.11% during 2026-2034. The market is growing due to government regulations aimed at reducing sugar intake, driving investment in healthier, low-calorie alternatives. The expanding processed food industry and the rise of online retail further catalyzing the demand for sweeteners, as convenience and health-consciousness increases. Additionally, digital marketing and e-commerce are influencing consumer awareness, enabling access to a broader range of specialty sweeteners, and expanding the Saudi Arabia food sweetener market share by promoting healthier product choices.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 883.4 Million |

| Market Forecast in 2034 | USD 1,065.9 Million |

| Market Growth Rate 2026-2034 | 2.11% |

Saudi Arabia Food Sweetener Market Trends:

Government Regulations and Sugar Reduction Policies

The governing body in Saudi Arabia is implementing regulations designed to limit sugar intake, which is vital in influencing the market for food sweeteners. Initiatives like sugar taxes on sweet drinks and required front-of-pack labeling have forced food and beverage (F&B) firms to alter their products using different sweeteners. These rules are integral to the larger Vision 2030 framework, which prioritizes enhancement of public health as a national objective. As businesses work to prevent financial repercussions and adverse reputations, there is an increase in investment in research and development (R&D) aimed at producing appealing, lower-sugar items with non-nutritive or low-calorie sweeteners. The regulatory drive also encourages the development of sweetener mixtures that satisfy both flavor and health criteria. This legislative framework not only promotes healthier consumer decisions but also generates market incentives for suppliers and manufacturers to embrace alternative sweetening options, thus speeding up market expansion and diversification. In 2024, the Saudi Food and Drug Authority (SFDA) announced new regulations for restaurants and delivery apps, starting November 30, 2024, and July 1, 2025. These included mandatory disclosure of calories, allergens, caffeine, and high-sodium content on menus. The regulations, consistent with Saudi Vision 2030, aimed to lower sugar, salt, and saturated and transformed fats in food products, encouraging healthier consumer choices.

To get more information on this market Request Sample

Expanding Processed and Packaged Food Industry

With lifestyles becoming more fast-paced, there is a rise in demand for convenient, ready-to-eat (RTE), and shelf-stable food products that often require sweeteners for flavor enhancement, texture, preservation, and consumer appeal. The growth of local production capabilities, along with the arrival of international food brands, is leading to a strong need for reliable and cost-effective sweetening solutions. Moreover, the retail industry is changing with the rise of contemporary supermarkets and online shopping platforms, increasing availability of processed food items that use alternative sweeteners. Additionally, Saudi Arabia's food packaging industry achieved USD 1,741.4 million in 2024 and is expected to expand to USD 2,552.5 million by 2033, demonstrating a CAGR of 4.25% (2025–2033), indicating the sector's growth trajectory. This expansion enhances overall food innovation and reformulation, allowing manufacturers to create sweetened items that match evolving consumer desires for flavor, convenience, and health-focused components. The expansion of the processing and food packaging industry is supporting the Saudi Arabia food sweetener market growth, as manufacturers focus on meeting the increasing demand for healthier and more versatile sweetening options.

Digital Marketing and E-Commerce Influence

The growth of digital marketing and e-commerce is greatly influencing consumer awareness and availability of food products with alternative sweeteners in Saudi Arabia. As smartphone usage becomes more common and digital skills increase, a larger number of people are interacting with online material that encourages low-sugar living, dietary movements, and health-aware decisions. Platforms that showcase influencer endorsements, nutritional tips, and product reviews are assisting in informing consumers about the advantages of different sweeteners and their appropriateness for diets like keto, diabetic-friendly, or calorie-restricted plans. E-commerce enhances this effect by providing a wider selection of specialty sweeteners, such as imported and niche items usually absent from physical stores. Smaller brands and health-oriented startups can connect with national audiences without depending on conventional retail channels. The International Trade Administration (ITA) estimates that the count of Saudi internet users engaging in e-commerce will hit 33.6 million by 2024, marking a 42% rise since 2019. This increase in digital use is broadening consumer options and driving steady demand for innovative food products based on sweeteners.

Saudi Arabia Food Sweetener Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type, application, and distribution channel.

Product Type Insights:

- Sucrose

- Starch Sweeteners and Sugar Alcohols

- Dextrose

- High Fructose Corn Syrup (HFCS)

- Maltodextrin

- Sorbitol

- Xylitol

- Others

- High Intensity Sweeteners (HIS)

- Sucralose

- Stevia

- Aspartame

- Saccharin

- Neotame

- Acesulfame Potassium (Ace-K)

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes sucrose, starch sweeteners and sugar alcohols (dextrose, high fructose corn syrup (HFCS), maltodextrin, sorbitol, xylitol, and others), and high intensity sweeteners (HIS) (sucralose, stevia, aspartame, saccharin, neotame, acesulfame potassium (Ace-K), and others).

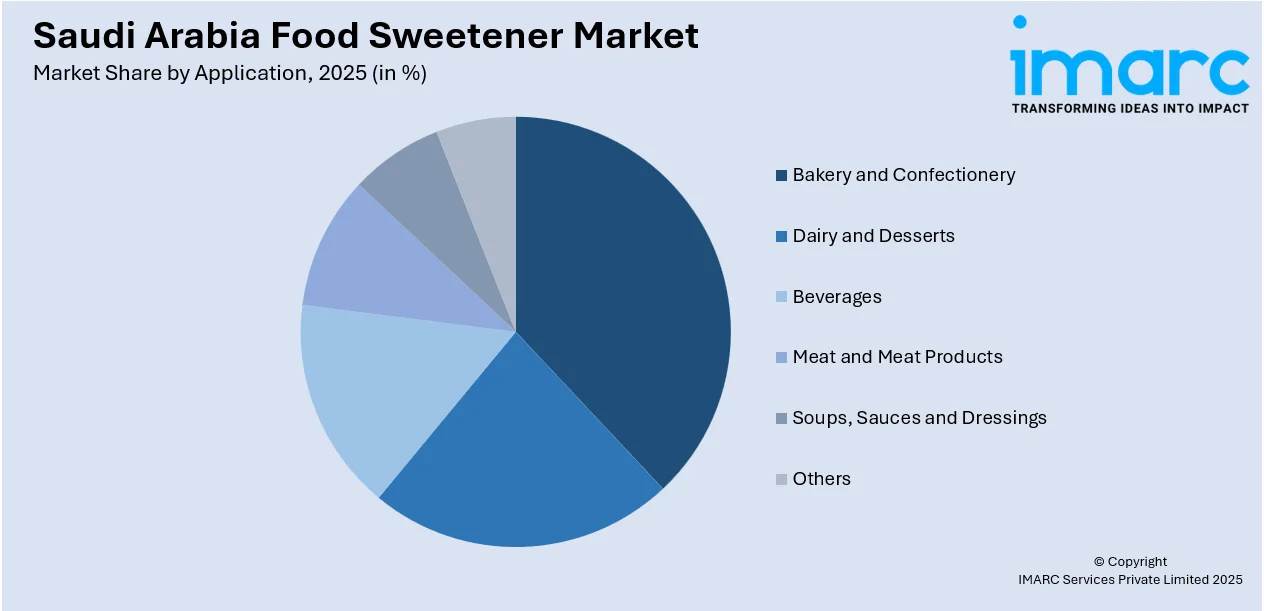

Application Insights:

Access the comprehensive market breakdown Request Sample

- Bakery and Confectionery

- Dairy and Desserts

- Beverages

- Meat and Meat Products

- Soups, Sauces and Dressings

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes bakery and confectionery, dairy and desserts, beverages, meat and meat products, soups, sauces and dressings, and others.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Departmental Stores

- Convenience Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, departmental stores, convenience stores, online stores, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Food Sweetener Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Applications Covered | Bakery and Confectionery, Dairy and Desserts, Beverages, Meat and Meat Products, Soups, Sauces and Dressings, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Departmental Stores, Convenience Stores, Online Stores, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia food sweetener market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia food sweetener market on the basis of product type?

- What is the breakup of the Saudi Arabia food sweetener market on the basis of application?

- What is the breakup of the Saudi Arabia food sweetener market on the basis of distribution channel?

- What is the breakup of the Saudi Arabia food sweetener market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia food sweetener market?

- What are the key driving factors and challenges in the Saudi Arabia food sweetener market?

- What is the structure of the Saudi Arabia food sweetener market and who are the key players?

- What is the degree of competition in the Saudi Arabia food sweetener market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia food sweetener market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia food sweetener market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia food sweetener industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)