Saudi Arabia Gas Turbine Market Size, Share, Trends and Forecast by Technology, Design Type, Rated Capacity, End-User, and Region, 2026-2034

Saudi Arabia Gas Turbine Market Overview:

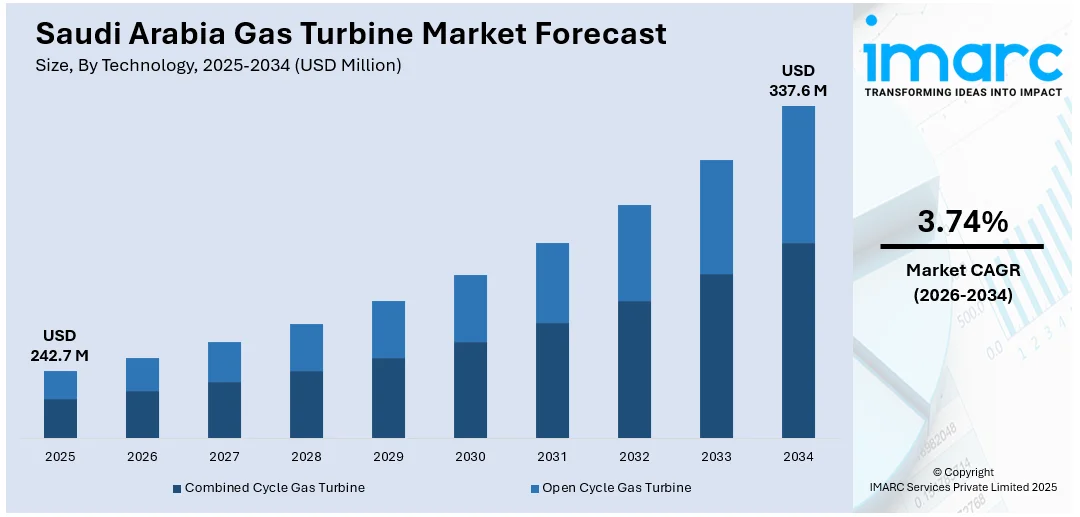

The Saudi Arabia gas turbine market size reached USD 242.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 337.6 Million by 2034, exhibiting a growth rate (CAGR) of 3.74% during 2026-2034. The market is driven by rising electricity demand, industrial growth, and the need for efficient power generation under Vision 2030. Government initiatives promoting energy diversification, hybrid systems integrating renewables, and the escalating shift toward low-emission technologies further accelerate demand. Investments in modern CCGT plants and hydrogen-ready turbines are further expanding the Saudi Arabia gas turbine market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 242.7 Million |

| Market Forecast in 2034 | USD 337.6 Million |

| Market Growth Rate 2026-2034 | 3.74% |

Saudi Arabia Gas Turbine Market Trends:

Increasing Demand for Efficient Power Generation Solutions

The market is experiencing significant growth due to the rising demand for efficient and reliable power generation solutions. In 2023, fossil fuels provided 99% of Saudi Arabia's electricity, while low-carbon sources provided only 1.4%, which is much lower than the global average of 41%. This gas dependence led to emissions of 8.9 tCO₂ per capita, which is almost five times the global average. The Kingdom plans to raise the proportion of renewables to 50% by 2030, and this will create opportunities for flexible gas turbine solutions to enable this shift. With the growth in the country's industrial sector and population, electricity demand continues to grow, which necessitates the establishment of a more sophisticated power infrastructure. Gas turbines are used as they have high efficiency, fast startup times, and compatibility with renewable sources. In addition, Saudi Arabia's Vision program emphasizes diversification and sustainability of energy, which results in investments in the latest gas turbine technologies. Combined-cycle gas turbine (CCGT) power plants, which are recognized for their higher efficiency and lower emissions than traditional power plants, are gaining more popularity. The government’s focus on reducing reliance on oil-based power generation is further supporting the Saudi Arabia gas turbine market growth. Key players in the market are introducing innovative, low-emission turbines to align with environmental regulations, making gas turbines a critical component of the Kingdom’s energy transition strategy.

To get more information on this market Request Sample

Shift Toward Hybrid Energy Systems

One of the major trends witnessed in the market is the increasing convergence of hybrid energy systems that combine gas turbines with renewable sources of energy. With the country stepping up its renewable energy programs, including solar and wind, gas turbines act as a versatile fallback option to ensure the stability of the grid. Hybrid systems leverage the quick response nature of gas turbines to mitigate the intermittent nature of renewable sources, thus providing a secure power supply. This is in line with Saudi Arabia's vision of having 50% of its energy come from renewable sources by 2030 while maintaining energy security. Large-scale projects such as NEOM and the Saudi Green Initiative are driving the need for hybrid power solutions. While at COP16, Saudi Arabia launched five new green projects worth USD 60 Million under the Saudi Green Initiative and now encompasses a cumulative investment of USD 188 Billion on 86 projects. The program will help eliminate 278 million tons of carbon dioxide emissions per year and attain a 50% contribution of renewable energy by 2030, thus complementing the efforts of the gas turbine industry in ensuring a reliable and cleaner energy shift. Producers are now developing turbines with the ability to use hydrogen and synthetic fuels for supporting decarbonization efforts. This shift, in addition to enhancing energy efficiency, also puts Saudi Arabia in a position as a leader in sustainable energy generation, which spurs long-lasting market growth.

Saudi Arabia Gas Turbine Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on technology, design type, rated capacity, and end-user.

Technology Insights:

- Combined Cycle Gas Turbine

- Open Cycle Gas Turbine

The report has provided a detailed breakup and analysis of the market based on the technology. This includes combined cycle gas turbine and open cycle gas turbine.

Design Type Insights:

- Heavy Duty (Frame) Type

- Aeroderivative Type

A detailed breakup and analysis of the market based on the design type have also been provided in the report. This includes heavy duty (frame) type and aeroderivative type.

Rated Capacity Insights:

- Above 300 MW

- 120-300 MW

- 40-120 MW

- Less Than 40 MW

The report has provided a detailed breakup and analysis of the market based on the rated capacity. This includes above 300 mw, 120-300 mw, 40-120 mw, and less than 40 mw.

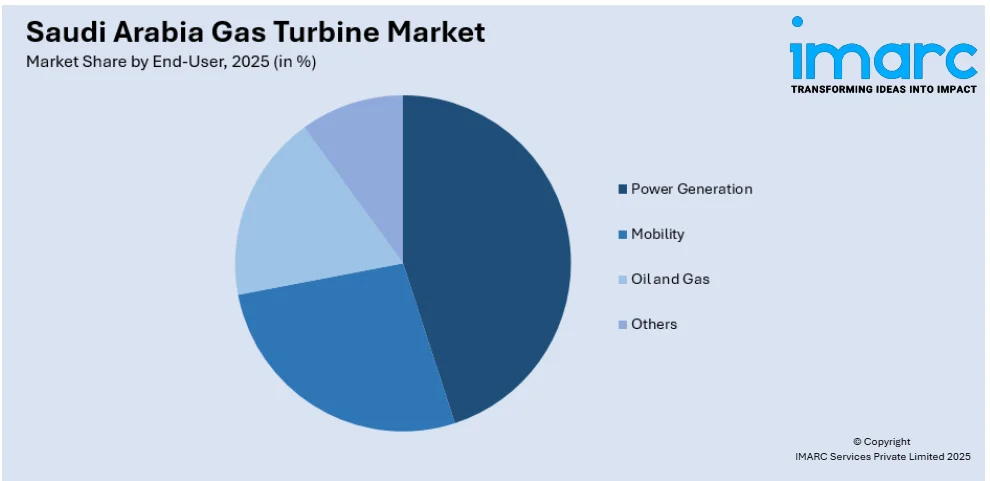

End-User Insights:

Access the comprehensive market breakdown Request Sample

- Power Generation

- Mobility

- Oil and Gas

- Others

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes power generation, mobility, oil and gas, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Gas Turbine Market News:

- March 24, 2025: GE Vernova and the Saudi Electricity Company successfully executed the first locally handled gas turbine maintenance project entirely led by Saudi engineers at the Riyadh 8th power plant, having four GE 7F turbines and production capacity exceeding 1,700 MW. This initiative highlights the Kingdom's commitment to localizing energy sector expertise and aligns with Vision 2030's goals of economic diversification and skill development.

- August 26, 2024: Mitsubishi Power secured its first order in Saudi Arabia for a J-class M501JAC gas turbine with an efficiency of over 64% to power the 475 MW Najim Cogeneration Plant to support SATORP's expansion in Jubail. The turbine will be locally assembled in Dammam, marking a milestone in the localization of Saudi Arabian energy under Vision 2030. The technology, which is hydrogen-ready, enhances the gas turbine sector in Saudi Arabia and supports Aramco in reaching its decarbonization targets.

Saudi Arabia Gas Turbine Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Combined Cycle Gas Turbine, Open Cycle Gas Turbine |

| Design Types Covered | Heavy Duty (Frame) Type, Aeroderivative Type |

| Rated Capacities Covered | Above 300 MW, 120-300 MW, 40-120 MW, Less Than 40 MW |

| End-Users Covered | Power Generation, Mobility, Oil and Gas, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia gas turbine market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia gas turbine market on the basis of technology?

- What is the breakup of the Saudi Arabia gas turbine market on the basis of design type?

- What is the breakup of the Saudi Arabia gas turbine market on the basis of rated capacity?

- What is the breakup of the Saudi Arabia gas turbine market on the basis of end-user?

- What is the breakup of the Saudi Arabia gas turbine market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia gas turbine market?

- What are the key driving factors and challenges in the Saudi Arabia gas turbine market?

- What is the structure of the Saudi Arabia gas turbine market and who are the key players?

- What is the degree of competition in the Saudi Arabia gas turbine market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia gas turbine market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia gas turbine market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia gas turbine industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)