Saudi Arabia Gaskets and Seals Market Size, Share, Trends and Forecast by Product, Material, Application, End Use, and Region, 2026-2034

Saudi Arabia Gaskets and Seals Market Overview:

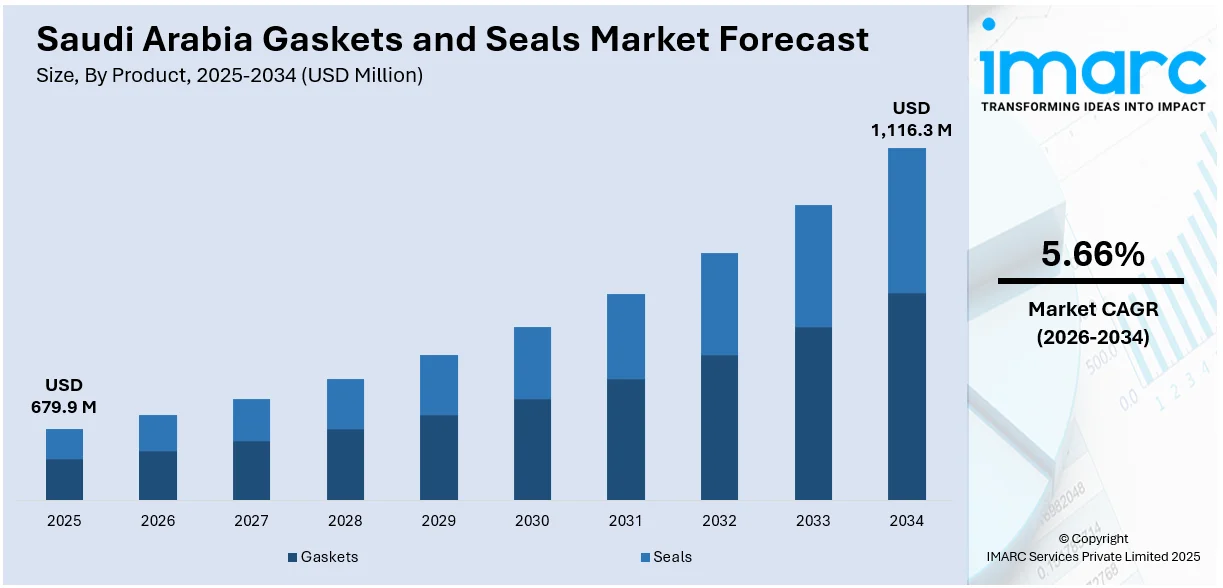

The Saudi Arabia gaskets and seals market size reached USD 679.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,116.3 Million by 2034, exhibiting a growth rate (CAGR) of 5.66% during 2026-2034. The market share is expanding, driven by the rising demand for high-quality components that ensure vehicle engine integrity and prevent fluid leakage, along with the increasing investments in the thriving energy sector.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 679.9 Million |

| Market Forecast in 2034 | USD 1,116.3 Million |

| Market Growth Rate 2026-2034 | 5.66% |

Saudi Arabia Gaskets and Seals Market Trends:

Increasing vehicle production

The rising production of vehicles is impelling the Saudi Arabia gaskets and seals market growth. As per industry reports, in 2024, Saudi Arabia recorded, for the first time in history, more than one Million vehicles in a single year. One week prior to the conclusion of 2024, there were 1,000,201 new vehicles registered. As more vehicles are being manufactured locally and imported for assembly, the demand for high-quality gaskets and seals that ensure engine integrity, prevent fluid leakage, and maintain pressure within various vehicle systems is steadily increasing. These components are essential for vehicle performance and safety, which makes them a critical part of the automotive supply chain. With Saudi Arabia aiming to strengthen its local manufacturing base and attract foreign investments into the auto sector, more assembly plants and component manufacturing units are emerging, further creating the need for reliable sealing solutions. Gaskets and seals are used extensively in engines, transmissions, fuel systems, and exhaust systems, making them indispensable in both conventional and electric vehicles (EVs). As people are adopting EVs, the requirement for advanced sealing solutions that can handle high temperatures and resist chemicals is growing. Suppliers and manufacturers are responding by developing innovative materials and designs tailored to meet the specific needs of new-generation vehicles. This ongoing expansion in vehicle manufacturing, coupled with a focus on technological advancements, is contributing to a strong and consistent demand for gaskets and seals across Saudi Arabia’s automotive landscape.

To get more information on this market, Request Sample

Rising oil and gas exploration operations

The growing oil and gas exploration operations are offering a favorable Saudi Arabia gaskets and seals market outlook. The oil and gas industry holds a large share of the nation’s gross domestic product (GDP), encouraging more investments. According to the General Authority for Statistics, in 2024, Saudi Arabia's GDP hit SR4.07 Trillion (USD 1.09 Trillion), with crude oil and natural gas making up 22.3% of that. With ongoing efforts to explore new oil reserves and enhance the output from existing fields, there is a growing need for reliable sealing solutions that can withstand extreme conditions, such as high pressure, temperature fluctuations, and exposure to harsh chemicals. Gaskets and seals play a crucial role in maintaining the safety and efficiency of drilling equipment, pipelines, valves, and pressure vessels used in oil and gas operations. As Saudi Arabia pursues projects under its Vision 2030 strategy to diversify its economy while reinforcing its position as a worldwide energy leader, the oil and gas industry remains a central focus. This leads to increased spending on infrastructure and equipment that require durable and high-performance sealing technologies. Manufacturers are responding with items designed to meet the stringent requirements of the sector, offering materials that resist corrosion and provide long-term reliability. The continuous expansion in exploration and production activities ensures a steady rise in demand for gaskets and seals across the energy value chain in the country.

Saudi Arabia Gaskets and Seals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on product, material, application, and end use.

Product Insights:

- Gaskets

- Metallic Gasket

- Rubber Gasket

- Cork Gasket

- Non-Asbestos Gasket

- Spiral Wound Gasket

- Others

- Seals

- Shaft Seals

- Molded Seals

- Motor Vehicle Body Seals

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes gaskets (metallic gasket, rubber gasket, cork gasket, non-asbestos gasket, spiral wound gasket, and others) and seals (shaft seals, molded seals, motor vehicle body seals, and others).

Material Insights:

- Fiber

- Graphite

- PTFE

- Rubber

- Silicones

- Others

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes fiber, graphite, PTFE, rubber, silicones, and others.

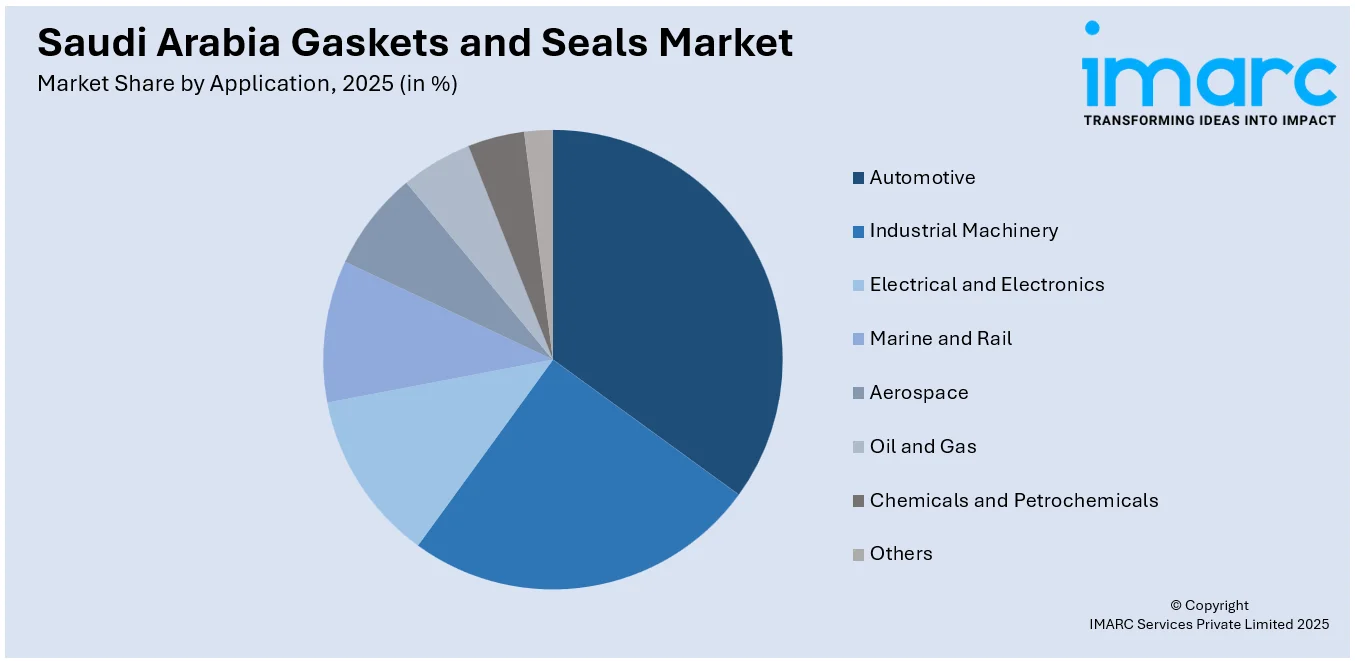

Application Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Automotive

- Industrial Machinery

- Electrical and Electronics

- Marine and Rail

- Aerospace

- Oil and Gas

- Chemicals and Petrochemicals

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes automotive, industrial machinery, electrical and electronics, marine and rail, aerospace, oil and gas, chemicals and petrochemicals, and others.

End Use Insights:

- OEM

- Aftermarket

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes OEM and aftermarket.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Gaskets and Seals Market News:

- In March 2025, Storagetech™, a worldwide leader in designing and producing storage tank equipment, declared the successful fulfillment of a customized external floating roof mechanical seal request for Saudi Aramco Jubail Refinery Company (SASREF) in Saudi Arabia. The firm handled the design, material provision, fabrication, packaging, and installation oversight of scissor-type primary, secondary, and fabric mechanical shoe seals for three storage tanks.

- In October 2024, Sealmatic collaborated with Saudi Thalate General Manufacturing Industrial Co Ltd (STG) to sell, repair, and refurbish mechanical seals in Saudi Arabia, catering to clients in the oil and gas, petrochemical, power, water, desalination, chemical, and various process sectors. The firm acknowledged the significant opportunities in the market and was enthusiastic about introducing its expertise and innovative and customized solutions in the country.

Saudi Arabia Gaskets and Seals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Materials Covered | Fiber, Graphite, PTFE, Rubber, Silicones, Others |

| Applications Covered | Automotive, Industrial Machinery, Electrical and Electronics, Marine and Rail, Aerospace, Oil and Gas, Chemicals and Petrochemicals, Others |

| End Uses Covered | OEM, Aftermarket |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia gaskets and seals market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia gaskets and seals market on the basis of product?

- What is the breakup of the Saudi Arabia gaskets and seals market on the basis of material?

- What is the breakup of the Saudi Arabia gaskets and seals market on the basis of application?

- What is the breakup of the Saudi Arabia gaskets and seals market on the basis of end use?

- What is the breakup of the Saudi Arabia gaskets and seals market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia gaskets and seals market?

- What are the key driving factors and challenges in the Saudi Arabia gaskets and seals market?

- What is the structure of the Saudi Arabia gaskets and seals market and who are the key players?

- What is the degree of competition in the Saudi Arabia gaskets and seals market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia gaskets and seals market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia gaskets and seals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia gaskets and seals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)