Saudi Arabia Fortified Baby Food Market Size, Share, Trends and Forecast by Product Type, Ingredients, Nutritional Additives, Distribution Channel, Age Group, and Region, 2026-2034

Saudi Arabia Fortified Baby Food Market Summary:

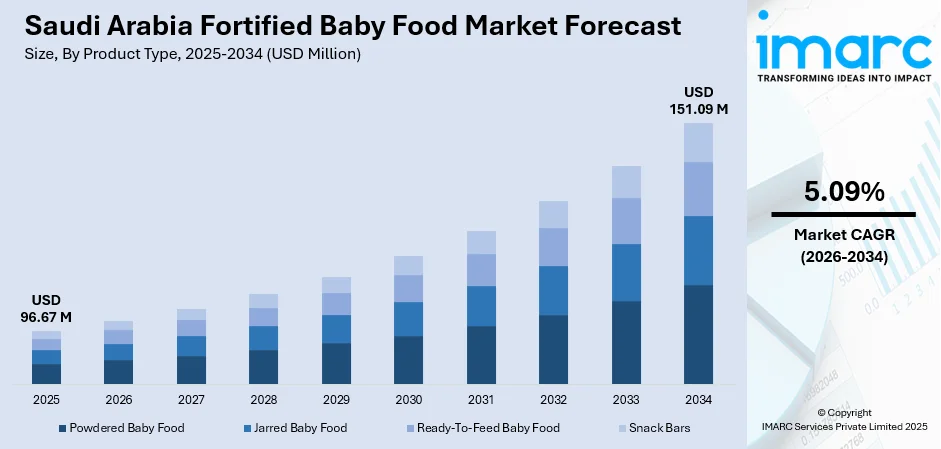

The Saudi Arabia fortified baby food market size was valued at USD 96.67 Million in 2025 and is projected to reach USD 151.09 Million by 2034, growing at a compound annual growth rate of 5.09% from 2026-2034.

The Saudi Arabia fortified baby food market is experiencing robust expansion driven by rising parental awareness regarding infant nutrition and the increasing number of working mothers participating in the workforce under Vision 2030 reforms. Growing disposable incomes, urbanization trends across major metropolitan areas, and heightened demand for convenient feeding solutions are propelling market growth. The convergence of demographic shifts, regulatory advancements by the Saudi Food and Drug Authority, and expanding modern retail infrastructure is fundamentally reshaping the competitive landscape and creating substantial opportunities across the Saudi Arabia fortified baby food market share.

Key Takeaways and Insights:

- By Product Type: Powdered baby food dominates the market with a share of 45% in 2025, driven by its extended shelf life, cost-effectiveness, and ease of preparation that appeals to busy parents seeking convenient nutritional solutions.

- By Ingredients: Cereals lead the market with a share of 30% in 2025, owing to their role as optimal first foods providing essential energy, iron fortification, and digestibility for complementary feeding.

- By Nutritional Additives: Vitamins represent the largest segment with a market share of 40% in 2025, reflecting parental emphasis on immune support, brain development, and overall health optimization for infants.

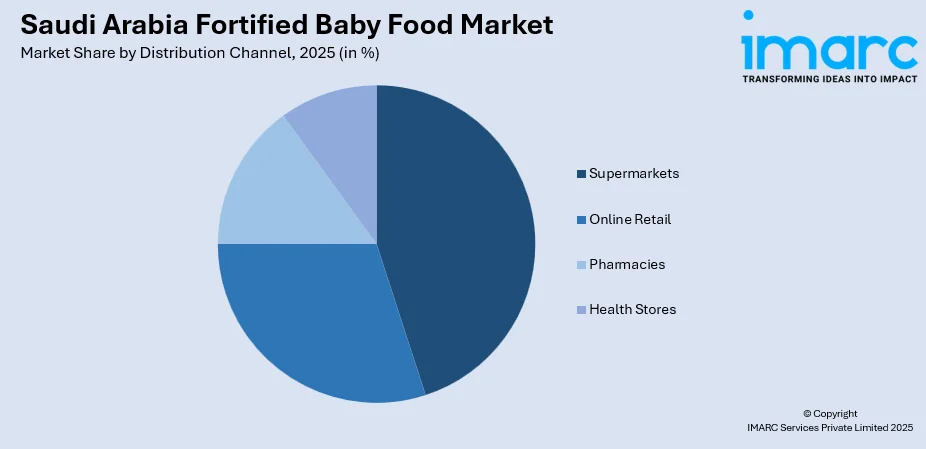

- By Distribution Channel: Supermarkets hold the largest share of 45% in 2025, benefiting from extensive product assortment, competitive pricing, and trusted retail environments for baby care purchases.

- By Age Group: Infants dominate with a 55% share in 2025, as this age group requires specialized fortified nutrition during critical developmental stages from birth to twelve months.

- Key Players: The Saudi Arabia fortified baby food market exhibits moderate competitive intensity, with multinational nutrition corporations competing alongside regional players across premium and value segments through innovation, localization strategies, and expanding distribution networks.

To get more information on this market Request Sample

Saudi Arabia's fortified baby food market represents one of the fastest-growing segments within the broader Gulf Cooperation Council infant nutrition industry. The kingdom's demographic transformation, characterized by a population exceeding 35.3 million with approximately 55.6% Saudi nationals, creates substantial domestic demand for specialized infant nutrition products. The kingdom's demographic transformation, characterized by a substantial and expanding population with a significant proportion of Saudi nationals, creates robust domestic demand for specialized infant nutrition products. The country's young population base, combined with rising urbanization across major metropolitan areas and increasing healthcare awareness among parents, establishes a strong foundation for sustained market growth. Government initiatives under Vision 2030 promoting women's workforce participation, enhanced maternal and child healthcare services, and retail modernization further support market expansion. The convergence of favorable demographic trends, evolving lifestyle patterns among young families, and growing parental emphasis on infant nutritional adequacy positions the Saudi Arabian market as a key growth driver within the regional infant nutrition landscape.

Saudi Arabia Fortified Baby Food Market Trends:

Rising Demand for Premium and Organic Fortified Products

The Saudi Arabia fortified baby food market is witnessing transformative growth in premium and organic product segments as health-conscious parents increasingly prioritize natural, non-GMO, and preservative-free ingredients for their infants. This trend reflects broader global consumer preferences for clean-label baby food products that combine nutritional completeness with ingredient transparency. In October 2024, the Saudi Food and Drug Authority published draft regulations on infant formula and formulas for special medical purposes, demonstrating regulatory commitment to enhancing product quality standards. Manufacturers are responding by expanding portfolios with organic cereals, plant-based options, and formulations featuring human milk oligosaccharides that closely mimic breast milk composition.

E-commerce Expansion and Digital Commerce Transformation

Digital commerce is fundamentally reshaping fortified baby food distribution in Saudi Arabia, offering parents unprecedented convenience, product variety, and discrete purchasing options. The kingdom's Vision 2030 initiative targeting 70% cashless transactions by 2025 is accelerating e-commerce adoption across consumer segments. IMARC Group further estimates Saudi Arabia e-commerce sales reached USD 222.9 Billion in 2024 and is projected to reach USD 708.7 Billion by 2033, exhibiting a growth rate (CAGR) of 12.8% during 2025-2033. This digital transformation particularly benefits working mothers seeking subscription-based delivery and personalized nutrition recommendations.

Local Manufacturing Investments and Supply Chain Localization

Major multinational corporations are establishing local manufacturing capabilities in Saudi Arabia to strengthen supply chain resilience and meet growing domestic demand. This strategic shift aligns with the kingdom's National Industrial Strategy promoting food sector development through industrial clusters in Jeddah's Second and Third Industrial Cities. In September 2024, Nestlé committed to constructing its first food manufacturing facility in Saudi Arabia on a 117,000 square meter site, with initial operations focusing on baby food production featuring an annual capacity of 15,000 tonnes. The factory represents an initial investment of SAR 270 Million and is expected to commence operations in 2025, creating hundreds of direct and indirect employment opportunities while supporting the kingdom's food security objectives.

Market Outlook 2026-2034:

The Saudi Arabia fortified baby food market demonstrates robust growth potential throughout the forecast period, underpinned by favorable demographic trends, rising disposable incomes, and evolving parental attitudes toward infant nutrition. Government initiatives under Vision 2030 supporting women's workforce participation, healthcare infrastructure expansion, and retail modernization create structural tailwinds for sustained market expansion. The market generated a revenue of USD 96.67 Million in 2025 and is projected to reach a revenue of USD 151.09 Million by 2034, growing at a compound annual growth rate of 5.09% from 2026-2034.

Saudi Arabia Fortified Baby Food Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Powdered Baby Food | 45% |

| Ingredients | Cereals | 30% |

| Nutritional Additives | Vitamins | 40% |

| Distribution Channel | Supermarkets | 45% |

| Age Group | Infants | 55% |

Product Type Insights:

- Powdered Baby Food

- Jarred Baby Food

- Ready-To-Feed Baby Food

- Snack Bars

The powdered baby food segment dominates the Saudi Arabia fortified baby food market with a 45% share in 2025.

Powdered baby food products encompass infant formula, fortified cereals, and nutrient-enriched meal preparations designed for reconstitution with water or breast milk. This format delivers superior cost-effectiveness, extended shelf stability, and precise portion control that resonates with Saudi parents seeking reliable nutritional solutions. The powder format maintains its market leadership due to established consumer trust, widespread retail availability across supermarkets and pharmacies, and compatibility with the kingdom's climate conditions that necessitate products resistant to temperature fluctuations during storage and transportation. Manufacturers continue innovating with advanced formulations incorporating prebiotics, probiotics, and human milk oligosaccharides to differentiate their powdered offerings.

The segment benefits from favorable regulatory frameworks and manufacturing investments that enhance local production capabilities. In September 2024, Nestlé announced its commitment to establish a baby food manufacturing facility in Jeddah's Third Industrial City with an initial annual production capacity of 15,000 tonnes, primarily focusing on powdered baby food products. This investment reflects multinational confidence in sustained demand for powdered formulations. The product format also aligns with e-commerce distribution trends, as lightweight packaging reduces shipping costs while extended shelf life accommodates subscription-based purchasing models increasingly popular among Saudi consumers.

Ingredients Insights:

- Fruits

- Vegetables

- Cereals

- Meats

- Dairy

The cereals segment leads the Saudi Arabia fortified baby food market with a 30% share in 2025.

Cereal-based baby foods serve as foundational first foods recommended by pediatric nutrition guidelines for complementary feeding introduction around six months of age. These products provide essential energy through easily digestible carbohydrates while serving as optimal vehicles for iron fortification critical during the weaning period when infant iron stores become depleted. Saudi parents recognize cereals as trusted, versatile ingredients that can be prepared with varying consistencies to match infant developmental stages and feeding preferences.

Iron-fortified cereals address nutritional gaps that breast milk alone cannot fulfill for infants beyond six months. Research published in The Journal of Nutrition demonstrated that adding iron-fortified infant cereal at rates of 35 mg per 100 grams dry weight effectively reduces iron inadequacy prevalence from 75% to approximately 5% among infants. Manufacturers including Gerber fortify infant cereals with 60% of recommended daily iron value per serving alongside vitamin C to enhance absorption, zinc for immune function, and B vitamins supporting brain development. The cereal segment also benefits from product innovation incorporating ancient grains, organic ingredients, and allergen-free formulations targeting health-conscious parents.

Nutritional Additives Insights:

- Vitamins

- Minerals

- Probiotics

- Omega-3 Fatty Acids

The vitamins segment holds the largest share at 40% of the Saudi Arabia fortified baby food market in 2025.

Vitamin fortification represents the cornerstone of fortified baby food formulations, addressing critical micronutrient requirements during rapid infant growth and neurological development. Key vitamins including vitamin D for bone health and calcium absorption, vitamin A for immune function and vision, and B-complex vitamins for energy metabolism and brain development drive parental purchasing decisions. The Gulf Cooperation Council Standardization Organization mandates fortification of infant formula with iron and vitamin D aligned with World Health Organization standards, ensuring baseline nutritional adequacy across commercial products available in Saudi Arabia.

The vitamin segment benefits from heightened parental awareness regarding early-life nutrition's impact on long-term health outcomes. Manufacturers are expanding vitamin-fortified product lines featuring comprehensive micronutrient blends including vitamin K for blood clotting, choline for cognitive development, and folate for cellular growth. Multi-vitamin premixes enable efficient fortification while maintaining taste profiles acceptable to infant palates, supporting market expansion across premium and value segments.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets

- Online Retail

- Pharmacies

- Health Stores

The supermarkets segment accounts for the largest share at 45% of the Saudi Arabia fortified baby food market in 2025.

Supermarkets and hypermarkets serve as primary distribution channels for fortified baby food products in Saudi Arabia, offering parents convenient access to comprehensive product assortments, competitive pricing, and trusted retail environments. Major chains including Panda Retail, Al Othaim Markets, Carrefour, and Lulu Hypermarket provide extensive baby food selections alongside complementary childcare products, facilitating one-stop shopping experiences.

The supermarket channel benefits from Saudi Arabia's retail modernization trajectory aligned with Vision 2030 objectives. According to Oliver Wyman's Market Pulse 2024 report, Saudi Arabia's grocery retail sector remains highly fragmented with opportunities for differentiation through enhanced product assortments and service offerings. The food retail market is expected to grow, providing expanding shelf space for fortified baby food products. Supermarkets increasingly integrate digital ordering, loyalty programs, and delivery partnerships to complement physical store experiences, positioning this channel for continued dominance despite rapid e-commerce growth.

Age Group Insights:

- Infants

- Toddlers

- Preschoolers

The infants segment exhibits clear dominance with a 55% share of the Saudi Arabia fortified baby food market in 2025.

The infants segment encompasses specialized nutrition products designed for children from birth through twelve months, representing the most critical period for nutritional intervention during rapid growth and neurological development. This age group requires carefully formulated products that closely mimic breast milk composition while providing essential vitamins, minerals, and macronutrients when breastfeeding is insufficient or unavailable. The General Authority for Statistics reported that 65% of Saudi women breastfed their newborns within the first hour of birth, indicating opportunities for complementary fortified products alongside breastfeeding.

The segment benefits from increasing maternal workforce participation driving demand for convenient infant feeding solutions. Working mothers increasingly rely on fortified infant formula and complementary foods to maintain nutritional adequacy while balancing career responsibilities. The SFDA mandates that infant formula products meet stringent safety and nutritional standards aligned with international guidelines, ensuring product quality across available options. Specialty formulas for lactose intolerance, allergies, and sensitive digestion are gaining popularity as parents demand personalized nutrition for their infants.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The Northern and Central region dominates the market, driven by Riyadh's concentration of dual-income households, advanced healthcare infrastructure, premium retail networks, and high urbanization rates fostering demand for fortified infant nutrition products.

The Western region represents a significant market share, supported by Jeddah's cosmopolitan consumer base, strong expatriate population, robust e-commerce penetration, and proximity to major seaports facilitating diverse product availability and distribution networks.

The Eastern region demonstrates steady growth, propelled by the oil-sector workforce's higher disposable incomes, expanding modern retail infrastructure, increasing female employment participation, and growing awareness of specialized infant nutritional requirements among young families.

The Southern region exhibits emerging potential, characterized by rising urbanization trends, expanding healthcare accessibility, government maternal health initiatives, and growing retail modernization connecting previously underserved communities to fortified baby food products.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Fortified Baby Food Market Growing?

Rising Female Workforce Participation Under Vision 2030 Reforms

Saudi Arabia's Vision 2030 initiative has catalyzed unprecedented transformation in female workforce participation, directly correlating with increased demand for convenient fortified baby food products. According to GASTAT data for 2024, the labor force participation rate of Saudi females reached 36.2% in the third quarter, representing substantial progress when Vision 2030 launched. The government has extended maternity leave for a period of 12 weeks in 2024, supporting working mothers while creating sustained demand for infant nutrition alternatives. Working women with limited time for meal preparation increasingly depend on fortified baby food products providing complete nutrition in convenient formats.

Expanding Modern Retail Infrastructure and E-commerce Penetration

Saudi Arabia's retail landscape is undergoing rapid modernization characterized by expanding supermarket networks, hypermarket development, and accelerating e-commerce adoption that enhance fortified baby food accessibility. The Saudi e-commerce market reached USD 222.9 Billion in 2024. The market is projected to reach USD 708.7 Billion by 2033, exhibiting a growth rate (CAGR) of 12.8% during 2025-2033. E-commerce penetration supports subscription-based baby food delivery models popular among time-constrained parents, while major retailers including Noon, Amazon Saudi Arabia, and Carrefour invest in baby product categories. The food retail market is forecast to expand, creating distribution opportunities across traditional and digital channels that benefit fortified baby food manufacturers.

Local Manufacturing Investments Enhancing Supply Chain Resilience

Multinational corporations are establishing local manufacturing facilities in Saudi Arabia, strengthening supply chains and demonstrating long-term commitment to the fortified baby food market. In September 2024, Nestlé signed an agreement with the Saudi Authority for Industrial Cities and Technology Zones to construct its first food manufacturing plant in the Kingdom, representing an initial investment of SAR 270 Million on a 117,000 square meter site in Jeddah's Third Industrial City. The facility will focus primarily on baby food production with an initial annual capacity of 15,000 tons, scheduled to commence operations in 2025 with qualified national personnel operating automated production lines. This investment aligns with Saudi Arabia's National Industrial Strategy developing food industry clusters to reinforce supply chains, boost exports, and reduce import dependency while creating employment opportunities across the value chain.

Market Restraints:

What Challenges the Saudi Arabia Fortified Baby Food Market is Facing?

Premium Product Pricing Limiting Mass Market Accessibility

High price points for premium fortified baby food products create affordability barriers that constrain market penetration among price-sensitive consumer segments. Specialty formulations featuring organic ingredients, advanced nutritional additives, and imported components command significant premiums over standard alternatives, limiting accessibility for middle and lower-income households despite growing awareness of infant nutrition importance.

Cultural Preferences for Traditional Breastfeeding and Homemade Foods

Strong cultural emphasis on breastfeeding combined with traditional preferences for homemade complementary foods influences purchasing decisions in certain consumer segments. Health authorities actively promote breastfeeding benefits while some families maintain skepticism toward commercial baby food products, requiring manufacturers to balance marketing approaches with cultural sensitivities and regulatory requirements limiting promotional activities.

Stringent Regulatory Requirements and Compliance Costs

The Saudi Food and Drug Authority maintains rigorous registration, labeling, and quality standards for infant nutrition products that create compliance complexity and costs for manufacturers. Ongoing regulatory evolution including draft technical regulations published in October 2024 requires continuous monitoring and formulation adjustments, while mandatory halal certification and Arabic labeling requirements add operational considerations for international brands entering the market.

Competitive Landscape:

The Saudi Arabia fortified baby food market exhibits moderate competitive intensity characterized by the presence of established multinational nutrition corporations competing alongside regional players across premium and value segments. Market dynamics reflect strategic positioning ranging from science-backed, innovation-driven offerings emphasizing advanced nutritional formulations to value-oriented products targeting cost-conscious consumers. Major players leverage extensive distribution networks, regulatory expertise, and brand equity to maintain market positions. The competitive landscape is increasingly shaped by local manufacturing investments, e-commerce capabilities, sustainability initiatives, and product innovation addressing evolving parental preferences for organic, clean-label, and specialty formulations meeting specific dietary requirements.

Recent Developments:

- In October 2024: Almarai signed a Memorandum of Cooperation with the Ministry of Human Resources and Social Development to create the "Baby Milk Products Discount" program, aimed at aiding children of social security claimants from newborns to two years old. Almarai's dedication to social responsibility and improving community wellbeing is reflected in this program, which is scheduled to start on October 1, 2024, in partnership with Al-Dawaa Pharmacies.

Saudi Arabia Fortified Baby Food Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Powdered Baby Food, Jarred Baby Food, Ready-To-Feed Baby Food, Snack Bars |

| Ingredients Covered | Fruits, Vegetables, Cereals, Meats, Dairy |

| Nutritional Additives Covered | Vitamins, Minerals, Probiotics, Omega-3 Fatty Acids |

| Distribution Channels Covered | Supermarkets, Online Retail, Pharmacies, Health Stores |

| Age Groups Covered | Infants, Toddlers, Preschoolers |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia fortified baby food market size was valued at USD 96.67 Million in 2025.

The Saudi Arabia fortified baby food market is expected to grow at a compound annual growth rate of 5.09% from 2026-2034 to reach USD 151.09 Million by 2034.

Powdered baby food dominated the Saudi Arabia fortified baby food market with a 45% share in 2025, driven by extended shelf life, cost-effectiveness, ease of preparation, and established consumer trust across retail and e-commerce channels.

Key factors driving the Saudi Arabia fortified baby food market include rising female workforce participation under Vision 2030 reforms reaching 36% in 2024, expanding modern retail infrastructure and e-commerce penetration, local manufacturing investments by multinational corporations, and heightened parental awareness regarding infant nutrition requirements.

Major challenges include premium product pricing limiting mass market accessibility, cultural preferences for traditional breastfeeding and homemade foods, stringent regulatory requirements and compliance costs, and competition from established international brands in a moderately concentrated market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)