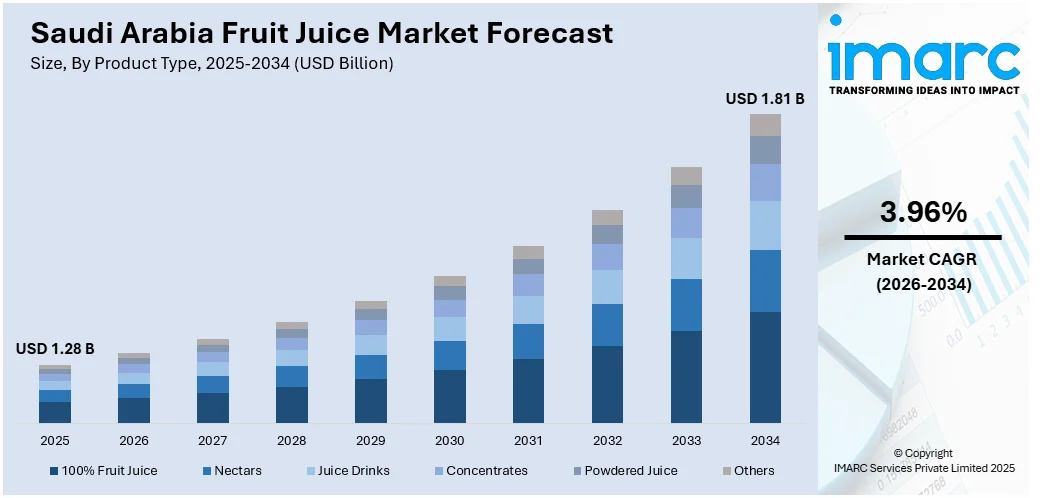

Saudi Arabia Fruit Juice Market Report by Product Type (100% Fruit Juice, Nectars, Juice Drinks, Concentrates, Powdered Juice, and Others), Flavor (Orange, Apple, Mango, Mixed Fruit, and Others), Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Specialty Food Stores, Online Retail, and Others), and Region 2026-2034

Market Overview:

Saudi Arabia fruit juice market size reached USD 1.28 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 1.81 Billion by 2034, exhibiting a growth rate (CAGR) of 3.96% during 2026-2034. The increasing prevalence of busier lifestyles and a preference for convenience, which have escalated the demand for ready-to-drink fruit juices that can be consumed on the go, is driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 1.28 Billion |

|

Market Forecast in 2034

|

USD 1.81 Billion |

| Market Growth Rate 2026-2034 | 3.96% |

Fruit juice is a popular and refreshing beverage derived from the liquid extracted from fruits. The process typically involves crushing or pressing fruits to extract their natural juices, which may then be filtered and sometimes concentrated. Fruit juices come in a variety of flavors, colors, and nutritional profiles, depending on the type of fruit used. These beverages are cherished for their vibrant taste, natural sweetness, and the vitamins and minerals they contain. Whether consumed as a standalone drink or used as an ingredient in cocktails, smoothies, or culinary recipes, fruit juice adds a burst of flavor and nutrition to various dishes. However, it's essential to note that some commercially available fruit juices may contain added sugars or preservatives, potentially diminishing their health benefits. As such, choosing freshly squeezed or 100% natural fruit juices can be a healthier option, offering a delightful and nutritious way to stay hydrated and enjoy the essence of fruits.

To get more information on this market Request Sample

Saudi Arabia Fruit Juice Market Trends:

Rising Health and Wellness Awareness

The growing focus on health and wellness is fueling the market growth in Saudi Arabia. As per the IMARC Group, the Saudi Arabia health and wellness market size reached USD 35,321.5 Million in 2024. With increasing concerns about obesity, diabetes, and other lifestyle-related diseases, people are shifting from carbonated soft drinks to healthier alternatives like natural fruit juices. Juices rich in vitamins, antioxidants, and minerals are perceived as essential for maintaining a balanced diet, especially among young professionals and families. Marketing campaigns emphasizing the nutritional value of 100% juices, cold-pressed options, and fortified blends are further catalyzing the demand. As fitness culture is spreading and more people are adopting healthy eating habits, fruit juices are positioned as a convenient and nutritious option.

Thriving Tourism and Hospitality Sectors

Saudi Arabia’s rapidly burgeoning tourism and hospitality industries, driven by Vision 2030 initiatives, are creating significant opportunities for the fruit juice market. Ahmed Al Khateeb, the Saudi Minister of Tourism, announced that the Kingdom welcomed 30 Million international visitors in 2024. Hotels, resorts, restaurants, and cafes increasingly offer fresh and packaged juices as part of their beverage menus, catering to both local consumers and international visitors. Tourists, especially those from health-conscious regions, demand a wide variety of natural juices, boosting sales in the food service sector. Events, exhibitions, and entertainment zones linked to the tourism boom are also expanding out-of-home juice consumption. Moreover, the rising number of juice bars and cafes, inspired by global trends, is further catalyzing the demand for innovative juice flavors and blends.

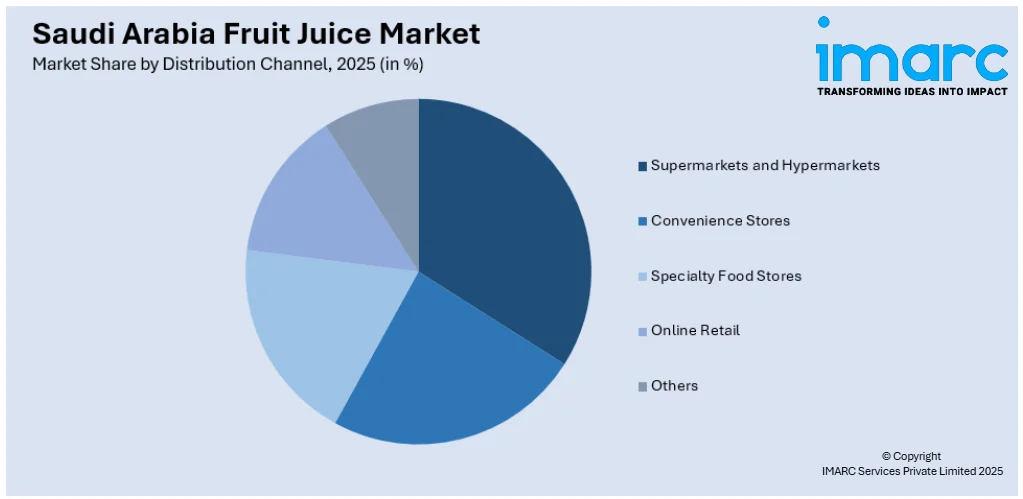

Increasing Retail Expansion and Distribution Channels

The broadening of modern retail formats across Saudi Arabia has significantly boosted the availability and visibility of fruit juice products. As per industry reports, KSA retail sales reached SAR 37.4 Billion during Q3 2024. Supermarkets, hypermarkets, and convenience stores offer a wide variety of packaged juices, giving consumers more choice and encouraging impulse purchases. The rise of e-commerce platforms and grocery delivery apps is further enhancing accessibility, especially in urban areas wherein online shopping is rapidly growing. Retailers actively promote fruit juice brands through discounts, product placement, and bundled offers, which increases sales volume. Additionally, partnerships between juice manufacturers and retail chains ensure strong distribution networks across both metropolitan and regional areas. With organized retail channels offering premium shelf space, international brands and local producers alike are benefiting from stronger consumer engagement.

Key Growth Drivers of Saudi Arabia Fruit Juice Market:

Youth Demographics and Rising Preferences for Flavored Beverages

Saudi Arabia’s young population is catalyzing the demand for flavored fruit juices as an alternative to carbonated soft drinks. Teens and young adults prefer innovative, trendy beverages that balance taste and health benefits, making juices with unique flavor combinations highly popular. This demographic also responds strongly to attractive packaging, marketing campaigns, and social media promotions, which boost brand loyalty and repeat purchases. With a large portion of the population under 35, the demand for refreshing, portable, and affordable fruit juice options continues to grow. The youth segment is also driving experimentation with exotic fruit blends, sparkling juices, and fusion beverages that cater to changing tastes. By aligning with youthful consumer preferences, juice brands are securing strong growth prospects, making Saudi Arabia’s demographic structure a significant contributor to the expansion of the market.

Shift Towards Premium and Organic Juices

Consumer preferences in Saudi Arabia are shifting towards premium and organic juices, as awareness about natural and chemical-free products is rising. Health-conscious people are increasingly willing to pay higher prices for cold-pressed, preservative-free, and 100% organic fruit juices that promise superior quality and nutrition. Premium juice brands are introducing innovative packaging and highlighting sustainability for appealing to affluent customers. This trend is reinforced by the growing presence of expatriates and global influences, which introduce new consumption patterns into the Saudi market. Organic products also resonate with people who prioritize environmentally responsible choices. As disposable incomes are rising and luxury consumption is expanding, premium juices are becoming a lifestyle product associated with wellness and sophistication.

Strong Government Support for Food and Beverage (F&B) Sector

Government policies supporting the F&B sector development are significantly contributing to the growth of the fruit juice market. Investments in local manufacturing, agricultural development, and food processing align with Vision 2030’s goal of diversifying the economy beyond oil. Incentives for setting up processing facilities and partnerships with international beverage companies are strengthening domestic production capacity. Public health campaigns that encourage reduced sugar intake aid in promoting fruit juice as a healthier alternative of sugary soft drinks. Moreover, initiatives to enhance local farming of fruits like dates, citrus, and tropical varieties provide raw material support for juice manufacturers. Government’s focus on food security, self-sufficiency, and healthier dietary habits positions fruit juice production as a priority within the broader F&B landscape.

Saudi Arabia Fruit Juice Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country levels for 2026-2034. Our report has categorized the market based on product type, flavor, and distribution channel.

Product Type Insights:

- 100% Fruit Juice

- Nectars

- Juice Drinks

- Concentrates

- Powdered Juice

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes 100% fruit juice, nectars, juice drinks, concentrates, powdered juice, and others.

Flavor Insights:

- Orange

- Apple

- Mango

- Mixed Fruit

- Others

A detailed breakup and analysis of the market based on the flavor have also been provided in the report. This includes orange, apple, mango, mixed fruit, and others.

Distribution Channel Insights:

Access the Comprehensive Market Breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Food Stores

- Online Retail

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, convenience stores, specialty food stores, online retail, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the key players include:

- Al Othman Holding

- Al Rabie Saudi Foods Co. Ltd.

- Almarai Co Ltd

- Gulf Union Foods Co.

- Halwani Bros

- National Agricultural Development Co.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Saudi Arabia Fruit Juice Market News:

- March 2025: In a statement issued for World Obesity Day, the Saudi Food and Drug Authority (SFDA) encouraged parents to motivate children to swap sugary beverages, such as sodas, for water and natural fruit juices. Acknowledging the concerning increase in obesity rates, the authority highlighted the need for heightened public awareness to tackle this escalating issue.

Saudi Arabia Fruit Juice Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | 100% Fruit Juice, Nectars, Juice Drinks, Concentrates, Powdered Juice, Others |

| Flavors Covered | Orange, Apple, Mango, Mixed Fruit, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Food Stores, Online Retail, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Companies Covered | Al Othman Holding, Al Rabie Saudi Foods Co. Ltd., Almarai Co Ltd, Gulf Union Foods Co., Halwani Bros, National Agricultural Development Co., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia fruit juice market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia fruit juice market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia fruit juice industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The fruit juice market in Saudi Arabia was valued at USD 1.28 Billion in 2025.

The Saudi Arabia fruit juice market is projected to exhibit a CAGR of 3.96% during 2026-2034, reaching a value of USD 1.81 Billion by 2034.

People are opting for juices rich in vitamins, antioxidants, and natural ingredients, aligning with global wellness trends. Product innovations, including low-sugar, fortified, and exotic fruit blends, are also attracting diverse consumer segments. Retail expansion, online grocery platforms, and the growth of convenience stores are further supporting wider accessibility and usage.

Some of the major players in the Saudi Arabia fruit juice market include Al Othman Holding, Al Rabie Saudi Foods Co. Ltd., Almarai Co Ltd, Gulf Union Foods Co., Halwani Bros, National Agricultural Development Co., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)