Saudi Arabia Fortified Health Drinks Market Size, Share, Trends and Forecast by Product Type, Form, Distribution Channel, and Region, 2026-2034

Saudi Arabia Fortified Health Drinks Market Overview:

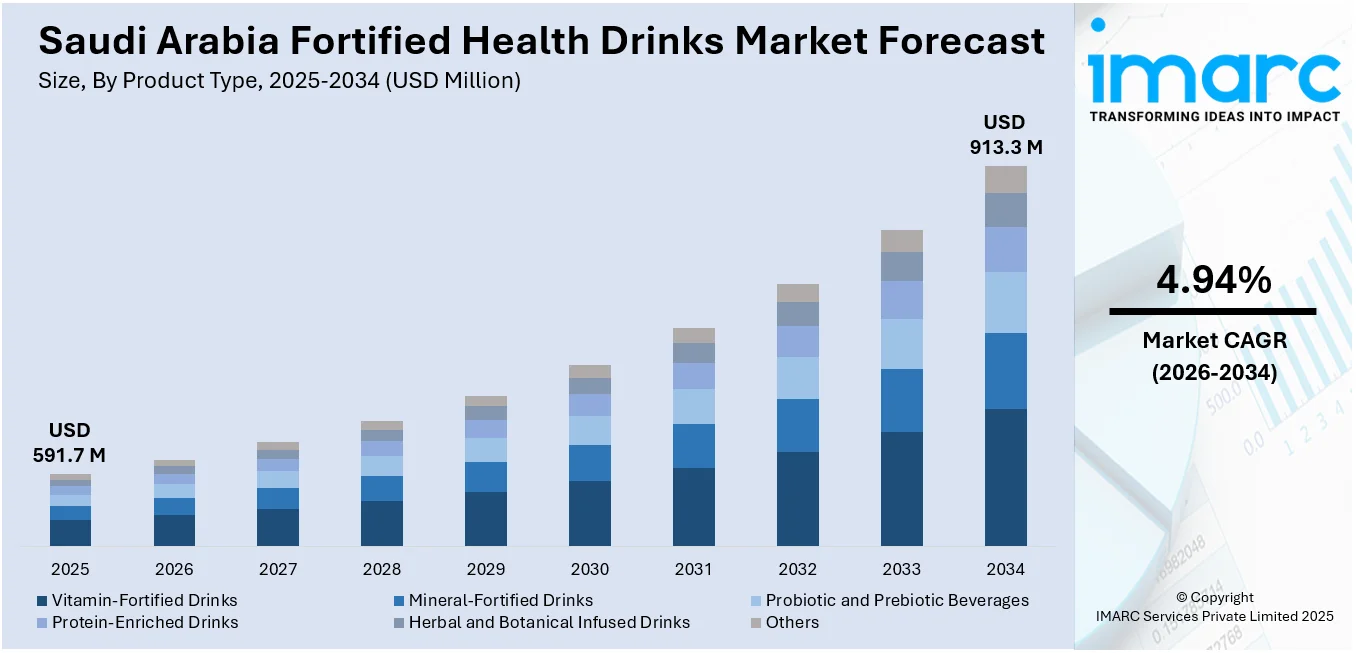

The Saudi Arabia fortified health drinks market size reached USD 591.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 913.3 Million by 2034, exhibiting a growth rate (CAGR) of 4.94% during 2026-2034. The market is growing due to expanded availability across retail and digital platforms, improved product visibility, and the escalating demand from health-focused consumers. The rise in fitness participation is further increasing interest in performance-oriented drinks that support hydration, energy, and recovery. Together, these factors are resulting in the growing incorporation of embedding fortified drinks into daily routines, making them a regular choice for a broad and increasingly active population, and contributing to the overall expansion of the Saudi Arabia fortified health drinks market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 591.7 Million |

|

Market Forecast in 2034

|

USD 913.3 Million |

| Market Growth Rate 2026-2034 | 4.94% |

Saudi Arabia Fortified Health Drinks Market Trends:

Increased Fitness and Sports Participation

The increasing popularity of fitness pursuits and organized sports in Saudi Arabia is driving the demand for enhanced health drinks focused on performance, endurance, and recovery. As gym memberships and involvement in marathons, sports leagues, and recreational training is growing, people are looking for convenient drinks that offer functional advantages like hydration, muscle support, and sustained energy. Enhanced beverages packed with electrolytes, proteins, and vitamins are increasingly favored by both dedicated gym enthusiasts and occasional fitness participants. As per IMARC Group, the health and fitness club sector in Saudi Arabia attained USD 1,147.9 million in 2024 and is expected to increase to USD 2,673.5 million by 2033, with a CAGR of 9.8% from 2025 to 2033. This growth indicates a larger societal trend of active living and preventive health, presenting chances for brands to align their products with fitness-focused demands. Focused advertising near gyms, fitness applications endorsing nutrition combinations, and retail positioning close to workout centers are enhancing the exposure of these drinks. Numerous consumers see fortified beverages as a crucial element of post-exercise regimens or meal substitutes, particularly when convenience and nutrient richness are essential.

To get more information on this market Request Sample

Expansion of Retail and Online Availability

The growing access to fortified health drinks via supermarkets, pharmacies, and online platforms is increasing their consumption throughout Saudi Arabia. Structured retail formats allocate specific shelf areas and in-store promotions that enhance visibility and stimulate spontaneous buying, whereas pharmacies provide trustworthiness and reach health-focused consumers looking for functional advantages. In addition, the rising number of e-commerce sites, which provide convenience, subscription services, and doorstep delivery, are bolstering the Saudi Arabia fortified health drinks market growth. Campaigns centered around health and bundle discounts prove especially impactful on online platforms, where tech-savvy shoppers are actively looking for nutrition-related products. The Ministry of Commerce announced that by the fourth quarter of 2024, Saudi Arabia boasted 40,953 registered e-commerce companies, indicating a year-on-year growth of 10 percent. This growth is not only boosting sales of fortified drinks but also providing smaller and specialized brands with direct access to niche consumer groups without depending exclusively on conventional retail. Furthermore, state-supported programs aimed at boosting local health food production and upgrading retail systems in smaller cities are improving supply chain effectiveness and product accessibility. Whether showcased in large urban hypermarkets or delivered conveniently to smaller towns, the blending of traditional and digital options is enhancing the accessibility of fortified drinks to a wider audience.

Saudi Arabia Fortified Health Drinks Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type, form, and distribution channel.

Product Type Insights:

- Vitamin-Fortified Drinks

- Mineral-Fortified Drinks

- Probiotic and Prebiotic Beverages

- Protein-Enriched Drinks

- Herbal and Botanical Infused Drinks

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes vitamin-fortified drinks, mineral-fortified drinks, probiotic and prebiotic beverages, protein-enriched drinks, herbal and botanical infused drinks, and others.

Form Insights:

- Powdered Drinks

- Ready-to-Drink (RTD)

- Liquid Concentrates

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes powdered drinks, ready-to-drink (RTD), and liquid concentrates.

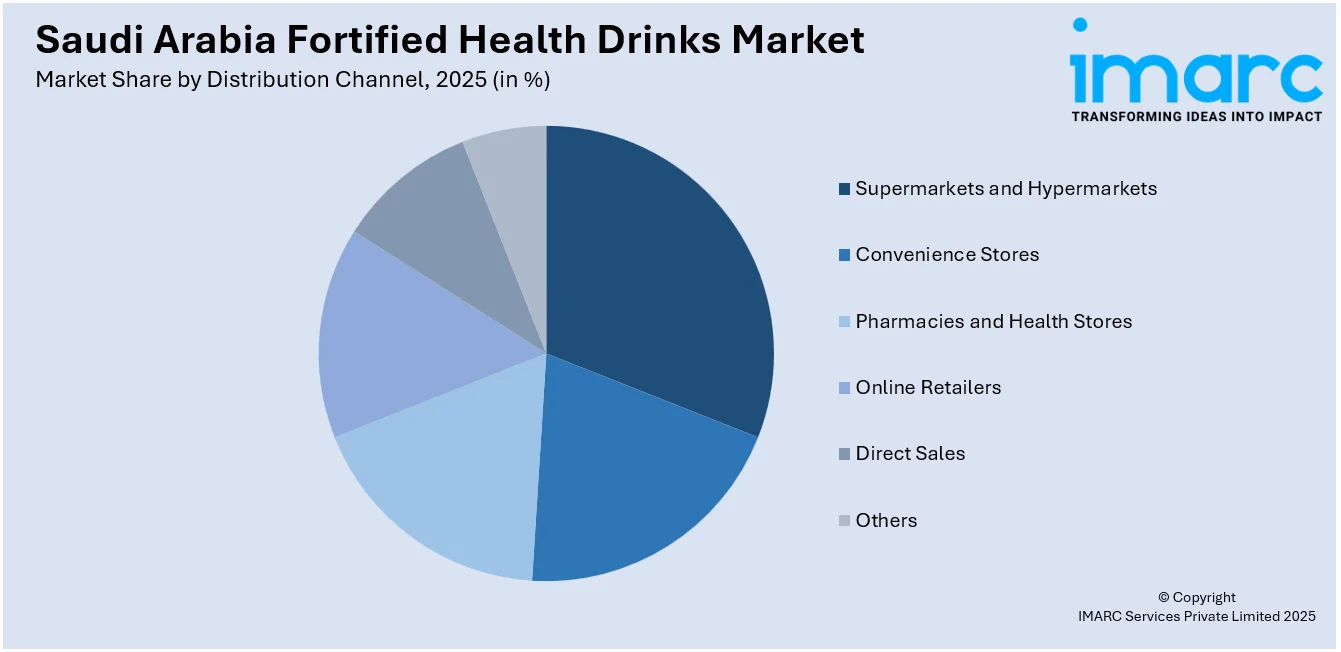

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Pharmacies and Health Stores

- Online Retailers

- Direct Sales

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, pharmacies and health stores, online retailers, direct sales, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Fortified Health Drinks Market News:

- In February 2025, iPRO launched its vitamin-fortified hydration drinks in Saudi Arabia through a partnership with Al Rabie Saudi Foods Company. The drinks contain added Vitamin C and B and electrolytes, and come in sustainable packaging. This move supports Saudi Arabia’s wellness goals under Vision 2030.

Saudi Arabia Fortified Health Drinks Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Vitamin-Fortified Drinks, Mineral-Fortified Drinks, Probiotic and Prebiotic Beverages, Protein-Enriched Drinks, Herbal and Botanical Infused Drinks, Others |

| Forms Covered | Powdered Drinks, Ready-to-Drink (RTD), Liquid Concentrates |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Pharmacies and Health Stores, Online Retailers, Direct Sales, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia fortified health drinks market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia fortified health drinks market on the basis of product type?

- What is the breakup of the Saudi Arabia fortified health drinks market on the basis of form?

- What is the breakup of the Saudi Arabia fortified health drinks market on the basis of distribution channel?

- What is the breakup of the Saudi Arabia fortified health drinks market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia fortified health drinks market?

- What are the key driving factors and challenges in the Saudi Arabia fortified health drinks market?

- What is the structure of the Saudi Arabia fortified health drinks market and who are the key players?

- What is the degree of competition in the Saudi Arabia fortified health drinks market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia fortified health drinks market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia fortified health drinks market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia fortified health drinks industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)