Saudi Arabia Generator Market Size, Share, Trends and Forecast by Fuel Type, Power Rating, Sales Channel, Design, Application, End User, and Region, 2026-2034

Saudi Arabia Generator Market Overview:

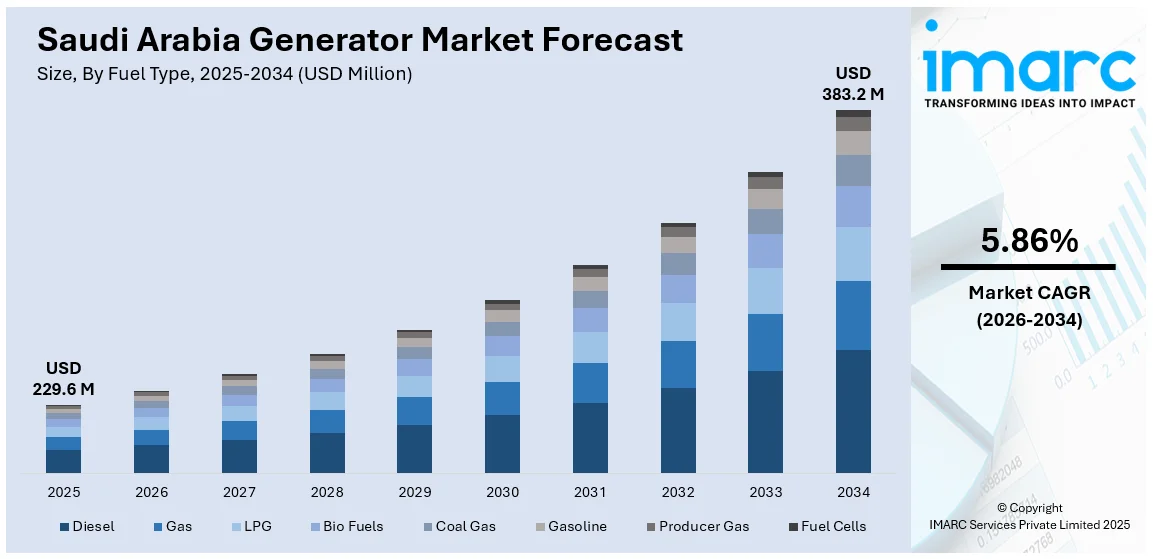

The Saudi Arabia generator market size reached USD 229.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 383.2 Million by 2034, exhibiting a growth rate (CAGR) of 5.86% during 2026-2034. The market is fueled by expanding infrastructure, rising power needs, and growing reliance on backup energy solutions across key sectors. Developments in construction, oil and gas, and industrial activities continue to boost demand, shaping competitive dynamics within the evolving landscape of the Saudi Arabia generator market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 229.6 Million |

| Market Forecast in 2034 | USD 383.2 Million |

| Market Growth Rate 2026-2034 | 5.86% |

Saudi Arabia Generator Market Trends:

Rapid Infrastructure Development

Saudi Arabia is undergoing extensive infrastructure transformation fueled by its Vision 2030 initiative. The government is investing heavily in smart cities, transport networks, housing projects, and tourism infrastructure. With these projects requiring constant and steady power, there is a strong need for generators to be used as backups. Initial phases at construction sites usually do not have electricity through the grid and depend on generators instead. High-capacity generators are needed to provide the support required by NEOM, the Red Sea Project and Qiddiya during their development and logistics operations. With all the construction and urban development happening now, both contractors and developers are turning to generators that use diesel or gas to keep their projects uninterrupted. As new road, rail and port infrastructure is added, it is expected that the Kingdom will require many more reliable, mobile and fuel-saving generators.

To get more information on this market Request Sample

Increasing Power Demand Across Sectors

Rising energy consumption across residential, commercial, and industrial sectors is another major driver of the Saudi Arabia generator market. As the population grows and urbanization accelerates, the pressure on the national grid intensifies, often resulting in power outages or shortages. Generators act as essential backup systems for homes, businesses, hospitals, data centers, and manufacturing units to ensure operational continuity. Additionally, sectors like retail, healthcare, hospitality, and education require uninterrupted power for equipment, lighting, and security systems. In remote and rural areas, generators often serve as the primary power source. This widespread and multi-sectoral dependence on generators, especially during peak demand periods or grid failures, continues to propel the market forward, encouraging investments in both portable and stationary generator solutions.

Technological Advancements and Product Innovation

Advancements in generator technology are significantly influencing market dynamics in Saudi Arabia. Manufacturers are introducing smart generators with features like remote monitoring, fuel efficiency optimization, and automated load management. These innovations cater to both commercial and industrial users seeking reliable and cost-effective power solutions. The rise of hybrid generators, which combine diesel with renewable energy sources, addresses the growing demand for environmentally sustainable options. Additionally, noise-reduction technologies and compact designs make generators more suitable for residential and urban applications. Product innovation also includes improved emission control systems in response to regulatory standards and environmental awareness. These technological improvements are not only enhancing user experience but also helping companies differentiate themselves in a competitive landscape, thereby driving the Saudi Arabia generator market growth.

Saudi Arabia Generator Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on fuel type, power rating, sales channel, design, application, and end user.

Fuel Type Insights:

- Diesel

- Gas

- LPG

- Bio Fuels

- Coal Gas

- Gasoline

- Producer Gas

- Fuel Cells

The report has provided a detailed breakup and analysis of the market based on the fuel type. This includes diesel, gas, LPG, bio fuels, coal gas, gasoline, producer gas, and fuel cells.

Power Rating Insights:

- Up to 50 Kw

- 51–280 Kw

- 281–500 Kw

- 501–2,000 Kw

- 2,001–3,500 Kw

- Above 3,500 Kw

A detailed breakup and analysis of the market based on the power rating have also been provided in the report. This includes up to 50 Kw, 51–280 Kw, 281–500 Kw, 501–2,000 Kw, 2,001–3,500 Kw, and above 3,500 Kw.

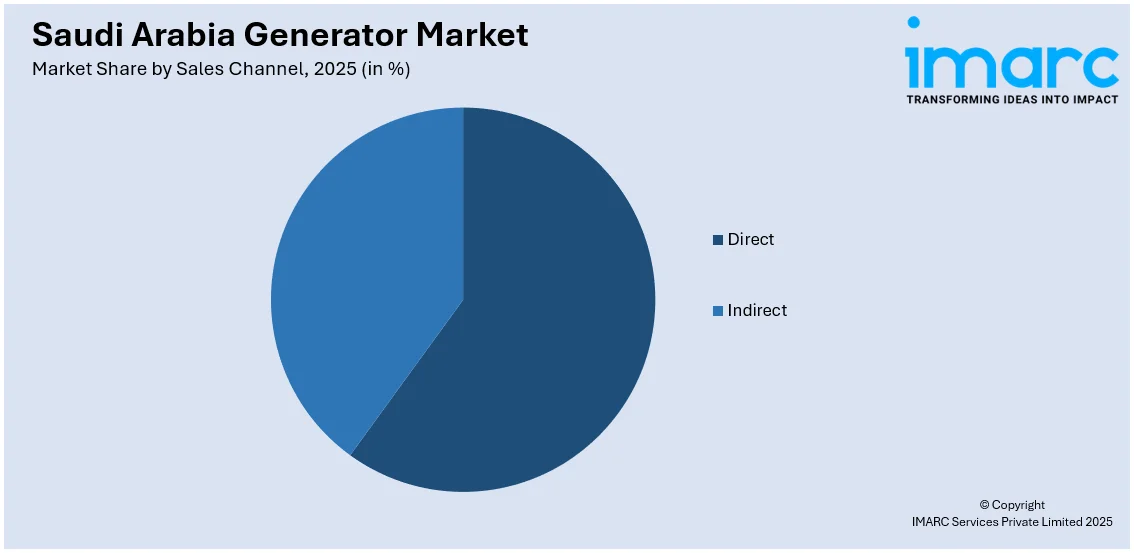

Sales Channel Insights:

Access the comprehensive market breakdown Request Sample

- Direct

- Indirect

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes direct and indirect.

Design Insights:

- Stationary

- Portable

A detailed breakup and analysis of the market based on the design have also been provided in the report. This includes stationery and portable.

Application Insights:

- Standby

- Prime and Continuous

- Peak Shaving

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes standby, prime and continuous, and peak shaving.

End User Insights:

- Utilities/Power Generation

- Oil and Gas

- Chemicals And Petrochemicals

- Mining and Metals

- Manufacturing

- Marine

- Construction

- Others

- Residential

- Commercial

- Healthcare

- IT and Telecommunications

- Data Centers

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes utilities/power generation (oil and gas, chemicals and petrochemicals, mining and metals, manufacturing, marine, construction, and others), residential, and commercial (healthcare, IT and telecommunications, data centers, and others).

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include the Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Generator Market News:

- In February 2025, Al Khorayef Group, a power generation leader with a wide range of experience in industrial machinery, agriculture, and irrigation solutions, signed a non-binding Letter of Intent (LOI) with a developer of sustainable electricity-producing technology, Hyliion Holdings Corp. Al Khorayef, headquartered in Saudi Arabia and operating in over 40 countries, is a major force in the Middle Eastern power generation market, leading the way with its Gulf Power brand.

- In October 2024, Mitsubishi Heavy Industries, Ltd. (MHI) partnered with Mitsubishi Power, a power solutions brand, to supply gas turbine generators for a new industrial steam and electricity cogeneration plant project in Saudi Arabia. The project is being developed by a consortium led by Japan's largest power generation company, JERA Co., Inc., and Abu Dhabi National Energy Company (TAQA), one of the largest listed integrated utility companies in the Middle East, Africa, and Europe.

Saudi Arabia Generator Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fuel Types Covered | Diesel, Gas, LPG, Bio Fuels, Coal Gas, Gasoline, Producer Gas, Fuel Cells |

| Power Ratings Covered | Up To 50 Kw, 51–280 Kw, 281–500 Kw, 501–2,000 Kw, 2,001–3,500 Kw, Above 3,500 Kw |

| Sales Channels Covered | Direct, Indirect |

| Designs Covered | Stationary, Portable |

| Applications Covered | Standby, Prime and Continuous, Peak Shaving |

| End Users Covered |

|

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia generator market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia generator market on the basis of fuel type?

- What is the breakup of the Saudi Arabia generator market on the basis of power rating?

- What is the breakup of the Saudi Arabia generator market on the basis of sales channel?

- What is the breakup of the Saudi Arabia generator market on the basis of design?

- What is the breakup of the Saudi Arabia generator market on the basis of application?

- What is the breakup of the Saudi Arabia generator market on the basis of end user?

- What is the breakup of the Saudi Arabia generator market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia generator market?

- What are the key driving factors and challenges in the Saudi Arabia generator market?

- What is the structure of the Saudi Arabia generator market and who are the key players?

- What is the degree of competition in the Saudi Arabia generator market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia generator market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia generator market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia generator industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)