Saudi Arabia Geriatric Healthcare Market Size, Share, Trends and Forecast by Product Type, Service Type, Disease Indication, End User, and Region, 2026-2034

Saudi Arabia Geriatric Healthcare Market Overview:

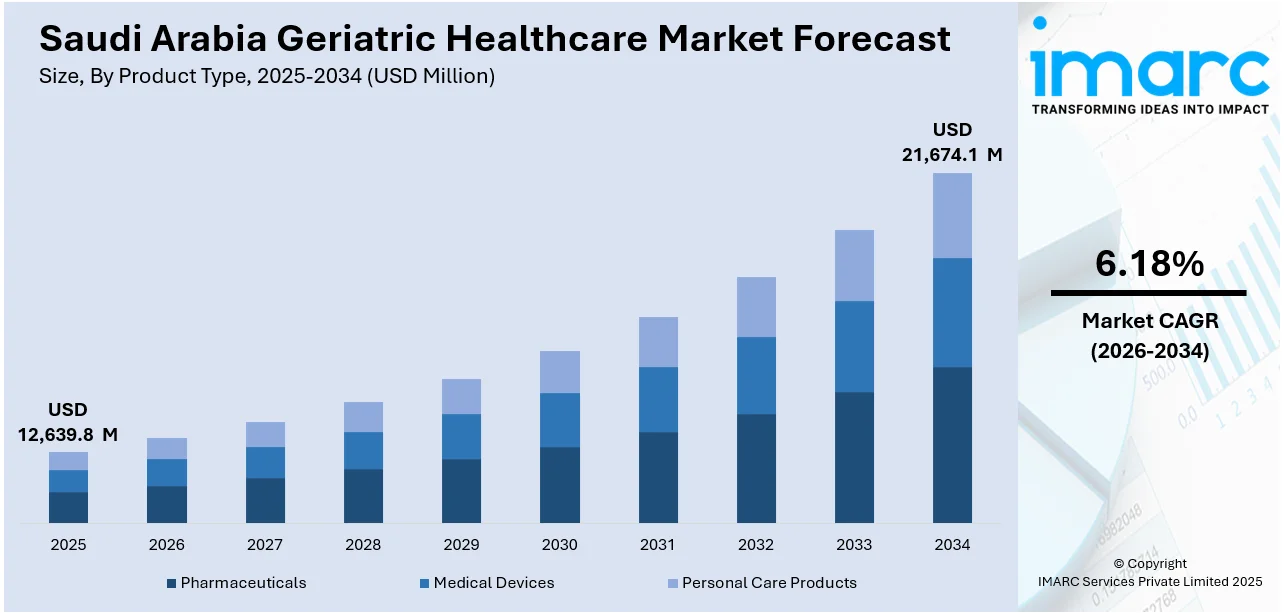

The Saudi Arabia geriatric healthcare market size reached USD 12,639.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 21,674.1 Million by 2034, exhibiting a growth rate (CAGR) of 6.18% during 2026-2034. The market is experiencing significant growth due to growing elderly population, increasing life expectancy, and rising cases of age-related chronic illnesses. Government support under Vision 2030, along with improved healthcare infrastructure and investment in elderly care facilities, is accelerating market development. The demand for specialized services, home healthcare, and geriatric diagnostics continues to rise, further strengthening the overall Saudi Arabia geriatric healthcare market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 12,639.8 Million |

|

Market Forecast in 2034

|

USD 21,674.1 Million |

| Market Growth Rate 2026-2034 | 6.18% |

Saudi Arabia Geriatric Healthcare Market Trends:

Growing Elderly Population

Saudi Arabia is experiencing a demographic shift marked by a steady increase in its elderly population. Individuals aged 60 and above are projected to account for a significant share of the total population by 2030, largely due to improved healthcare access, better living standards, and lower fertility rates. According to the data published by the World Bank, the population aged over 65 in Saudi Arabia is expected to nearly double from 2020 to 2030. This study projects prevalence rates for ten non-communicable diseases, including ischemic heart disease and diabetes, impacting national healthcare costs significantly, necessitating increased spending as the aging population grows. This shift is intensifying the demand for specialized geriatric care services, including chronic disease management, rehabilitation, and home-based health solutions. Age-related conditions such as arthritis, diabetes, hypertension, and dementia are becoming more prevalent, requiring comprehensive and continuous care. Public and private healthcare providers are expanding infrastructure and services to meet this growing need. Additionally, family structures are evolving, with smaller household sizes increasing the reliance on formal elderly care solutions. The rise in elderly citizens is prompting long-term planning and policy formulation to ensure sustainable and inclusive healthcare delivery.

To get more information on this market Request Sample

Expansion of Long-Term Care Services

The geriatric healthcare market of Saudi Arabia is experiencing rapid growth as a result of enhanced investment in long-term care facilities. With the growing older population, the demand for ongoing and supportive care outside acute hospitals is on the rise. This has encouraged the establishment of specialized geriatric hospitals, rehabilitation facilities, and home healthcare services for elderly citizens. These institutions are being created to cater to chronic disease, mobility problems, and cognitive impairment in a manner that maximizes independence and the quality of life. The government is promoting public-private collaborations for increasing capacity and improving quality of care as per Vision 2030. Cultural change and urbanization are also making family caregiving less accessible, further increasing demand for organized long-term care options. The emphasis on elderly care models that are patient-centered and on integrated elderly care is a major driving force behind the future of healthcare in Saudi Arabia.

Digital Health Integration

The integration of digital health technologies is significantly boosting the Saudi Arabia geriatric healthcare market growth. As the elderly population faces an increased burden of chronic conditions like diabetes, hypertension, and heart disease, digital tools are helping to deliver more efficient and accessible care. Telemedicine platforms allow elderly patients especially those in rural or remote areas to consult with specialists without needing to travel. Remote patient monitoring systems keep tabs on vital signs and notify healthcare professionals of any irregularities, facilitating prompt intervention. Electronic Health Records (EHRs) enhance coordinated care by providing easy access to patient histories for various providers. The government’s push for healthcare digitization under Vision 2030 has led to expanded investment in digital infrastructure, while private providers are adopting smart devices and AI-based tools. These innovations are improving elderly patient outcomes, reducing hospital visits, and supporting home-based care models.

Saudi Arabia Geriatric Healthcare Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type, service type, disease indication, and end user.

Product Type Insights:

- Pharmaceuticals

- Medical Devices

- Personal Care Products

The report has provided a detailed breakup and analysis of the market based on the product type. This includes pharmaceuticals, medical devices, and personal care products.

Service Type Insights:

- Home Healthcare Services

- Hospital and Clinical Services

- Assisted Living and Nursing Care

- Palliative and Hospice Care

A detailed breakup and analysis of the market based on the service type have also been provided in the report. This includes home healthcare services, hospital and clinical services, assisted living and nursing care, and palliative and hospice care.

Disease Indication Insights:

- Cardiovascular Diseases

- Neurological Disorders

- Diabetes and Endocrine Disorders

- Respiratory Disorders

- Osteoarthritis and Musculoskeletal Disorders

- Cancer

- Others

A detailed breakup and analysis of the market based on the disease indication have also been provided in the report. This includes cardiovascular diseases, neurological disorders, diabetes and endocrine disorders, respiratory disorders, osteoarthritis and musculoskeletal disorders, cancer, and others.

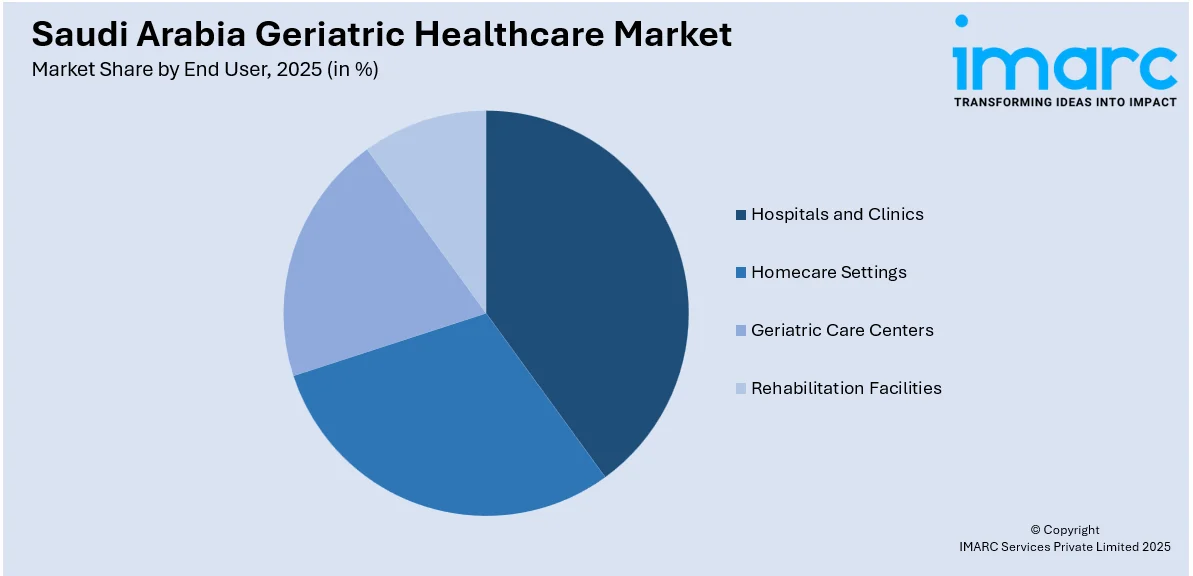

End User Insights:

Access the comprehensive market breakdown Request Sample

- Hospitals and Clinics

- Homecare Settings

- Geriatric Care Centers

- Rehabilitation Facilities

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals and clinics, homecare settings, geriatric care centers, and rehabilitation facilities.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Geriatric Healthcare Market News:

- In February 2025, Saudi Arabia’s Ministry of Health launched the ‘Jam AI’ initiative to enhance healthcare for elderly individuals and women. This program aims to develop innovative solutions and tackle health challenges using modern technologies.

Saudi Arabia Geriatric Healthcare Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Pharmaceuticals, Medical Devices, Personal Care Products |

| Service Types Covered | Home Healthcare Services, Hospital and Clinical Services, Assisted Living and Nursing Care, Palliative and Hospice Care |

| Disease Indications Covered | Cardiovascular Diseases, Neurological Disorders, Diabetes and Endocrine Disorders, Respiratory Disorders, Osteoarthritis and Musculoskeletal Disorders, Cancer, Others |

| End Users Covered | Hospitals and Clinics, Homecare Settings, Geriatric Care Centers, Rehabilitation Facilities |

| Regions Covered | Northern And Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia geriatric healthcare market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia geriatric healthcare market on the basis of product type?

- What is the breakup of the Saudi Arabia geriatric healthcare market on the basis of service type?

- What is the breakup of the Saudi Arabia geriatric healthcare market on the basis of disease indication?

- What is the breakup of the Saudi Arabia geriatric healthcare market on the basis of end user?

- What is the breakup of the Saudi Arabia geriatric healthcare market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia geriatric healthcare market?

- What are the key driving factors and challenges in the Saudi Arabia geriatric healthcare market?

- What is the structure of the Saudi Arabia geriatric healthcare market and who are the key players?

- What is the degree of competition in the Saudi Arabia geriatric healthcare market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia geriatric healthcare market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia geriatric healthcare market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia geriatric healthcare industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)