Saudi Arabia Freight Transportation Market Size, Share, Trends and Forecast by Offering, Transport, End Use, and Region, 2025-2033

Saudi Arabia Freight Transportation Market Overview:

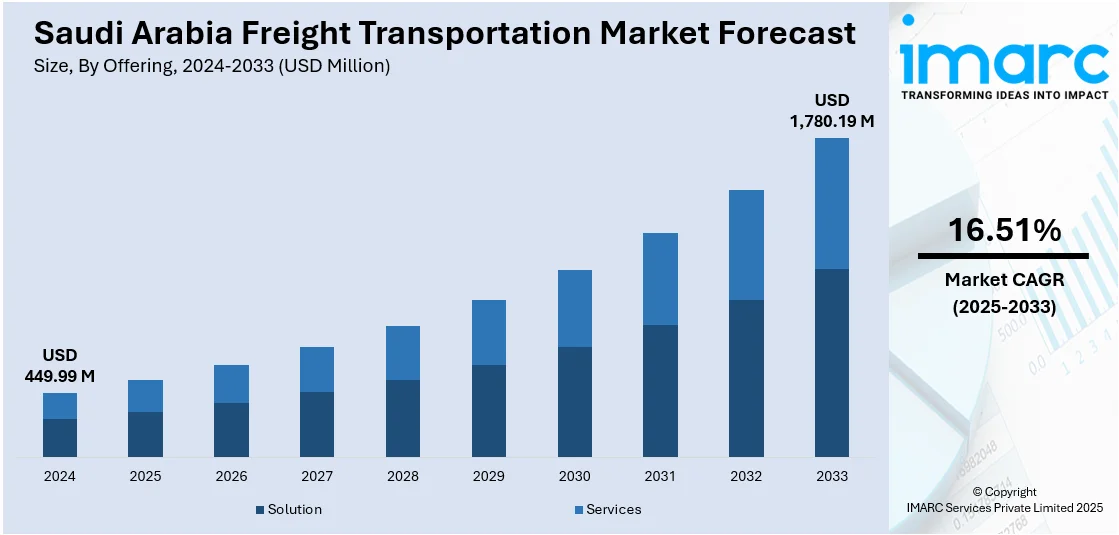

The Saudi Arabia freight transportation market size reached USD 449.99 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,780.19 Million by 2033, exhibiting a growth rate (CAGR) of 16.51% during 2025-2033. The market is fueled by technological advancements, where automation and AI enhance efficiency and lower costs of operations. Strategic investments in port development, like port expansion, and advanced road networks improve the connectivity and freight capacity of the country and increase market penetration. The increasing demand from domestic consumption as well as global trade drives the demand for effective logistics solutions, further increasing the Saudi Arabia freight transportation market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 449.99 Million |

| Market Forecast in 2033 | USD 1,780.19 Million |

| Market Growth Rate 2025-2033 | 16.51% |

Saudi Arabia Freight Transportation Market Trends:

Growing Demand from Domestic and International Trade

Saudi Arabia's growing domestic consumption and active participation in international trade have become key drivers of the freight transportation market. As the country’s economy continues to expand, the demand for goods and raw materials has surged, requiring more extensive freight solutions. The increasing importance of the Kingdom as a trade hub within the Gulf Cooperation Council (GCC) and its involvement in global supply chains further accelerates transportation needs. Moreover, the expansion of e-commerce has added another layer of demand for quick and efficient logistics services, particularly for smaller, high-demand goods. On December 22, 2024, Saudi Arabia announced plans to increase the number of logistics zones from 22 to 59 by 2030. The country is investing over SAR 10 billion (USD 2.66 billion) to develop 18 logistics zones near ports. This initiative, part of a broader strategy to attract global investments, was discussed during the sixth edition of the Supply Chain Conference in Riyadh, where 91 agreements worth SAR 8.3 billion (USD 2.2 billion) were signed to improve supply chain efficiency. These factors are increasing the volume of shipments, both within the region and internationally, which is contributing to the overall growth of the market in the region. Furthermore, the development of digital platforms has provided better tracking and real-time updates, enhancing transparency and improving service delivery for customers. The growth in demand for faster and more reliable logistics solutions has accelerated the adoption of these technologies. Automation in warehousing and inventory control has streamlined processes, while the use of AI in route optimization has enhanced delivery efficiency and reduced operational costs. As technology continues to evolve, it is expected to play a significant role in shaping the future of the sector, thereby driving Saudi Arabia freight transportation market growth.

Expansion of Infrastructure and Strategic Location

Saudi Arabia’s strategic geographic location as a gateway between Europe, Asia, and Africa gives it a prominent role in the overall global market. The country’s investments in modernizing its infrastructure, including seaports, airports, and road networks, is boosting its ability to handle a higher volume of cargo. The expansion of major ports like King Abdullah Port and the development of land transport networks connecting key cities are pivotal to facilitating smoother trade and freight movement. The market is also greatly influenced by the integration of automation, artificial intelligence, and data analytics into the logistics sector, enabling companies to optimize their operations and improve supply chain management. Additionally, the government's focus on the Vision 2030 initiative, which seeks to diversify the economy, has led to large-scale investments in transportation infrastructure. On November 21, 2024, Alstom signed a SAR 300 million (USD 80 million) agreement with Saudi Railway Company (SAR) to enhance the east-west freight corridor in Saudi Arabia. This five-year agreement includes technical support, spare parts supply, and staff training, with a focus on improving the performance and reliability of freight locomotives. This infrastructure development is poised to enhance the efficiency and capacity of the freight transportation sector, contributing to an increase in overall market activity.

Saudi Arabia Freight Transportation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on offering, transport, and end use.

Offering Insights:

- Solution

- Freight Transportation Cost Management

- Freight Mobility Solution

- Freight Security and Monitoring System

- Freight Information Management System

- Fleet Tracking and Maintenance Solution

- Freight Operational Management Solutions

- Freight 3PL Solution

- Warehouse Management System

- Services

The report has provided a detailed breakup and analysis of the market based on the offering. This includes solution (freight transportation cost management, freight mobility solution, freight security and monitoring system, freight information management system, fleet tracking and maintenance solution, freight operational management solutions, freight 3PL solution, and warehouse management system) and services.

Transport Insights:

- Roadways

- Railways

- Waterways

- Airways

The report has provided a detailed breakup and analysis of the market based on the transport. This includes roadways, railways, waterways, and airways.

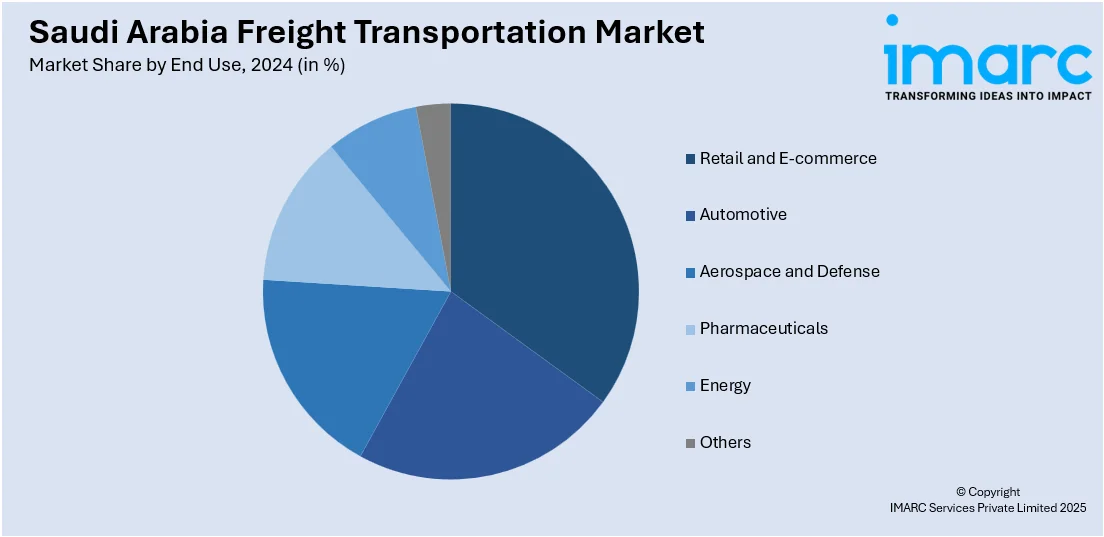

End Use Insights:

- Retail and E-commerce

- Automotive

- Aerospace and Defense

- Pharmaceuticals

- Energy

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes retail and e-commerce, automotive, aerospace and defense, pharmaceuticals, energy, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all major regional markets. This includes Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Freight Transportation Market News:

- On February 24, 2025, DHL eCommerce entered the Saudi Arabian market by acquiring a minority stake in AJEX Logistics, a rapidly growing parcel logistics company. Established in 2021, AJEX has over 50 facilities and 900 vehicles, employing 1,500 people. The partnership targets Saudi Arabia’s booming e-commerce market, which is projected to experience double-digit growth.

Saudi Arabia Freight Transportation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Offerings Covered |

|

| Transports Covered | Roadways, Railways, Waterways, Airway |

| End Uses Covered | Retail and E-commerce, Automotive, Aerospace and Defense, Pharmaceuticals, Energy, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia freight transportation market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia freight transportation market on the basis of offering?

- What is the breakup of the Saudi Arabia freight transportation market on the basis of transport?

- What is the breakup of the Saudi Arabia freight transportation market on the basis of end use?

- What is the breakup of the Saudi Arabia freight transportation market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia freight transportation market?

- What are the key driving factors and challenges in the Saudi Arabia freight transportation market?

- What is the structure of the Saudi Arabia freight transportation market and who are the key players?

- What is the degree of competition in the Saudi Arabia freight transportation market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia freight transportation market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia freight transportation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia freight transportation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)