Saudi Arabia Gaming Furniture Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

Saudi Arabia Gaming Furniture Market Summary:

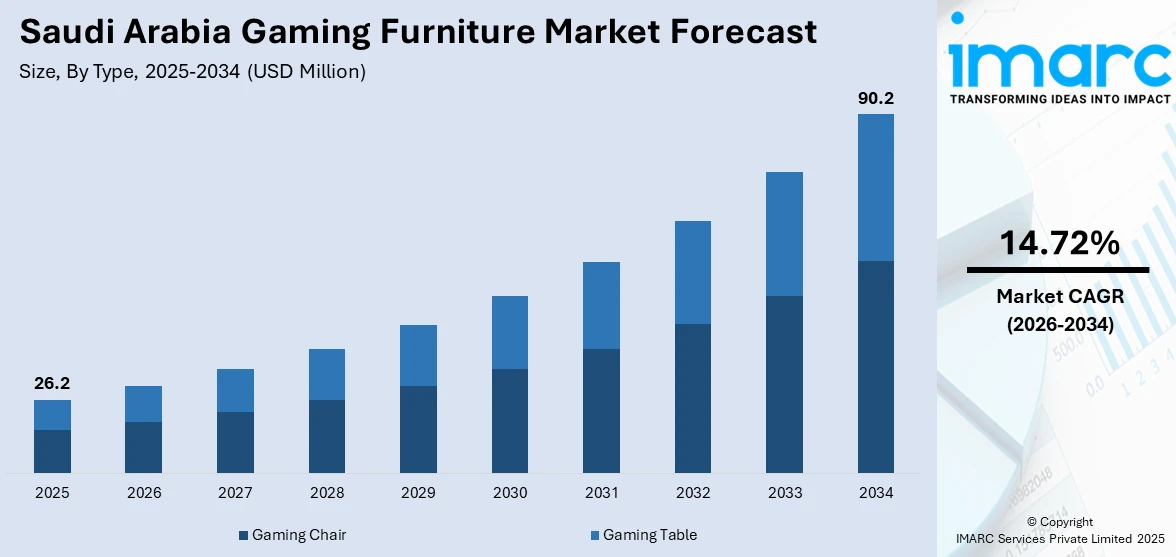

The Saudi Arabia gaming furniture market size was valued at USD 26.2 Million in 2025 and is projected to reach USD 90.2 Million by 2034, growing at a compound annual growth rate of 14.72% from 2026-2034.

The Saudi Arabia gaming furniture market is experiencing robust expansion driven by the Kingdom's rapidly growing gaming population, heightened awareness of ergonomic solutions among gamers, and increasing demand for specialized furniture that supports extended gaming sessions. The convergence of government-backed Vision 2030 initiatives promoting digital entertainment, rising disposable incomes, and the growing influence of esports tournaments is propelling market growth and elevating the Saudi Arabia gaming furniture market share.

Key Takeaways and Insights:

- By Type: Gaming chair dominates the market with a share of 71% in 2025, driven by the growing emphasis on ergonomic support and comfort during extended gaming sessions, with professional and casual gamers increasingly prioritizing lumbar support, adjustable features, and high-quality materials that reduce physical strain.

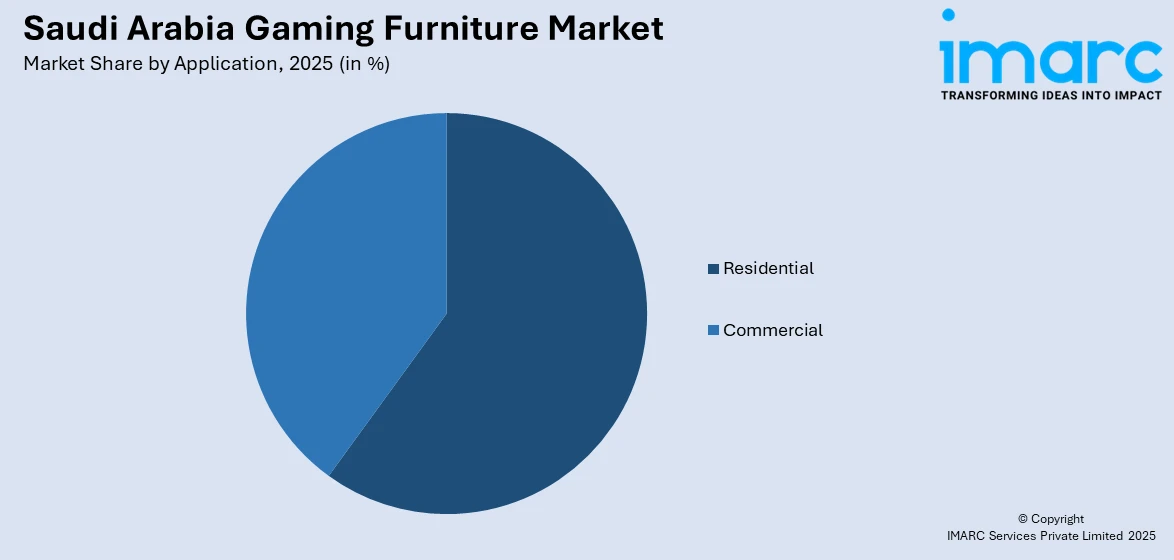

- By Application: Residential leads the market with a share of 76% in 2025, attributed to the expanding home gaming culture among Saudi youth, rising disposable incomes enabling premium furniture purchases, and the increasing trend of dedicated home gaming setups for streaming and content creation.

- By Region: Northern and Central Region represents the largest segment with a market share of 35% in 2025, owing to Riyadh's concentration of young tech-savvy population, higher disposable incomes, superior retail infrastructure, and proximity to major esports venues and gaming centers.

- Key Players: The Saudi Arabia gaming furniture market exhibits moderate competitive intensity, with international brands competing alongside regional distributors and emerging local manufacturers. Companies are differentiating through ergonomic innovation, aesthetic customization, and strategic partnerships with esports organizations.

To get more information on this market Request Sample

The Saudi Arabia gaming furniture market is undergoing a significant transformation as the Kingdom positions itself as a global gaming and esports hub. With approximately 23.5 million gamers representing nearly 67% of the population, the demand for specialized gaming furniture has intensified substantially. The National Gaming and Esports Strategy, launched as part of Vision 2030, aims to create 39,000 jobs and contribute USD 13.3 billion to GDP by 2030, directly stimulating auxiliary industries including gaming furniture. Institutional demand for professional-grade gaming furniture in Saudi Arabia is rising, highlighted by partnerships that provide custom-designed equipment for esports tournaments. This growth is further supported by the expansion of gaming cafés, esports arenas, and dedicated gaming zones in major cities, which generate steady commercial demand alongside increasing residential consumption, driving overall market growth and adoption of specialized gaming furniture.

Saudi Arabia Gaming Furniture Market Trends:

Expanding Gaming Community and Esports Ecosystem

The Saudi Arabia gaming furniture sector is experiencing robust growth as the gaming population continues expanding rapidly throughout the nation. The government's Vision 2030 strategy, strategically targeting digital entertainment and youth participation, is encouraging substantial investments in infrastructure and partnerships promoting esports and gaming development. This encompasses the creation of high-technology gaming centers, gaming hubs, and large-scale tournaments, all driving demand for high-performance and ergonomically styled gaming furniture. Under Vision 2030, Saudi Arabia aims to establish 250 gaming companies by 2030 and has committed substantial funds through the Public Investment Fund's Savvy Games Group.

Increased Health Consciousness and Demand for Ergonomic Solutions

The increasing health, posture, and long-term ergonomics awareness among the gaming population is propelling the Saudi Arabia gaming furniture market growth. As gaming sessions become longer and more prolonged, consumers are becoming increasingly aware of the physical strain associated with inferior seating and desk setups. This awareness is resulting in greater demand for ergonomically designed gaming chairs featuring memory foam, adjustable armrests, lumbar support pillows, and height-adjustable desks. Major gaming chair manufacturers are incorporating wellness features and breathable, durable materials to meet this growing demand for health-conscious gaming solutions.

Growing Influence of Live Streaming and Content Creation

The rising popularity of live streaming and content creation in Saudi Arabia is boosting demand for gaming furniture that combines advanced functionality with appealing aesthetics. Gamers are designing elaborate setups not only for comfort but also for on-camera presentation during streams. Social media influencers and content creators showcase premium gaming chairs, LED-equipped desks, and customized room designs, inspiring followers and fueling aspirational trends. This growing creator-driven culture is expanding the market for specialized gaming furniture, as both professional and casual gamers seek equipment that enhances performance, visual appeal, and overall streaming or gaming experience.

How Vision 2030 is Transforming the Saudi Arabia Gaming Furniture Market:

Vision 2030 is transforming Saudi Arabia’s gaming furniture market by driving economic diversification, boosting the entertainment sector, and fostering a vibrant digital economy. Government initiatives, including the development of e-sports hubs, gaming events, and tech-focused entertainment zones, are increasing demand for specialized gaming setups. Rising youth engagement, higher disposable incomes, and a growing gaming culture are encouraging consumers to invest in ergonomic, high-performance gaming chairs, desks, and accessories. Additionally, Vision 2030’s support for local manufacturing and international partnerships is facilitating the availability of premium and customized gaming furniture, strengthening the market’s growth trajectory and positioning Saudi Arabia as a leading gaming hub in the Middle East.

Market Outlook 2026-2034:

The Saudi Arabia gaming furniture market outlook remains highly positive, underpinned by the Kingdom's strategic positioning as a global gaming and esports destination. The development of Qiddiya Entertainment City, featuring the world's first dedicated gaming and esports neighborhood with four esports arenas and training centers, will generate substantial institutional furniture demand. For instance, the upcoming Olympic Esports Games, scheduled to be hosted in Riyadh, and the hosting of the Esports World Cup with prize pools exceeding USD 70 million are expected to catalyze investments in gaming infrastructure and associated furniture requirements. The market generated a revenue of USD 26.2 Million in 2025 and is projected to reach a revenue of USD 90.2 Million by 2034, growing at a compound annual growth rate of 14.72% from 2026-2034.

Saudi Arabia Gaming Furniture Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Gaming Chair |

71% |

|

Application |

Residential |

76% |

|

Region |

Northern and Central Region |

35% |

Type Insights:

- Gaming Chair

- Gaming Table

Gaming chair dominates with a market share of 71% of the total Saudi Arabia gaming furniture market in 2025.

Gaming chairs represent the largest product segment in Saudi Arabia’s gaming furniture market, fueled by the critical need for comfort during long gaming sessions. Demand is driven by both professional gamers and casual enthusiasts who value ergonomic features such as adjustable lumbar support, multi-directional armrests, and high-density cushioning. Strong market presence is supported by well-established distribution networks through e-commerce platforms and specialty gaming retailers across major cities, ensuring accessibility and visibility of a wide range of gaming chair options to meet diverse consumer preferences.

The gaming chair segment is strongly supported by the expanding esports ecosystem, where professional tournaments demand standardized, high-performance seating. Partnerships providing custom-designed chairs for competitive events highlight institutional recognition of premium gaming furniture. At the same time, the growing trend of home office integration has broadened the market, with gaming chairs serving dual purposes for both gaming and remote work, appealing to young professionals seeking versatile and ergonomic furniture solutions.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

Residential leads with a share of 76% of the total Saudi Arabia gaming furniture market in 2025.

The residential segment leads the Saudi Arabia gaming furniture market, driven by the widespread popularity of home gaming setups among the country’s young population. Increasing disposable incomes and a cultural shift toward home-based entertainment have encouraged households to invest in premium gaming chairs and specialized desks. These products are designed to complement advanced gaming equipment, including multi-monitor setups, enhancing both comfort and performance. Growing engagement in gaming activities has made residential consumers a key driver of market growth, fueling demand for high-quality, ergonomically designed furniture tailored to immersive home gaming experiences.

The growth of content creation and livestreaming has further amplified residential demand, as aspiring streamers invest in aesthetically appealing gaming setups featuring RGB-lit desks and visually distinctive chairs. The residential market also benefits from expanding e-commerce infrastructure, with platforms such as Amazon.sa and noon.com offering extensive gaming furniture selections with convenient home delivery services. The trend toward creating dedicated gaming rooms within Saudi households has transformed gaming furniture from discretionary purchases into essential home furnishing categories.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region represents the largest share with 35% of the total Saudi Arabia gaming furniture market in 2025.

The Northern and Central Region, anchored by Riyadh, dominates the Saudi Arabia gaming furniture market due to its concentration of government institutions, corporate headquarters, and young tech-savvy population. The region benefits from superior retail infrastructure, including major gaming retail outlets and specialty furniture showrooms. The presence of key esports venues, including Boulevard Riyadh City which hosts the Esports World Cup, creates substantial institutional demand while raising consumer awareness of premium gaming furniture brands.

The development of Qiddiya Entertainment City, located just 45 kilometers from downtown Riyadh, is expected to further strengthen the region's market dominance. The project features the world's first dedicated gaming and esports neighborhood with multiple esports arenas, training centers, and gaming-themed residential communities. Additionally, Riyadh's logistics corridors and advanced last-mile delivery networks support efficient distribution of furniture products, enabling same-week installation services demanded by consumers seeking premium gaming setups.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Gaming Furniture Market Growing?

Government Vision 2030 Initiatives and Strategic Gaming Investments

The Saudi government’s Vision 2030 has elevated gaming and esports as strategic priority sectors, driving significant investments that boost demand for gaming furniture. National initiatives aim to expand the industry’s economic contribution and create employment opportunities, while major investment funds are backing the development of Saudi Arabia as a leading global gaming hub, fostering infrastructure, events, and professional ecosystems that further stimulate the market for specialized gaming furniture. For instance, in March 2024, the National Development Fund and Social Development Bank launched two venture capital funds worth USD 120 million to accelerate growth in the gaming and esports sectors. These institutional investments are creating a robust ecosystem that generates sustained demand for professional-grade gaming furniture across tournament venues, gaming academies, and training facilities.

Rapid Expansion of Gaming Population and Youth Demographics

Saudi Arabia has a highly engaged gaming community, supported by a predominantly young population. This demographic trend ensures strong and sustained consumer interest in gaming equipment, accessories, and related furniture, driving ongoing demand and fostering growth within the Kingdom’s gaming market. Saudi Arabia imported more than 2.4 million video game consoles in 2024 and 2025, indicating growing investment in gaming setups that necessitate complementary furniture. The emergence of gaming as a socially accepted and culturally endorsed activity, supported by royal endorsement and celebrity participation, has normalized furniture investments that support serious gaming pursuits.

E-commerce Growth and Enhanced Distribution Infrastructure

The intensive development of e-commerce platforms in Saudi Arabia is greatly improving the availability of gaming furniture and accessibility to the market. Online stores such as Amazon.sa, noon.com, and specialized gaming retailers, have large product assortments and a convenient delivery service. The internet penetration is higher and smartphone penetration is high with more than 99% and with this Saudi consumers are also doing research on purchasing gaming furniture online. The SAL Logistics Zone's SAR 4 billion investment in automated warehousing in Riyadh has improved last-mile capabilities for bulky goods, enabling efficient furniture delivery across the Kingdom. Major international gaming furniture brands have established regional distribution partnerships, while local retailers have expanded their online presence with virtual room visualization tools that assist purchase decisions.

Market Restraints:

What Challenges the Saudi Arabia Gaming Furniture Market is Facing?

Import Dependence and Supply Chain Vulnerabilities

The gaming furniture sector in Saudi Arabia is particularly challenged by the high dependency on imports, with the majority of the products being imported by the global manufacturers. Such reliance exposes the market to supply chain disruptions, volatile freight costs, and geopolitical uncertainties. These factors may increase retailers' operational expenses, influence pricing policies, and increase the likelihood of discontinuous product delivery to the market, ultimately affecting the stability and growth of the market as a whole.

Premium Pricing and Price Sensitivity Among Consumers

The premium pricing of quality gaming furniture presents adoption barriers for price-sensitive consumer segments. High-end ergonomic gaming chairs from established brands often command significant price premiums, limiting accessibility for budget-conscious gamers. Additionally, import duties and customs procedures add to final product costs, creating price points that may deter casual gamers from upgrading their furniture setups despite interest in ergonomic solutions.

Limited Local Manufacturing Capabilities

The absence of substantial local gaming furniture manufacturing capacity constrains market development and product customization opportunities. While general furniture manufacturing exists in Saudi Arabia, specialized gaming furniture production remains nascent. This limitation reduces flexibility in meeting specific regional preferences and extending product availability while maintaining price competitiveness against imports.

Competitive Landscape:

The Saudi Arabia gaming furniture market shows moderate competitive intensity, with international and regional players vying for market share alongside emerging local retailers. Competition is driven by product innovation, ergonomic design, brand reputation, and partnerships with esports and gaming events. Retailers are expanding gaming furniture offerings, including specialized collections tailored for different user needs. The market is also seeing increasing price segmentation, with premium products catering to professional gamers and content creators, while more affordable options target casual gamers seeking entry-level ergonomic solutions. Overall, innovation, quality, and targeted marketing are key factors shaping market dynamics and consumer choice.

Recent Developments:

- June 2025: The Esports World Cup Foundation renewed its partnership with Secretlab as the Official Gaming Chair Partner through 2026. The collaboration will equip players with the custom-designed Secretlab TITAN Evo Esports World Cup 2025 Edition at the tournament held in Riyadh.

Saudi Arabia Gaming Furniture Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Gaming Chair, Gaming Table |

| Applications Covered | Residential, Commercial |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia gaming furniture market size was valued at USD 26.2 Million in 2025.

The Saudi Arabia gaming furniture market is expected to grow at a compound annual growth rate of 14.72% from 2026-2034 to reach USD 90.2 Million by 2034.

Gaming chairs dominated the market with a 71% share in 2025, driven by the fundamental importance of ergonomic seating during extended gaming sessions, rising awareness of posture-related health concerns, and growing demand from professional gamers and content creators for premium comfortable seating solutions.

Key factors driving the Saudi Arabia gaming furniture market include government Vision 2030 initiatives promoting gaming and esports, rapid expansion of the gaming population exceeding 23 million gamers, growing e-commerce infrastructure, rising disposable incomes, and increased demand for ergonomic solutions supporting extended gaming sessions.

Major challenges include heavy import dependence exposing the market to supply chain disruptions and elevated freight costs, premium pricing of quality products limiting accessibility for budget-conscious consumers, limited local manufacturing capabilities, and customs procedures that increase final product prices.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)