Saudi Arabia Glass Market Size, Share, Trends and Forecast by Product Type, End Use Industry, and Region, 2026-2034

Saudi Arabia Glass Market Overview:

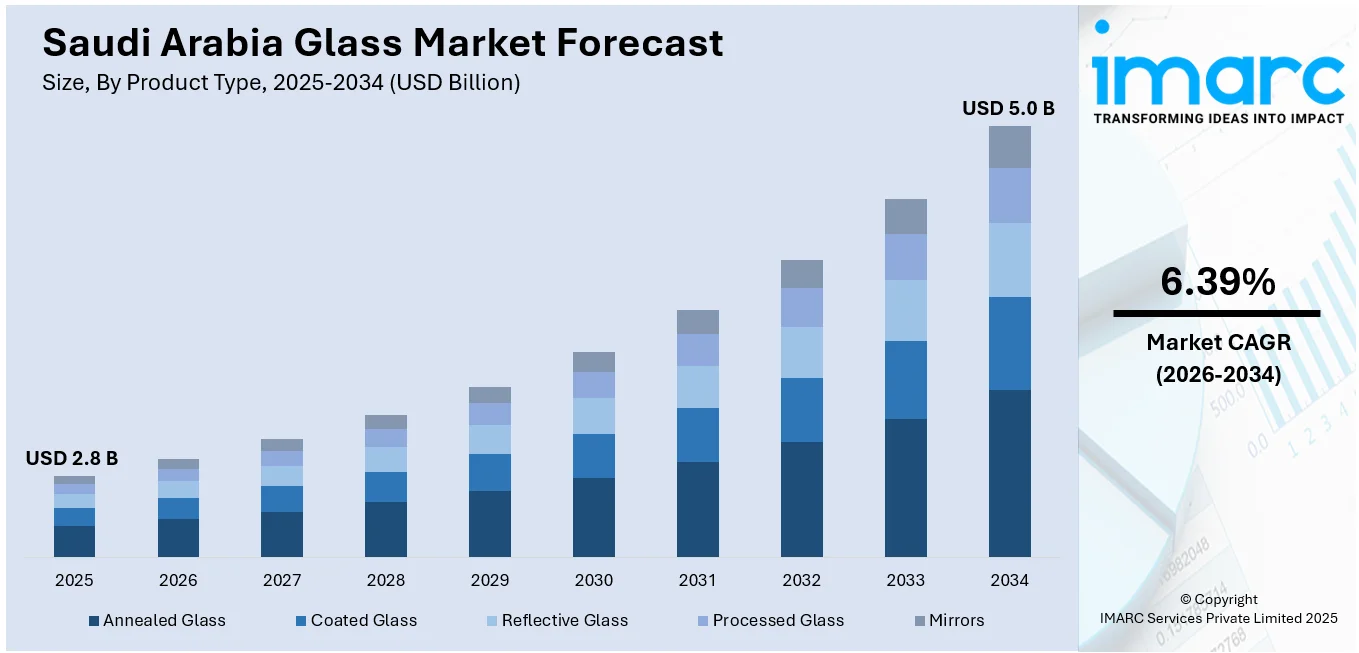

The Saudi Arabia glass market size reached USD 2.8 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 5.0 Billion by 2034, exhibiting a growth rate (CAGR) of 6.39% during 2026-2034. The market is witnessing steady growth, driven by rapid urban development, increased construction activity, and rising demand from the automotive and packaging sectors. Energy-efficient and decorative glass gaining popularity in modern buildings, along with the technological advancements and domestic production capabilities also support market resilience. Government infrastructure projects further contribute to the overall Saudi Arabia glass market share across various sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2.8 Billion |

| Market Forecast in 2034 | USD 5.0 Billion |

| Market Growth Rate 2026-2034 | 6.39% |

Saudi Arabia Glass Market Trends:

Boom in Construction and Infrastructure Projects

Saudi Arabia’s ambitious Vision 2030 is fueling a massive construction and infrastructure boom which is directly boosting demand in the glass market. According to the Minister of Economy, Saudi Arabia plans to invest around USD 1 Trillion in infrastructure by 2030. This investment aims to diversify the economy beyond oil enhance non-oil sectors and promote public-private partnerships all in line with the Saudi Vision 2030 economic transformation strategy. Mega-projects such as NEOM, the Red Sea Project, Qiddiya, and Diriyah Gate are transforming the built environment and creating large-scale demand for flat, laminated, and architectural glass. These developments emphasize modern design, sustainability, and high-performance building materials pushing the use of energy-efficient glazing, curtain wall systems, and structural glass. Commercial towers, luxury hotels, airports, and smart cities across the kingdom are specifying advanced glass types to meet safety, insulation, and aesthetic requirements. As a result, both local and international glass manufacturers are expanding operations or entering the market to capitalize on this sustained demand. This surge in construction activity is expected to remain a major growth driver for the Saudi Arabia glass market through the next decade.

To get more information on this market Request Sample

Expansion of Automotive Sector

The automotive sector in Saudi Arabia is undergoing steady expansion, contributing to the overall glass market growth. With rising consumer demand, increasing vehicle imports, and the country’s push toward local automotive manufacturing under Vision 2030, the need for high-quality automotive glass is on the rise. Saudi Arabia is advancing its automotive industry, focusing on electric vehicles (EVs) and local manufacturing. Initiatives include partnerships with OEMs, establishing Ceer Motors, and launching the National Automotive & Vehicles Academy. By 2030, the Kingdom aims for 30% EV fleet penetration in Riyadh, supporting its Vision 2030 goals. Laminated glass is now standard for windshields due to its safety benefits, while tempered glass is widely used in sides and rear windows. Additionally, growing interest in electric vehicles (EVs) and luxury models is driving demand for advanced glazing solutions such as solar-reflective and UV-protective glass. As new manufacturing plants and assembly lines are set up, local sourcing of automotive-grade glass is becoming more viable. This shift is encouraging international suppliers and domestic processors to expand capabilities, directly contributing to the momentum behind Saudi Arabia glass market growth in the transportation segment.

Saudi Arabia Glass Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type and end use industry.

Product Type Insights:

- Annealed Glass

- Coated Glass

- Reflective Glass

- Processed Glass

- Mirrors

The report has provided a detailed breakup and analysis of the market based on the product type. This includes annealed glass, coated glass, reflective glass, processed glass, and mirrors.

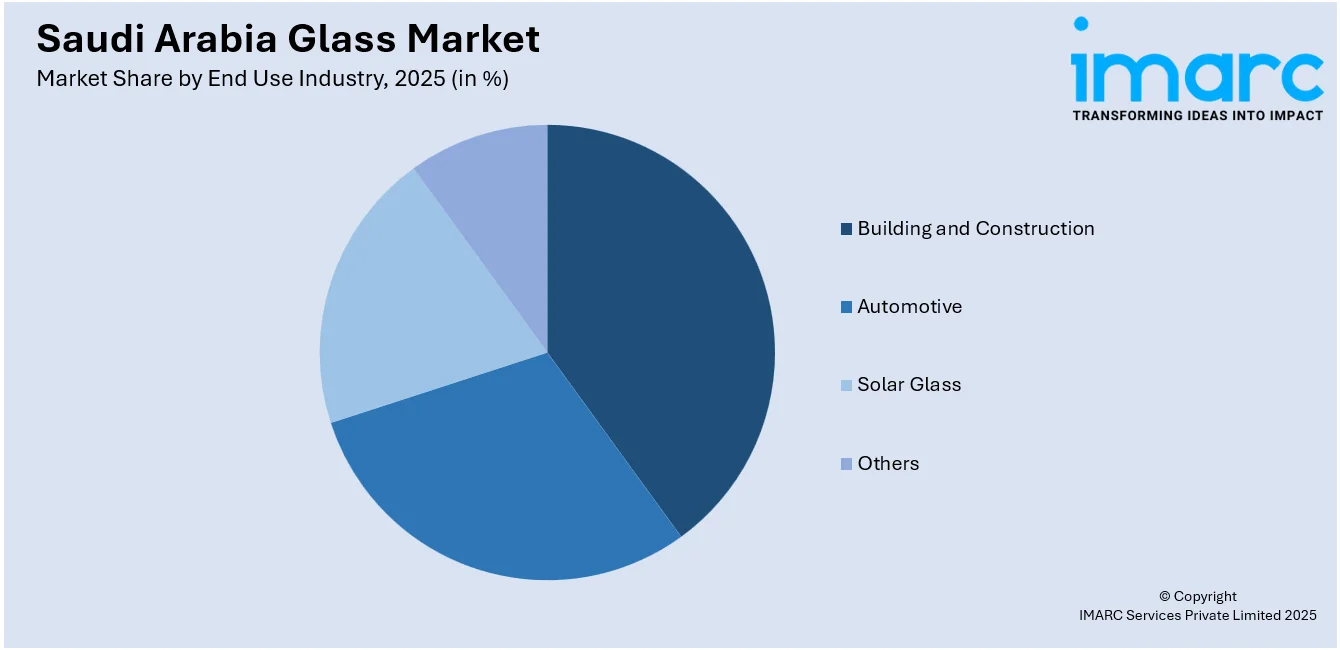

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Building and Construction

- Automotive

- Solar Glass

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes building and construction, automotive, solar glass, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Glass Market News:

- In February 2025, the General Authority for Competition (GAC) granted conditional approval for the acquisition of Saudi Arabian Glass Co. Ltd. (SAGCO) by the National Company for Glass Industries (Zoujaj). The approval includes conditions to maintain fair competition, with a five-year compliance monitoring period following the transaction.

- In August 2024, the National Company for Glass Industries (Zoujaj) announced its affiliate, Saudi Guardian International Float Glass Company (Gulf Guard), will establish a float and insulating glass factory in Jubail. The facility, costing approximately USD 215 Million, will have a production capacity of 750 Tons per day, enhancing local manufacturing capabilities.

Saudi Arabia Glass Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Annealed Glass, Coater Glass, Reflective Glass, Processed Glass, Mirrors |

| End User Industries Covered | Building and Construction, Automotive, Solar Glass, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia glass market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia glass market on the basis of product type?

- What is the breakup of the Saudi Arabia glass market on the basis of end use industry?

- What is the breakup of the Saudi Arabia glass market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia glass market?

- What are the key driving factors and challenges in the Saudi Arabia glass market?

- What is the structure of the Saudi Arabia glass market and who are the key players?

- What is the degree of competition in the Saudi Arabia glass market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia glass market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia glass market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia glass industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)