Saudi Arabia Functional Supplements Market Size, Share, Trends and Forecast by Product Type, Formulation Type, Health Benefits, Distribution Channel, and Region, 2026-2034

Saudi Arabia Functional Supplements Market Overview:

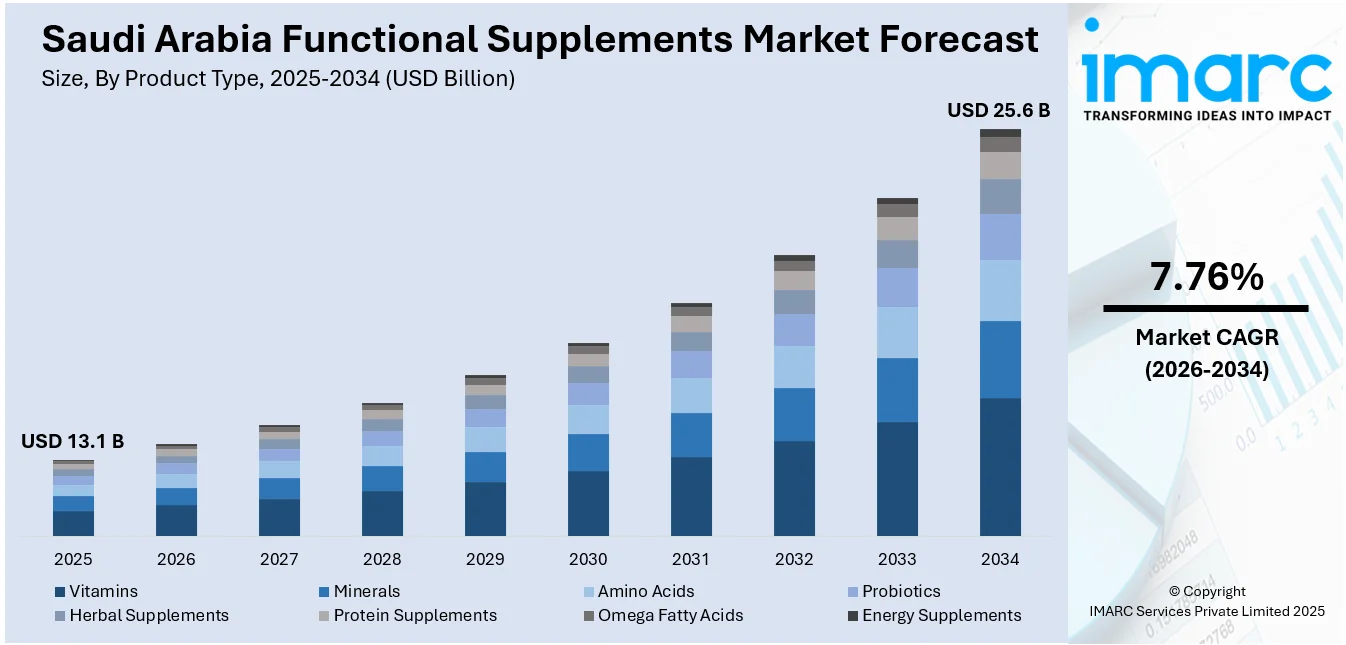

The Saudi Arabia functional supplements market size reached USD 13.1 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 25.6 Billion by 2034, exhibiting a growth rate (CAGR) of 7.76% during 2026-2034. The market is growing steadily, driven by rising health awareness and a shift toward preventive wellness. Consumers are also increasingly turning to supplements to support immunity, energy, and overall health. Government health initiatives and improved product availability are some of the other growth-inducing factors further enhancing the Saudi Arabia functional supplements market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 13.1 Billion |

| Market Forecast in 2034 | USD 25.6 Billion |

| Market Growth Rate 2026-2034 | 7.76% |

Saudi Arabia Functional Supplements Market Trends:

Expanding Fitness and Active Lifestyle Culture

With the government promoting physical activity through initiatives like Vision 2030, the fitness and wellness movement in Saudi Arabia has accelerated. Gyms, health clubs, and sports events are on the rise, creating strong demand for supplements tailored to performance, endurance, and recovery. Products such as protein powders, amino acids, pre-workout blends, and hydration supplements are especially popular among athletes and fitness-conscious consumers. Functional supplements that enhance stamina, build muscle, or speed up recovery are no longer niche—they’re becoming mainstream. Brands are targeting gym-goers and health influencers to promote performance-related products, aligning with broader wellness goals. This cultural shift toward active living is driving continued interest and growth in the functional supplements segment throughout the Kingdom.

To get more information on this market Request Sample

Growth of E-commerce and Retail Accessibility

The availability of functional supplements through both brick-and-mortar outlets and online platforms is significantly boosting consumer access. Pharmacies, health food stores, and supermarkets are offering a wider range of supplements, while e-commerce platforms are expanding consumer reach with subscription models, personalized nutrition options, and detailed product information. This multi-channel approach helps consumers explore new products based on their unique health goals. Influencer marketing and social media platforms also play a role in guiding purchasing decisions, especially among younger consumers. The convenience of digital shopping, combined with fast delivery and a growing variety of international and local brands, is accelerating adoption. Improved retail access is thus a vital factor contributing to the Saudi Arabia functional supplements market growth.

Government Initiatives and Regulatory Support

The Saudi government is actively promoting better health through national strategies that encourage nutritional awareness and healthy lifestyles. These policies are not only increasing demand for functional supplements but also ensuring higher product standards. The Saudi Food and Drug Authority (SFDA) plays a key role in regulating ingredients, labeling, and health claims, enhancing consumer trust and product credibility. Additionally, Vision 2030’s focus on healthcare diversification and prevention aligns closely with the growth of the supplements sector. Government-backed health campaigns are raising awareness about the benefits of supplementation for deficiencies, immunity, and chronic condition management. By providing a supportive regulatory and policy environment, the government is facilitating innovation, investment, and sustainable growth in Saudi Arabia’s functional supplements market.

Saudi Arabia Functional Supplements Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type, formulation type, health benefits, and distribution channel.

Product Type Insights:

- Vitamins

- Minerals

- Amino Acids

- Probiotics

- Herbal Supplements

- Protein Supplements

- Omega Fatty Acids

- Energy Supplements

The report has provided a detailed breakup and analysis of the market based on the product type. This includes vitamins, minerals, amino acids, probiotics, herbal supplements, protein supplements, omega fatty acids, and energy supplements.

Formulation Type Insights:

- Pills and Capsules

- Powders

- Liquids

- Gummies

- Bars

A detailed breakup and analysis of the market based on the formulation type have also been provided in the report. This includes pills and capsules, powders, liquids, gummies, and bars.

Health Benefit Insights:

- Weight Management

- Digestive Health

- Joint Health

- Immunity Boosting

- Energy Enhancement

- Heart Health

- Mental Wellbeing

- Bone Health

A detailed breakup and analysis of the market based on the health benefit have also been provided in the report. This includes weight management, digestive health, joint health, immunity boosting, energy enhancement, heart health, mental wellbeing, and bone health.

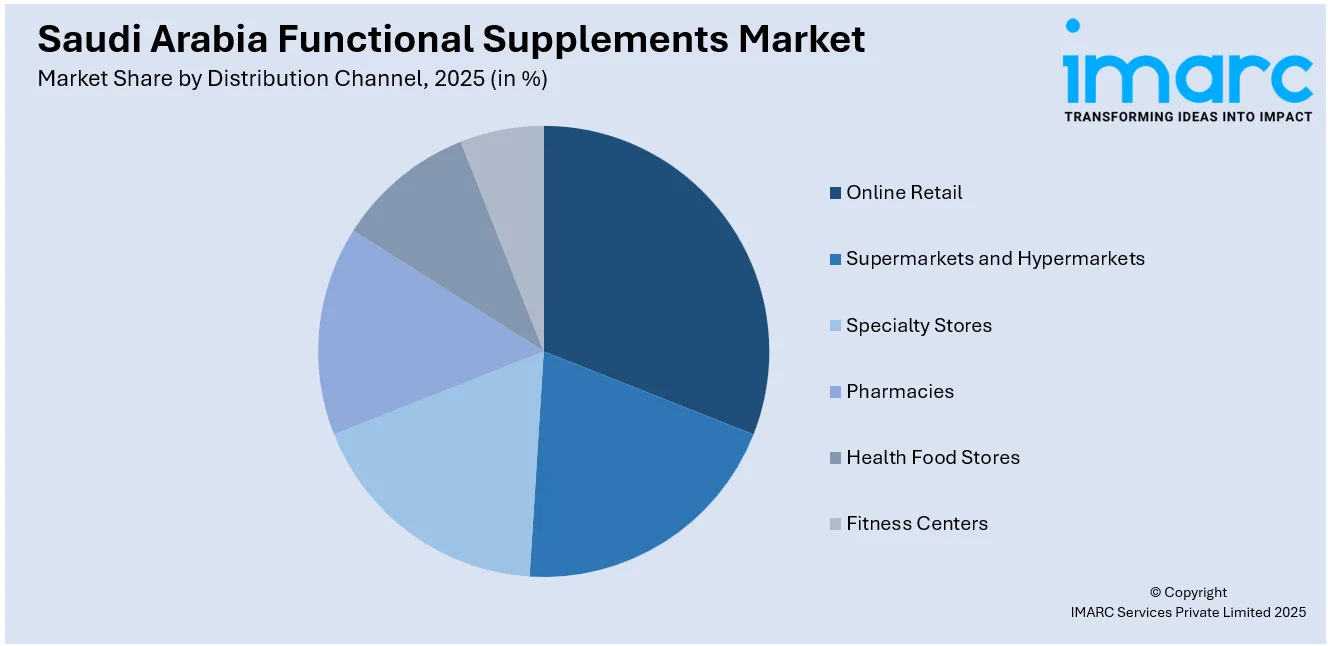

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online Retail

- Supermarkets and Hypermarkets

- Specialty Stores

- Pharmacies

- Health Food Stores

- Fitness Centers

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online retail, supermarkets and hypermarkets, specialty stores, pharmacies, health food stores, and fitness centers.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include the Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Functional Supplements Market News:

- In March 2023, the GoFigure consumer brand of nutritious shakes and bars was introduced in Saudi Arabia by OptiBiotix Health Plc (York, UK), a supplier of substances related to microbiome health. The company claims that making these items available in Saudi Arabia is aligned with the nation's objective of tackling the rising obesity rates among its citizens.

Saudi Arabia Functional Supplements Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Vitamins, Minerals, Amino Acids, Probiotics, Herbal Supplements, Protein Supplements, Omega Fatty Acids, Energy Supplements |

| Formulation Types Covered | Pills and Capsules, Powders, Liquids, Gummies, Bars |

| Health Benefits Covered | Weight Management, Digestive Health, Joint Health, Immunity Boosting, Energy Enhancement, Heart Health, Mental Wellbeing, Bone Health |

| Distribution Channels Covered | Online Retail, Supermarkets and Hypermarkets, Specialty Stores, Pharmacies, Health Food Stores, Fitness Centers |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia functional supplements market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia functional supplements market on the basis of product type?

- What is the breakup of the Saudi Arabia functional supplements market on the basis of formulation type?

- What is the breakup of the Saudi Arabia functional supplements market on the basis of health benefit?

- What is the breakup of the Saudi Arabia functional supplements market on the basis of distribution channel?

- What is the breakup of the Saudi Arabia functional supplements market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia functional supplements market?

- What are the key driving factors and challenges in the Saudi Arabia functional supplements market?

- What is the structure of the Saudi Arabia functional supplements market and who are the key players?

- What is the degree of competition in the Saudi Arabia functional supplements market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia functional supplements market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia functional supplements market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia functional supplements industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)