Saudi Arabia Generative AI Market Size, Share, Trends and Forecast by Offering Type, Technology Type, Application, and Region, 2026-2034

Saudi Arabia Generative AI Market Summary:

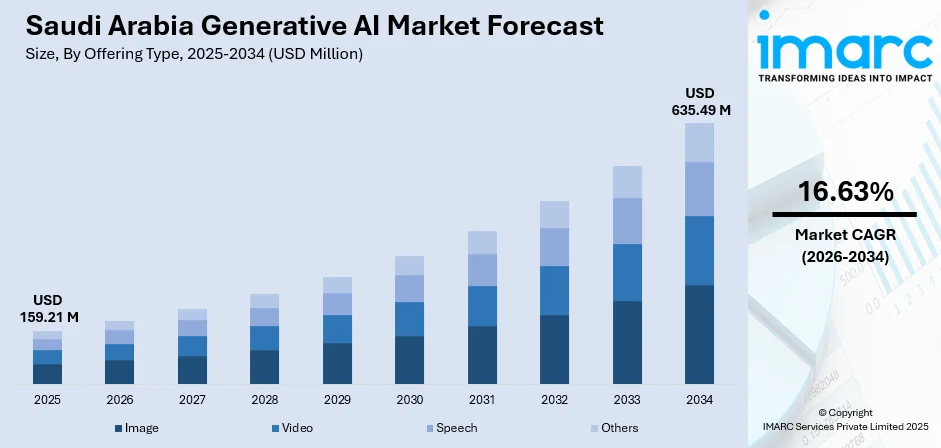

The Saudi Arabia generative AI market size was valued at USD 159.21 Million in 2025 and is projected to reach USD 635.49 Million by 2034, growing at a compound annual growth rate of 16.63% from 2026-2034.

The market growth is propelled by extensive government investments under Vision 2030 aligned with digital transformation initiatives and rapid deployment of advanced cloud computing infrastructure supporting Arabic language model development. Apart from this, the accelerating adoption of artificial intelligence (AI) across healthcare, finance, media, and public sector applications that enhance operational efficiency while addressing localized content generation needs thereby expanding the Saudi Arabia generative AI market share.

Key Takeaways and Insights:

- By Offering Type: Image dominates the market with a share of 36.1% in 2025, driven by widespread adoption across marketing campaigns, social media content creation, and e-commerce product visualization requiring photorealistic outputs that reduce production costs.

- By Technology Type: Generative adversarial networks lead the market with a share of 42.08% in 2025, leading deployment in medical imaging diagnostics, smart city surveillance systems, and creative content production leveraging superior image synthesis capabilities compared to alternative architectures.

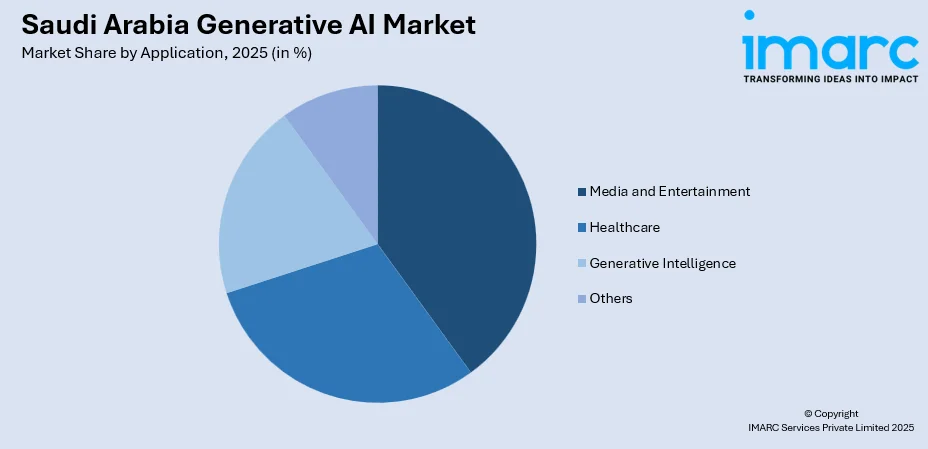

- By Application: Media and entertainment represent the largest segment with a market share of 34.09% in 2025, propelled by automated scriptwriting tools, personalized content recommendation engines, and virtual influencer development supporting Saudi Arabia's expanding digital content ecosystem.

- By Region: Northern and central region leads the market with a share of 32% in 2025, largely due to Vision 2030's emphasis on technological growth and heightened emphasis on AI innovation, with substantial government investments in infrastructure such as data centers and AI research initiatives.

- Key Players: The Saudi Arabia generative AI market exhibits intense competitive dynamics with multinational technology corporations collaborating alongside government-backed entities across enterprise and public sector segments. Major market players maintain significant market presence through strategic partnerships with Saudi Data and Artificial Intelligence Authority, while regional players including drive adoption through sector-specific AI solutions and sovereign cloud platforms.

To get more information on this market Request Sample

Saudi Arabia's generative AI market is experiencing transformative growth as the Kingdom positions itself as a regional AI powerhouse through systematic government coordination, substantial infrastructure investments, and international technology partnerships. The market benefits from Vision 2030's digital transformation mandate which embeds AI across government operations, healthcare modernization, financial services innovation, and smart city development including flagship projects like NEOM. Rapid 5G network expansion covering 77% of the population with Riyadh exceeding 94% connectivity enables real-time AI application deployment while sovereign cloud infrastructure development by AWS, Microsoft, Google, and Oracle provides localized computing capacity essential for data sovereignty requirements. For instance, in February 2025, integrating IBM's watsonx AI platform featuring ALLaM, an Arabic Large Language Model specifically designed for regional linguistic requirements, with Lenovo's computing infrastructure enabling on-premises and cloud deployment across public safety systems, customer service automation, and fraud detection applications demonstrating the market's focus on culturally aligned AI capabilities.

Saudi Arabia Generative AI Market Trends:

Government-Led Digital Transformation Under Vision 2030 Framework

Saudi Arabia's generative AI market expansion is fundamentally driven by comprehensive government coordination through the Saudi Data and Artificial Intelligence Authority which oversees national AI strategy implementation aligned with Vision 2030 economic diversification objectives. The government established dedicated AI research centers, allocated substantial funding exceeding SAR 75 billion for AI development by 2030, and implemented regulatory frameworks governing ethical AI deployment across public and private sectors. This strategic approach created predictable demand patterns with government agencies mandating AI integration in service delivery while providing financial incentives for technology adoption. Major infrastructure projects including NEOM smart city development, The Line urban planning initiative, and King Salman Park incorporate generative AI for urban planning optimization, traffic management systems, and resource allocation demonstrating systematic technology integration.

Arabic Language Model Development and Localization Initiatives

The market demonstrates pronounced focus on Arabic language processing capabilities addressing fundamental limitations in global AI models which predominantly train on English language datasets. SDAIA's partnership with IBM produced ALLaM (Arabic Large Language Model), an open-source large language model optimized for Arabic dialects and cultural context, hosted on the watsonx platform enabling enterprise deployment with governance frameworks ensuring responsible AI usage. This localization extends beyond language translation to cultural nuance understanding, dialect recognition, and integration with Islamic content requirements for applications in religious education and financial services compliant with Shariah principles. These developments address the needs of Arabic speakers globally while creating competitive differentiation for Saudi AI solutions in Middle East and North Africa markets where Arabic language proficiency remains critical for user adoption and regulatory compliance.

Enterprise-Wide AI Integration Across Industries

Generative AI adoption is transitioning from pilot programs to scaled enterprise deployment across healthcare diagnostics, financial services automation, telecommunications customer service, and energy sector optimization. Healthcare providers integrate AI-driven diagnostic imaging analysis, personalized treatment planning systems, and telemedicine platforms with government supporting AI technology implementation in hospitals and clinics nationwide. Financial institutions deploy generative AI for fraud detection algorithms, automated customer service chatbots reducing operational costs, and algorithmic trading systems with Saudi Central Bank's regulatory sandbox fostering fintech innovation while ensuring compliance standards. Persivia Inc., a U.S.-based frontrunner in AI-driven healthcare insights, revealed the initiation of its National Health Intelligence Initiative (NHI) at the Global Health Exhibition (GHE) 2025 in Riyadh. The initiative marks a significant advancement in Saudi Arabia’s efforts to utilize artificial intelligence, sophisticated data analysis, and population health knowledge to enhance its Vision 2030 healthcare transformation.

How Vision 2030 is Transforming the Saudi Arabia Generative AI Market:

Saudi Arabia's Vision 2030 is reshaping the country's generative AI market by focusing on technological advancements and infrastructure development. The government is investing in digital infrastructure, including large data centers, to support AI services and ensure data sovereignty. This initiative is propelling the growth in the generative AI startup ecosystem, with more local firms receiving funding to develop AI tools tailored to various industries. Additionally, Vision 2030 emphasizes talent development, AI research, and responsible AI usage through national policies. The AI market is being adopted across sectors such as healthcare, education, finance, and public services, improving efficiency and service delivery. Key events and global collaborations are fostering innovation and attracting investment, further positioning Saudi Arabia as a regional AI hub. The Vision’s long-term goals also include increasing AI literacy, ensuring the workforce is prepared for the evolving tech-driven economy.

Market Outlook 2026-2034:

The Saudi Arabia generative AI market is positioned for sustained expansion driven by continued government commitment to AI infrastructure development, maturation of Arabic language models enabling wider enterprise adoption, and integration across emerging smart city projects creating diverse application opportunities. The market generated a revenue of USD 159.21 Million in 2025 and is projected to reach a revenue of USD 635.49 Million by 2034, growing at a compound annual growth rate of 16.63% from 2026-2034. Revenue growth will accelerate as cloud computing capacity expansion by hyperscale providers reduces infrastructure barriers for small and medium enterprises while 5G network coverage approaching universal accessibility enables edge computing applications in autonomous vehicles, industrial automation, and Internet of Things deployments

Saudi Arabia Generative AI Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Offering Type |

Image |

36.1% |

|

Technology Type |

Generative Adversarial Networks |

42.08% |

|

Application |

Media and Entertainment |

34.09% |

|

Region |

Northern and Central Region |

32% |

Offering Type Insights:

- Image

- Video

- Speech

- Others

Image dominates with a market share of 36.1% of the total Saudi Arabia generative AI market in 2025.

Image-based generative AI dominates the Saudi market driven by extensive deployment across marketing agencies requiring rapid campaign asset creation, e-commerce platforms automating product photography and lifestyle imagery, and social media content creators producing engaging visual content at scale. The technology enables photorealistic image synthesis from text descriptions reducing production timelines from days to minutes while eliminating costly photography studio sessions and model contracts. Real estate developers utilize AI-generated architectural visualizations for project marketing materials while automotive companies create vehicle configuration images across hundreds of color and feature combinations without physical prototyping.

Entertainment industry applications include concept art generation for film and television productions, video game asset creation, and virtual environment design supporting Saudi Arabia's growing media production sector. Text generation applications serve business communication automation including email drafting, report compilation, and proposal development across professional services sectors. Financial institutions deploy text-based AI for regulatory document analysis, compliance report generation, and customer communication personalization. Government agencies utilize Arabic language text models for public service chatbots, document translation services, and citizen inquiry response automation.

Technology Type Insights:

- Autoencoders

- Generative Adversarial Networks

- Others

Generative adversarial networks lead with a share of 42.08% of the total Saudi Arabia generative AI market in 2025.

Generative adversarial networks (GANs) maintain technological leadership through proven superior performance in image synthesis quality, medical imaging applications requiring diagnostic accuracy, and creative content generation where output realism determines commercial viability. Healthcare sector adoption leverages GANs for medical image enhancement improving diagnostic imaging clarity, synthetic medical data generation for training algorithms while maintaining patient privacy, and disease progression prediction models supporting personalized treatment planning. Smart city surveillance systems employ GAN-based facial recognition technology for public safety applications while retail analytics utilize customer behavior pattern recognition optimizing store layouts and inventory management. The architecture's competitive advantage stems from adversarial training methodology producing outputs approaching photorealistic quality surpassing alternative approaches for image-centric applications.

Transformer-based architectures gain traction for natural language processing applications including Arabic language understanding, document analysis automation, and conversational AI development. The technology excels in sequential data processing enabling machine translation accuracy, sentiment analysis for customer feedback systems, and content summarization tools supporting media monitoring applications. Diffusion networks emerge for high-quality image and video generation particularly in creative industries requiring controllable content creation with specific stylistic attributes.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Healthcare

- Generative Intelligence

- Media and Entertainment

- Others

Media and entertainment exhibit a clear dominance with a 34.09% share of the total Saudi Arabia generative AI market in 2025.

Media and entertainment dominate application deployment reflecting Saudi Arabia's strategic cultural sector development under Vision 2030 diversification initiatives away from oil dependency toward creative economy growth. Generative AI enables automated video editing reducing post-production timelines by 60%, script generation tools supporting Arabic content creation for television and streaming platforms, and personalized content recommendation systems increasing viewer engagement across digital platforms. Marketing agencies deploy AI-generated advertising content including product imagery, social media graphics, and campaign videos at significantly reduced costs compared to traditional production methodologies.

Music production incorporates AI-assisted composition tools, lyric generation in Arabic supporting local artists, and audio enhancement technology improving recording quality. Virtual influencer development creates digital personalities for brand marketing campaigns while maintaining cultural appropriateness and regulatory compliance. The Saudi government's establishment of AI Centers for Media and launch of Generative AI Future Camp for Media demonstrates institutional support across technology, media, and entertainment sectors according to consultancy analysis.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and central region leads with a share of 32% of the total Saudi Arabia generative AI market in 2025.

The northern and central regions of Saudi Arabia are emerging as key players in the generative AI market, largely due to Vision 2030's emphasis on technological growth. Riyadh, as the country’s capital, is at the forefront of AI innovation, with substantial government investments in infrastructure such as data centers and AI research initiatives. These efforts have fostered an environment conducive to the development of generative AI solutions, particularly in sectors like healthcare, education, and finance, fueling a dynamic startup ecosystem.

Strategically located, the northern and central regions offer access to diverse industries and key markets, further accelerating AI adoption. Local and international companies are increasingly establishing operations in these areas, drawn by the favorable business climate and government-backed initiatives. As the generative AI market expands, these regions are becoming regional AI hubs, driving productivity across various sectors. The integration of AI into public services and private enterprises is crucial to Saudi Arabia's long-term economic diversification under Vision 2030.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Generative AI Market Growing?

Strategic Government Investments and Vision 2030 Policy Support

Saudi Arabia's generative AI market expansion is fundamentally underpinned by systematic government coordination through the Saudi Data and Artificial Intelligence Authority which allocated SAR 75 billion (approximately $20 billion) specifically for AI development initiatives by 2030 as core component of Vision 2030 economic diversification strategy. This government commitment manifests through multiple coordinated initiatives including establishment of National Center for Artificial Intelligence providing research infrastructure and talent development programs, implementation of regulatory frameworks governing ethical AI deployment while fostering innovation-friendly business environment, and direct public sector procurement mandates requiring AI integration across government service delivery systems. Major infrastructure projects integrate generative AI as foundational technology for urban planning optimization, traffic management systems, and resource allocation creating sustained demand for AI solutions while demonstrating government-led technology adoption as market catalyst establishing confidence for private sector investment decisions.

Cloud Infrastructure Expansion and 5G Network Development

The market benefits substantially from parallel investments in digital infrastructure creating technical foundation essential for generative AI deployment at enterprise scale. Saudi Arabia achieved nationwide 5G network coverage with capital city Riyadh exceeding penetration ranking among global leaders in high-speed wireless connectivity enabling real-time AI application deployment for edge computing scenarios including autonomous vehicles, industrial robotics, and Internet of Things implementations. In 2025, stc Group declared notable accomplishments in broadening its 5G network and improving connectivity for pilgrims in Makkah and Madinah, aligning with its strategy to facilitate digital transformation throughout the Kingdom. These initiatives correspond with the organization's ongoing contributions during the 1446 AH Hajj season and demonstrate its dedication to delivering advanced digital infrastructure in alignment with Saudi Vision 2030.

International Technology Partnerships and Knowledge Transfer

Strategic collaborations between Saudi institutions and global technology leaders accelerate market development through expertise transfer, joint research initiatives, and co-development of Arabic language AI models addressing regional market requirements. For example, at LEAP 2025 conference, Saudi Arabia secured $14.9 billion in AI investments positioning the Kingdom as regional hub. Educational partnerships between SDAIA and leading universities including MIT, Stanford, and local institutions King Abdullah University of Science and Technology foster innovation ecosystems through research collaboration, student exchange programs, and faculty development initiatives creating talent pipeline essential for sustained technological advancement beyond initial technology transfer phase toward indigenous innovation capabilities.

Market Restraints:

What Challenges the Saudi Arabia Generative AI Market is Facing?

Acute Talent Shortage and Skills Gap in AI Specializations

The Saudi Arabia generative AI market confronts significant constraints from limited availability of qualified AI professionals with current workforce comprising limited specialized practitioners while market demand projections indicate requirements exceeding and creating substantial skills deficit hampering technology implementation pace and quality. This talent scarcity manifests across multiple dimensions including shortage of data scientists capable of training and optimizing generative models, lack of AI ethics specialists needed for governance framework implementation ensuring responsible deployment, insufficient Arabic language processing experts required for localization initiatives, and limited project managers experienced in AI solution integration across enterprise systems.

Data Privacy and Security Concerns Amid Regulatory Evolution

Growing adoption of generative AI systems generating and processing vast data volumes raises substantial concerns regarding data privacy protection, cybersecurity vulnerabilities, and regulatory compliance requirements creating hesitancy among potential adopters particularly in sensitive sectors including healthcare, financial services, and government operations. Organizations must balance leveraging data for enhanced AI model performance against maintaining user privacy, preventing algorithmic bias perpetuation, and ensuring transparent decision-making processes especially in applications affecting individuals such as loan approvals, healthcare diagnostics, and employment screening where errors or discrimination could cause significant harm requiring complex technical solutions and governance oversight mechanisms.

High Implementation Costs and Infrastructure Requirements

Deploying generative AI solutions demands substantial capital investment in computing infrastructure, specialized software licenses, ongoing model training and maintenance, and skilled personnel creating financial barriers particularly for small and medium enterprises lacking resources for initial outlays and sustained operational expenditure. Enterprise-grade AI implementations require high-performance computing clusters, extensive data storage capacity, robust networking infrastructure, and redundant systems ensuring reliability and availability representing multi-million dollar commitments before realizing productivity benefits or revenue generation.

Competitive Landscape:

The Saudi Arabia generative AI market exhibits dynamic competitive intensity characterized by strategic collaboration between multinational technology corporations, regional telecommunications operators, government-backed entities, and emerging startups creating multilayered competitive landscape across enterprise software, cloud services, and specialized solution segments. Global technology leaders establish market presence through strategic partnerships with Saudi Data and Artificial Intelligence Authority enabling technology transfer, joint research initiatives, and co-development of Arabic language models addressing regional requirements while gaining preferential access to government procurement opportunities and large enterprise accounts. Market consolidation trends emerge as larger corporations acquire promising startups gaining specialized capabilities, intellectual property portfolios, and talent teams while startup ecosystem benefits from government funding initiatives, accelerator programs, and venture capital investment supporting innovation pipeline feeding competitive intensity sustaining market dynamism.

Recent Developments:

- In December 2025, Newera.ai, a startup from Saudi Arabia focused on generative AI solutions for businesses, has raised $2.1 million (SAR 8 million) in a pre-seed funding round to aid its growth throughout the Kingdom. The funding round was spearheaded by Embark, alongside contributions from a collection of angel investors. The funds will be allocated to expand Newera.ai’s AI-based solutions regionally, enhance its research and development resources, and introduce products designed specifically for the Saudi market.

- In October 2025, HUMAIN and Qualcomm Technologies, Inc. revealed a groundbreaking partnership to implement advanced AI infrastructure in Saudi Arabia prior to the 9th edition of the Future Investment Initiative (FII) conference. This project will provide worldwide AI inference services and become the first fully optimized hybrid AI spanning from edge to cloud. This initiative aims to establish Saudi Arabia as a worldwide center for artificial intelligence and follows the declaration made by the two firms at the US – Saudi Investment Forum in May 2025. Qualcomm's AI200 and AI250 solutions provide rack-scale performance and enhanced memory capacity for rapid generative AI inference at the industry's top total cost of ownership, representing a significant advancement in facilitating scalable, efficient, and versatile generative AI across sectors and fully optimized edge-to-cloud, end-to-end hybrid AI services.

Saudi Arabia Generative AI Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Offering Types Covered | Image, Video, Speech, Others |

| Technology Types Covered | Autoencoders, Generative Adversarial Networks, Others |

| Applications Covered | Healthcare, Generative Intelligence, Media and Entertainment, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia generative AI market size was valued at USD 159.21 Million in 2025.

The Saudi Arabia generative AI market is expected to grow at a compound annual growth rate of 16.63% from 2026-2034 to reach USD 635.49 Million by 2034.

Image dominated the offering segment with 36.1% market share in 2025, driven by widespread adoption across marketing campaigns, e-commerce product visualization, and social media content creation requiring photorealistic outputs that reduce production costs and timelines compared to traditional photography and design methods.

Key factors driving the Saudi Arabia Generative AI market include strategic government investments under Vision 2030 allocating funds for AI development creating sustained demand through public sector procurement mandates, rapid expansion of cloud computing infrastructure by key market players reducing capital barriers for enterprise adoption, international technology partnerships enabling Arabic language model development addressing regional linguistic requirements, and 5G network deployment achieving national coverage enabling real-time AI application deployment across autonomous vehicles, smart cities, and industrial automation sectors.

Major challenges include acute talent shortage with limited qualified AI specialists against demand exceeding professionals creating skills gap hindering implementation quality and pace, data privacy and security concerns with companies hesitant adopting AI solutions due to breach fears requiring stringent governance frameworks under Personal Data Protection Law increasing operational complexity, high implementation costs for computing infrastructure and specialized software creating financial barriers particularly for small and medium enterprises, and regulatory uncertainty as frameworks evolve requiring continuous compliance adaptation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)