Saudi Arabia Gearbox Market Size, Share, Trends and Forecast by Type, Gear Type, End User, and Region, 2026-2034

Saudi Arabia Gearbox Market Overview:

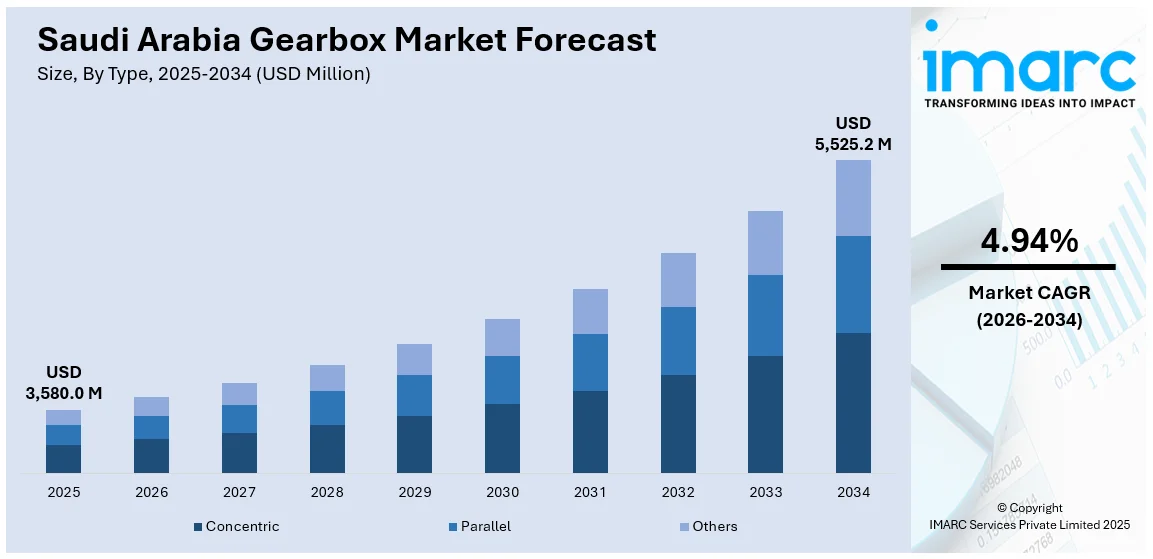

The Saudi Arabia gearbox market size reached USD 3,580.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 5,525.2 Million by 2034, exhibiting a growth rate (CAGR) of 4.94% during 2026-2034. The market is growing steadily due to increased industrial automation, expanding manufacturing activities, and rising demand across sectors like oil and gas, mining, and power generation. Advancements in machinery, coupled with infrastructure development and the push for energy efficiency, are also contributing to market momentum. These trends are shaping competition and product innovation within the evolving landscape of the Saudi Arabia gearbox market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 3,580.0 Million |

| Market Forecast in 2034 | USD 5,525.2 Million |

| Market Growth Rate 2026-2034 | 4.94% |

Saudi Arabia Gearbox Market Trends:

Growth in Industrial Automation and Manufacturing

Saudi Arabia is actively diversifying its economy, emphasizing industrialization and automation under Vision 2030. As a result, the manufacturing sector, including food processing, automotive assembly, and cement production, is growing, leading to higher demand for gearboxes. Automation in machinery and production lines depends heavily on precision gear systems for accurate motion control and load transmission. Advanced gearboxes are also vital for robotics, CNC machines, and conveyor systems. With the integration of smart technologies and digital controls in manufacturing, industries are opting for gearboxes with features like low noise, minimal backlash, and energy efficiency. This trend is boosting both local production and imports of high-quality gearboxes. Consequently, the expansion of manufacturing capabilities is a key factor shaping demand in the Saudi Arabia gearbox market.

To get more information on this market Request Sample

Infrastructure and Construction Sector Development

Saudi Arabia's large-scale infrastructure projects, spanning roads, railways, airports, and urban development, are major factors driving the Saudi Arabia gearbox market growth. Construction equipment such as cranes, excavators, and concrete mixers relies on gear systems for smooth and powerful mechanical operation. The need for durable and high-torque gearboxes is growing as construction activities intensify, particularly with mega-projects like NEOM, the Red Sea Project, and Qiddiya. Heavy machinery used in material handling and site development requires robust gearboxes that can withstand extreme operating conditions. Furthermore, logistics and material transport systems within construction zones often employ conveyor belts and lifting equipment powered by gear mechanisms. This ongoing infrastructure boom is creating steady demand for both standard and application-specific gearboxes across the Kingdom’s construction sector.

Focus on Energy Efficiency and Technological Innovation

As Saudi Arabia places greater emphasis on sustainability and energy conservation, industries are increasingly turning to energy-efficient gearboxes to reduce operational costs and carbon emissions. Modern gearboxes are being designed with improved lubrication systems, lightweight materials, and precision-cut gears to maximize efficiency and minimize power loss. Additionally, technological advancements such as condition monitoring, predictive maintenance, and smart diagnostics are making gearboxes more intelligent and reliable. These innovations are particularly attractive to sectors with continuous operations, like manufacturing and utilities, where efficiency and uptime are critical. The shift toward automation and digital control systems is also driving demand for gearboxes compatible with IoT and smart factory platforms. This focus on innovation is transforming the competitive landscape and supporting long-term growth in the Saudi Arabia gearbox market.

Saudi Arabia Gearbox Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, gear type, and end user.

Type Insights:

- Concentric

- Parallel

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes concentric, parallel, and others.

Gear Type Insights:

- Spur Gear

- Worm Gear

- Bevel Gear

- Helical Gear

- Others

A detailed breakup and analysis of the market based on the gear type have also been provided in the report. This includes spur gear, worm gear, bevel gear, helical gear, and others.

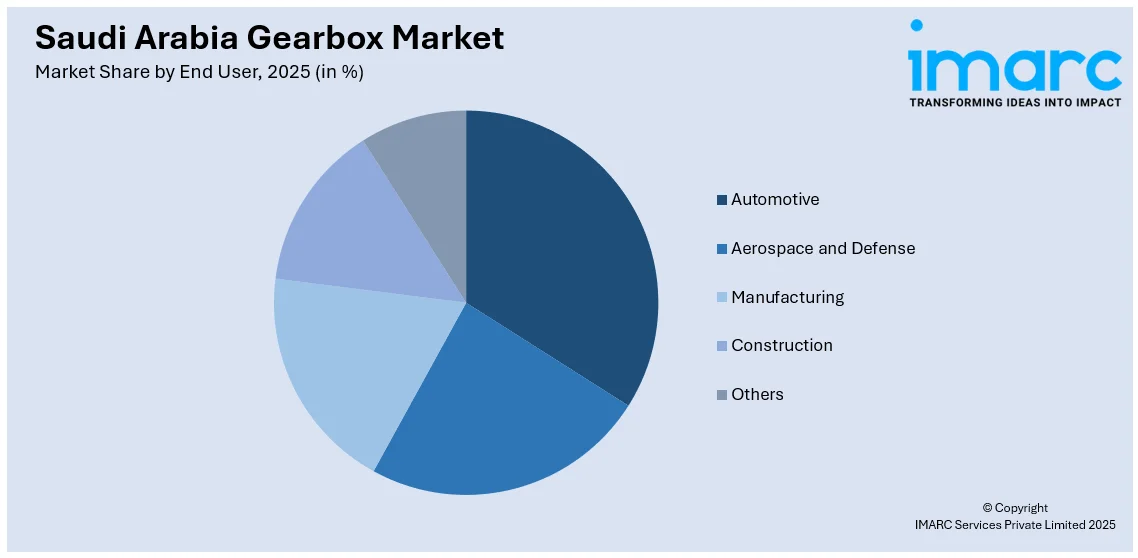

End User Insights:

Access the comprehensive market breakdown Request Sample

- Automotive

- Aerospace and Defense

- Manufacturing

- Construction

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes automotive, aerospace and defense, manufacturing, construction, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include the Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Gearbox Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Concentric, Parallel, Others |

| Gear Types Covered | Spur Gear, Worm Gear, Bevel Gear, Helical Gear, Others |

| End Users Covered | Automotive, Aerospace and Defense, Manufacturing, Construction, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia gearbox market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia gearbox market on the basis of type?

- What is the breakup of the Saudi Arabia gearbox market on the basis of gear type?

- What is the breakup of the Saudi Arabia gearbox market on the basis of end user?

- What is the breakup of the Saudi Arabia gearbox market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia gearbox market?

- What are the key driving factors and challenges in the Saudi Arabia gearbox market?

- What is the structure of the Saudi Arabia gearbox market and who are the key players?

- What is the degree of competition in the Saudi Arabia gearbox market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia gearbox market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia gearbox market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia gearbox industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)