Saudi Arabia Frozen Foods Market Size, Share, Trends and Forecast by Product and Region, 2026-2034

Saudi Arabia Frozen Foods Market Overview:

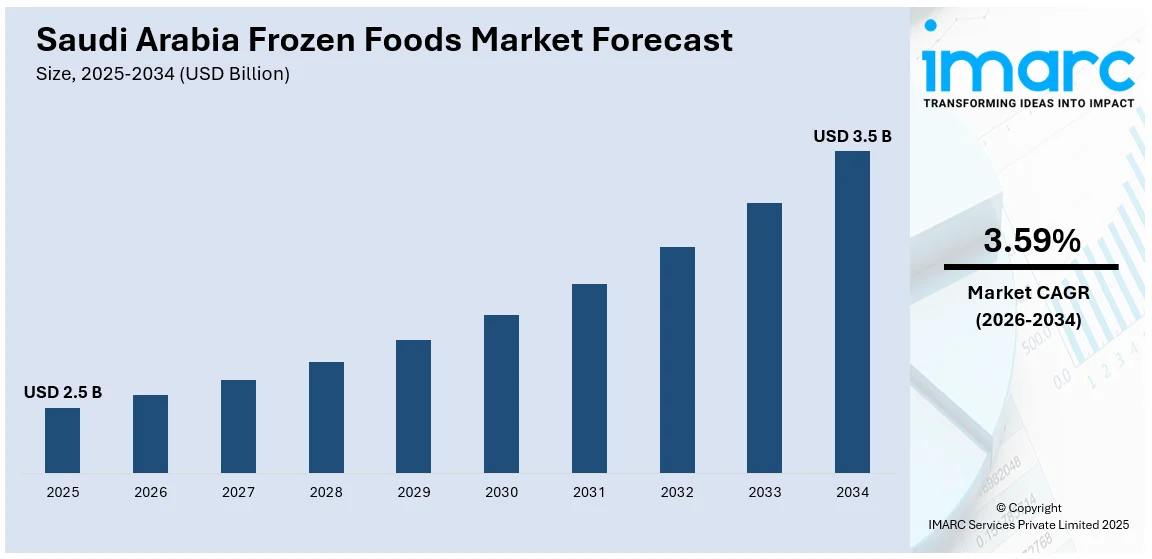

The Saudi Arabia frozen foods market size reached USD 2.5 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 3.5 Billion by 2034, exhibiting a growth rate (CAGR) of 3.59% during 2026-2034. The market is experiencing strong growth, driven by increasing consumer demand for convenience and high-quality products. Investments in local manufacturing, such as new production facilities by Americana, Farm Frites, and Agthia, are expanding the Saudi Arabia frozen foods market share and supporting Vision 2030 goals.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2.5 Billion |

| Market Forecast in 2034 | USD 3.5 Billion |

| Market Growth Rate 2026-2034 | 3.59% |

Saudi Arabia Frozen Foods Market Trends:

Expansion of Local Manufacturing Capacity

The Saudi frozen foods market is growing at a fast rate due to local manufacturing capacity building. This move supports the government's Vision 2030 plan, which promotes investment in local production and food security. The focus is to lower the country's reliance on imports and provide a consistent supply of high-quality food products to fulfill growing consumer demand. Local production not only generates jobs but also solidifies the food sector by increasing output and enhancing the supply chain, rendering food items more accessible and affordable. In November 2024, Americana and Farm Frites announced a USD 100 million investment to build a state-of-the-art frozen French fries factory in Saudi Arabia, which will begin operations in 2026. The new plant is designed to increase local manufacturing and counter the increasing demand for frozen potato foods, especially French fries. The factory will assist the firms in adhering to Saudi Arabia's Vision 2030 aim of increasing local food production and enhancing food security. The action is anticipated to consolidate the frozen foods industry in the MENA region, especially in the sector of frozen potatoes. It will allow Americana and Farm Frites to take advantage of the growing demand for frozen food in the country. Through concentration on local manufacturing, the firms will assist in lowering the demand for imports as well as enhancing supply chain efficiency.

To get more information on this market Request Sample

Growing Demand for Processed Foods and Innovation

The increasing need for frozen food in Saudi Arabia is stimulated by changing consumer taste towards convenience and quality. Due to consumer demand for healthier, high-quality food that is convenient to prepare, the processed food industry has become a fundamental component of the Kingdom's food market. This has encouraged the manufacturers to invest in research and develop their capacities to produce food that meets the changing consumer taste. Additionally, government initiatives like Vision 2030 are supporting the food industry's growth, encouraging businesses to enhance local production and support food security. In July 2024, Agthia Group, a leading food and beverage company, opened a new AED 90 Million protein manufacturing facility in Jeddah. This new plant, with a capacity of 9,000 tons per year, is intended to meet the growing demand for frozen and processed meat products in Saudi Arabia. The plant will manufacture a variety of products to appeal to local customers, enhancing Agthia's position in the Saudi Arabian market and the wider MENA region. Through the increase in its manufacturing capabilities, Agthia is optimally positioned to address existing as well as future market needs. The investment responds to the increased demand for regional production within the region, and especially processed food. With rising consumer demand for convenience and high-quality products, Agthia's strategic investment in operational effectiveness and innovation will enable it to consolidate its market leadership position within the Saudi frozen foods sector. The initiatives of the company to increase production capacities will add to the overall Saudi Arabia frozen foods market growth.

Saudi Arabia Frozen Foods Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2026-2034. Our report has categorized the market based on product.

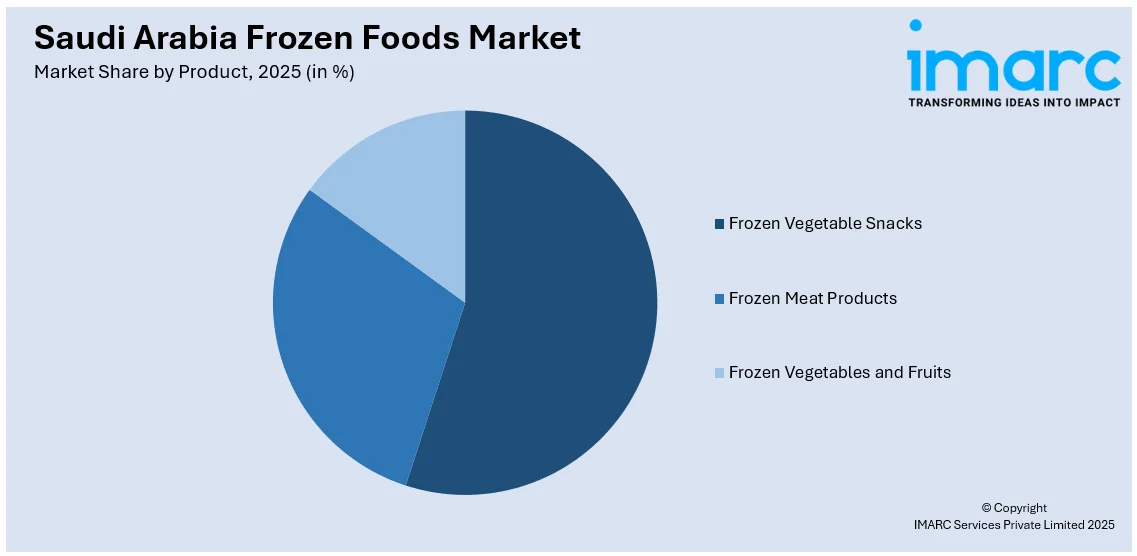

Analysis by Product:

Access the comprehensive market breakdown Request Sample

- Frozen Vegetable Snacks

- French Fries

- Bites, Wedges and Smileys

- Aloo Tikki

- Nuggets

- Others

- Frozen Meat Products

- Chicken

- Fish

- Pork

- Mutton

- Others

- Frozen Vegetables and Fruits

- Breakup by Frozen Vegetables

- Green Peas

- Corn

- Mixed Vegetables

- Carrot

- Cauliflower

- Others

- Breakup by Frozen Fruits

- Strawberries

- Berries (Raspberries, Blueberries and Blackberries)

- Cherries

- Others

- Breakup by Frozen Vegetables

The report has provided a detailed breakup and analysis of the market based on the product. This includes frozen vegetable snacks (french fries, bites, wedges and smileys, aloo tikki, nuggets, and others), frozen meat products (chicken, fish, pork, mutton, and others), and frozen vegetables and fruits [breakup by frozen vegetables (green peas, corn, mixed vegetables, carrot, cauliflower, and others), breakup by frozen fruits (strawberries, berries (raspberries, blueberries and blackberries), cherries, and others)].

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central region, Western region, Eastern region, and Southern region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Frozen Foods Market News:

- May 2025: SADAFCO showcased its growth and products at the Saudi Food Show, highlighting its investments in the frozen foods sector. The company expanded its ice cream factory with an additional SR20 Million investment, boosting production capacity and product variety, positively impacting the Saudi frozen foods market.

- January 2025: Siniora Foods announced a USD 40 Million investment to construct a new manufacturing facility in Jeddah, Saudi Arabia, focusing on cold cuts and frozen foods. This move aimed to enhance production capacity, supporting Saudi Arabia’s growing domestic food industry and increasing market share for frozen foods.

Saudi Arabia Frozen Foods Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia frozen foods market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia frozen foods market on the basis of product?

- What is the breakup of the Saudi Arabia frozen foods market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia frozen foods market?

- What are the key driving factors and challenges in the Saudi Arabia frozen foods market?

- What is the structure of the Saudi Arabia frozen foods market and who are the key players?

- What is the degree of competition in the Saudi Arabia frozen foods market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia frozen foods market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia frozen foods market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia frozen foods industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)