Saudi Arabia Glass Cleaner Market Size, Share, Trends and Forecast by Form, Distribution Channel, End User, and Region, 2026-2034

Saudi Arabia Glass Cleaner Market Overview:

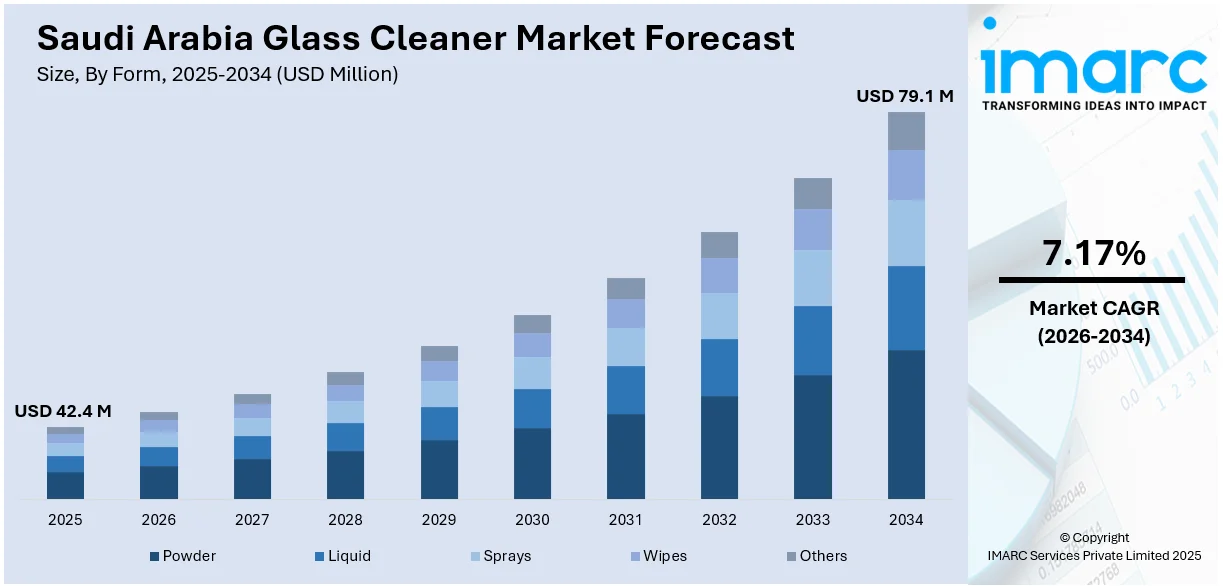

The Saudi Arabia glass cleaner market size reached USD 42.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 79.1 Million by 2034, exhibiting a growth rate (CAGR) of 7.17% during 2026-2034. The market is witnessing significant growth, fueled by heightened hygiene standards, growing residential and commercial cleaning needs, and increasing use in hospitality and healthcare sectors. Rising consumer awareness about specialized cleaning solutions has driven demand for eco-friendly, streak-free, and antimicrobial formulations. Enhanced distribution through modern retail and e-commerce, along with continuous product innovation and regulatory support for safe chemicals, further strengthen overall Saudi Arabia glass cleaner market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 42.4 Million |

| Market Forecast in 2034 | USD 79.1 Million |

| Market Growth Rate 2026-2034 | 7.17% |

Saudi Arabia Glass Cleaner Market Trends:

Rising Demand from the Residential Sector

The residential segment is emerging as a key driver of growth in the Saudi Arabia glass cleaner market. Rapid urbanization, increasing apartment living, and a shift toward modern interiors with large glass surfaces have amplified the need for regular cleaning solutions. Households are now more focused on maintaining spotless windows, mirrors, and glass furniture, leading to higher consumption of specialized glass cleaning products. The growing middle-class population, coupled with rising disposable income, is also contributing to more frequent purchases of branded and higher-quality cleaners. Consumer expectations for streak-free finishes and easy-to-use spray formats have encouraged companies to innovate with improved formulations. Additionally, marketing efforts through retail chains and e-commerce platforms are helping educate consumers on product benefits. As lifestyle standards evolve, glass cleaners are becoming essential in household cleaning routines across Saudi homes.

To get more information on this market Request Sample

Surge in Commercial Cleaning Contracts

The commercial and institutional segment is playing a major role in accelerating Saudi Arabia glass cleaner market growth. As office complexes, shopping malls, hospitals, and hotels expand across key cities, the demand for professional cleaning services has surged. These facilities rely on bulk procurement of high-performance glass cleaning products to maintain hygiene and visual appeal, especially for glass facades, partitions, and windows. With stricter sanitation standards post-pandemic and rising expectations for spotless environments, cleaning contractors are choosing industrial-grade, streak-free glass cleaners that offer efficiency and speed. Additionally, facility management companies are seeking cost-effective solutions in large volumes, prompting manufacturers to offer bulk packaging and concentrated formulas. Government initiatives focused on public health and cleanliness in commercial spaces are further driving institutional demand. This steady increase in large-scale usage is boosting overall sales and market expansion across the kingdom.

Growing Preference for Ammonia-Free and Eco-Friendly Formulas

In Saudi Arabia, there is a noticeable shift in consumer preferences toward ammonia-free and eco-friendly glass cleaners. Health-conscious households and environmentally aware users are increasingly avoiding products with harsh chemicals and strong odors. Ammonia-based cleaners, while effective, are being replaced by gentler alternatives that are non-toxic, biodegradable, and safe for both users and surfaces. This trend is particularly prominent in homes with children, pets, or elderly residents, where product safety is a top priority. Additionally, growing awareness of indoor air quality and chemical exposure has pushed brands to innovate with green ingredients and plant-based formulas. Retailers are promoting these variants through clear labeling and environmental certifications, which further influence buyer choices. As sustainability becomes a key purchasing factor, eco-friendly glass cleaners are gaining ground across both mass-market and premium segments in Saudi Arabia’s cleaning supplies landscape.

Saudi Arabia Glass Cleaner Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on form, distribution channel, and end user.

Form Insights:

- Powder

- Liquid

- Sprays

- Wipes

- Others

The report has provided a detailed breakup and analysis of the market based on the form. This includes powder, liquid, sprays, wipes, and others.

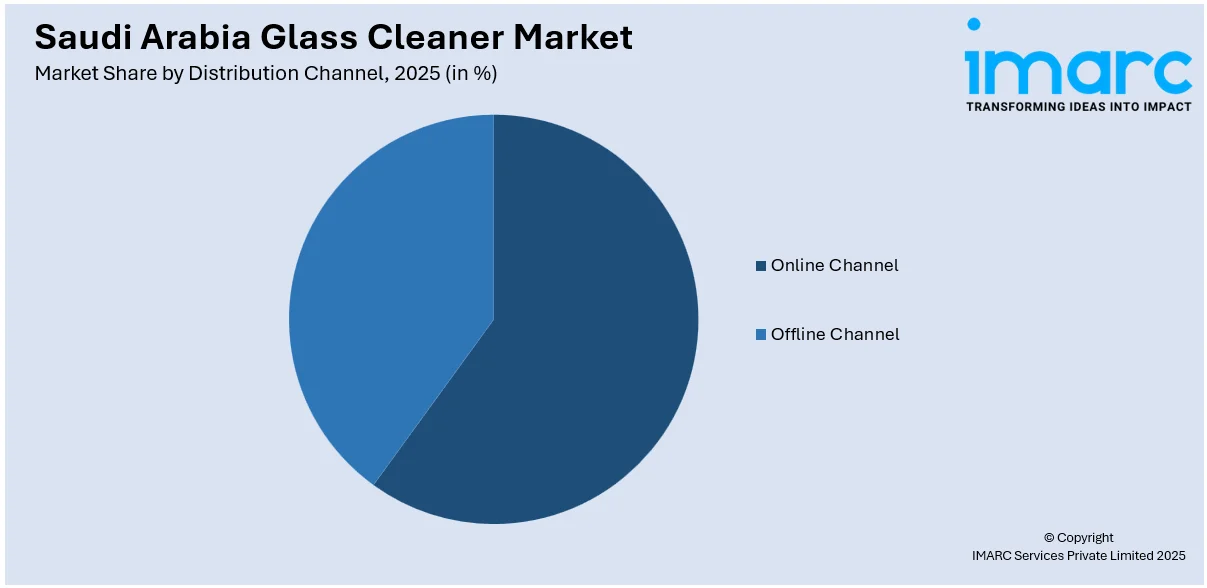

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online Channel

- Offline Channel

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online channel and offline channel.

End User Insights:

- Residential

- Commercial

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes residential and commercial.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Glass Cleaner Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Forms Covered | Powder, Liquid, Sprays, Wipes, Others |

| Distribution Channels Covered | Online Channel, Offline Channel |

| End Users Covered | Residential, Commercial |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia glass cleaner market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia glass cleaner market on the basis of form?

- What is the breakup of the Saudi Arabia glass cleaner market on the basis of distribution channel?

- What is the breakup of the Saudi Arabia glass cleaner market on the basis of end user?

- What is the breakup of the Saudi Arabia glass cleaner market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia glass cleaner market?

- What are the key driving factors and challenges in the Saudi Arabia glass cleaner market?

- What is the structure of the Saudi Arabia glass cleaner market and who are the key players?

- What is the degree of competition in the Saudi Arabia glass cleaner market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia glass cleaner market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia glass cleaner market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia glass cleaner industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)