Saudi Arabia Forklift Trucks Market Size, Share, Trends and Forecast by Product Type, Technology, Class, Application, and Region, 2026-2034

Saudi Arabia Forklift Trucks Market Overview:

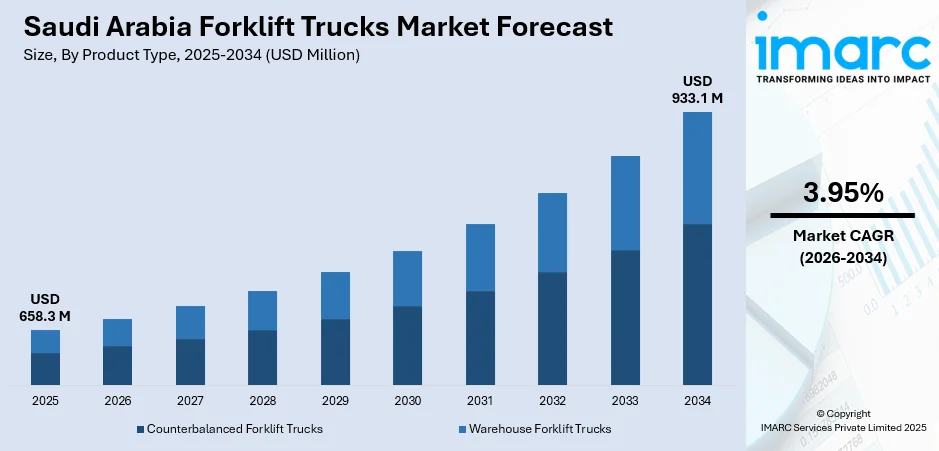

The Saudi Arabia forklift trucks market size reached USD 658.3 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 933.1 Million by 2034, exhibiting a growth rate (CAGR) of 3.95% during 2026-2034. The market is driven by industrial development, particularly in construction, logistics, and manufacturing industries, growing infrastructure projects, greater trading activity, and expansion of warehouses and distribution centers spur demand. Moreover, government efforts toward economic diversification and automation also drive the demand for effective material handling equipment.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 658.3 Million |

| Market Forecast in 2034 | USD 933.1 Million |

| Market Growth Rate 2026-2034 | 3.95% |

Saudi Arabia Forklift Trucks Market Trends:

Growing Industrial Innovation and Infrastructure Growth

Saudi Arabia is in the process of going through massive industrialization and infrastructure growth, with Vision 2030 being a major driving force towards this change. The kingdom is constantly constructing new industrial areas, commercial centers, manufacturing plants, and infrastructure mega projects like roads, airports, and railway systems. In 2025, The Royal Commission for Riyadh City, in collaboration with the National Center for Privatization & PPP and Qiddiya Investment Company, has initiated the registration phase for firms and organizations competing to execute the initial phase of the Qiddiya high-speed rail project, based on a public-private partnership model. These advances are generating an increasing demand for sophisticated material handling solutions, and forklift trucks are becoming an essential instrument in these industries. As the number of manufacturing and construction activities increases, businesses need to find effective means of transporting heavy goods, storing products, and optimizing warehouse processes.

To get more information on this market, Request Sample

Expansion in E-commerce and Retail Sector

Saudi Arabia's retailing and e-commerce sectors are presently growing due to shifting consumer tastes, advancements in technology, and the opening up of the digital economy. This boom is creating huge demand for logistics solutions, especially in warehouse and distribution center operations. With the transition toward online shopping, retailers and e-commerce powerhouses are constantly investing in cutting-edge fulfillment centers to deliver customer expectations of speedy, high-quality deliveries. Forklift trucks are a crucial part of such facilities since they assist in effectively controlling inventory, loading and offloading materials, and in ensuring products are stored and transported in an orderly fashion. As the trend of shopping online becomes more popular, the need for rapid and precise order fulfillment is also on the rise, putting more pressure on warehouses to run effectively. To achieve these requirements, most of the Saudi Arabian companies are going for forklifts that are capable of improving the speed and accuracy of operations, such as automated guided vehicles (AGVs) and electric forklifts that minimize carbon emissions as well as operating costs. This increase in warehouse development, coupled with the demand for efficient logistics networks, is increasingly fueling the forklift industry's growth, as companies seek to address the rising need for efficient material handling in the retail and online shopping markets. IMARC Group predicts that the Saudi Arabia e-commerce market is projected to attain USD 708.7 Billion by 2033.

Government Policies and Economic Diversification

Saudi Arabia's Vision 2030 is increasingly transforming the economy of Saudi Arabia, with its emphasis on minimizing the country's dependence on the exportation of oil and diversifying into other non-oil industries. In order to fulfill this ambition, the government is investing heavily in infrastructure, technology, manufacturing, and services. The change is directly influencing the demand for industrial machinery, such as forklift trucks, as companies across these industries look to increase efficiency and productivity. The government's diversification of the economy is constantly encouraging new sectors like mining, logistics, and renewable energy to expand. With additional factories, warehouses, and distribution facilities being constructed to underpin these sectors, the need for material handling equipment, such as forklifts, is increasing rapidly. Forklifts are being utilized to maximize operations, cut labor costs, and enhance workplace safety, all of which are critical for companies working towards achieving the kingdom's ambitious economic goals. Furthermore, the government's efforts in developing logistics infrastructure, including the construction of new transport stations, harbors, and roads, are also increasing the demand for forklifts in warehouses and distribution centers throughout the nation. In 2025, The ports authority of Saudi Arabia has inaugurated its 30th new shipping service for the year, creating a direct connection between Jeddah Islamic Port and Port Sudan. The initiative is part of Mawani’s effort to boost global standings, increase efficiency at Jeddah port, and reinforce Saudi Arabia’s position as a trade connector among Asia, Africa, and Europe.

Saudi Arabia Forklift Trucks Market Growth Drivers:

Technological Advancements in Forklift Trucks

Technological innovation in forklift trucks is constantly transforming the Saudi Arabian market. Advanced forklifts are no longer merely manual lifting devices as they are being increasingly infused with advanced technologies that enhance their performance, make them more efficient and easier to operate. Some of the key innovations involve the integration of telematics systems through which fleet managers can monitor forklift performance, fuel consumption, and maintenance requirements and thus minimize downtime and improve operational efficiency. Furthermore, automation developments are gaining prominence in the forklift industry. Automated forklifts, like automated guided vehicles (AGVs), are increasingly being incorporated in bigger warehouses and distribution warehouses to undertake repetitive work, ultimately enhancing overall productivity with minimized human error. Further, electric and hybrid forklifts are becoming more popular in Saudi Arabia because they emit fewer emissions, offer quieter operation, and have lower operating expenses than conventional internal combustion engine forklifts. These developments are also fueling increased interest in eco-friendly and sustainable material handling solutions, aligned with international trends towards green operations. With forklift technology advancing further, companies in Saudi Arabia are going increasingly towards these new-age solutions to boost productivity, lower the cost of operations, and ensure competitiveness within a fast-changing market.

Increased Demand for Warehousing and Logistics Solutions

The warehousing and logistics industries in Saudi Arabia are constantly growing with the country's steady investment in infrastructure, supply chain optimization, and trade facilitation. With Saudi Arabia emerging as a leading logistics hub in the Middle East, the need for sophisticated warehousing solutions is constantly increasing. This growth is most visible in the creation of big distribution centers, cold storage facilities, and specialty warehouses used to store a range of goods, from consumer goods to industrial supplies. Forklift trucks are becoming an integral part of such operations, as they assist in managing the flow of goods, maximizing storage capacity, and expediting order fulfillment. As global supply chains become more sophisticated, companies are ever searching for means of automating their operations and cutting costs, which has enhanced their dependency on equipment such as forklifts to materialize this. Besides, the rise in online shopping and online commerce has necessitated faster and more efficient warehousing options, further fueling the demand for forklifts. Firms are also spending money on advanced, automated forklifts to maintain pace with the demand for efficiency and speed in today's warehouses.

Attention on Employee Safety and Operations Efficiency

Workplace safety and operational efficiency are emerging as top business priorities in Saudi Arabia for most businesses, especially in manufacturing, logistics, and construction sectors. Forklifts are increasingly used to mitigate the hazards of manual material handling, which can cause workplace injuries and accidents. Through the automation of the transportation of goods and materials, forklifts minimize the danger of worker injury through the lifting of heavy loads, exposure to dangerous environments, or the performance of intricate operations. This emphasis on safety in the workplace is constantly propelling the demand for forklifts conforming to global safety standards, including those that are more stable, ergonomically designed, and equipped with collision-avoidance technologies. Also, companies are constantly in search of ways to optimize operational efficiency in their warehouses and manufacturing facilities. Forklifts serve a critical role in realizing these objectives by enabling companies to maximize their storage systems, lower labor expenses, and accelerate the transportation of goods in their facilities. With Saudi Arabia increasing focus on enhancing workplace safety standards and elevating productivity, forklifts are increasingly becoming essential equipment for industries that want to lower costs, enhance working conditions, and uphold high standards of safety. This relentless drive to improve operational efficiency is creating constant demand for forklifts in different sectors.

Saudi Arabia Forklift Trucks Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on product type, technology, class, and application.

Product Type Insights:

- Counterbalanced Forklift Trucks

- Warehouse Forklift Trucks

The report has provided a detailed breakup and analysis of the market based on the product type. This includes counterbalanced forklift trucks and warehouse forklift trucks.

Technology Insights:

- Electricity Problem

- Internal Combustion Engine Powered

The report has provided a detailed breakup and analysis of the market based on the technology. This includes electricity problem and internal combustion engine powered.

Class Insights:

- Class I

- Class II

- Class III

- Class IV

- Class V

The report has provided a detailed breakup and analysis of the market based on the class. This includes class I, class II, class III, class IV, and class V.

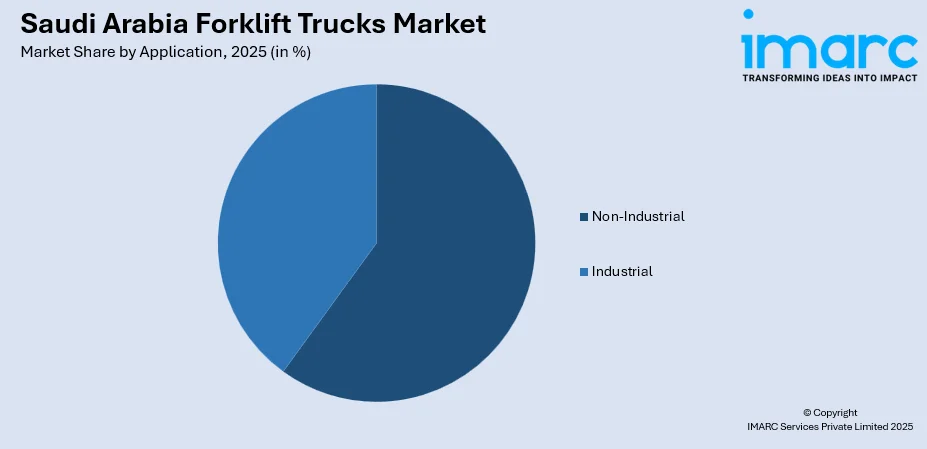

Application Insights:

- Non-Industrial

- Warehouse and Distribution Centers

- Construction Sites

- Dockyards

- Snow Plows

- Industrial

- Manufacturing

- Recycling Operations

The report has provided a detailed breakup and analysis of the market based on the application. This includes non-industrial (warehouse and distribution centers, construction sites, dockyards, and snow plows), and industrial (manufacturing, recycling operations).

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Forklift Trucks Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Counterbalanced Forklift Trucks, Warehouse Forklift Trucks |

| Technologies Covered | Electricity Problem, Internal Combustion Engine Powered |

| Classes Covered | Class I, Class II, Class III, Class IV, Class V |

| Applications Covered |

|

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia forklift trucks market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia forklift trucks market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia forklift trucks industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The forklift trucks market in Saudi Arabia was valued at USD 658.3 Million in 2025.

The Saudi Arabia forklift trucks market is projected to exhibit a CAGR of 3.95% during 2026-2034, reaching a value of USD 933.1 Million by 2034.

Key factors driving the Saudi Arabia forklift trucks market include increasing industrial innovation rapid growth in e-commerce and retail sectors, government-led economic diversification under Vision 2030, technological advancements in forklift designs, expansion of logistics and warehousing infrastructure, and a growing focus on workforce safety and operational efficiency.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)