Saudi Arabia French Fries Market Size, Share, Trends and Forecast by Product Type, Pricing, End User, Import and Domestic Production, Distribution Channel, and Region, 2026-2034

Saudi Arabia French Fries Market Summary:

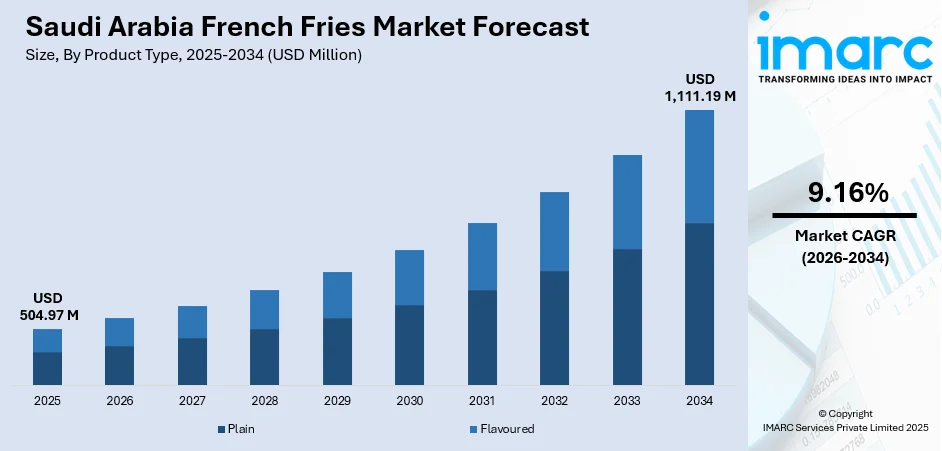

The Saudi Arabia French fries market size was valued at USD 504.97 Million in 2025 and is projected to reach USD 1,111.19 Million by 2034, growing at a compound annual growth rate of 9.16% from 2026-2034.

The Saudi Arabia French fries market is experiencing strong expansion driven by the rapid proliferation of quick-service restaurants and changing consumer dining preferences. Increasing urbanization and rising disposable incomes are fueling demand for convenient food options, with French fries emerging as a staple accompaniment across fast-food chains and casual dining establishments. The growing influence of Western culinary trends, particularly among the Kingdom's youthful population, continues to strengthen consumption patterns and boost Saudi Arabia French fries market share.

Key Takeaways and Insights:

- By Product Type: Plain dominates the market with a share of 83% in 2025, owing to its versatility in pairing with diverse seasonings and condiments, widespread consumer familiarity, and cost-effective production processes that enable competitive pricing across retail and food service channels.

- By Pricing: Mass leads the market with a share of 72% in 2025. This dominance is driven by affordability requirements of quick-service restaurants, price-sensitive consumer segments, and the emphasis on high-volume procurement strategies adopted by commercial food operators.

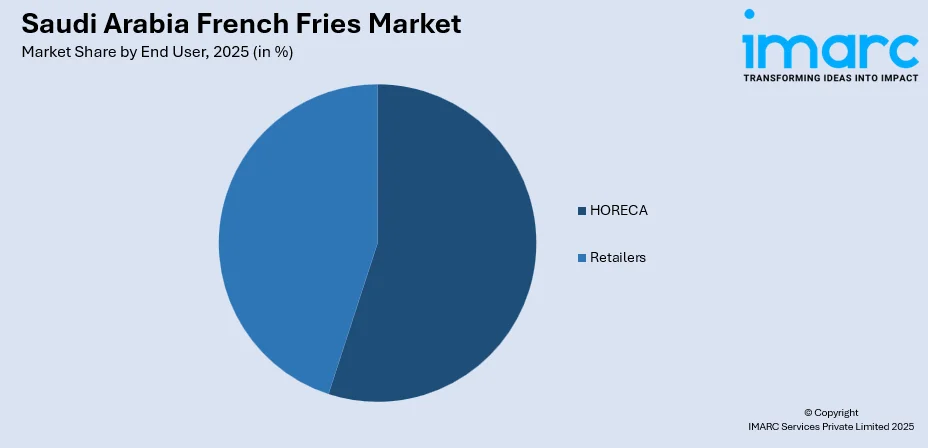

- By End User: HORECA represents the largest segment with a market share of 52% in 2025, reflecting the expanding hospitality and foodservice industry infrastructure driven by tourism growth and Vision 2030 initiatives that are transforming Saudi Arabia's dining landscape.

- By Import and Domestic Production: Import exhibits a clear dominance in the market with 67% share in 2025, reflecting continued reliance on established international suppliers while domestic manufacturing capabilities are progressively expanding to address food security objectives.

- By Distribution Channel: Business-to-Business (B2B) dominates the market with a share of 66% in 2025, underpinned by the extensive network of commercial food operators, institutional buyers, and wholesale distribution arrangements serving the Kingdom's growing restaurant sector.

- By Region: Al Riyadh is the largest region with 30% share in 2025, driven by the capital's concentration of quick-service restaurant outlets, expanding tourism infrastructure, and the presence of major commercial and hospitality developments.

- Key Players: Key players drive the Saudi Arabia French fries market by expanding production facilities, improving cold chain logistics, and strengthening distribution partnerships. Their investments in manufacturing capacity, product innovation, and strategic collaborations with foodservice operators enhance market penetration and ensure consistent supply. Some of the key players operating in the market include Al Kabeer Group ME (Savola Group), Al Munajem Cold Stores Company, Americana Group Inc, BRF S.A, Food & Fine Pastries Al Sunbulah Manufacturing Co, Fresh Del Monte Produce Inc., Kühne + Heitz B.V., Lamb Weston Holdings Inc, McCain Foods Limited, Mondial Foods B.V., Saudia Dairy & Foodstuff Company, and Wafrah for Industry and Development.

To get more information on this market Request Sample

The Saudi Arabia French fries market is witnessing transformative growth as the Kingdom pursues ambitious economic diversification goals under Vision 2030. The hospitality sector expansion, underpinned by mega-tourism projects and entertainment developments, is creating substantial demand for quality frozen potato products across foodservice establishments. Quick-service restaurants continue to proliferate in urban centers, with international chains and local operators alike incorporating French fries as essential menu components. The November 2024 launch of the Jeddah Food Cluster, spanning 11 Million square meters with investment targets of SAR 20 Billion and recognition as the world's largest food park by Guinness World Records, represents a watershed moment for domestic food manufacturing capabilities. Consumer preferences are evolving toward convenient meal solutions, with online food delivery platforms such as Jahez, HungerStation, and emerging competitors accelerating French fries consumption through takeaway and delivery channels. Flavor innovation, including seasoned and specialty variants, is attracting younger demographics seeking diverse culinary experiences. Infrastructure investments in cold chain logistics and processing facilities are strengthening supply chain resilience, positioning the market for sustained expansion throughout the forecast period.

Saudi Arabia French Fries Market Trends:

Expansion of Local Manufacturing Capabilities

Saudi Arabia is witnessing significant investments in domestic French fries production facilities as manufacturers seek to reduce import dependency and strengthen food security. Leading food conglomerates are establishing state-of-the-art processing plants equipped with advanced technology to convert locally grown potatoes into premium frozen products for both domestic consumption and regional export markets. This trend toward localization is enabling manufacturers to better serve commercial customers through improved supply chain responsiveness while supporting the Kingdom's broader industrial development objectives and creating employment opportunities for Saudi nationals. Strategic partnerships between international potato processing specialists and local agricultural companies are accelerating knowledge transfer and operational excellence across the emerging domestic manufacturing sector.

Rise of Online Food Delivery Platforms

Digital food ordering platforms are fundamentally reshaping French fries consumption patterns in Saudi Arabia, driving substantial growth in takeaway and delivery channels. Major platforms and emerging competitors have established extensive nationwide coverage, connecting restaurants with residential consumers across urban and suburban areas throughout the Kingdom. French fries remain among the most frequently ordered items through these platforms, benefiting from their universal appeal and suitability for delivery without significant quality degradation during transportation. This digital shift is encouraging restaurants to optimize their French fries offerings for delivery while expanding market reach beyond traditional dine-in customers. Cloud kitchen operations are further amplifying this trend by enabling food operators to serve delivery-focused menus featuring French fries as core menu components.

Growing Demand for Flavor Innovation

Consumer preferences are evolving beyond traditional plain French fries toward seasoned and specialty variants that offer enhanced taste experiences. To appeal to diverse palates, quick-service restaurants and casual dining venues are presenting a variety of flavor profiles, such as cheesy fries, selections flavored with chili, and regional seasoning mixes. This innovation trend is particularly resonant among Saudi Arabia's predominantly young population, who demonstrate openness to international culinary influences and novel taste combinations. Manufacturers are responding by expanding their product portfolios to include flavored and coated French fry varieties that command premium positioning.

How Vision 2030 is Transforming the Saudi Arabia French Fries Market:

Vision 2030 is fundamentally reshaping the Saudi Arabia French fries market through unprecedented investments in tourism, hospitality, and food manufacturing infrastructure. The launch of the Jeddah Food Cluster, recognized by Guinness World Records as the world's largest food park, exemplifies the Kingdom's commitment to expanding domestic food production capabilities and establishing regional leadership in food manufacturing. Ambitious tourism growth objectives are driving rapid expansion of hotels, restaurants, and entertainment venues that incorporate French fries as essential menu components across diverse dining formats. Mega-projects including NEOM, the Red Sea Project, and Qiddiya entertainment city are creating substantial commercial foodservice demand that elevates consumption volumes across institutional channels. Government initiatives supporting local potato cultivation and advanced processing technologies are strengthening supply chain resilience while reducing import dependency. The hospitality sector transformation is generating unprecedented requirements for reliable frozen food supply arrangements, positioning French fries manufacturers to capitalize on expanding commercial opportunities throughout the Kingdom.

Market Outlook 2026-2034:

The Saudi Arabia French fries market is poised for sustained expansion as structural growth drivers continue strengthening across multiple dimensions. The Kingdom's economic transformation under Vision 2030 is catalyzing hospitality infrastructure development, with mega-projects including NEOM, the Red Sea Project, and entertainment cities creating substantial commercial foodservice demand. Tourism growth objectives, targeting 150 Million annual visitors by 2030, are driving restaurant sector expansion and elevating French fries consumption volumes across quick-service and full-service dining formats. The market generated a revenue of USD 504.97 Million in 2025 and is projected to reach a revenue of USD 1,111.19 Million by 2034, growing at a compound annual growth rate of 9.16% from 2026-2034. Domestic production capacity expansion, exemplified by the Al-Jouf Agricultural Development Co.’s French fries factory operating at 35,000 Tons annual capacity with planned expansion to 53,000 Tons, is reducing import reliance while improving supply chain efficiency. The proliferation of food delivery applications and cloud kitchen operations is extending market reach to residential consumers, complementing traditional institutional and commercial channels.

Saudi Arabia French Fries Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Plain | 83% |

| Pricing | Mass | 72% |

| End User | HORECA | 52% |

| Import and Domestic Production | Import | 67% |

| Distribution Channel | Business-to-Business (B2B) | 66% |

| Region | Al Riyadh | 30% |

Product Type Insights:

- Plain

- Flavoured

Plain dominates with a market share of 83% of the total Saudi Arabia French fries market in 2025.

Plain French fries maintain overwhelming market dominance due to their universal appeal and operational versatility across diverse foodservice formats. Quick-service restaurant chains prefer plain variants as they enable customization through various seasoning applications at point-of-service, accommodating regional taste preferences while streamlining inventory management. The Saudi fast food market, valued at USD 10,067.40 Million in 2025 according to industry assessments, relies heavily on plain French fries as a foundational menu component across thousands of restaurant outlets operating throughout the Kingdom. Restaurant operators benefit from simplified procurement processes and reduced storage complexity when standardizing plain variants that serve multiple menu applications.

Manufacturing efficiency advantages further reinforce plain French fries dominance, as standardized production processes enable cost optimization and consistent quality output. Hotels, restaurants, and catering establishments benefit from the flexibility that plain variants provide, allowing kitchen staff to prepare customized offerings based on customer preferences and emerging flavor trends. The segment's pricing accessibility ensures broad market reach across both premium and value-oriented consumer segments, supporting sustained demand growth in institutional and retail channels. Plain French fries also facilitate portion control standardization essential for commercial food cost management.

Pricing Insights:

- Mass

- Premium

Mass leads with a share of 72% of the total Saudi Arabia French fries market in 2025.

Mass-priced French fries command substantial market share driven by the affordability requirements of high-volume commercial operators and price-conscious consumer segments. Quick-service restaurants, which constitute the fastest-growing foodservice category in Saudi Arabia, prioritize cost-effective procurement strategies to maintain competitive menu pricing while preserving profit margins. The emphasis on value-oriented offerings resonates strongly with the Kingdom's young population seeking affordable dining options without compromising on taste or quality. Budget-conscious families and students represent significant consumption segments that gravitate toward establishments featuring competitively priced meal combinations incorporating French fries.

Wholesale distribution dynamics strongly favor mass-priced products as commercial food operators leverage bulk purchasing arrangements to optimize food costs. School cafeterias, hospital food services, and corporate catering operations similarly prioritize affordable options that enable serving large populations while managing tight budget constraints. The mass segment's dominance reflects the Saudi Arabian food industry's structural characteristics, where volume-driven business models predominate across both traditional and emerging foodservice channels. Institutional buyers negotiate favorable pricing through long-term supply contracts that ensure predictable costs and reliable product availability throughout operational periods.

End User Insights:

Access the comprehensive market breakdown Request Sample

- HORECA

- Retailers

HORECA exhibits a clear dominance with a 52% share of the total Saudi Arabia French fries market in 2025.

The HORECA segment's leadership position reflects Saudi Arabia's rapidly expanding hospitality infrastructure and restaurant industry development. Vision 2030 initiatives are driving unprecedented investment in tourism and entertainment facilities, with the Public Investment Fund allocating SAR 42 Billion through its Tourism Investment Enabler Program for hospitality infrastructure development. Hotels, restaurants, and catering operations throughout the Kingdom rely on French fries as an essential menu component that complements diverse cuisine offerings while delivering consistent customer satisfaction.

Quick-service restaurant proliferation continues accelerating HORECA segment demand, with major international chains including McDonald's, Burger King, and KFC maintaining extensive outlet networks across Saudi cities. Local restaurant chains are similarly expanding their footprints, incorporating French fries into traditional and fusion menu offerings that appeal to domestic consumers. The segment benefits from established supply chain relationships and specialized distribution networks that ensure reliable product availability for commercial food operators. Catering companies servicing corporate events, weddings, and institutional functions represent an additional growth dimension within the HORECA segment.

Import and Domestic Production Insights:

- Import

- Domestic Production

Import represents the leading segment with a 67% share of the total Saudi Arabia French fries market in 2025.

Import channels maintain substantial market share as established international suppliers continue meeting the Kingdom's growing French fries requirements. Global potato processing leaders possess production scale advantages and quality certifications that resonate with commercial foodservice operators requiring consistent product specifications. European and North American suppliers have cultivated longstanding relationships with Saudi distributors, ensuring reliable supply chains that deliver premium frozen products meeting stringent food safety standards. International brands benefit from established reputations for quality consistency that commercial operators prioritize when selecting suppliers for high-volume requirements. The Netherlands, Belgium, and other major potato-producing nations have developed specialized export infrastructure supporting efficient shipment to Gulf markets.

Quick-service restaurant chains particularly favor imported French fries due to global sourcing agreements that ensure uniform product characteristics across international franchise networks. Cold chain logistics connecting major ports in Jeddah and Dammam with inland distribution centers facilitate efficient import product movement throughout the Kingdom. Established importers maintain strategic inventory positions to buffer against shipping delays and seasonal demand fluctuations. The import channel's maturity provides commercial operators with diverse supplier options, competitive pricing through scale economies, and access to innovative product varieties developed in established potato processing markets.

Distribution Channel Insights:

- Business-to-Business (B2B)

- Business-to-Consumer (B2C)

Business-to-Business (B2B) holds the largest share with a 66% share of the total Saudi Arabia French fries market in 2025.

The B2B distribution channel dominates owing to the structural importance of commercial foodservice operations in Saudi Arabia's French fries consumption landscape. Institutional buyers, including restaurant chains, hotels, catering companies, and food processors, procure French fries through wholesale and direct distribution arrangements that ensure consistent supply for high-volume operations. Commercial operators prioritize supplier relationships offering competitive pricing, reliable delivery schedules, and technical support for product handling and preparation. The B2B channel's sophistication in managing complex logistics requirements positions it as the backbone of French fries distribution throughout the Kingdom.

Specialized cold chain logistics networks support B2B distribution efficiency, with suppliers maintaining dedicated infrastructure for serving commercial customers requiring reliable delivery schedules and temperature-controlled storage. Partnership arrangements between French fries manufacturers and major foodservice distributors ensure market coverage across the Kingdom's diverse geographic regions. The B2B channel's efficiency in handling bulk transactions and managing credit arrangements makes it the preferred procurement route for professional food operators. Dedicated account management and customized service agreements further strengthen supplier-buyer relationships within institutional distribution networks serving the expanding hospitality sector.

Regional Insights:

- Al Riyadh

- Jeddah

- Dammam

- Makkah

- Others

Al Riyadh dominates the market with a 30% share of the total Saudi Arabia French fries market in 2025.

Al Riyadh's market leadership reflects the capital city's concentration of commercial and hospitality infrastructure that drives substantial French fries consumption. Riyadh Province hosts more than 33,399 restaurants, cafes, and bakeries, representing the largest concentration of food establishments in the Kingdom. The city's expanding entertainment and tourism developments, including the Riyadh Metro system enabling enhanced food court accessibility, are strengthening quick-service restaurant penetration and elevating French fries demand across diverse consumption channels serving the capital's growing population. Major shopping mall developments incorporating extensive food court facilities create concentrated demand nodes attracting significant French fries consumption volumes.

The capital's status as the Kingdom's economic and administrative center attracts substantial working population requiring convenient dining options throughout business districts. Corporate catering requirements and institutional food services supporting government facilities further amplify B2B French fries demand within the region. Riyadh's hosting of international events, conferences, and entertainment activities generates additional hospitality sector requirements that incorporate French fries across diverse menu applications. The city's continued infrastructure expansion and population growth trajectory indicate sustained demand strengthening throughout the forecast period.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia French Fries Market Growing?

Rapid Expansion of Quick-Service Restaurant Sector

The proliferation of quick-service restaurants across Saudi Arabia is establishing a fundamental demand foundation for French fries consumption. International fast-food chains and local operators are continuously expanding their outlet networks, positioning French fries as an essential menu accompaniment for burgers, fried chicken, and sandwich offerings. The Kingdom's young, urbanized population demonstrates strong preference for convenient dining options that incorporate French fries as a staple side dish. Restaurant operators are investing in standardized preparation equipment and training programs to ensure consistent French fries quality across expanding outlet networks. The April 2025 launch of Pret A Manger's first outlet in Riyadh's Olaya Towers exemplifies the continuing international brand expansion driving commercial French fries demand growth. Menu innovation incorporating diverse French fries presentations is attracting broader consumer segments while reinforcing French fries as a core revenue contributor for foodservice establishments.

Rising Disposable Incomes and Evolving Consumer Lifestyles

Increasing household spending power across Saudi Arabia is fundamentally strengthening consumer demand for convenient food products including French fries. Economic prosperity is enabling more frequent dining out occasions and greater acceptance of premium frozen food products for home consumption. According to the Mastercard Economics Institute's Economic Outlook 2025 for Saudi Arabia, the Kingdom's GDP is expected to increase by 3.7% annually while consumer expenditure is anticipated to grow by 4.5%, reflecting robust purchasing capacity expansion. Urbanization is accelerating lifestyle transformations, with busy work schedules and reduced meal preparation time driving preference for ready-to-eat and quick-cooking food solutions. French fries, as an affordable and universally appealing side dish, benefit directly from these consumption pattern shifts across both foodservice and retail channels. The expanding middle class demonstrates increasing willingness to spend on convenient meal options that align with modern lifestyles. Dual-income households particularly favor frozen French fries for their ease of preparation and consistent quality. Urban consumers' growing exposure to international food trends is normalizing French fries consumption as a regular dietary component rather than occasional indulgence, supporting sustained volume growth throughout the forecast period.

Digital Food Delivery Platform Proliferation

Online food ordering platforms are transforming consumption patterns and extending market reach for French fries products throughout Saudi Arabia. Digital channels enable restaurants to serve residential customers who previously relied exclusively on dine-in or takeaway options, substantially broadening addressable market scope. French fries maintain strong positioning within delivery orders due to their universal appeal and suitability for transportation without significant quality degradation. Platform partnerships with restaurant chains ensure prominent menu placement and promotional visibility for French fries offerings.

Market Restraints:

What Challenges the Saudi Arabia French Fries Market is Facing?

Cold Chain Infrastructure Limitations

Maintaining consistent cold chain integrity across Saudi Arabia's expansive geography presents operational challenges for French fries distribution. Temperature control requirements are particularly demanding during summer months when ambient conditions can compromise product quality during transportation and storage. Distribution to secondary cities and remote areas requires specialized logistics capabilities that smaller operators may lack, potentially limiting market penetration in underserved regions.

Health-Conscious Consumer Trends

Growing awareness regarding dietary health is influencing consumer attitudes toward fried food consumption, creating headwinds for traditional French fries products. Concerns about caloric content, oil quality, and nutritional value are prompting some consumers to reduce French fries intake or seek healthier alternatives. Foodservice operators are responding with air-fried options and reduced-fat preparations, though these variants represent a minor portion of current market volumes.

Import Dependency and Supply Chain Vulnerability

Substantial reliance on imported French fries exposes the market to supply chain disruptions, currency fluctuations, and international logistics constraints. Global shipping cost volatility and port congestion can impact product availability and pricing stability for commercial operators dependent on imported supply. While domestic production is expanding, current manufacturing capacity remains insufficient to fully address import substitution requirements.

Competitive Landscape:

The Saudi Arabia French fries market features participation from established international potato processing corporations alongside expanding domestic manufacturers. Global suppliers leverage production scale advantages and established foodservice relationships to maintain substantial market positions. Competition is intensifying as local manufacturers invest in modern processing facilities to capture market share and reduce import dependency. Strategic partnerships between international suppliers and regional distributors ensure comprehensive market coverage across commercial and retail channels. Companies are differentiating through product innovation, quality certifications, and supply reliability to strengthen relationships with institutional buyers. Investment in cold chain infrastructure and distribution capabilities represents a critical competitive dimension as operators seek to serve expanding quick-service restaurant networks and emerging delivery platforms.

Some of the key players include:

- Al Kabeer Group ME (Savola Group)

- Al Munajem Cold Stores Company

- Americana Group Inc

- BRF S.A

- Food & Fine Pastries Al Sunbulah Manufacturing Co

- Fresh Del Monte Produce Inc.

- Kühne + Heitz B.V.

- Lamb Weston Holdings Inc

- McCain Foods Limited

- Mondial Foods B.V.

- Saudia Dairy & Foodstuff Company

- Wafrah for Industry and Development

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD, Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Plain, Flavoured |

| Pricing Covered | Mass, Premium |

| End Users Covered | HORECA, Retailers |

| Imports and Domestic Production Covered | Import, Domestic Production |

| Distribution Channels Covered | Business-to-Business (B2B), Business-to-Consumer (B2C) |

| Regions Covered | Al Riyadh, Jeddah, Dammam, Makkah, Others |

| Companies Covered | Al Kabeer Group ME (Savola Group), Al Munajem Cold Stores Company, Americana Group Inc, BRF S.A, Food & Fine Pastries Al Sunbulah Manufacturing Co, Fresh Del Monte Produce Inc., Kühne + Heitz B.V., Lamb Weston Holdings Inc, McCain Foods Limited, Mondial Foods B.V., Saudia Dairy & Foodstuff Company and Wafrah for Industry and Development |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia French fries market size was valued at USD 504.97 Million in 2025.

The Saudi Arabia French fries market is expected to grow at a compound annual growth rate of 9.16% from 2026-2034 to reach USD 1,111.19 Million by 2034.

Plain dominated the market with a share of 83%, owing to its versatility, widespread consumer acceptance, and cost-effective production processes that enable competitive pricing across commercial channels.

Key factors driving the Saudi Arabia French fries market include rapid quick-service restaurant expansion, Vision 2030 tourism and hospitality development, digital food delivery platform proliferation, and growing consumer preference for convenient dining options.

Major challenges include cold chain infrastructure limitations in remote areas, health-conscious consumer trends influencing fried food consumption, import dependency creating supply chain vulnerabilities, and competition from alternative snack categories.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)