Saudi Arabia Generic Injectables Market Size, Share, Trends and Forecast by Therapeutic Area, Container, Distribution Channel, and Region, 2026-2034

Saudi Arabia Generic Injectables Market Overview:

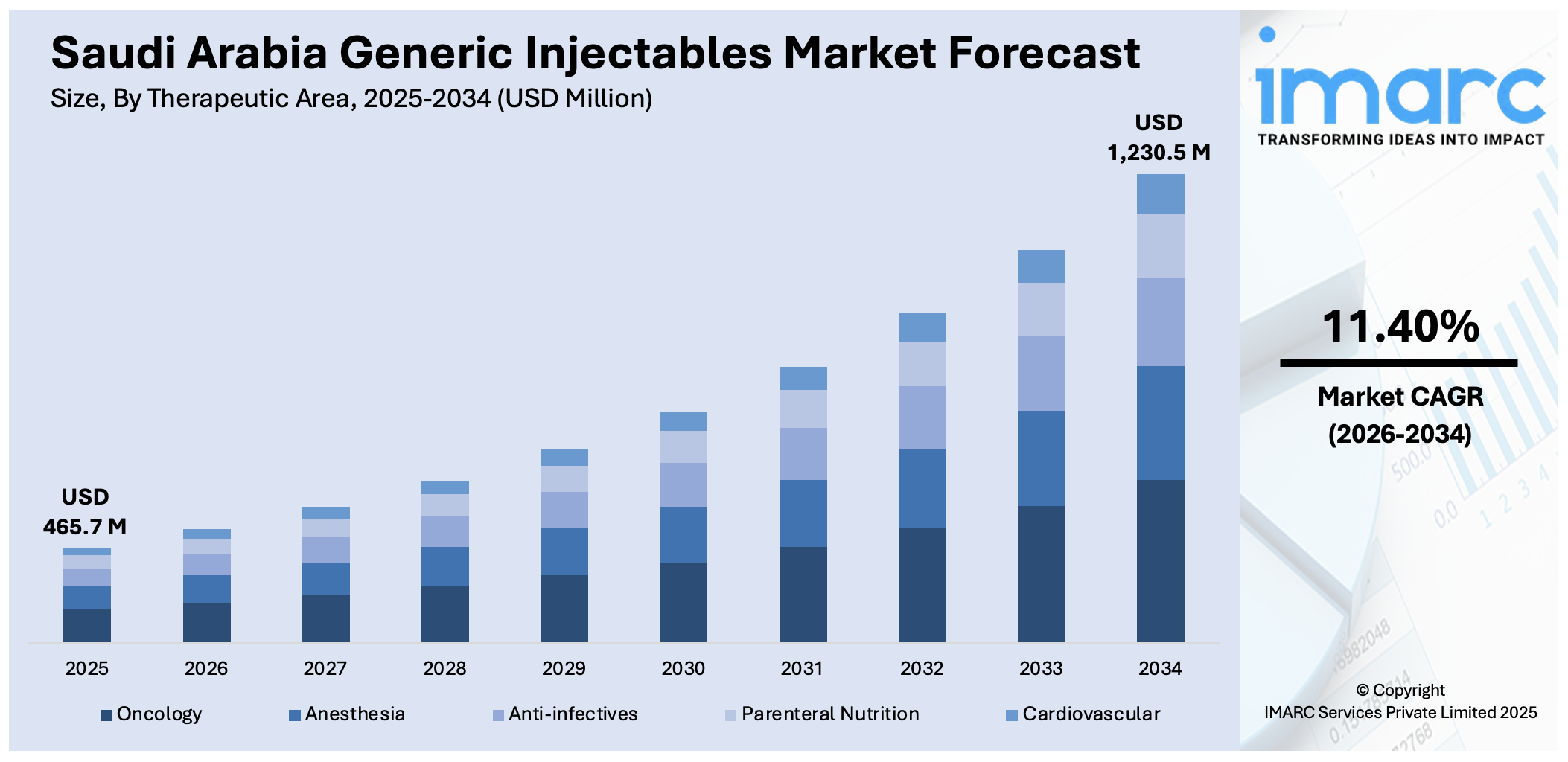

The Saudi Arabia generic injectables market size reached USD 465.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,230.5 Million by 2034, exhibiting a growth rate (CAGR) of 11.40% during 2026-2034. Government-led localization programs, SFDA-backed regulatory incentives, public tender preferences for domestic products, expanding hospital and critical care infrastructure, rising demand for cost-effective injectables, and joint ventures and technology transfers are some of the factors positively impacting the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 465.7 Million |

| Market Forecast in 2034 | USD 1,230.5 Million |

| Market Growth Rate 2026-2034 | 11.40% |

Saudi Arabia Generic Injectables Market Trends:

Government-Backed Localization Initiatives and Regulatory Incentives

Saudi Arabia’s pharmaceutical strategy is anchored in Vision 2030, which emphasizes domestic production capacity, including generic injectables, to reduce reliance on imports and improve national health resilience. The government, through entities such as the Saudi Food and Drug Authority (SFDA) and the Local Content and Government Procurement Authority, has introduced policies to encourage local manufacturing of pharmaceuticals. These include faster regulatory timelines, pricing advantages for domestic producers, and preferential procurement policies that favor locally manufactured generics. According to a study, injectables made up 30% of all locally manufactured pharmaceutical dosage forms in Saudi Arabia. As public sector tenders remain the dominant procurement route for injectables, these measures have significantly altered supplier dynamics. This structural shift has allowed regional and local players to expand, particularly in high-volume therapeutic segments such as anti-infectives, analgesics, and cardiovascular medications, thereby influencing the overall Saudi Arabia generic injectables market share. Moreover, strategic collaborations between multinational firms and Saudi-based manufacturers have accelerated technology transfer and scale-up capabilities for parenteral drug production. Joint ventures and contract manufacturing agreements are becoming more frequent, driven by regulatory frameworks that prioritize local investment. The country’s public healthcare sector, including entities such as the Ministry of Health and National Guard Health Affairs, is aligning its procurement practices with national self-sufficiency targets. These macro-level policies are steadily shifting competitive dynamics and reshaping the injectable supply ecosystem across Saudi Arabia.

To get more information on this market Request Sample

Expansion of Hospital Infrastructure and Critical Care Services

Saudi Arabia has invested heavily in expanding its healthcare infrastructure, with a particular focus on tertiary care hospitals, specialist treatment centers, and critical care units. These facilities require a steady and diversified supply of injectable drugs, which are essential for surgical, oncological, emergency, and intensive care treatments. The growing footprint of these institutions across Riyadh, Jeddah, Dammam, and emerging urban clusters has led to increased demand for a broad range of generic injectables. This trend is contributing to substantial Saudi Arabia generic injectables market growth in high-demand categories, particularly antibiotics, anesthetics, antiemetics, and anticoagulants. In parallel, health insurance penetration has grown in both public and private sectors, reinforcing standardized treatment protocols that prioritize cost-effective therapeutic options. Hospital pharmacies and procurement bodies are under pressure to maintain uninterrupted access to essential injectables at optimal pricing, pushing generics to the forefront. According to a recent research article, 53% of national pharmaceutical companies in Saudi Arabia produce parenteral products. Digitalization of health systems and centralized procurement platforms, such as NUPCO, are optimizing supply chains and enabling more transparent vendor selection. As the nation’s disease burden grows in tandem with urbanization and demographic trends, the generic injectables segment continues to exhibit strong fundamentals. The Saudi Arabia generic injectables market outlook is shaped supported by SFDA reforms aimed at reducing registration timelines and enhancing pharmacovigilance for generic products.

Saudi Arabia Generic Injectables Market Growth Drivers:

Emerging Trends of Chronic and Lifestyle Diseases

The Saudi Arabian generic injectables market is witnessing tremendous growth since the incidence of lifestyle and chronic diseases is on the rise. Diabetes, cardiovascular conditions, cancer, and autoimmune diseases are on the increase because of lifestyle diseases, food habits, and genetic factors. According to the International Diabetes Federation, in 2024, a total of 5,344,600 cases of diabetes were recorded in Saudi Arabia. This is driving a consistent demand for injectable drugs, especially in therapeutic categories where they need to be delivered quickly and with maximum bioavailability. The government is constantly investing in patient awareness initiatives and healthcare infrastructure, allowing more access to treatment alternatives such as generics. Clinics and hospitals are increasingly using affordable injectable medicines to contain long-term treatment costs without sacrificing efficacy. The industry is reacting by developing local manufacturing capacity to produce generic injectables, which provide a consistent supply of medicines to serve both the public and private sectors. This steady transition is solidifying the place of generic injectables as an essential part of Saudi Arabia's healthcare delivery framework.

Increased Demand for Affordable Treatment Alternatives

The Saudi Arabia generic injectables market is progressing as patients, physicians, and policymakers are increasingly choosing cost-effective modes of treatment with no compromise on therapeutic efficacy. Increasing costs of medicine and budgetary limitations are compelling hospitals and clinics to explore cheaper alternatives to branded injectables, and generics provide the same efficacy at one-fourth the cost. Chronic patients who need long-term injectable treatment are experiencing lower out-of-pocket costs, motivating greater treatment compliance. The government's emphasis on maximizing healthcare expenditure is following in its footsteps, as public tenders and procurement processes are giving priority to competitive pricing. The insurance companies are also encouraging the trend toward generics by providing wider coverage for cost-effective formulations. With increasing awareness of safety and quality standards of generic drugs, both patients and prescribers are increasingly sure of using them. This financial and clinical feasibility is repeatedly placing generic injectables as the first choice within Saudi Arabia's healthcare system.

Enhancing Local Pharmaceutical Production Capacities

The ongoing development of Saudi Arabian local pharmaceutical manufacturing capacity, especially generic injectable manufacturing is contributing to the market growth. Under its strategic healthcare and industrial diversification roadmap under Vision 2030, the nation is investing in state-of-the-art manufacturing facilities. Technology transfer, quality assurance training, and regulatory compliance expertise are being enabled through collaborations among domestic pharmaceutical firms and foreign players. This growth is providing a more stable and independent supply chain, lowering reliance on imports, and increasing the nation's ability to rapidly react to spikes in demand. Domestic manufacturing is also providing shorter lead times, improved cost management, and regional health needs customization of injectable formulations.

Saudi Arabia Generic Injectables Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on therapeutic area, container, and distribution channel.

Therapeutic Area Insights:

- Oncology

- Anesthesia

- Anti-infectives

- Parenteral Nutrition

- Cardiovascular

The report has provided a detailed breakup and analysis of the market based on the therapeutic area. This includes oncology, anesthesia, anti-infectives, parenteral nutrition, and cardiovascular.

Container Insights:

- Vials

- Ampoules

- Premix

- Prefilled Syringes

The report has provided a detailed breakup and analysis of the market based on the container. This includes vials, ampoules, premix, and prefilled syringes.

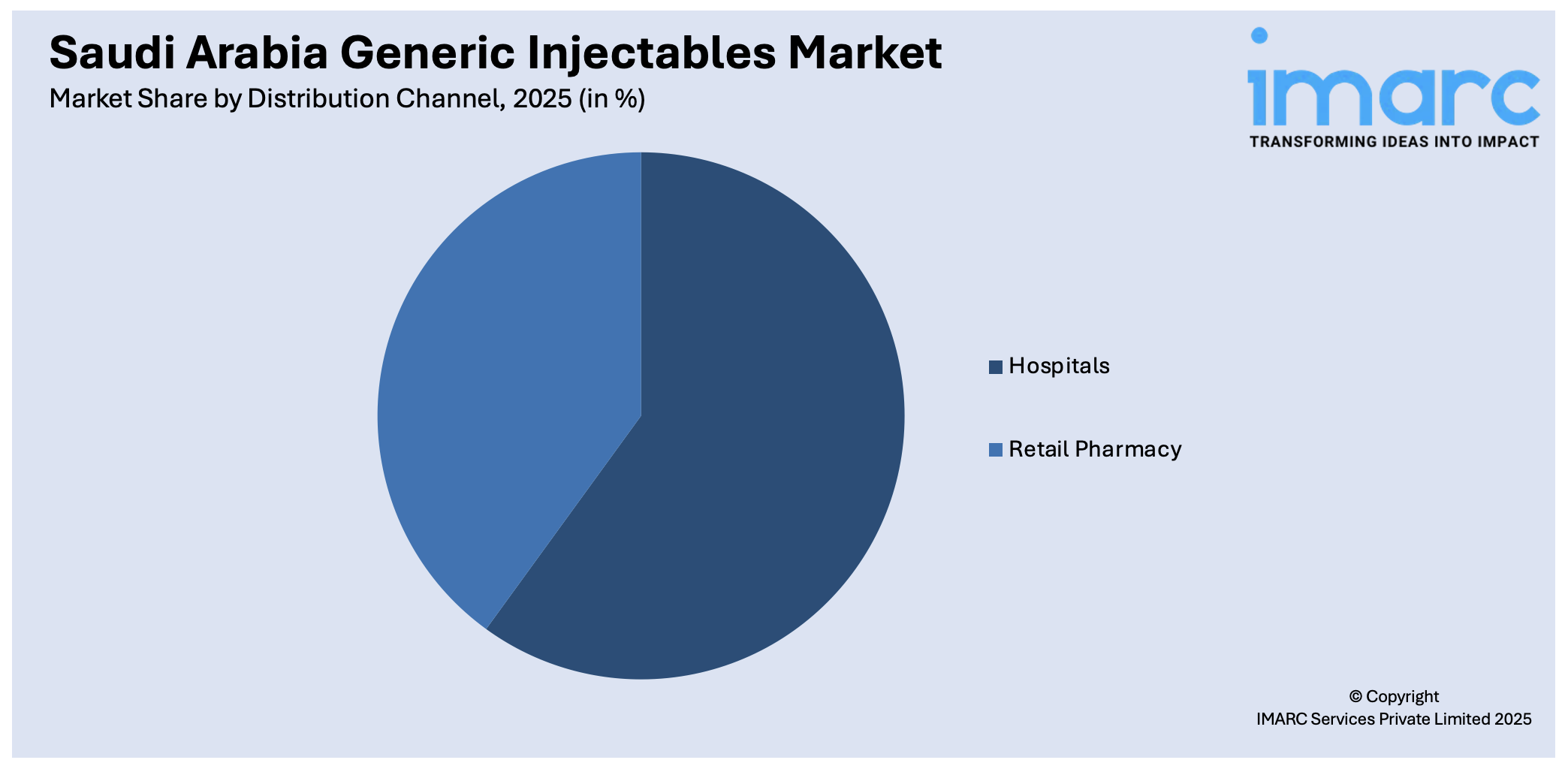

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Hospitals

- Retail Pharmacy

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes hospitals and retail pharmacy.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Generic Injectables Market News:

- On February 2025, Mabwell (Shanghai) Pharmaceuticals announced the approval of its biosimilar monoclonal antibody, Mabthéra® (rituximab), for use in the Saudi Arabian market. This approval marks an important step in expanding the availability of cost-effective injectable biologics in the region. As Saudi Arabia continues to embrace biosimilars as part of its Vision 2030 health strategy, this development adds momentum to the growing market for injectable generics in the country.

Saudi Arabia Generic Injectables Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Therapeutic Areas Covered | Oncology, Anesthesia, Anti-infectives, Parenteral Nutrition, Cardiovascular |

| Containers Covered | Vials, Ampoules, Premix, Prefilled Syringes |

| Distribution Channels Covered | Hospitals, Retail Pharmacy |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia generic injectables market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia generic injectables market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia generic injectables industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The generic injectables market in Saudi Arabia was valued at USD 465.7 Million in 2025.

The Saudi Arabia generic injectables market is projected to exhibit a CAGR of 11.40% during 2026-2034, reaching a value of USD 1,230.5 Million by 2034.

Key factors driving the Saudi Arabia generic injectables market include increasing demand for cost-effective treatment options, government support for local manufacturing, rising prevalence of chronic diseases, expanding healthcare infrastructure, and growing awareness of generic drug safety and efficacy. These factors are contributing to widespread adoption and market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)